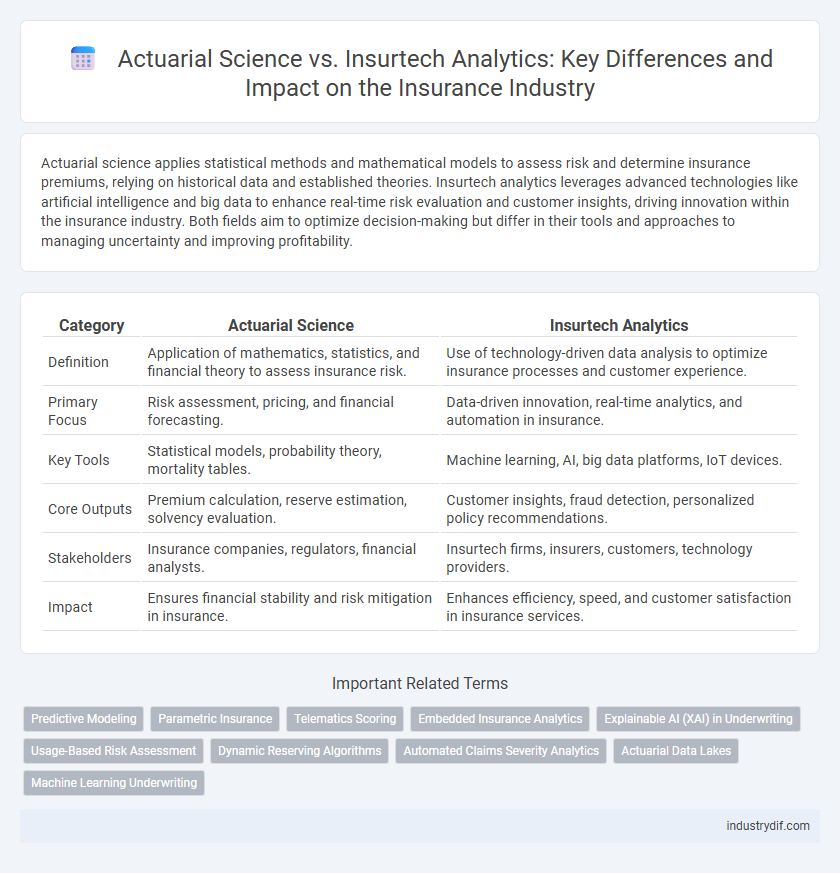

Actuarial science applies statistical methods and mathematical models to assess risk and determine insurance premiums, relying on historical data and established theories. Insurtech analytics leverages advanced technologies like artificial intelligence and big data to enhance real-time risk evaluation and customer insights, driving innovation within the insurance industry. Both fields aim to optimize decision-making but differ in their tools and approaches to managing uncertainty and improving profitability.

Table of Comparison

| Category | Actuarial Science | Insurtech Analytics |

|---|---|---|

| Definition | Application of mathematics, statistics, and financial theory to assess insurance risk. | Use of technology-driven data analysis to optimize insurance processes and customer experience. |

| Primary Focus | Risk assessment, pricing, and financial forecasting. | Data-driven innovation, real-time analytics, and automation in insurance. |

| Key Tools | Statistical models, probability theory, mortality tables. | Machine learning, AI, big data platforms, IoT devices. |

| Core Outputs | Premium calculation, reserve estimation, solvency evaluation. | Customer insights, fraud detection, personalized policy recommendations. |

| Stakeholders | Insurance companies, regulators, financial analysts. | Insurtech firms, insurers, customers, technology providers. |

| Impact | Ensures financial stability and risk mitigation in insurance. | Enhances efficiency, speed, and customer satisfaction in insurance services. |

Defining Actuarial Science in the Insurance Sector

Actuarial Science in the insurance sector involves applying mathematical and statistical methods to assess risk and uncertainty, ensuring accurate premium pricing and financial stability for insurance companies. Actuaries analyze large datasets to model potential future events, such as mortality rates and claim probabilities, enabling insurers to maintain solvency and meet regulatory requirements. This discipline forms the foundation for risk management and product development by quantifying financial impacts associated with insurance policies.

What is Insurtech Analytics?

Insurtech analytics refers to the application of advanced data analytics, machine learning, and artificial intelligence techniques within the insurance industry to optimize risk assessment, pricing, and claims processing. It leverages big data from multiple sources including IoT devices, social media, and telematics to deliver real-time insights that enhance underwriting efficiency and customer experience. Unlike traditional actuarial science which relies on historical data and statistical models, insurtech analytics emphasizes predictive modeling and data-driven innovation to transform insurance operations.

Core Competencies: Actuaries vs. Insurtech Analysts

Actuaries excel in risk assessment, statistical modeling, and regulatory compliance, leveraging deep expertise in probability theory and financial mathematics to predict insurance liabilities and ensure solvency. Insurtech analysts specialize in data science, machine learning, and technology integration, focusing on real-time data analytics and automation to enhance underwriting, claims processing, and customer experience. While actuaries provide foundational risk evaluation rooted in traditional insurance metrics, insurtech analysts drive innovation through advanced analytics platforms and AI-driven insights that optimize operational efficiency.

Traditional Actuarial Methods Explained

Traditional actuarial methods rely heavily on statistical models and historical data to assess risk and determine insurance premiums, emphasizing mortality rates, claim frequency, and loss severity. Actuaries utilize techniques such as life tables, survival analysis, and stochastic modeling to forecast future liabilities and ensure financial solvency. These conventional approaches provide a foundational framework for risk management, distinct from the data-driven, real-time insights offered by insurtech analytics.

The Rise of Data-Driven Insurtech Solutions

Actuarial science traditionally relies on historical data and statistical models to assess risk and set insurance premiums, whereas insurtech analytics leverages real-time data, artificial intelligence, and machine learning to enhance predictive accuracy and customer personalization. The rise of data-driven insurtech solutions has accelerated innovation by enabling insurers to analyze complex datasets, optimize underwriting processes, and improve fraud detection. This shift fosters more agile risk management strategies and drives competitive advantages in the evolving insurance landscape.

Machine Learning in Insurance Risk Assessment

Actuarial science relies on traditional statistical methods to evaluate insurance risk, utilizing historical data and probability theory to predict future claims. Insurtech analytics, driven by machine learning algorithms, enhances risk assessment by processing vast datasets, identifying complex patterns, and generating real-time predictive insights. Machine learning models improve the accuracy of underwriting, fraud detection, and pricing strategies, enabling insurers to optimize risk management and customer targeting.

Comparing Predictive Accuracy: Legacy vs. Digital Models

Legacy actuarial science relies on traditional statistical methods and historical data to predict insurance risks, often resulting in robust but sometimes less granular accuracy. Insurtech analytics leverages big data, machine learning, and real-time information, enhancing predictive accuracy by capturing complex, dynamic risk factors. Comparative studies show digital models outperform legacy approaches in identifying emerging trends and individual risk profiles, driving more precise underwriting and pricing strategies.

Regulatory Considerations for Actuarial and Insurtech Approaches

Regulatory considerations for actuarial science emphasize compliance with established actuarial standards, risk-based capital requirements, and solvency regulations governed by bodies such as the SOA and NAIC. Insurtech analytics must navigate evolving data privacy laws like GDPR and CCPA, ensuring transparency in AI-driven risk assessments while adhering to underwriting and claims regulations. Both approaches require rigorous validation and auditability of models to meet regulatory scrutiny and maintain market stability.

Impact on Customer Experience and Personalization

Actuarial science uses statistical models to assess risk and set premiums, ensuring financial stability and fair pricing for customers. Insurtech analytics leverages big data and AI to provide real-time insights, enabling personalized insurance products and faster claims processing. Together, these technologies enhance customer experience by delivering tailored solutions and improving service efficiency.

Future Trends: Hybrid Models Uniting Actuarial Science and Insurtech Analytics

Hybrid models integrating actuarial science and insurtech analytics are transforming predictive accuracy and risk assessment in the insurance industry. By combining traditional statistical methods with advanced machine learning algorithms, these models enable real-time data processing and personalized policy pricing. Future trends indicate increased adoption of AI-driven actuarial tools that enhance underwriting efficiency and fraud detection capabilities.

Related Important Terms

Predictive Modeling

Actuarial Science relies on established statistical models and historical insurance data to perform risk assessments and premium calculations through predictive modeling. Insurtech Analytics leverages advanced machine learning algorithms and real-time data integration to enhance predictive accuracy and enable dynamic risk management in insurance.

Parametric Insurance

Actuarial Science in parametric insurance relies on traditional statistical models to evaluate risk and set premiums based on historical data and probability theory. Insurtech Analytics enhances this approach by utilizing real-time data, machine learning, and advanced algorithms to create more accurate and automated parametric triggers, improving claim efficiency and customer experience.

Telematics Scoring

Telematics scoring leverages real-time driving data to enhance risk assessment in insurance, integrating actuarial science principles with insurtech analytics for more precise premium calculations. This fusion enables insurers to move beyond traditional statistical models, using granular behavioral data to improve underwriting accuracy and customer segmentation.

Embedded Insurance Analytics

Embedded insurance analytics integrates actuarial science methodologies with advanced insurtech tools to enhance risk assessment and pricing accuracy in real-time. This fusion enables insurers to leverage predictive models and big data analytics directly within customer touchpoints, improving underwriting efficiency and personalized policy offerings.

Explainable AI (XAI) in Underwriting

Explainable AI (XAI) in underwriting bridges traditional actuarial science with insurtech analytics by providing transparent, interpretable models that enhance risk assessment accuracy and compliance. This integration enables insurers to understand algorithmic decisions, improve customer trust, and optimize premium pricing through clear rationale behind predictive analytics.

Usage-Based Risk Assessment

Actuarial Science relies on statistical models and historical data to evaluate risk and determine insurance premiums, while Insurtech Analytics leverages real-time telematics and IoT data for dynamic, usage-based risk assessment. Usage-based insurance (UBI) enables personalized pricing by analyzing driver behavior, enabling insurers to optimize risk management and improve customer engagement.

Dynamic Reserving Algorithms

Dynamic reserving algorithms in actuarial science leverage statistical models and historical data to predict insurance liabilities accurately, ensuring precise reserve estimates. Insurtech analytics enhances these algorithms with real-time data integration and machine learning, offering adaptive, data-driven reserve management for improved financial stability and risk assessment.

Automated Claims Severity Analytics

Automated Claims Severity Analytics leverages Insurtech technologies such as machine learning and big data to enhance predictive accuracy and speed in evaluating claim costs, surpassing traditional Actuarial Science methods that rely heavily on historical statistical models. Insurtech-driven analytics provide real-time insights and dynamic risk assessment, optimizing claims management and improving loss reserving precision within modern insurance operations.

Actuarial Data Lakes

Actuarial Data Lakes centralize vast insurance datasets, enabling advanced risk modeling and predictive analytics critical for pricing policies and managing reserves. These data repositories support Actuarial Science by integrating structured and unstructured data, enhancing accuracy in loss forecasting compared to traditional Insurtech Analytics platforms.

Machine Learning Underwriting

Machine learning underwriting in actuarial science leverages statistical models and traditional risk assessment to predict insurance liabilities with high accuracy. Insurtech analytics enhances this process by integrating big data and AI algorithms, enabling real-time underwriting decisions and personalized policy pricing.

Actuarial Science vs Insurtech Analytics Infographic

industrydif.com

industrydif.com