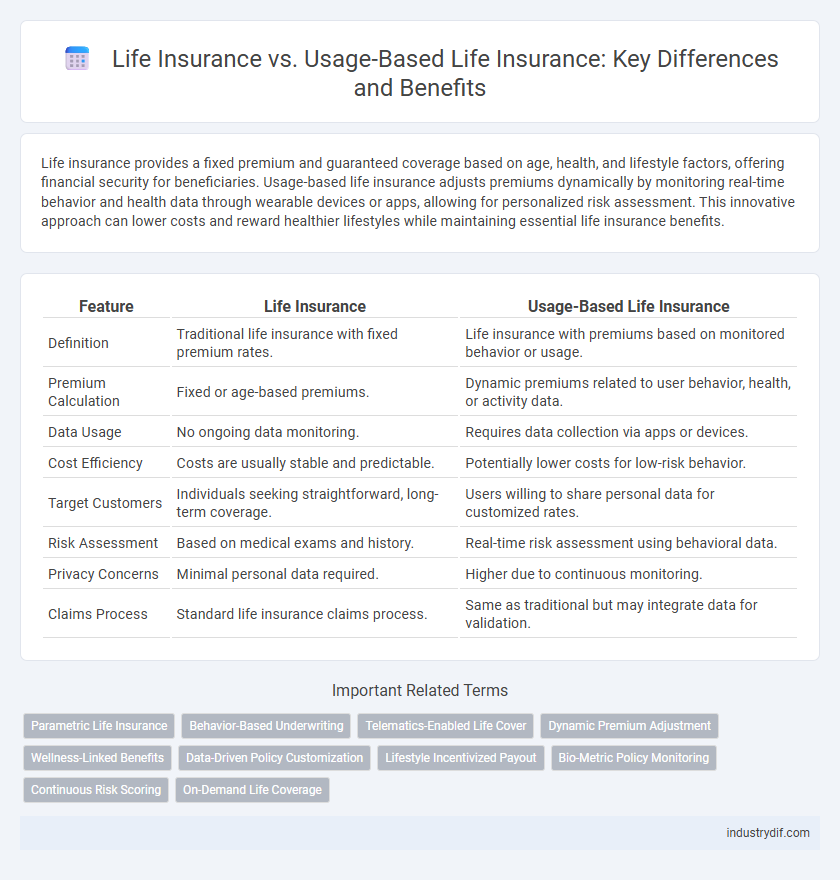

Life insurance provides a fixed premium and guaranteed coverage based on age, health, and lifestyle factors, offering financial security for beneficiaries. Usage-based life insurance adjusts premiums dynamically by monitoring real-time behavior and health data through wearable devices or apps, allowing for personalized risk assessment. This innovative approach can lower costs and reward healthier lifestyles while maintaining essential life insurance benefits.

Table of Comparison

| Feature | Life Insurance | Usage-Based Life Insurance |

|---|---|---|

| Definition | Traditional life insurance with fixed premium rates. | Life insurance with premiums based on monitored behavior or usage. |

| Premium Calculation | Fixed or age-based premiums. | Dynamic premiums related to user behavior, health, or activity data. |

| Data Usage | No ongoing data monitoring. | Requires data collection via apps or devices. |

| Cost Efficiency | Costs are usually stable and predictable. | Potentially lower costs for low-risk behavior. |

| Target Customers | Individuals seeking straightforward, long-term coverage. | Users willing to share personal data for customized rates. |

| Risk Assessment | Based on medical exams and history. | Real-time risk assessment using behavioral data. |

| Privacy Concerns | Minimal personal data required. | Higher due to continuous monitoring. |

| Claims Process | Standard life insurance claims process. | Same as traditional but may integrate data for validation. |

Definition of Life Insurance

Life insurance is a financial product providing a death benefit to beneficiaries upon the policyholder's death, helping to secure their financial future. Traditional life insurance policies include term life, whole life, and universal life, each with varying premiums, coverage durations, and cash value components. Usage-based life insurance, a modern variant, adjusts premiums based on real-time data such as lifestyle, health habits, or biometric information, offering a more personalized risk assessment.

Overview of Usage-Based Life Insurance

Usage-based life insurance leverages telematics technology to monitor real-time data such as health habits, activity levels, and biometric information, offering personalized premium rates based on individual behavior. This approach contrasts with traditional life insurance, which relies primarily on static factors like age, medical history, and demographics for policy underwriting. By integrating wearable devices and mobile apps, usage-based life insurance promotes proactive health management, potentially lowering costs and enhancing policyholder engagement.

Key Features: Traditional vs Usage-Based Policies

Traditional life insurance offers fixed premiums and coverage amounts based on age, health, and lifestyle factors assessed at policy inception, providing predictable financial protection. Usage-based life insurance adjusts premiums dynamically using real-time data such as biometric monitoring and activity levels, enabling personalized risk assessment and potential cost savings. Key distinctions include the static underwriting of traditional policies versus the data-driven, adaptive pricing models characteristic of usage-based options.

Premium Calculation Methods

Traditional life insurance premiums are typically calculated using factors such as age, health, lifestyle, and family medical history, relying on actuarial data to assess risk. Usage-based life insurance leverages telematics and real-time behavioral data, such as physical activity levels and biometric monitoring, to tailor premiums more dynamically to the insured's actual health and habits. This method allows for more personalized and potentially cost-effective premium rates, reflecting the policyholder's current risk profile rather than historical or static factors.

Risk Assessment and Underwriting Differences

Traditional life insurance relies on static risk assessment methods such as medical exams, health questionnaires, and demographic data to determine underwriting and premiums. Usage-based life insurance incorporates real-time data from wearable devices, activity trackers, and biometric monitoring, allowing for dynamic risk evaluation and personalized pricing. This approach offers more precise underwriting by continuously assessing lifestyle habits and health behaviors rather than one-time evaluations.

Benefits of Traditional Life Insurance

Traditional life insurance offers guaranteed coverage and fixed premiums, providing financial stability and predictable costs over time. It includes whole life and term life policies that build cash value or offer straightforward death benefits, ensuring reliable protection for beneficiaries. Policyholders gain long-term security and potential investment growth, supporting estate planning and wealth transfer needs.

Advantages of Usage-Based Life Insurance

Usage-based life insurance leverages real-time data from wearable devices to offer personalized premiums, rewarding policyholders for healthy behaviors and lifestyle choices. This approach enhances risk assessment accuracy and promotes proactive health management, potentially lowering long-term costs. Policyholders benefit from increased transparency, flexibility, and engagement compared to traditional life insurance models.

Privacy and Data Considerations

Life Insurance traditionally relies on medical history and demographic data, preserving policyholder privacy by limiting ongoing data collection. Usage-Based Life Insurance incorporates real-time monitoring through wearable devices or apps, raising significant privacy concerns due to continuous health and behavioral data tracking. Policyholders must weigh the trade-off between personalized premiums and the potential risks of data breaches or misuse of sensitive information.

Suitability: Who Should Choose Which Type?

Traditional life insurance suits individuals seeking stable, long-term financial protection with predictable premiums and coverage regardless of lifestyle changes. Usage-based life insurance appeals to those with low-risk behaviors who prefer premiums that adjust based on real-time data such as driving habits or health activities. Choosing between these depends on one's risk profile, financial goals, and preference for premium flexibility versus predictability.

Future Trends in Life Insurance Products

Future trends in life insurance products emphasize increased personalization through usage-based life insurance, which leverages real-time data from wearables and health apps to tailor premiums and coverage. Advances in artificial intelligence and data analytics enhance risk assessment accuracy, enabling insurers to offer dynamic policies that adjust with customers' lifestyle changes. Integration of IoT devices and blockchain technology further ensures transparency, security, and automated claims processing, shaping the next generation of life insurance solutions.

Related Important Terms

Parametric Life Insurance

Parametric Life Insurance offers predefined payout triggers based on measurable events, providing faster claims processing compared to traditional Life Insurance. Usage-Based Life Insurance integrates real-time data such as lifestyle and biometric information, enhancing risk assessment accuracy and personalized premium calculation.

Behavior-Based Underwriting

Behavior-based underwriting in usage-based life insurance leverages real-time data from wearable devices and health apps to assess risk more accurately, offering personalized premiums based on individual lifestyle habits. Traditional life insurance relies on static medical exams and questionnaires, often resulting in less precise risk evaluations and standardized pricing.

Telematics-Enabled Life Cover

Telematics-enabled life cover leverages real-time data from wearable devices and smartphones to customize life insurance premiums based on individual behaviors such as physical activity, sleep patterns, and heart rate, offering a personalized alternative to traditional life insurance that relies on static health assessments. By integrating telematics, insurers enhance risk assessment accuracy, encouraging healthier lifestyles while potentially lowering costs for policyholders through behavior-driven incentives.

Dynamic Premium Adjustment

Life insurance traditionally relies on fixed premiums determined by age, health, and coverage amount, while usage-based life insurance employs dynamic premium adjustment by continuously analyzing real-time data such as lifestyle, activity levels, and biometric indicators. This flexible pricing model enables personalized insurance costs that reflect ongoing risk factors, potentially lowering premiums for safer behaviors and improving overall policy affordability.

Wellness-Linked Benefits

Life Insurance traditionally offers fixed premiums and coverage regardless of personal habits, while Usage-Based Life Insurance integrates wellness-linked benefits by monitoring health data through wearables to tailor premiums and incentivize healthy behavior. This innovative approach leverages biometric data, promoting proactive health management and potentially lowering costs for policyholders who maintain a healthy lifestyle.

Data-Driven Policy Customization

Usage-based life insurance leverages real-time behavioral data such as physical activity, sleep patterns, and biometric indicators to tailor coverage and premiums more accurately than traditional life insurance policies that rely primarily on demographic and medical history. This data-driven policy customization enhances risk assessment precision, enabling insurers to offer personalized rates and incentives that promote healthier lifestyles and reduce overall mortality risk.

Lifestyle Incentivized Payout

Usage-Based Life Insurance leverages lifestyle data such as physical activity, sleep patterns, and diet to incentivize healthier behaviors with potential payout increases, aligning policy benefits directly with policyholder habits. Traditional Life Insurance offers fixed payouts unaffected by lifestyle changes, lacking personalized incentives tied to real-time health metrics and behavioral improvements.

Bio-Metric Policy Monitoring

Life insurance policies traditionally rely on fixed terms and risk assessments without continuous health data input, whereas usage-based life insurance leverages biometric policy monitoring through wearable devices and health apps to dynamically adjust premiums based on real-time health metrics like heart rate and activity levels. This bio-metric approach enables more personalized and accurate risk evaluation, promoting proactive health management and potentially lowering insurance costs for policyholders.

Continuous Risk Scoring

Continuous risk scoring in usage-based life insurance leverages real-time data from wearable devices and behavioral patterns to provide dynamic premiums tailored to individual risk profiles. Traditional life insurance relies on static assessments, while usage-based models enhance accuracy by continuously updating risk factors for personalized coverage and pricing.

On-Demand Life Coverage

On-demand life coverage offers policyholders flexible, usage-based insurance that adjusts premiums according to real-time risk factors and coverage needs, contrasting with traditional life insurance's fixed premiums and static terms. This innovative model enables consumers to activate and pay for life insurance protection only when necessary, enhancing affordability and personalized financial security.

Life Insurance vs Usage-Based Life Insurance Infographic

industrydif.com

industrydif.com