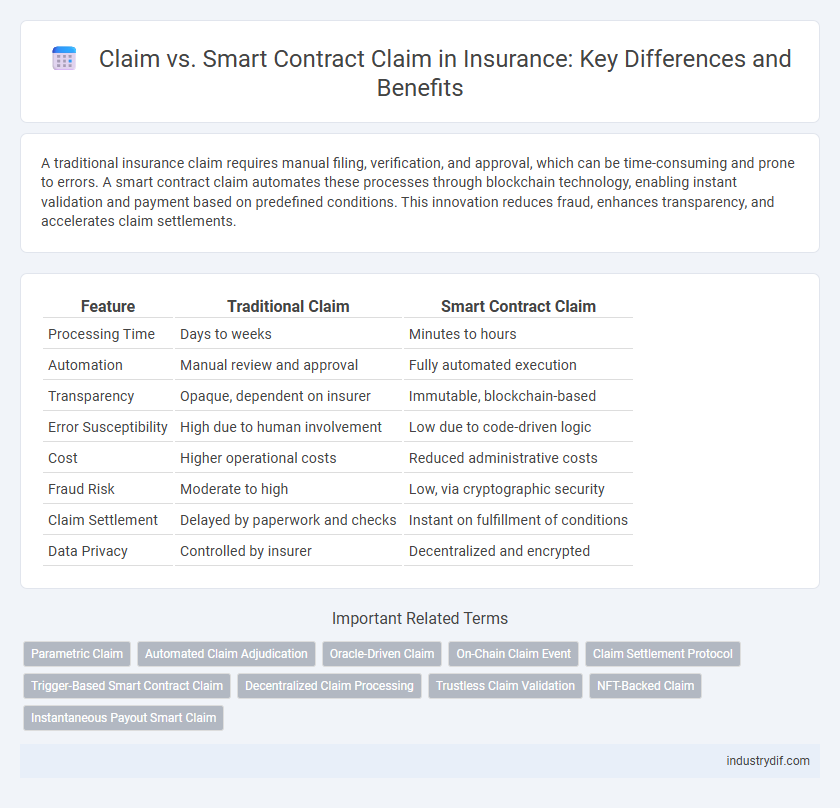

A traditional insurance claim requires manual filing, verification, and approval, which can be time-consuming and prone to errors. A smart contract claim automates these processes through blockchain technology, enabling instant validation and payment based on predefined conditions. This innovation reduces fraud, enhances transparency, and accelerates claim settlements.

Table of Comparison

| Feature | Traditional Claim | Smart Contract Claim |

|---|---|---|

| Processing Time | Days to weeks | Minutes to hours |

| Automation | Manual review and approval | Fully automated execution |

| Transparency | Opaque, dependent on insurer | Immutable, blockchain-based |

| Error Susceptibility | High due to human involvement | Low due to code-driven logic |

| Cost | Higher operational costs | Reduced administrative costs |

| Fraud Risk | Moderate to high | Low, via cryptographic security |

| Claim Settlement | Delayed by paperwork and checks | Instant on fulfillment of conditions |

| Data Privacy | Controlled by insurer | Decentralized and encrypted |

Introduction to Traditional Insurance Claims

Traditional insurance claims involve a policyholder submitting a request for compensation after an insured event, requiring manual verification, documentation, and approval by insurance adjusters. This process often entails delays due to human error, complex paperwork, and the need for multiple intermediary reviews. In contrast, the emerging use of smart contract claims automates verification and payouts through blockchain technology, reducing processing time and enhancing transparency in the insurance industry.

What Is a Smart Contract Claim?

A smart contract claim is an automated insurance claim process executed through blockchain technology, where predefined conditions trigger claim approval and payout without manual intervention. Unlike traditional claims, smart contracts eliminate paperwork and reduce processing time by using self-executing code to verify claim validity. This innovation enhances transparency, security, and efficiency in the insurance claims lifecycle.

Key Differences: Traditional vs. Smart Contract Claims

Traditional insurance claims involve manual processes including paperwork, human verification, and longer settlement times, often leading to delays and potential errors. Smart contract claims leverage blockchain technology to automate claim verification and payment through predefined conditions coded into the contract, ensuring transparency, speed, and reduced fraud. This shift enhances efficiency by eliminating intermediaries and providing real-time claim status updates.

How Traditional Claim Processing Works

Traditional claim processing in insurance involves manual submission of documents, verification by claims adjusters, and extensive communication between policyholders and insurers to validate and approve claims. This process often leads to delays, increased administrative costs, and potential errors due to human intervention. Data entry, policy checks, and fraud detection rely heavily on labor-intensive workflows, impacting the overall efficiency and customer satisfaction.

How Smart Contract Claims Are Automated

Smart contract claims in insurance leverage blockchain technology to automate the claims process by using pre-defined rules and conditions encoded directly into the contract. Once the claim event triggers the agreed criteria, the smart contract executes automatically, verifying data from external sources like IoT devices or oracles without manual intervention. This automation reduces processing time, minimizes human error, and enhances transparency and trust between policyholders and insurers.

Benefits of Using Smart Contract Claims

Smart contract claims automate the insurance claim process using blockchain technology, ensuring transparency, security, and faster settlement times. By eliminating manual verification and reducing human errors, smart contracts significantly lower administrative costs and minimize fraud risk. Policyholders benefit from real-time claim tracking and prompt payouts, enhancing overall customer satisfaction and trust.

Challenges and Limitations of Smart Contract Claims

Smart contract claims face challenges such as limited flexibility in handling complex insurance scenarios that require human judgment or interpretation. These contracts rely on predefined code, causing difficulties in accommodating exceptions, ambiguous policy terms, or evolving regulations. Reliance on accurate data inputs from oracles also exposes smart contract claims to risks of data manipulation or inaccuracies, limiting their effectiveness in real-world insurance claim processing.

Security and Trust in Smart Contract Claims

Smart contract claims enhance security by automating verification processes on decentralized blockchain networks, reducing human error and fraud risks inherent in traditional insurance claims. The immutability and transparency of smart contracts foster trust among policyholders and insurers through real-time, tamper-proof claim settlements. By eliminating intermediaries, smart contract claims accelerate payouts and ensure compliance with predefined contract terms, strengthening overall trust and security in the insurance ecosystem.

Real-World Applications of Smart Contract Claims

Smart contract claims streamline insurance processes by automating claim validation and payouts, reducing fraud and processing time significantly. Real-world applications include parametric insurance for weather events, where smart contracts trigger payments based on predefined conditions like rainfall or temperature data. This innovation enhances transparency, minimizes human errors, and supports faster settlement for both insurers and policyholders.

The Future of Claims Handling in Insurance Industry

The future of claims handling in the insurance industry is being transformed by smart contract claims, which automate and accelerate the claims process through blockchain technology. Unlike traditional claims that require manual verification and processing, smart contract claims execute predetermined terms automatically, reducing fraud and operational costs while enhancing transparency. This shift enables insurers to provide faster settlements and improved customer experiences, marking a significant evolution in claims management.

Related Important Terms

Parametric Claim

Parametric claims streamline insurance payouts by using predefined parameters in smart contracts, triggering automatic disbursements upon event verification, such as rainfall levels or flight delays. This contrasts with traditional claims requiring manual assessment and documentation, reducing processing time and enhancing transparency in payout accuracy.

Automated Claim Adjudication

Automated claim adjudication leverages smart contract claims to streamline the insurance payout process by automatically verifying policy conditions and triggering payments without manual intervention. This technology reduces processing time, minimizes errors, and enhances transparency compared to traditional claim handling methods.

Oracle-Driven Claim

Oracle-driven claims in insurance leverage external data sources to automatically verify and trigger payouts, enhancing transparency and reducing processing time compared to traditional claim methods. Smart contract claims utilize blockchain technology to execute terms based on oracle-verified events, minimizing disputes and fraud by ensuring contract conditions are met before payment release.

On-Chain Claim Event

On-chain claim events enable transparent, immutable recording of insurance claims directly on the blockchain, facilitating faster verification and reducing fraud compared to traditional claim processes. Smart contract claims automate payout triggers based on predefined conditions coded within the contract, ensuring real-time, trustless execution without manual intervention.

Claim Settlement Protocol

Claim settlement protocols streamline the process by verifying policy details and damage assessments before disbursing funds, ensuring accuracy and reducing processing time. Smart contract claims automate settlement using predefined rules encoded on the blockchain, eliminating manual errors and enabling instant payouts once claim conditions are met.

Trigger-Based Smart Contract Claim

Trigger-based smart contract claims automate insurance payouts by directly linking claim approval to predefined data inputs from IoT devices or external data oracles, eliminating manual verification delays and reducing fraud risk. Unlike traditional claims that require extensive paperwork and human intervention, these smart contracts enhance accuracy and efficiency through real-time, programmable triggers.

Decentralized Claim Processing

Decentralized claim processing leverages blockchain technology to automate and verify insurance claims through smart contracts, reducing fraud and speeding up settlements. Unlike traditional claims, smart contract claims execute predefined conditions automatically, ensuring transparent, tamper-proof, and efficient insurance claim management.

Trustless Claim Validation

Smart contract claims enable trustless claim validation by automating the verification process through pre-defined blockchain protocols, eliminating the need for intermediaries and reducing fraud risks. Traditional claims rely on manual review and subjective judgment, which increases processing time and potential disputes.

NFT-Backed Claim

NFT-backed claims leverage blockchain technology to automate insurance payouts through smart contracts, reducing fraud and increasing transparency by securely verifying asset ownership. Unlike traditional claims, where manual processing and subjective assessments prevail, these smart contract claims execute predetermined conditions instantly, ensuring faster and more reliable settlements.

Instantaneous Payout Smart Claim

Instantaneous payout smart claims leverage blockchain technology to automate verification and settlement processes, drastically reducing claim processing time compared to traditional insurance claims. This approach enhances transparency, minimizes human error, and ensures policyholders receive immediate compensation upon meeting predefined contract conditions.

Claim vs Smart Contract Claim Infographic

industrydif.com

industrydif.com