Indemnity policies provide coverage by reimbursing the policyholder for losses up to the policy limit, typically based on assessed damages or claims filed. Usage-based insurance customizes premiums according to the actual usage and driving behavior of the insured, leveraging telematics data for more personalized risk assessment. Choosing between indemnity policies and usage-based insurance depends on whether fixed coverage or dynamic pricing aligned with real-time usage best suits the policyholder's needs.

Table of Comparison

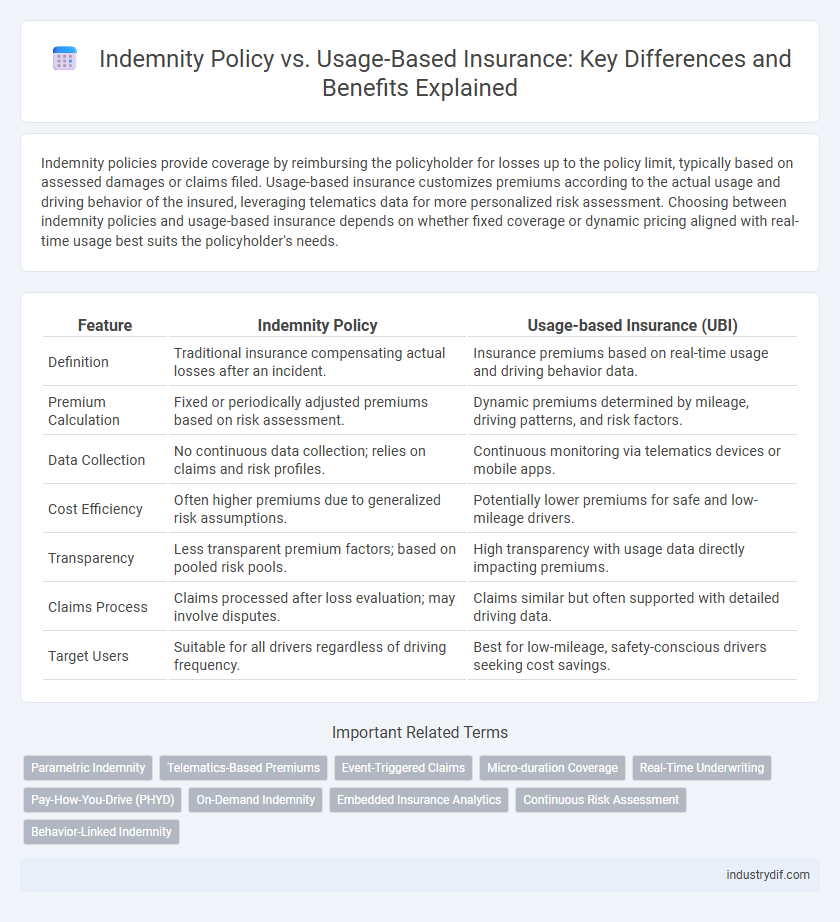

| Feature | Indemnity Policy | Usage-based Insurance (UBI) |

|---|---|---|

| Definition | Traditional insurance compensating actual losses after an incident. | Insurance premiums based on real-time usage and driving behavior data. |

| Premium Calculation | Fixed or periodically adjusted premiums based on risk assessment. | Dynamic premiums determined by mileage, driving patterns, and risk factors. |

| Data Collection | No continuous data collection; relies on claims and risk profiles. | Continuous monitoring via telematics devices or mobile apps. |

| Cost Efficiency | Often higher premiums due to generalized risk assumptions. | Potentially lower premiums for safe and low-mileage drivers. |

| Transparency | Less transparent premium factors; based on pooled risk pools. | High transparency with usage data directly impacting premiums. |

| Claims Process | Claims processed after loss evaluation; may involve disputes. | Claims similar but often supported with detailed driving data. |

| Target Users | Suitable for all drivers regardless of driving frequency. | Best for low-mileage, safety-conscious drivers seeking cost savings. |

Understanding Indemnity Policy: Definition and Basics

An indemnity policy in insurance guarantees financial reimbursement to policyholders for actual losses incurred, up to the policy limits, ensuring protection against specific risks. This type of policy focuses on restoring the insured to their pre-loss financial position without profit or gain. Indemnity policies are commonly used in property, casualty, and health insurance to provide compensation based on the extent of the damage or loss.

What is Usage-based Insurance? Key Features Explained

Usage-based insurance (UBI) is a modern auto insurance model that calculates premiums based on real-time driving behavior using telematics devices or smartphone apps. Key features include personalized rates, monitoring of metrics such as mileage, speed, acceleration, and braking patterns, which help insurers assess risk more accurately. This approach contrasts with traditional indemnity policies by rewarding safe driving habits and promoting cost savings.

Core Differences Between Indemnity Policy and Usage-based Insurance

Indemnity policies provide fixed monetary compensation based on the insured's loss, focusing on restoring the insured to their original financial position. Usage-based insurance calculates premiums dynamically using real-time data such as driving behavior, mileage, and time of use, enabling personalized coverage and cost savings for safer drivers. The core difference lies in indemnity's static, claim-driven payout model versus usage-based insurance's data-driven, risk-adjusted premium structure.

Coverage Mechanism: Indemnity Policy vs Usage-based Insurance

Indemnity policies provide coverage by reimbursing policyholders for actual financial losses incurred, ensuring compensation up to the policy limits based on documented damages. Usage-based insurance (UBI) employs telematics or usage data to adjust premiums and coverage dynamically, aligning costs directly with driving behavior and mileage. This mechanism allows UBI to offer personalized risk assessment and potential discounts, contrasting the fixed coverage approach of traditional indemnity policies.

Pricing Models: Fixed Premiums vs Usage-based Premiums

Indemnity policies rely on fixed premiums, providing predictable costs regardless of actual usage, which appeals to customers seeking budget certainty. Usage-based insurance (UBI) employs dynamic pricing models, adjusting premiums based on real-time data such as mileage, driving behavior, and risk exposure to reward low-risk drivers with lower costs. This contrast in pricing models highlights the trade-off between premium stability in indemnity policies and personalized, potentially cost-saving premiums in usage-based insurance.

Advantages of Indemnity Policy for Traditional Policyholders

Indemnity policies provide traditional policyholders with guaranteed financial protection by reimbursing actual losses, ensuring coverage stability regardless of behavioral data fluctuations. These policies offer simplicity and predictability, making them attractive to individuals who prefer fixed premiums without usage monitoring complexities. Their well-established nature facilitates easier claim processing and broader acceptance among insurers and consumers compared to usage-based insurance models.

Benefits of Usage-based Insurance for Modern Consumers

Usage-based insurance (UBI) offers modern consumers personalized premiums based on real-time driving behavior, promoting cost savings and fairness compared to traditional indemnity policies. Advanced telematics devices and mobile apps collect data such as speed, mileage, and braking patterns, enabling insurers to tailor coverage and reward safe drivers with lower rates. This data-driven approach enhances transparency, encourages responsible driving, and adapts to individual lifestyles, making UBI a preferred choice for technology-savvy policyholders.

Technological Integration in Usage-based Insurance

Usage-based insurance (UBI) leverages telematics technology to monitor real-time driving behavior, enabling personalized premium calculations that reflect actual risk more accurately than traditional indemnity policies. Indemnity policies rely on historical data and fixed risk assessments, lacking the dynamic adaptability facilitated by sensor data collection in UBI. The integration of GPS, accelerometers, and mobile apps in UBI systems enhances fraud detection, claims processing efficiency, and customer engagement through data-driven insights.

Choosing the Right Insurance: Factors to Consider

When selecting between an indemnity policy and usage-based insurance, evaluate your driving habits, coverage needs, and budget constraints. Indemnity policies offer fixed premiums with predictable costs, ideal for consistent drivers seeking comprehensive protection. Usage-based insurance leverages telematics to tailor premiums based on actual vehicle use, benefiting low-mileage or cautious drivers looking to optimize savings.

Future Trends: Indemnity Policy vs Usage-based Insurance

Future trends in insurance indicate a growing shift from traditional indemnity policies to usage-based insurance (UBI) models, driven by advancements in telematics and IoT technology. Usage-based insurance leverages real-time data to personalize premiums based on actual behavior, enhancing risk accuracy and customer engagement. This evolution is expected to increase market share for UBI, particularly in auto and health insurance sectors, as consumers demand more transparent and flexible coverage options.

Related Important Terms

Parametric Indemnity

Parametric indemnity policies in insurance provide pre-agreed payouts based on specific measurable parameters, such as weather events or natural disasters, offering swift and transparent claim settlements compared to traditional indemnity policies that require proof of actual loss. Usage-based insurance leverages real-time data to customize premiums, whereas parametric indemnity focuses on triggering payments through external indices, reducing claim assessment delays and enhancing customer trust.

Telematics-Based Premiums

Telematics-based premiums in usage-based insurance (UBI) leverage real-time driving data to calculate personalized rates, improving accuracy over traditional indemnity policies that rely on historical claim data. By analyzing metrics such as distance driven, speed, and braking patterns, telematics enable insurers to reward safe driving behaviors with lower premiums, fostering risk mitigation and cost efficiency.

Event-Triggered Claims

Indemnity policies provide predetermined coverage amounts based on the insured's declared value, triggering claims only after verified losses, whereas usage-based insurance (UBI) leverages telematics data to initiate event-triggered claims in real time, enhancing claims accuracy and speed. Event-triggered claims in UBI rely on metrics like driving behavior, mileage, and impact sensors, enabling insurers to assess risk dynamically and offer personalized premiums.

Micro-duration Coverage

Indemnity policies provide traditional fixed-coverage limits for a set term, while usage-based insurance offers flexible, micro-duration coverage based on real-time risk assessment and actual usage data. Micro-duration coverage in usage-based insurance enables cost-efficient, on-demand protection tailored to short periods of exposure, optimizing premiums for policyholders with variable needs.

Real-Time Underwriting

Indemnity policies provide coverage based on pre-agreed terms and fixed premiums, while usage-based insurance leverages real-time data such as driving behavior and mileage to tailor premiums dynamically. Real-time underwriting in usage-based insurance enhances risk assessment accuracy, enabling insurers to offer personalized policies and adjust coverage instantly according to policyholder activity.

Pay-How-You-Drive (PHYD)

Indemnity policies provide fixed coverage amounts based on assessed risk factors, while Usage-Based Insurance (UBI), particularly Pay-How-You-Drive (PHYD) programs, leverage telematics to monitor real-time driving behavior and adjust premiums accordingly. PHYD models optimize insurance costs by analyzing metrics such as mileage, speed, acceleration, and braking patterns, enabling personalized risk assessment and enhancing cost efficiency.

On-Demand Indemnity

On-demand indemnity policies provide immediate, event-triggered coverage tailored to specific incidents, contrasting with traditional indemnity policies that offer pre-set, broader protection. Usage-based insurance leverages telematics to adjust premiums dynamically, while on-demand indemnity focuses on compensating verified losses precisely when and where they occur.

Embedded Insurance Analytics

Embedded insurance analytics in indemnity policies leverage historical claims data to optimize risk assessment and premium pricing, enhancing traditional coverage models. Usage-based insurance integrates real-time telematics and driver behavior data, enabling dynamic policy adjustments and personalized risk mitigation strategies.

Continuous Risk Assessment

Indemnity policies provide coverage based on the extent of loss or damage after an event, relying on claims filed and assessed post-incident, while usage-based insurance continuously monitors driving behavior through telematics to dynamically adjust premiums and manage risk in real time. Continuous risk assessment in usage-based insurance enables personalized pricing models and proactive loss prevention, contrasting with the static, retrospective evaluation characteristic of indemnity policies.

Behavior-Linked Indemnity

Behavior-linked indemnity policies tailor compensation based on insured individuals' actions, integrating data from telematics and behavior analysis to assess risk accurately. Usage-based insurance enhances this by directly correlating premiums and indemnity amounts with real-time driving behavior, promoting safer habits and cost-efficient coverage.

Indemnity Policy vs Usage-based Insurance Infographic

industrydif.com

industrydif.com