Premium insurance requires a fixed payment upfront, providing predictable coverage over a set period, while pay-as-you-go models charge based on actual usage or risk exposure, offering more flexibility and potentially lower initial costs. The premium approach suits individuals seeking stability and comprehensive protection, whereas pay-as-you-go appeals to those preferring cost control and adjustments based on changing circumstances. Choosing between them depends on budget preferences and the desired level of coverage customization.

Table of Comparison

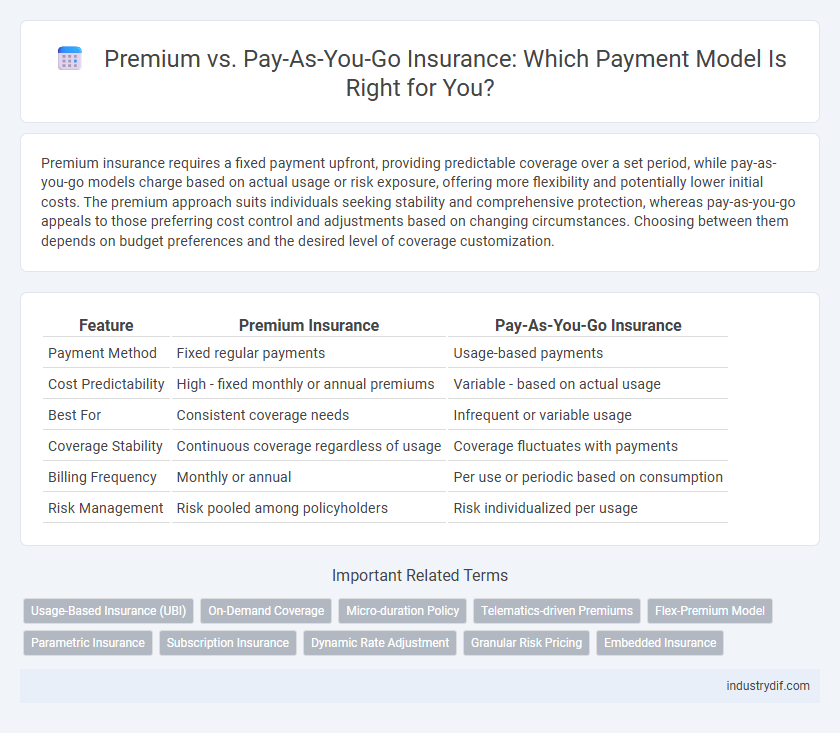

| Feature | Premium Insurance | Pay-As-You-Go Insurance |

|---|---|---|

| Payment Method | Fixed regular payments | Usage-based payments |

| Cost Predictability | High - fixed monthly or annual premiums | Variable - based on actual usage |

| Best For | Consistent coverage needs | Infrequent or variable usage |

| Coverage Stability | Continuous coverage regardless of usage | Coverage fluctuates with payments |

| Billing Frequency | Monthly or annual | Per use or periodic based on consumption |

| Risk Management | Risk pooled among policyholders | Risk individualized per usage |

Understanding Premium Insurance Models

Premium insurance models require fixed, upfront payments that provide predictable coverage and financial planning for policyholders. Pay-as-you-go insurance offers flexibility with variable costs based on actual usage or risk exposure, allowing customers to pay only for the coverage they need. Understanding these models helps consumers balance cost certainty against adaptability in managing insurance expenses effectively.

What is Pay-As-You-Go (PAYG) Insurance?

Pay-As-You-Go (PAYG) insurance is a flexible payment model where policyholders pay premiums based on actual usage or risk exposure rather than a fixed amount. This approach is common in auto insurance, allowing drivers to pay according to miles driven or driving behavior, optimizing cost-efficiency. PAYG insurance leverages telematics and real-time data to personalize rates, enhancing affordability and transparency for consumers.

Key Differences Between Premium and PAYG

Premium insurance requires upfront fixed payments based on estimated risk, while Pay-As-You-Go (PAYG) charges customers according to actual usage or claims, offering more flexibility. Premium plans provide predictable costs but may lead to overpayment if claims are low, whereas PAYG models align expenses closely with real-time behavior or events, reducing financial waste. Insurance companies use premium pricing to manage risk pools, whereas PAYG supports personalized risk assessment and incentivizes risk-reducing actions.

Cost Structure Comparison: Premium vs PAYG

Premium insurance features a fixed cost structure with predictable monthly or annual payments, providing cost stability regardless of usage patterns. Pay-As-You-Go (PAYG) insurance utilizes a variable cost model, charging consumers based on actual usage or risk exposure, often resulting in lower upfront expenses but fluctuating monthly costs. This comparison highlights premium plans as suitable for budget predictability while PAYG offers flexibility and potential savings for low-usage policyholders.

Flexibility and Customization in PAYG

Pay-As-You-Go insurance offers unparalleled flexibility by allowing policyholders to pay based on actual usage, reducing upfront costs and adapting to changing needs. This model supports customization through real-time data tracking, enabling personalized premiums that reflect individual risk profiles and behavior. Insurers benefit from improved customer engagement and retention by tailoring coverage dynamically, contrasting with the fixed payments of traditional premium plans.

Risk Management in Both Models

Premium insurance models involve fixed payments that provide predictable coverage and facilitate long-term risk pooling, enhancing overall financial stability for insurers. Pay-As-You-Go policies adjust costs based on actual usage or claims, allowing for more precise risk alignment and incentivizing safer behavior among policyholders. Both models require robust risk assessment techniques to balance premium income with potential liabilities, optimizing risk management strategies across different customer profiles.

Suitability for Different Customer Segments

Premium insurance plans suit customers seeking predictable monthly costs and comprehensive coverage, often ideal for families and long-term policyholders. Pay-as-you-go models benefit infrequent drivers and gig economy workers by aligning costs directly with actual usage, offering flexibility and potential savings. Choosing the right model depends on driving habits, risk tolerance, and financial stability, ensuring personalized coverage efficiency.

Digital Innovations Shaping PAYG

Digital innovations in Pay-As-You-Go (PAYG) insurance leverage telematics, IoT devices, and AI-driven analytics to tailor premiums based on real-time behavior and usage patterns. Mobile apps and connected devices enable seamless premium adjustments, improving transparency and customer engagement. These technological advancements reduce fraud, optimize risk assessment, and create more flexible insurance models compared to traditional fixed premium structures.

Regulatory Considerations for Both Models

Premium-based insurance models require compliance with fixed regulatory premiums set by authorities, ensuring predictable revenue streams but less flexibility for consumers. Pay-as-you-go insurance must adhere to dynamic regulatory frameworks addressing real-time usage data privacy, premium calculation transparency, and anti-fraud measures. Both models demand rigorous oversight on solvency requirements and consumer protection mandates to maintain market stability and trust.

Future Trends: Premium vs PAYG Insurance

Future trends in insurance show a growing shift towards Pay-As-You-Go (PAYG) models, which offer personalized premiums based on real-time data from IoT devices and telematics. Traditional premium-based insurance remains prevalent but faces pressure to evolve with technological advancements and consumer demand for flexibility. Enhanced data analytics and AI integration are expected to drive PAYG adoption, optimizing risk assessment and customer engagement.

Related Important Terms

Usage-Based Insurance (UBI)

Usage-Based Insurance (UBI) leverages telematics data to calculate premiums based on actual driving behavior, offering personalized rates that reward safe and infrequent drivers. Unlike traditional fixed premiums, Pay-As-You-Go models provide cost efficiency by charging customers strictly for miles driven or risk levels, enhancing affordability and fairness in auto insurance.

On-Demand Coverage

On-demand coverage in insurance offers flexibility by allowing policyholders to pay only for the coverage they use, contrasting with traditional premium models that require fixed periodic payments regardless of usage. This pay-as-you-go approach reduces upfront costs and aligns insurance expenses directly with actual risk exposure, enhancing cost efficiency for occasional or unpredictable insurance needs.

Micro-duration Policy

Micro-duration insurance policies offer flexible coverage periods ranging from hours to days, making premium calculations highly precise based on real-time risk exposure, unlike traditional fixed premiums that cover longer terms. Pay-As-You-Go models enhance affordability and accessibility by charging customers solely for the exact usage duration, optimizing cost-efficiency in short-term insurance solutions.

Telematics-driven Premiums

Telematics-driven premiums use real-time data on driving behavior to tailor insurance costs more accurately than traditional fixed premiums, rewarding safe drivers with lower rates. Pay-as-you-go models leverage this technology to charge customers based on actual miles driven and driving habits, promoting cost efficiency and personalized coverage.

Flex-Premium Model

The Flex-Premium Model in insurance offers policyholders the flexibility to adjust their premium payments based on their current financial situation, blending the predictability of fixed premiums with the adaptability of pay-as-you-go plans. This model optimizes cash flow management and enhances affordability by allowing variable premium contributions while maintaining continuous coverage.

Parametric Insurance

Parametric insurance offers a pay-as-you-go model that triggers automatic payments based on predefined event parameters, unlike traditional premium-based policies that require periodic fixed payments regardless of actual loss. This innovative approach enhances cash flow efficiency and reduces claim processing times by aligning coverage directly with measurable risk metrics such as weather data or seismic activity.

Subscription Insurance

Subscription insurance offers flexible coverage through a pay-as-you-go model, allowing policyholders to pay premiums based on actual usage or risk exposure rather than a fixed amount. This approach contrasts with traditional fixed premium plans by providing cost-efficiency, real-time adjustments, and tailored protection aligned with individual behaviors and needs.

Dynamic Rate Adjustment

Pay-As-You-Go insurance leverages dynamic rate adjustment by calculating premiums based on real-time usage data, enabling more accurate and personalized pricing compared to traditional fixed premium models. This approach enhances cost-efficiency and risk alignment by continuously adapting rates to changing behaviors and circumstances.

Granular Risk Pricing

Granular risk pricing in insurance enables personalized premium calculations based on detailed data such as driving behavior, location, and usage patterns, enhancing accuracy and fairness in underwriting. Pay-as-you-go models leverage telematics and real-time data to adjust premiums dynamically, reducing costs for low-risk policyholders while promoting proactive risk management.

Embedded Insurance

Embedded insurance integrates premium payments directly into product or service costs, offering seamless coverage without separate billing. This contrasts with pay-as-you-go models, where policyholders pay based on usage, providing flexible but potentially fluctuating insurance expenses.

Premium vs Pay-As-You-Go Infographic

industrydif.com

industrydif.com