Actuaries use advanced statistical models and deep industry knowledge to assess risks and determine insurance premiums, ensuring financial stability for insurance companies. Insurtech leverages cutting-edge technology such as AI, big data, and machine learning to transform traditional insurance processes, enhancing efficiency and customer experience. Comparing actuaries and insurtech highlights the blend of expertise and innovation driving the future of risk management and insurance solutions.

Table of Comparison

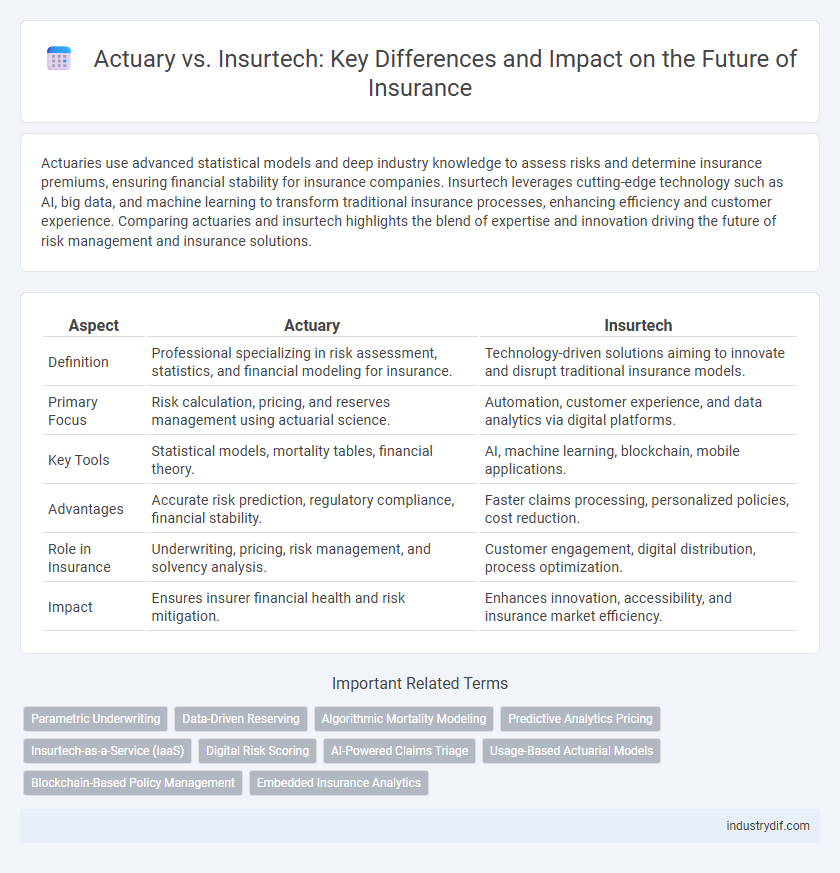

| Aspect | Actuary | Insurtech |

|---|---|---|

| Definition | Professional specializing in risk assessment, statistics, and financial modeling for insurance. | Technology-driven solutions aiming to innovate and disrupt traditional insurance models. |

| Primary Focus | Risk calculation, pricing, and reserves management using actuarial science. | Automation, customer experience, and data analytics via digital platforms. |

| Key Tools | Statistical models, mortality tables, financial theory. | AI, machine learning, blockchain, mobile applications. |

| Advantages | Accurate risk prediction, regulatory compliance, financial stability. | Faster claims processing, personalized policies, cost reduction. |

| Role in Insurance | Underwriting, pricing, risk management, and solvency analysis. | Customer engagement, digital distribution, process optimization. |

| Impact | Ensures insurer financial health and risk mitigation. | Enhances innovation, accessibility, and insurance market efficiency. |

Defining Actuary and Insurtech

An actuary is a professional who applies mathematical and statistical methods to assess risk in insurance, finance, and other industries, playing a crucial role in pricing policies and ensuring financial stability. Insurtech refers to the innovative use of technology, such as artificial intelligence, big data, and machine learning, to improve and disrupt traditional insurance processes, from underwriting to claims management. Both actuaries and insurtech drive transformation in the insurance industry through data analysis, risk assessment, and enhancing operational efficiency.

Historical Development of Actuarial Science

Actuarial science originated in the 17th century, evolving from early probability theories used to assess risk and life expectancy in insurance. Traditional actuaries relied heavily on mathematical models, mortality tables, and statistical analysis to price insurance products and manage risk. The rise of insurtech in the 21st century introduces advanced data analytics, artificial intelligence, and real-time data, transforming actuarial methods while maintaining the foundational principles established through centuries of actuarial development.

The Rise of Insurtech in the Insurance Industry

Insurtech companies are revolutionizing the insurance industry by leveraging artificial intelligence, big data, and machine learning to streamline underwriting, claims processing, and customer experience. Actuaries traditionally rely on statistical models and historical data to assess risks, while insurtech innovations enable real-time analytics and predictive insights for more accurate pricing and risk management. This rise of insurtech fosters increased efficiency, customization, and competitiveness in the insurance market.

Key Roles and Responsibilities: Actuaries

Actuaries analyze statistical data to assess risk and determine accurate insurance premiums, ensuring financial stability for insurance companies. They develop predictive models to forecast claims, reserves, and profitability, leveraging advanced mathematical and statistical techniques. Actuaries also comply with regulatory standards and provide strategic advice to support product development and risk management.

Key Roles and Functions: Insurtech Firms

Insurtech firms leverage advanced technologies such as artificial intelligence, big data analytics, and blockchain to innovate risk assessment, claims processing, and customer experience in the insurance industry. They focus on automating underwriting, enhancing fraud detection, and providing personalized insurance products through digital platforms. Key functions include streamlining policy administration, improving pricing accuracy, and enabling real-time data integration for proactive risk management.

Data Analytics: Traditional vs. Emerging Approaches

Actuaries rely on traditional statistical models and historical data to assess risk and calculate premiums, utilizing well-established actuarial tables and mortality rates. Insurtech leverages emerging data analytics techniques such as machine learning, artificial intelligence, and real-time data streams from IoT devices to create dynamic risk assessments and personalized insurance products. This shift toward advanced analytics enables faster decision-making and more accurate predictions, fundamentally transforming risk management in the insurance industry.

Impact of Automation on Actuarial Work

Automation transforms actuarial work by integrating advanced algorithms and machine learning to enhance risk assessment and pricing accuracy. Insurtech platforms leverage big data and predictive analytics, streamlining traditionally manual actuarial tasks and enabling real-time decision-making. This shift drives efficiency, reduces human error, and fosters innovation in insurance product development.

Collaboration Between Actuaries and Insurtech

Collaboration between actuaries and insurtech leverages advanced data analytics and artificial intelligence to enhance risk modeling and pricing accuracy. Actuaries provide critical expertise in statistical methods and regulatory compliance, while insurtech firms drive innovation through automation and real-time data integration. This synergy improves underwriting efficiency, fraud detection, and customer personalization within the insurance industry.

Challenges and Opportunities for Integration

Actuaries bring deep expertise in risk assessment and statistical modeling, essential for accurate insurance pricing and reserve calculations, while insurtech introduces advanced technologies like AI and blockchain to streamline processes and enhance data analytics. Integrating actuaries with insurtech solutions presents challenges such as aligning traditional actuarial methods with innovative digital tools and addressing data security concerns, yet it offers opportunities for improved predictive accuracy, real-time risk management, and personalized product development. Successful collaboration can drive efficiency, reduce costs, and foster innovation in underwriting and claims processing.

The Future of Actuary and Insurtech Synergy

The future of actuarial science hinges on seamless integration with insurtech innovations, leveraging big data analytics and AI-driven risk modeling to enhance precision in policy pricing and claims forecasting. Actuaries equipped with advanced data science skills will drive predictive accuracy, enabling insurers to develop personalized products and improve customer experience at scale. This synergy between traditional actuarial expertise and cutting-edge technology will transform underwriting processes and risk management, making insurance more adaptive and resilient.

Related Important Terms

Parametric Underwriting

Parametric underwriting leverages insurtech innovations by using real-time data and automated algorithms to assess risk with precision, reducing reliance on traditional actuarial models. This approach enhances efficiency and accuracy in insurance pricing by directly correlating payouts to predefined event triggers rather than subjective risk assessments.

Data-Driven Reserving

Actuaries leverage statistical models and historical data to enhance accuracy in data-driven reserving, ensuring insurers maintain sufficient capital for future claims. Insurtech firms integrate advanced analytics, machine learning, and real-time data streams to optimize reserving processes, enabling faster and more precise risk assessment and financial forecasting.

Algorithmic Mortality Modeling

Algorithmic mortality modeling leverages advanced machine learning techniques to enhance risk assessment accuracy, enabling insurtech companies to design more personalized insurance products. Actuaries integrate traditional statistical methods with these algorithms to validate models and ensure regulatory compliance while optimizing pricing and reserves.

Predictive Analytics Pricing

Actuaries leverage predictive analytics to assess risk and determine insurance pricing through statistical modeling and historical data analysis. Insurtech companies enhance this process by integrating machine learning algorithms and real-time data, enabling dynamic pricing strategies that improve accuracy and customer segmentation.

Insurtech-as-a-Service (IaaS)

Insurtech-as-a-Service (IaaS) revolutionizes insurance by integrating advanced technologies such as AI-driven risk modeling and real-time data analytics, enhancing underwriting precision beyond traditional actuarial methods. This platform empowers insurers to accelerate policy customization and claims processing while maintaining compliance, surpassing standard actuarial capabilities with scalable, technology-driven solutions.

Digital Risk Scoring

Digital risk scoring in insurtech leverages machine learning algorithms and big data analytics to provide real-time, personalized risk assessments, significantly enhancing accuracy over traditional actuarial models. Actuaries traditionally rely on historical data and statistical methods, while insurtech platforms integrate diverse data sources such as social media, IoT devices, and telematics to dynamically adjust insurance premiums and underwriting decisions.

AI-Powered Claims Triage

AI-powered claims triage in insurtech enhances the efficiency and accuracy of claims processing by automating data analysis and risk assessment traditionally performed by actuaries. This integration leverages machine learning algorithms to predict claim outcomes and prioritize cases, significantly reducing processing time and operational costs while maintaining actuarial precision.

Usage-Based Actuarial Models

Usage-based actuarial models leverage real-time data collected from telematics and IoT devices to refine risk assessment and pricing strategies within insurance, enhancing traditional actuarial methods with dynamic, personalized insights. Insurtech firms specialize in integrating these advanced data analytics and machine learning technologies to optimize underwriting processes and develop more accurate, usage-driven insurance products.

Blockchain-Based Policy Management

Blockchain-based policy management revolutionizes actuarial processes by enhancing data transparency, accuracy, and security, enabling actuaries to perform more precise risk assessments and pricing models. Insurtech leverages blockchain to streamline policy issuance and claims processing, reducing operational costs and improving customer trust through immutable, real-time data records.

Embedded Insurance Analytics

Embedded insurance analytics integrates actuaries' expertise with real-time data processing to optimize risk assessment and pricing models. This fusion enhances underwriting accuracy and customer personalization by leveraging predictive algorithms within digital insurance platforms.

Actuary vs Insurtech Infographic

industrydif.com

industrydif.com