Insurance brokers provide personalized guidance by analyzing individual needs and offering tailored policy recommendations, while robo-advisor insurance platforms use algorithms to automate policy selection and pricing. Brokers excel in complex situations requiring human insight and negotiation, whereas robo-advisors offer convenience, lower costs, and quick comparisons for standard insurance products. Choosing between the two depends on the level of customization needed and the user's preference for human interaction versus automated efficiency.

Table of Comparison

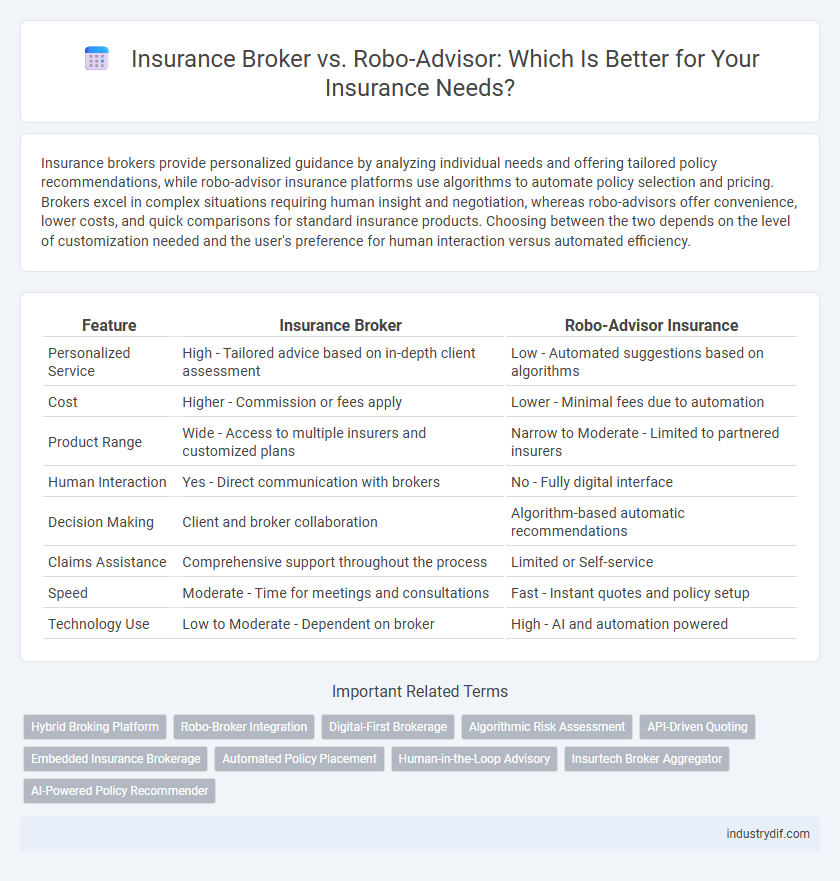

| Feature | Insurance Broker | Robo-Advisor Insurance |

|---|---|---|

| Personalized Service | High - Tailored advice based on in-depth client assessment | Low - Automated suggestions based on algorithms |

| Cost | Higher - Commission or fees apply | Lower - Minimal fees due to automation |

| Product Range | Wide - Access to multiple insurers and customized plans | Narrow to Moderate - Limited to partnered insurers |

| Human Interaction | Yes - Direct communication with brokers | No - Fully digital interface |

| Decision Making | Client and broker collaboration | Algorithm-based automatic recommendations |

| Claims Assistance | Comprehensive support throughout the process | Limited or Self-service |

| Speed | Moderate - Time for meetings and consultations | Fast - Instant quotes and policy setup |

| Technology Use | Low to Moderate - Dependent on broker | High - AI and automation powered |

Introduction to Insurance Brokers and Robo-Advisor Insurance

Insurance brokers act as licensed intermediaries who provide personalized advice by analyzing clients' unique risk profiles and tailoring insurance solutions accordingly. Robo-advisor insurance platforms utilize algorithms and artificial intelligence to offer automated, cost-efficient policy recommendations based on data inputs and customer preferences. Both options streamline insurance purchasing, but brokers offer human expertise and nuanced risk assessment, while robo-advisors emphasize convenience and scalability.

Key Differences Between Insurance Brokers and Robo-Advisors

Insurance brokers provide personalized advice by evaluating individual client needs and offering tailored insurance policies from multiple providers, ensuring human expertise and customized risk assessment. Robo-advisor insurance platforms use algorithms and data analytics to automate policy recommendations, offering convenience and lower costs but less personalized guidance. Key differences include the level of human interaction, customization of insurance solutions, and the balance between cost-efficiency and individualized service.

How Insurance Brokers Operate

Insurance brokers act as licensed intermediaries who assess clients' unique insurance needs and provide personalized policy recommendations across multiple insurers, leveraging their expertise and market knowledge. They facilitate detailed face-to-face or virtual consultations, analyze risk factors, and negotiate terms to secure optimal coverage and pricing for the client. Brokers also offer ongoing support for claims processing, policy adjustments, and renewals, ensuring continuous alignment with the client's evolving insurance requirements.

How Robo-Advisor Insurance Platforms Work

Robo-advisor insurance platforms leverage algorithms and AI to analyze user data and automatically recommend tailored insurance policies based on individual risk profiles and coverage needs. These platforms collect information through digital questionnaires and utilize machine learning to continuously refine recommendations, offering a streamlined and cost-effective alternative to traditional insurance brokers. By integrating real-time analytics and automated policy management, robo-advisors enhance transparency and efficiency in selecting and maintaining insurance coverage.

Advantages of Using an Insurance Broker

Insurance brokers provide personalized guidance by assessing individual risk profiles and matching clients with tailored coverage options from multiple carriers. Their expertise helps navigate complex policy terms, ensuring comprehensive protection and potential cost savings. Brokers also offer ongoing support and advocacy during claims, enhancing customer service beyond automated robo-advisor platforms.

Benefits of Robo-Advisor Insurance Solutions

Robo-advisor insurance solutions offer 24/7 accessibility and personalized policy recommendations powered by advanced algorithms, ensuring cost-efficient and tailored coverage options. These platforms leverage data analytics to quickly compare numerous insurance products, reducing human bias and administrative overhead. Enhanced user experiences are achieved through seamless digital interfaces that simplify policy management and claims processing.

Cost Comparison: Broker vs. Robo-Advisor Insurance

Insurance brokers typically charge commission fees ranging from 5% to 15% of the policy premium, which can increase the overall cost for clients. Robo-advisor insurance platforms offer lower-cost alternatives by utilizing automated algorithms to recommend policies, often reducing fees to as little as 1% to 3% of the premium. Savings from robo-advisors stem from minimal human intervention and streamlined processes, making them cost-effective choices for budget-conscious insurance seekers.

Personalization and Customer Experience

Insurance brokers offer highly personalized services by assessing individual client needs and providing tailored policy recommendations, ensuring a deep understanding of complex coverage options. Robo-advisor insurance platforms leverage AI algorithms to deliver quick, automated policy comparisons and suggestions but often lack the nuanced customization and human interaction that enhance customer experience. Clients seeking personalized guidance and empathy typically prefer brokers, while those prioritizing speed and convenience may opt for robo-advisor solutions.

Regulatory and Compliance Considerations

Insurance brokers operate under strict regulatory frameworks requiring licensing, adherence to fiduciary duties, and compliance with privacy laws to protect client interests. Robo-advisor insurance platforms must comply with digital financial regulations, including data security standards and algorithm transparency mandates, to ensure lawful automated advice delivery. Both entities face ongoing scrutiny from regulatory bodies to maintain consumer protection and operational integrity in insurance services.

Choosing the Right Option for Your Insurance Needs

Insurance brokers offer personalized guidance by analyzing your unique risk profile and preferences to tailor coverage options, while robo-advisor insurance platforms use algorithms to provide quick, cost-effective policy recommendations based on standardized data inputs. Choosing the right option depends on factors such as the complexity of your insurance needs, your comfort with technology, and desire for human interaction. For customized, nuanced advice, insurance brokers are preferable; for straightforward policies and lower costs, robo-advisors provide efficient solutions.

Related Important Terms

Hybrid Broking Platform

A hybrid broking platform combines the personalized expertise of an insurance broker with the efficiency and data-driven insights of a robo-advisor, offering tailored insurance solutions with enhanced customer experience. This integration leverages AI algorithms for risk assessment and policy comparison while maintaining human advisory support to address complex insurance needs and regulatory compliance.

Robo-Broker Integration

Robo-broker integration in insurance combines automated algorithms with personalized broker expertise to optimize policy selection and claims management. This hybrid model enhances customer experience by providing real-time data analysis and tailored advice, increasing efficiency while maintaining human oversight.

Digital-First Brokerage

Digital-first insurance brokerages leverage advanced algorithms and personalized service to offer tailored insurance solutions, combining human expertise with AI-driven insights for optimized policy selection. Robo-advisor insurance platforms provide automated, cost-effective options with seamless digital onboarding, prioritizing speed and convenience over individualized advisory.

Algorithmic Risk Assessment

Insurance brokers leverage personalized expertise and human judgment to navigate complex policy options, whereas robo-advisor insurance platforms utilize algorithmic risk assessment to analyze large datasets rapidly and provide cost-effective, automated recommendations. Algorithmic models enhance efficiency and consistency in risk evaluation but may lack the nuanced understanding and tailored advice that experienced brokers offer for unique or complex insurance needs.

API-Driven Quoting

API-driven quoting in insurance brokers enables personalized policy recommendations through direct integration with multiple insurers' databases, enhancing accuracy and customer trust. In contrast, robo-advisor insurance platforms rely on algorithm-based models to automate quotes, offering speed and efficiency but often limited customization compared to human brokers leveraging API connectivity.

Embedded Insurance Brokerage

Embedded insurance brokerage integrates insurance products directly within non-insurance platforms, offering personalized broker services through automated robo-advisor technology that enhances customer experience and streamlines policy selection. This fusion leverages artificial intelligence and real-time data analysis to provide tailored insurance solutions, combining the expertise of traditional brokers with the efficiency of robo-advisors for seamless, on-demand coverage.

Automated Policy Placement

Automated policy placement through robo-advisor insurance platforms leverages AI algorithms to streamline policy selection and purchasing, reducing human error and increasing efficiency. Insurance brokers provide personalized guidance but typically involve manual processes that can slow down policy placement compared to automated solutions.

Human-in-the-Loop Advisory

Insurance brokers provide personalized, human-in-the-loop advisory services that leverage expert judgment to tailor policies based on individual client needs, risk profiles, and complex regulations. Robo-advisor insurance platforms offer algorithm-driven recommendations but often lack the nuanced understanding and empathy essential for addressing unique client circumstances and adapting to evolving insurance landscapes.

Insurtech Broker Aggregator

Insurtech broker aggregators revolutionize insurance by combining AI-driven robo-advisor algorithms with traditional insurance broker expertise, delivering personalized policy recommendations and instant quotes. This hybrid model enhances efficiency, broadens market access, and improves customer experience by leveraging big data and automated risk assessments within a single platform.

AI-Powered Policy Recommender

AI-powered policy recommenders in robo-advisor insurance platforms analyze extensive datasets to provide personalized coverage options efficiently, often enhancing policy matching speed and accuracy. Insurance brokers leverage human expertise and nuanced understanding of client needs to offer tailored advice and complex risk assessments that AI systems may overlook.

Insurance Broker vs Robo-Advisor Insurance Infographic

industrydif.com

industrydif.com