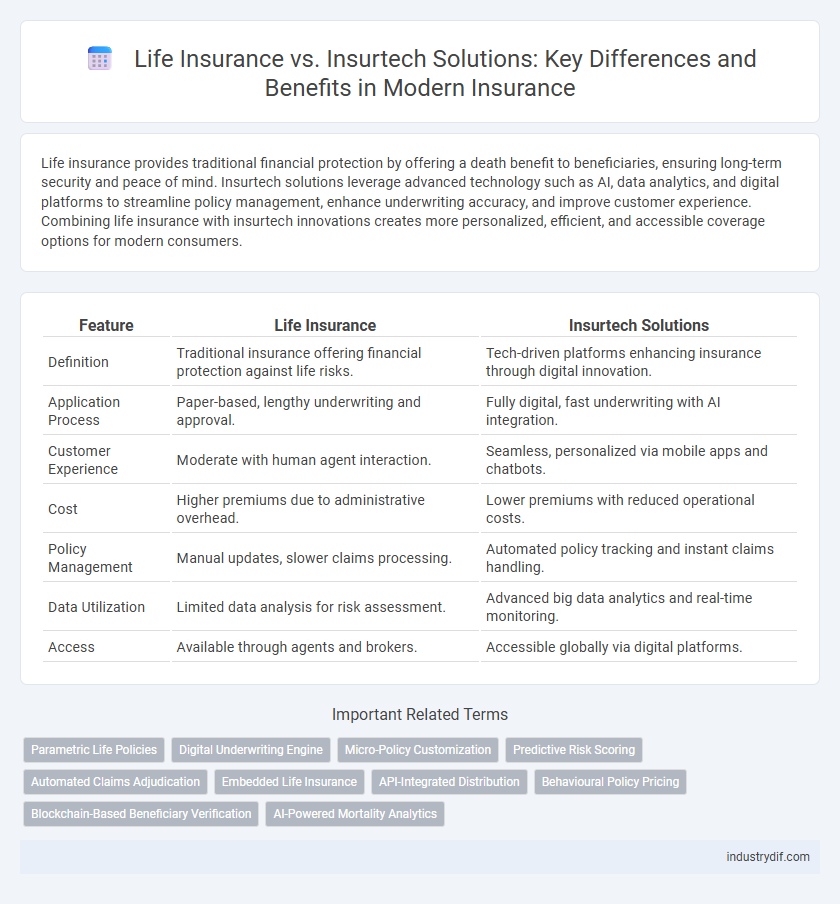

Life insurance provides traditional financial protection by offering a death benefit to beneficiaries, ensuring long-term security and peace of mind. Insurtech solutions leverage advanced technology such as AI, data analytics, and digital platforms to streamline policy management, enhance underwriting accuracy, and improve customer experience. Combining life insurance with insurtech innovations creates more personalized, efficient, and accessible coverage options for modern consumers.

Table of Comparison

| Feature | Life Insurance | Insurtech Solutions |

|---|---|---|

| Definition | Traditional insurance offering financial protection against life risks. | Tech-driven platforms enhancing insurance through digital innovation. |

| Application Process | Paper-based, lengthy underwriting and approval. | Fully digital, fast underwriting with AI integration. |

| Customer Experience | Moderate with human agent interaction. | Seamless, personalized via mobile apps and chatbots. |

| Cost | Higher premiums due to administrative overhead. | Lower premiums with reduced operational costs. |

| Policy Management | Manual updates, slower claims processing. | Automated policy tracking and instant claims handling. |

| Data Utilization | Limited data analysis for risk assessment. | Advanced big data analytics and real-time monitoring. |

| Access | Available through agents and brokers. | Accessible globally via digital platforms. |

Understanding Traditional Life Insurance

Traditional life insurance provides financial security through policies like term, whole, and universal life, offering death benefits and cash value accumulation. These policies rely on actuarial data and underwriting processes to assess risk and determine premiums tailored to individual needs. Understanding traditional life insurance requires recognizing its stability, regulated frameworks, and long-term protection compared to the emerging flexibility and technology-driven models of insurtech solutions.

What Are Insurtech Solutions?

Insurtech solutions leverage advanced technologies such as artificial intelligence, big data analytics, and blockchain to transform traditional life insurance processes, enhancing efficiency and customer experience. These innovations enable personalized policy offerings, faster claim processing, and improved risk assessment by utilizing real-time data and automation. By integrating digital platforms and smart algorithms, insurtech disrupts conventional life insurance models, making coverage more accessible and affordable for consumers.

Key Differences Between Life Insurance and Insurtech

Life insurance traditionally involves policyholders paying premiums to receive a death benefit, offering financial security to beneficiaries upon the insured's death, while insurtech solutions leverage advanced technology, such as AI and blockchain, to streamline underwriting, claims processing, and customer experience. Life insurance is often characterized by long-term contracts and regulatory oversight, whereas insurtech platforms emphasize speed, customization, and digital accessibility, disrupting conventional insurance models. The key differences lie in operational efficiency, user engagement, and the integration of innovative digital tools that transform risk assessment and policy management.

How Technology Is Transforming Insurance

Insurtech solutions are revolutionizing life insurance by leveraging artificial intelligence, big data analytics, and blockchain technology to enhance underwriting accuracy and streamline claims processing. Digital platforms enable personalized policy management, faster customer service, and real-time risk assessment, significantly reducing operational costs. This technological transformation increases accessibility and transparency, ultimately improving customer experience and driving growth in the life insurance sector.

Customer Experience: Traditional vs. Insurtech

Traditional life insurance often involves lengthy paperwork, in-person meetings, and slower claim processing, leading to a less convenient customer experience. Insurtech solutions leverage digital platforms, AI, and automation to provide faster policy issuance, real-time claim tracking, and personalized service through mobile apps. Enhanced transparency and 24/7 accessibility improve overall customer satisfaction by reducing friction and increasing engagement.

Pricing and Underwriting Innovations

Life insurance pricing traditionally relies on actuarial tables and standard underwriting processes, resulting in fixed premiums based on broad risk categories. Insurtech solutions leverage big data analytics, AI, and machine learning to deliver personalized pricing models and dynamic underwriting, increasing accuracy and efficiency. This innovation reduces costs and turnaround times, offering more competitive premiums and tailored coverage options for policyholders.

Claims Processing: Manual vs. Automated

Life insurance claims processing traditionally involves manual verification, causing delays and potential errors in claim settlements. Insurtech solutions leverage automated workflows and AI-driven analytics to expedite claims adjudication, improving accuracy and customer satisfaction. Automation reduces processing time from weeks to days, enhances fraud detection, and streamlines documentation handling for faster payouts.

Regulatory Compliance in Life Insurance and Insurtech

Life insurance companies operate under stringent regulatory frameworks established by state insurance departments to ensure policyholder protection and financial solvency, whereas insurtech solutions often navigate evolving regulatory landscapes that integrate technology standards with traditional insurance laws. Compliance in life insurance mandates adherence to statutes such as the Insurance Regulatory and Development Authority (IRDA) guidelines, while insurtech firms must also address data privacy laws like GDPR and cybersecurity mandates due to their digital platforms. Both sectors prioritize transparency, risk management, and consumer protections, yet insurtech innovations require continuous regulatory updates to accommodate emerging technologies like AI-driven underwriting and blockchain-based claims processing.

Future Trends in Insurance Technology

Life insurance is increasingly integrating insurtech solutions such as AI-driven underwriting and blockchain for transparent policy management to enhance customer experience and risk assessment accuracy. Future trends in insurance technology emphasize personalized policies through predictive analytics, automated claims processing, and wearable device data integration for proactive health monitoring. The convergence of life insurance and insurtech is driving a shift towards more efficient, customer-centric, and data-driven insurance ecosystems.

Choosing the Right Insurance Solution

Selecting the right insurance solution involves comparing traditional life insurance policies with innovative insurtech offerings that leverage technology to streamline underwriting and claims processing. Life insurance provides guaranteed financial protection with established reliability, while insurtech solutions offer personalized coverage options, faster approvals, and digital convenience. Evaluating factors such as premium costs, coverage flexibility, and customer service responsiveness helps determine the most suitable option for individual financial goals and risk tolerance.

Related Important Terms

Parametric Life Policies

Parametric life insurance policies leverage insurtech innovations by using predefined triggers and automated claims processing to provide faster, transparent payouts compared to traditional life insurance models, which often involve lengthy assessments and subjective underwriting. Integrating blockchain technology and IoT data, parametric life policies minimize claim disputes and reduce administrative costs, enhancing customer trust and operational efficiency within the insurance sector.

Digital Underwriting Engine

Life insurance is rapidly evolving with Insurtech solutions leveraging digital underwriting engines that analyze vast data sets instantly for accurate risk assessment and personalized policy pricing. These platforms streamline traditional underwriting by automating medical records retrieval, predictive analytics, and real-time decision-making, enhancing customer experience and reducing policy issuance times.

Micro-Policy Customization

Life insurance traditionally offers standardized coverage with limited flexibility, whereas insurtech solutions provide micro-policy customization that allows policyholders to tailor coverage according to specific needs and budgets. This granular approach enhances affordability and accessibility, leveraging data analytics and AI to optimize risk assessment and personalize premiums.

Predictive Risk Scoring

Life insurance companies increasingly incorporate predictive risk scoring through advanced insurtech solutions to enhance underwriting accuracy and personalize policy offerings. Predictive analytics leverage big data and machine learning algorithms to assess individual risk profiles more precisely, reducing default rates and optimizing premium pricing.

Automated Claims Adjudication

Automated claims adjudication in insurtech solutions dramatically reduces processing time for life insurance claims by utilizing artificial intelligence and machine learning algorithms to instantly verify policy details and assess claim validity. This innovation enhances accuracy, minimizes fraud, and delivers faster payouts compared to traditional manual adjudication methods in conventional life insurance companies.

Embedded Life Insurance

Embedded life insurance integrates coverage seamlessly within digital platforms, offering personalized, on-demand policies that adapt to user behavior and lifestyle. This innovation leverages insurtech advancements such as AI-driven underwriting and automated claims processing, enhancing customer experience and reducing operational costs compared to traditional life insurance models.

API-Integrated Distribution

API-integrated distribution in insurtech solutions revolutionizes life insurance by enabling seamless policy issuance, real-time underwriting, and instant claims processing through automated digital platforms. This technology enhances customer experience, reduces operational costs, and accelerates market reach compared to traditional life insurance methods relying on manual processes and broker networks.

Behavioural Policy Pricing

Life insurance traditionally relies on demographic data and actuarial tables for policy pricing, whereas insurtech solutions leverage behavioral data from wearable devices and real-time monitoring to create personalized premiums. Behavioral policy pricing enhances risk assessment accuracy by incorporating individual lifestyle habits, enabling dynamic adjustments and promoting healthier living.

Blockchain-Based Beneficiary Verification

Blockchain-based beneficiary verification in life insurance enhances security and transparency by using immutable ledgers to authenticate beneficiary identities, reducing fraud and claim disputes. Insurtech solutions leverage this technology to streamline payout processes, ensuring faster and more accurate benefits distribution compared to traditional methods.

AI-Powered Mortality Analytics

AI-powered mortality analytics revolutionize life insurance by enabling highly accurate risk assessments and personalized policy pricing, leveraging vast datasets and machine learning algorithms. Insurtech solutions integrate these advanced analytics to streamline underwriting processes, reduce costs, and enhance customer experience through real-time insights and predictive modeling.

Life Insurance vs Insurtech Solutions Infographic

industrydif.com

industrydif.com