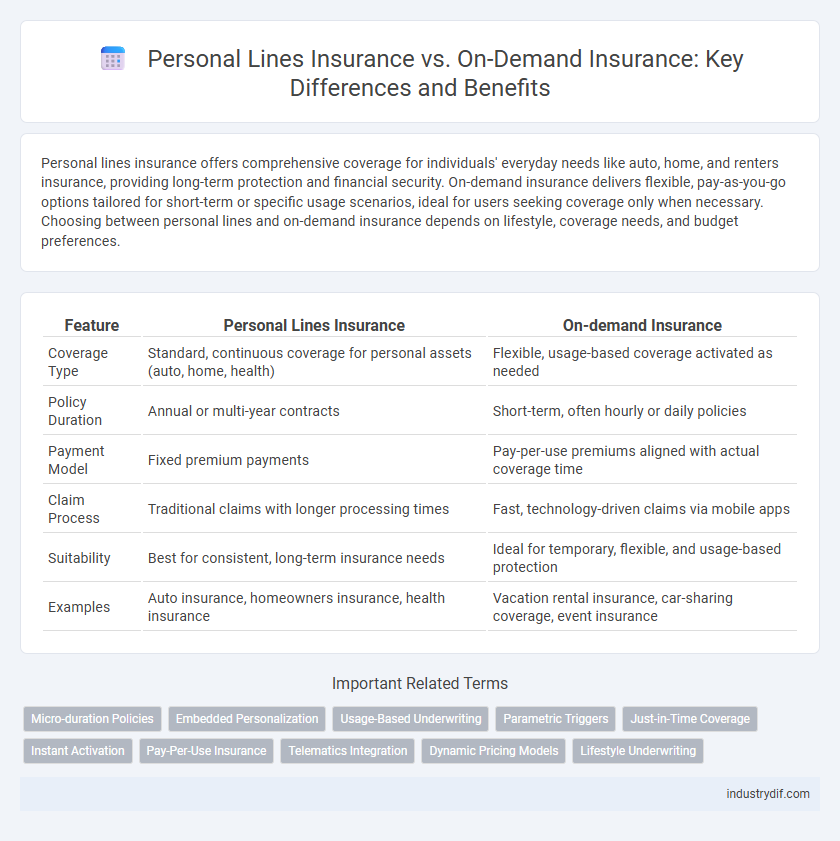

Personal lines insurance offers comprehensive coverage for individuals' everyday needs like auto, home, and renters insurance, providing long-term protection and financial security. On-demand insurance delivers flexible, pay-as-you-go options tailored for short-term or specific usage scenarios, ideal for users seeking coverage only when necessary. Choosing between personal lines and on-demand insurance depends on lifestyle, coverage needs, and budget preferences.

Table of Comparison

| Feature | Personal Lines Insurance | On-demand Insurance |

|---|---|---|

| Coverage Type | Standard, continuous coverage for personal assets (auto, home, health) | Flexible, usage-based coverage activated as needed |

| Policy Duration | Annual or multi-year contracts | Short-term, often hourly or daily policies |

| Payment Model | Fixed premium payments | Pay-per-use premiums aligned with actual coverage time |

| Claim Process | Traditional claims with longer processing times | Fast, technology-driven claims via mobile apps |

| Suitability | Best for consistent, long-term insurance needs | Ideal for temporary, flexible, and usage-based protection |

| Examples | Auto insurance, homeowners insurance, health insurance | Vacation rental insurance, car-sharing coverage, event insurance |

Definition of Personal Lines Insurance

Personal Lines Insurance provides coverage tailored to individual consumers for personal risks such as auto, homeowners, renters, and personal liability insurance. It involves standardized policies designed to protect individuals' assets and financial well-being from everyday risks and unforeseen events. Unlike commercial insurance, Personal Lines Insurance focuses exclusively on personal property and liabilities rather than business-related exposures.

Overview of On-demand Insurance

On-demand insurance offers flexible, usage-based coverage that can be activated instantly via mobile apps, catering primarily to personal lines such as auto, travel, and rental insurance. This model reduces costs by allowing customers to pay only for the coverage they need during specific time frames, enhancing convenience and accessibility. Advanced technology platforms and real-time data analytics enable insurers to provide personalized policies with dynamic pricing and seamless claims processing.

Key Differences Between Personal Lines and On-demand Insurance

Personal lines insurance provides comprehensive, fixed-coverage policies for individuals, typically covering auto, home, and renters insurance with long-term contracts and consistent premium payments. On-demand insurance offers flexible, short-term coverage activated instantly via digital platforms, ideal for specific needs like travel or ride-sharing, allowing policyholders to pay only for the coverage period they require. Key differences include policy duration, payment structure, and flexibility, with personal lines emphasizing stable, broad protection and on-demand focusing on convenience and customization.

Coverage Scope and Flexibility

Personal Lines insurance typically offers broad coverage for individuals' standard needs such as auto, home, and renters insurance, providing predictable protection with fixed terms and limits. On-demand insurance delivers highly flexible coverage tailored to specific time frames or activities, enabling policyholders to activate policies only when needed, often through digital platforms. This flexibility in on-demand insurance maximizes cost-efficiency and adaptability, contrasting with the comprehensive but less adjustable nature of traditional personal lines.

Application and Purchase Process

Personal Lines insurance typically requires a detailed application process involving risk assessment, underwriting, and binding through traditional agents or digital platforms, often taking several days for approval. On-demand insurance offers immediate coverage with minimal application steps via mobile apps, allowing users to activate or deactivate policies instantly based on their needs. The purchase process in on-demand insurance emphasizes convenience and flexibility, contrasting with the more comprehensive but time-intensive procedures found in Personal Lines.

Cost Comparison: Premiums and Payments

Personal lines insurance typically involves fixed premiums paid monthly or annually, offering consistent coverage for homes, autos, and personal valuables, with costs influenced by risk factors and policy limits. On-demand insurance features flexible, usage-based premiums charged only when coverage is active, often making it more cost-effective for users with sporadic or short-term insurance needs. Comparing payments, personal lines provide budget predictability, while on-demand insurance can reduce overall expenses by avoiding continuous premiums during inactive periods.

Suitability for Different Consumer Needs

Personal lines insurance offers comprehensive coverage tailored for traditional, long-term protection such as home, auto, and renters insurance, meeting the consistent needs of individuals and families. On-demand insurance provides flexible, short-term policies ideal for consumers seeking coverage for specific events, activities, or items, enabling instant activation and cost-efficiency. Suitability depends on the consumer's lifestyle and risk exposure, with personal lines fitting stable, ongoing coverage requirements, while on-demand insurance is optimal for occasional or unpredictable risk scenarios.

Claims and Policy Management

Personal lines insurance requires traditional claims processing with extensive documentation and fixed policy terms, leading to longer resolution times. On-demand insurance offers flexible, real-time coverage activated through digital platforms, streamlining claims submission and accelerating policy adjustments. Advanced AI-driven systems in on-demand models enhance efficiency by automating claims validation and enabling dynamic policy management tailored to user behavior.

Technological Advancements in On-demand Insurance

On-demand insurance leverages advanced technologies such as AI, IoT, and mobile platforms to offer real-time, flexible coverage tailored to individual needs, contrasting with traditional personal lines insurance's fixed policies. Machine learning algorithms enable instant risk assessment and dynamic pricing in on-demand models, enhancing customer experience and operational efficiency. This technological integration facilitates seamless policy activation and claims processing, setting on-demand insurance apart in the evolving insurance landscape.

Future Trends in Personal and On-demand Insurance

Future trends in personal lines insurance emphasize increased integration of artificial intelligence and big data analytics to offer highly personalized coverage and dynamic pricing models. On-demand insurance is expected to expand rapidly due to consumer demand for flexible, usage-based policies powered by mobile apps and real-time risk assessment technologies. The convergence of IoT devices and telematics will further drive innovation, enabling insurers to provide seamless, instant coverage adjustments and predictive risk management in both personal lines and on-demand segments.

Related Important Terms

Micro-duration Policies

Personal Lines insurance covers traditional, long-term policies for individuals, while On-demand Insurance offers flexible, micro-duration policies that activate instantly for specific time frames, ideal for temporary coverage needs. Micro-duration policies in On-demand Insurance provide cost-effective, pay-as-you-go protection for hours or days, enhancing convenience and control in personal risk management.

Embedded Personalization

Embedded personalization in personal lines insurance enhances customer experience by tailoring coverage options based on individual behavior, preferences, and risk profiles, resulting in optimized policy pricing and terms. On-demand insurance leverages real-time data and digital platforms to offer flexible, usage-based coverage, integrating seamless personalization that adapts instantly to customers' situational needs and activity patterns.

Usage-Based Underwriting

Usage-based underwriting in personal lines insurance leverages telematics and real-time data to assess individual risk profiles more accurately compared to traditional methods. On-demand insurance enhances this model by offering flexible, moment-to-moment coverage triggered by specific user activity, optimizing premiums based on actual usage patterns.

Parametric Triggers

Personal lines insurance traditionally relies on detailed claims assessments whereas on-demand insurance leverages parametric triggers, automatically activating coverage based on predefined events like weather thresholds or travel delays. Parametric triggers enable faster claims processing, reduce administrative costs, and provide transparent, data-driven payouts tailored to consumer-specific risks.

Just-in-Time Coverage

Just-in-time coverage in on-demand insurance offers personalized, flexible protection activated only when needed, contrasting with traditional personal lines insurance that provides continuous, fixed-coverage policies. On-demand insurance leverages real-time data and digital platforms to deliver cost-efficient, usage-based premiums tailored to specific events or periods, enhancing customer control and affordability.

Instant Activation

Personal Lines insurance offers comprehensive coverage with policies typically activated after thorough underwriting, whereas On-demand Insurance provides instant activation through mobile apps, enabling users to purchase coverage precisely when needed. This immediate activation feature of On-demand Insurance enhances flexibility and convenience for customers seeking short-term or situational protection.

Pay-Per-Use Insurance

Pay-Per-Use Insurance, a subset of Personal Lines, charges premiums based on actual usage or exposure, offering cost efficiency for low-mileage drivers or infrequent users. This on-demand insurance model leverages telematics data to tailor coverage and pricing dynamically, enhancing flexibility compared to traditional Personal Lines policies.

Telematics Integration

Personal lines insurance increasingly incorporates telematics integration to provide tailored premiums based on real-time driving behavior and risk assessment. On-demand insurance leverages telematics for flexible coverage activation, allowing policyholders to insure vehicles only when in use, enhancing cost efficiency and convenience.

Dynamic Pricing Models

Personal Lines insurance typically relies on traditional risk assessments and fixed premiums based on demographic data and historical claims, whereas On-demand Insurance leverages dynamic pricing models driven by real-time usage data and behavioral analytics to adjust premiums instantly. This shift enables personalized coverage options and cost efficiency, enhancing customer engagement and risk management through AI-powered algorithms and telematics.

Lifestyle Underwriting

Personal lines insurance traditionally relies on broad risk categories and demographic data for underwriting, whereas on-demand insurance leverages lifestyle underwriting by using real-time data from mobile devices and IoT to tailor coverage to individual behaviors. This dynamic approach enhances risk accuracy and offers personalized premium adjustments based on lifestyle choices such as driving habits, travel frequency, or exercise routines.

Personal Lines vs On-demand Insurance Infographic

industrydif.com

industrydif.com