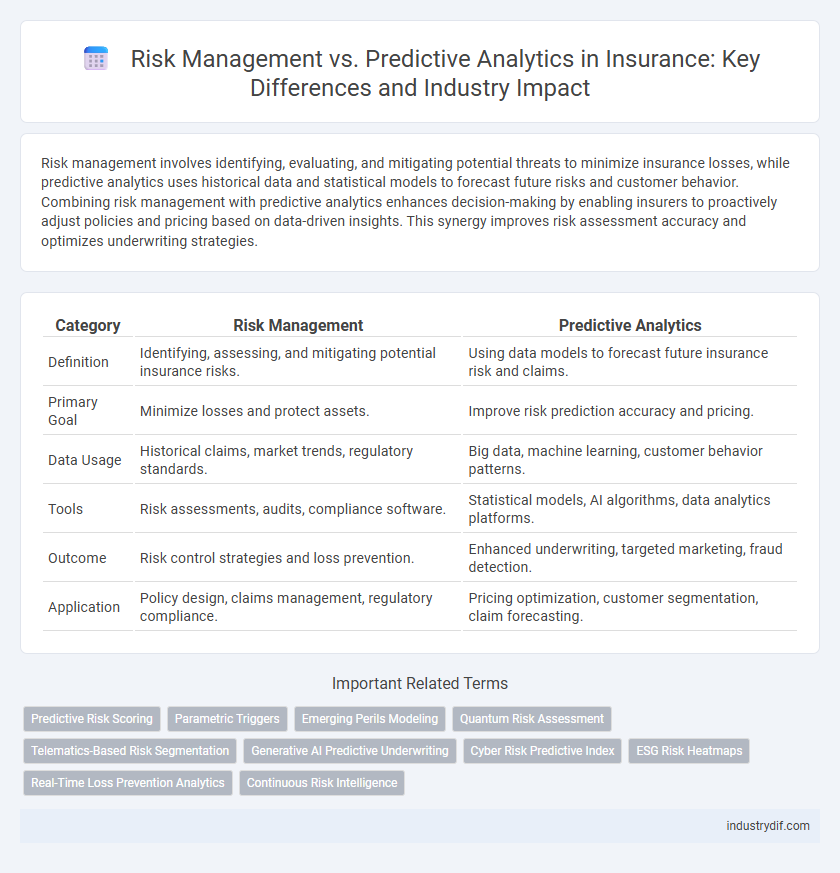

Risk management involves identifying, evaluating, and mitigating potential threats to minimize insurance losses, while predictive analytics uses historical data and statistical models to forecast future risks and customer behavior. Combining risk management with predictive analytics enhances decision-making by enabling insurers to proactively adjust policies and pricing based on data-driven insights. This synergy improves risk assessment accuracy and optimizes underwriting strategies.

Table of Comparison

| Category | Risk Management | Predictive Analytics |

|---|---|---|

| Definition | Identifying, assessing, and mitigating potential insurance risks. | Using data models to forecast future insurance risk and claims. |

| Primary Goal | Minimize losses and protect assets. | Improve risk prediction accuracy and pricing. |

| Data Usage | Historical claims, market trends, regulatory standards. | Big data, machine learning, customer behavior patterns. |

| Tools | Risk assessments, audits, compliance software. | Statistical models, AI algorithms, data analytics platforms. |

| Outcome | Risk control strategies and loss prevention. | Enhanced underwriting, targeted marketing, fraud detection. |

| Application | Policy design, claims management, regulatory compliance. | Pricing optimization, customer segmentation, claim forecasting. |

Introduction to Risk Management and Predictive Analytics

Risk management in insurance involves identifying, assessing, and prioritizing potential risks to minimize financial losses, ensuring stability and compliance. Predictive analytics uses data, statistical algorithms, and machine learning techniques to forecast future risk trends and customer behavior, enhancing underwriting accuracy. Integrating risk management with predictive analytics enables insurers to proactively mitigate risks and optimize decision-making processes.

Defining Risk Management in Insurance

Risk management in insurance involves identifying, assessing, and prioritizing potential risks to minimize financial loss and ensure policyholder protection. It integrates underwriting strategies, claims analysis, and reinsurance to balance risk exposure and optimize profitability. This process is essential for maintaining solvency and complying with regulatory requirements across the insurance industry.

Understanding Predictive Analytics in Insurance

Predictive analytics in insurance leverages advanced algorithms and historical data to forecast potential risks and customer behaviors with greater accuracy. By analyzing patterns from vast datasets, insurers can tailor policies, optimize pricing models, and proactively manage claims to reduce losses. This data-driven approach enhances risk assessment beyond traditional methods, enabling more precise underwriting and improved financial performance.

Key Differences Between Risk Management and Predictive Analytics

Risk management in insurance involves identifying, assessing, and mitigating potential losses by implementing strategies to minimize exposure, whereas predictive analytics uses historical data and statistical models to forecast future claims and trends. Risk management focuses on controlling uncertainties and protecting assets, while predictive analytics enhances decision-making through data-driven insights and trend prediction. The key difference lies in risk management's proactive approach to prevent damages versus predictive analytics' reliance on data patterns to anticipate potential outcomes.

Role of Data in Modern Risk Management

Data drives modern risk management by enabling comprehensive risk identification, assessment, and mitigation strategies that are more precise and dynamic. Predictive analytics leverages vast datasets and advanced algorithms to forecast potential risks, enhancing decision-making and proactive risk control in insurance. Integrating real-time data sources allows insurers to customize policies, optimize premiums, and reduce losses more effectively than traditional risk management methods.

Predictive Modeling Techniques in Insurance

Predictive modeling techniques in insurance leverage historical data and statistical algorithms to forecast future risks, customer behaviors, and claim probabilities. Common methods include logistic regression, decision trees, random forests, and neural networks, which help insurers assess underwriting risks and optimize pricing strategies. These models enhance risk segmentation and claim prediction accuracy, reducing loss ratios and improving profitability.

How Predictive Analytics Enhances Risk Assessment

Predictive analytics enhances risk assessment by leveraging advanced algorithms and vast datasets to identify patterns and predict future risk events with greater accuracy. By integrating historical claims data, customer behavior, and external factors, insurers can quantify risk exposure more precisely and tailor underwriting decisions accordingly. This data-driven approach reduces uncertainty, improves loss prevention strategies, and optimizes premium pricing models.

Integrating Predictive Analytics into Risk Management Workflows

Integrating predictive analytics into risk management workflows enhances the identification and mitigation of potential insurance claims by leveraging data-driven insights and machine learning models. This integration enables insurers to proactively assess risk exposure, optimize underwriting decisions, and improve loss prevention strategies through real-time data analysis. Effective use of predictive analytics streamlines risk assessment processes, reduces operational costs, and increases accuracy in forecasting future risk scenarios within the insurance industry.

Challenges in Adopting Predictive Analytics for Risk Management

Adopting predictive analytics in risk management faces challenges including data quality issues, integration with existing legacy systems, and a shortage of skilled professionals to interpret complex models. Insurers struggle with regulatory compliance and ensuring transparency in algorithmic decision-making processes. Additionally, the high costs of implementation and resistance to change within traditional risk management frameworks hinder widespread adoption.

Future Trends in Insurance: From Risk Management to Predictive Insight

Future trends in insurance emphasize the shift from traditional risk management to advanced predictive analytics, leveraging big data and artificial intelligence for precise risk assessment. Predictive insights enable insurers to anticipate claims, optimize underwriting, and personalize policies, enhancing customer experience and operational efficiency. The integration of machine learning models and real-time data analytics is transforming insurance into a proactive industry focused on prevention and risk mitigation.

Related Important Terms

Predictive Risk Scoring

Predictive risk scoring in insurance leverages advanced algorithms and historical data to quantify the likelihood of future claims, enabling precise underwriting and pricing strategies. Integrating predictive analytics enhances risk management by identifying high-risk policyholders early, reducing losses and improving portfolio performance.

Parametric Triggers

Parametric triggers in risk management enable insurers to initiate payouts automatically based on predefined environmental or event-based parameters, enhancing efficiency and transparency compared to traditional claims processes. Predictive analytics leverages historical data and statistical models to forecast potential risks and tailor parametric triggers, optimizing risk mitigation strategies and improving financial resilience.

Emerging Perils Modeling

Emerging perils modeling in insurance leverages predictive analytics to identify and quantify novel risks by analyzing vast, real-time data sets, enabling proactive risk management strategies. This approach enhances insurers' ability to anticipate evolving threats such as cyberattacks, climate change impacts, and pandemics, reducing potential losses and optimizing portfolio resilience.

Quantum Risk Assessment

Quantum Risk Assessment leverages quantum computing algorithms to evaluate complex insurance risk scenarios with unprecedented speed and accuracy, surpassing traditional risk management methods. This advanced approach enhances predictive analytics by processing vast datasets to identify subtle patterns and potential losses, enabling insurers to make more informed underwriting and pricing decisions.

Telematics-Based Risk Segmentation

Telematics-based risk segmentation in insurance leverages real-time driving data to enhance risk management by accurately categorizing policyholders according to their behavior patterns. Predictive analytics processes these telematics inputs through advanced algorithms, enabling insurers to forecast risk more precisely and personalize premiums effectively.

Generative AI Predictive Underwriting

Generative AI predictive underwriting revolutionizes risk management in insurance by using advanced machine learning models to analyze vast datasets, enabling accurate risk assessment and personalized policy pricing. This technology enhances underwriting efficiency, reduces human bias, and predicts potential claims with greater precision compared to traditional predictive analytics methods.

Cyber Risk Predictive Index

The Cyber Risk Predictive Index leverages advanced predictive analytics to quantify potential cyber threats, enabling insurers to enhance risk management strategies with data-driven insights that improve threat identification and mitigation. By integrating this index, insurance companies optimize underwriting accuracy and develop proactive cybersecurity measures to reduce potential financial losses from cyber incidents.

ESG Risk Heatmaps

ESG risk heatmaps integrate environmental, social, and governance factors within risk management frameworks to visually identify and prioritize potential vulnerabilities for insurance portfolios. Predictive analytics enhance these heatmaps by leveraging data-driven models to forecast risk patterns, enabling insurers to proactively mitigate ESG-related exposures and optimize decision-making.

Real-Time Loss Prevention Analytics

Real-time loss prevention analytics in insurance leverages predictive analytics to identify potential risks instantly by analyzing live data streams, enabling proactive risk management decisions that reduce claim frequency and severity. Integrating advanced algorithms with IoT sensors and telematics improves accuracy in forecasting losses, enhancing risk mitigation strategies and optimizing underwriting processes.

Continuous Risk Intelligence

Continuous Risk Intelligence integrates real-time data and advanced predictive analytics to enhance risk management by identifying emerging threats and dynamically adjusting risk mitigation strategies. This approach allows insurers to proactively manage exposure, reduce losses, and improve underwriting accuracy through continuous monitoring and data-driven insights.

Risk Management vs Predictive Analytics Infographic

industrydif.com

industrydif.com