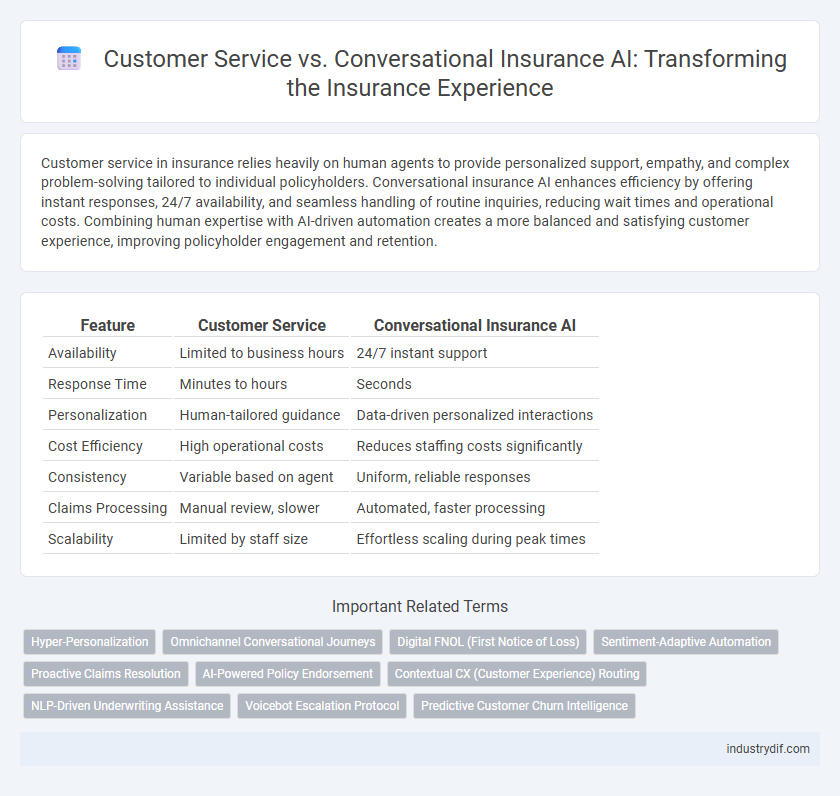

Customer service in insurance relies heavily on human agents to provide personalized support, empathy, and complex problem-solving tailored to individual policyholders. Conversational insurance AI enhances efficiency by offering instant responses, 24/7 availability, and seamless handling of routine inquiries, reducing wait times and operational costs. Combining human expertise with AI-driven automation creates a more balanced and satisfying customer experience, improving policyholder engagement and retention.

Table of Comparison

| Feature | Customer Service | Conversational Insurance AI |

|---|---|---|

| Availability | Limited to business hours | 24/7 instant support |

| Response Time | Minutes to hours | Seconds |

| Personalization | Human-tailored guidance | Data-driven personalized interactions |

| Cost Efficiency | High operational costs | Reduces staffing costs significantly |

| Consistency | Variable based on agent | Uniform, reliable responses |

| Claims Processing | Manual review, slower | Automated, faster processing |

| Scalability | Limited by staff size | Effortless scaling during peak times |

Defining Traditional Customer Service in Insurance

Traditional customer service in insurance involves direct human interaction where agents handle claims, policy inquiries, and issue resolution through phone, email, or in-person meetings. This method requires extensive training to ensure representatives understand complex insurance products and regulatory compliance. Despite its personalized approach, traditional customer service often faces challenges in scalability and response time efficiency.

What is Conversational Insurance AI?

Conversational Insurance AI refers to advanced artificial intelligence systems designed to interact with customers in real-time through natural language processing, automating policy inquiries, claims processing, and providing personalized support. This technology enables insurers to deliver efficient, 24/7 customer service, reducing response times and operational costs compared to traditional customer service channels. By leveraging machine learning and data analytics, Conversational Insurance AI improves accuracy in handling complex requests while enhancing overall customer satisfaction.

Key Differences: Human Agents vs AI Solutions

Human agents in insurance customer service provide personalized empathy, nuanced understanding, and complex problem-solving, catering to unique customer needs. Conversational insurance AI offers 24/7 availability, instant responses, and efficient handling of routine inquiries through natural language processing and machine learning. The key differences lie in human agents' emotional intelligence and adaptability compared to AI's scalability, speed, and consistent data-driven interactions.

Benefits of Conversational AI for Policyholders

Conversational Insurance AI offers policyholders immediate, personalized responses, enhancing claim processing speed and accuracy while reducing human error. This AI-powered interaction streamlines customer service by providing 24/7 accessibility, policy information retrieval, and tailored coverage recommendations. Improved engagement through natural language understanding leads to higher satisfaction rates and easier resolution of complex insurance inquiries.

Efficiency and Response Time Comparison

Customer service in insurance relies heavily on human agents for claim processing and policy inquiries, typically resulting in response times ranging from several minutes to hours during peak periods. Conversational insurance AI utilizes natural language processing and machine learning to provide instant, 24/7 responses, significantly reducing claim filing times and enhancing customer satisfaction. Efficiency gains from AI include automated document verification and personalized policy recommendations, leading to faster resolutions and decreased operational costs for insurers.

Personalization in Insurance: Humans vs AI

Human customer service agents in insurance offer personalized interactions by understanding unique client needs and building emotional connections that foster trust and loyalty. Conversational insurance AI enhances personalization through data-driven insights, analyzing client behavior, policy history, and preferences to deliver tailored recommendations and instant responses. Combining human empathy with AI's precision creates a more efficient and customized insurance experience, balancing personalization with scalability.

Cost Implications: Manual Support vs AI Automation

Manual customer service in insurance incurs high operational costs due to staffing, training, and handling complex inquiries, leading to slower response times and increased overhead. Conversational insurance AI reduces expenses by automating routine tasks, providing 24/7 support, and efficiently managing claims processing, which significantly lowers labor costs and improves scalability. Integrating AI-driven solutions results in cost optimization, faster customer interactions, and enhanced service personalization compared to traditional manual support.

Data Security and Compliance in Conversational AI

Conversational Insurance AI enhances customer service by automating routine inquiries while maintaining stringent data security protocols aligned with industry regulations such as GDPR and HIPAA. Advanced encryption methods and real-time compliance monitoring ensure sensitive customer information remains protected throughout interactions. This integration reduces risks of data breaches and supports insurers in adhering to regulatory standards without compromising user experience.

Customer Experience: Satisfaction and Trust

Customer service in insurance relies on human agents to address client needs, often resulting in personalized interactions that build trust and satisfaction through empathy and problem-solving skills. Conversational insurance AI enhances customer experience by providing instant, 24/7 support with consistent responses, reducing wait times and improving accessibility. Integrating AI-driven chatbots with human oversight creates a balanced approach that maximizes customer satisfaction and strengthens trust by combining efficiency with empathetic service.

Future Trends: Evolving Roles of AI in Insurance Customer Service

Future trends in insurance customer service reveal a growing integration of conversational AI, enhancing efficiency by automating routine inquiries and claims processing. Conversational insurance AI leverages natural language understanding and machine learning to provide personalized, real-time support, reducing response times and operational costs. Human agents will focus more on complex problem-solving and empathetic interactions, as AI handles standardized tasks and data-driven decision-making.

Related Important Terms

Hyper-Personalization

Hyper-personalization in conversational insurance AI transforms customer service by leveraging real-time data analytics and machine learning to deliver tailored policy recommendations, claims processing, and proactive risk management unique to each client's profile. This technology surpasses traditional customer service by anticipating needs, reducing response times, and enhancing customer satisfaction through context-aware interactions.

Omnichannel Conversational Journeys

Omnichannel conversational journeys in insurance seamlessly integrate customer service agents with conversational AI, enabling personalized, real-time support across multiple platforms such as chat, email, social media, and voice channels. This approach improves claim processing efficiency, enhances customer satisfaction, and reduces operational costs by leveraging AI-driven natural language understanding and predictive analytics.

Digital FNOL (First Notice of Loss)

Digital FNOL streamlines claims processing by enabling customers to report losses instantly through conversational insurance AI, reducing response times and minimizing manual errors. Unlike traditional customer service, conversational AI leverages natural language processing to provide 24/7 support, personalize interactions, and accelerate claim resolution.

Sentiment-Adaptive Automation

Sentiment-adaptive automation in conversational insurance AI enhances customer service by dynamically adjusting responses based on real-time emotional analysis, improving claim resolution efficiency and customer satisfaction. This technology reduces wait times and personalizes interactions, outperforming traditional customer service methods in handling complex insurance inquiries.

Proactive Claims Resolution

Proactive claims resolution powered by conversational insurance AI accelerates claim processing by instantly analyzing customer data and predicting potential issues before they arise, reducing the need for manual intervention. This technology enhances customer satisfaction through real-time updates and personalized interactions, outperforming traditional customer service approaches that rely on reactive communication and delayed responses.

AI-Powered Policy Endorsement

AI-powered policy endorsement streamlines the customer service process by enabling real-time, accurate adjustments to insurance policies without human intervention, significantly reducing processing time and errors. This conversational insurance AI leverages natural language processing to interpret customer requests efficiently, enhancing user experience and operational scalability.

Contextual CX (Customer Experience) Routing

Contextual CX routing in conversational insurance AI enables seamless, personalized customer service by dynamically directing inquiries based on real-time data and intent analysis, improving resolution speed and satisfaction. Leveraging natural language processing and machine learning, this approach surpasses traditional customer service by anticipating needs and providing accurate, relevant responses tailored to each policyholder's unique situation.

NLP-Driven Underwriting Assistance

NLP-driven underwriting assistance enhances accuracy by analyzing vast amounts of customer data quickly, identifying risk factors through natural language processing algorithms that improve decision-making efficiency. This technology seamlessly integrates with traditional customer service, reducing manual workload and accelerating policy approvals while maintaining personalized communication.

Voicebot Escalation Protocol

Voicebot Escalation Protocol in conversational insurance AI ensures seamless transition from automated voice interactions to human customer service agents when complex issues or customer frustration arise, minimizing resolution time and enhancing policyholder satisfaction. Effective escalation reduces call abandonment rates by over 30% and maintains compliance with insurance regulations, delivering personalized support across claim processing and policy inquiries.

Predictive Customer Churn Intelligence

Predictive Customer Churn Intelligence powered by Conversational Insurance AI analyzes customer interactions and behavior patterns to identify at-risk policyholders before they decide to leave, enabling targeted retention strategies. Traditional customer service relies on reactive support, whereas AI-driven predictive insights facilitate proactive engagement that minimizes churn and enhances customer loyalty in the insurance industry.

Customer Service vs Conversational Insurance AI Infographic

industrydif.com

industrydif.com