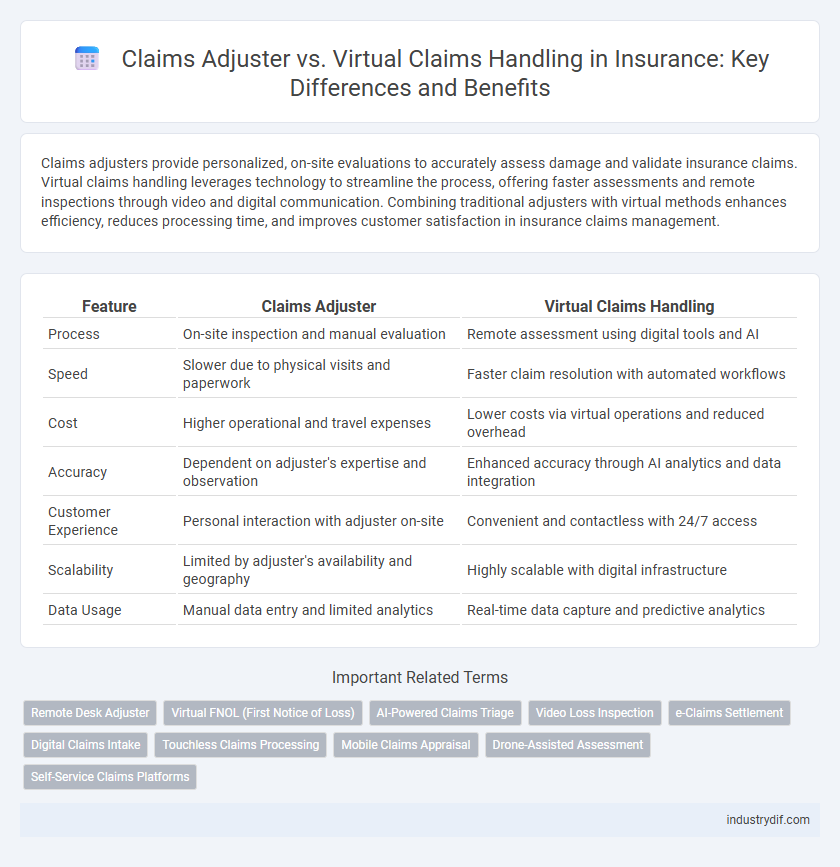

Claims adjusters provide personalized, on-site evaluations to accurately assess damage and validate insurance claims. Virtual claims handling leverages technology to streamline the process, offering faster assessments and remote inspections through video and digital communication. Combining traditional adjusters with virtual methods enhances efficiency, reduces processing time, and improves customer satisfaction in insurance claims management.

Table of Comparison

| Feature | Claims Adjuster | Virtual Claims Handling |

|---|---|---|

| Process | On-site inspection and manual evaluation | Remote assessment using digital tools and AI |

| Speed | Slower due to physical visits and paperwork | Faster claim resolution with automated workflows |

| Cost | Higher operational and travel expenses | Lower costs via virtual operations and reduced overhead |

| Accuracy | Dependent on adjuster's expertise and observation | Enhanced accuracy through AI analytics and data integration |

| Customer Experience | Personal interaction with adjuster on-site | Convenient and contactless with 24/7 access |

| Scalability | Limited by adjuster's availability and geography | Highly scalable with digital infrastructure |

| Data Usage | Manual data entry and limited analytics | Real-time data capture and predictive analytics |

Introduction to Claims Adjusters and Virtual Claims Handling

Claims adjusters are professionals who investigate, evaluate, and negotiate insurance claims to determine the insurer's liability and ensure fair settlements. Virtual claims handling leverages digital platforms and artificial intelligence to streamline the claims process, offering faster assessments and improved customer experiences. This shift towards virtual methods enhances efficiency by reducing manual interventions while maintaining accuracy in claims evaluation.

Roles and Responsibilities of Traditional Claims Adjusters

Traditional claims adjusters conduct in-person investigations to assess damage, interview claimants and witnesses, and verify policy coverage to determine claim validity. They are responsible for gathering evidence, estimating repair costs, and negotiating settlements directly with claimants and service providers. Their role requires physical site visits, detailed documentation, and personalized communication to ensure accurate and fair claim resolutions.

Understanding Virtual Claims Handling Processes

Virtual claims handling streamlines the insurance claims process by leveraging digital platforms and remote communication tools to assess damage, verify claims, and expedite settlements. Unlike traditional claims adjusters who conduct in-person inspections, virtual claims handling uses high-resolution images, videos, and AI-powered analysis to accurately evaluate losses. This technology-driven approach enhances efficiency, reduces processing time, and improves customer satisfaction by enabling faster claim resolutions without the need for physical presence.

Key Differences Between Traditional and Virtual Claims Handling

Traditional claims adjusters physically inspect damages and conduct in-person interviews, resulting in longer processing times and higher operational costs. Virtual claims handling leverages digital tools such as mobile apps, video assessments, and AI-driven analytics to expedite claim evaluations remotely, enhancing efficiency and customer satisfaction. The key difference lies in the integration of technology that reduces human intervention and accelerates claim resolution while maintaining accuracy.

Technology and Tools in Virtual Claims Management

Virtual claims handling leverages advanced technology such as AI-powered imaging analysis, automated document processing, and real-time data integration to streamline claim assessments. These tools enable faster, more accurate damage evaluations and reduce the need for physical inspections, enhancing efficiency and customer satisfaction. Claims adjusters utilizing virtual claims management benefit from cloud-based platforms that centralize communication and documentation, optimizing workflow and decision-making.

Benefits of Virtual Claims Handling for Insurers

Virtual claims handling enhances efficiency by enabling real-time claim assessments and faster decision-making through digital platforms and AI integration. It reduces operational costs by minimizing the need for physical inspections and travel expenses traditionally associated with claims adjusters. Insurers benefit from improved customer satisfaction and streamlined workflows, leading to quicker claim resolutions and better resource allocation.

Challenges and Limitations of Virtual Claims vs. In-Person Adjusters

Virtual claims handling faces challenges including limited capacity for thorough on-site damage inspections and potential technology barriers for customers, which can lead to incomplete assessments. In-person claims adjusters offer the advantage of direct property evaluation and face-to-face interactions, enhancing accuracy and customer trust. However, virtual methods may struggle with complex or large-scale claims requiring physical verification and nuanced judgment.

Impact on Customer Experience and Satisfaction

Claims adjusters provide personalized, on-site assessments that build trust through face-to-face interactions, enhancing customer satisfaction during complex or high-value claims. Virtual claims handling leverages digital tools and remote evaluations to expedite processing times, offering convenience and faster resolutions that increase customer satisfaction for straightforward claims. Combining traditional adjusters with virtual methods optimizes customer experiences by balancing thoroughness with efficiency, improving overall claims service quality.

Trends Shaping the Future of Claims Handling

Claims adjusters increasingly integrate advanced data analytics and AI-driven tools, enhancing accuracy and efficiency in damage assessments and fraud detection. Virtual claims handling leverages real-time video inspections and automated workflows, reducing settlement times and improving customer satisfaction through seamless remote interactions. Emerging trends show a hybrid model combining human expertise with virtual technologies as the future standard for streamlined, cost-effective claims processing.

Choosing the Right Approach: Factors for Insurers to Consider

Claims adjusters offer in-person assessments and personalized evaluations, essential for complex or high-value insurance claims requiring detailed inspections. Virtual claims handling leverages technology to expedite processing, reduce costs, and enhance customer convenience, particularly effective for straightforward claims and minor damages. Insurers should consider claim complexity, cost efficiency, customer experience, and technological infrastructure when deciding between traditional adjusters and virtual claims handling solutions.

Related Important Terms

Remote Desk Adjuster

Remote Desk Adjusters leverage advanced digital tools to evaluate insurance claims efficiently without on-site visits, significantly reducing processing time and operational costs. Virtual Claims Handling integrates AI-driven analytics and real-time communication platforms to enhance accuracy and customer satisfaction in claims assessment.

Virtual FNOL (First Notice of Loss)

Virtual FNOL streamlines the claims process by enabling policyholders to report losses instantly through digital platforms, reducing processing time and enhancing accuracy in data capture. This approach leverages AI-powered tools to assess damages remotely, minimizing the need for on-site claims adjuster visits while accelerating claims resolution and improving customer satisfaction.

AI-Powered Claims Triage

AI-powered claims triage leverages machine learning algorithms to rapidly assess claim details, prioritize cases based on severity, and streamline the claims process. While traditional claims adjusters rely on manual evaluation and on-site inspections, virtual claims handling utilizes AI to enhance accuracy, reduce processing time, and improve customer satisfaction through automated decision-making and real-time data analysis.

Video Loss Inspection

Claims adjusters perform on-site evaluations to assess damage, while virtual claims handling uses video loss inspection technology to expedite the process and reduce the need for physical visits. Video loss inspections enhance accuracy, improve customer satisfaction, and lower operational costs by enabling real-time remote damage assessments through high-definition streaming and documentation.

e-Claims Settlement

Claims adjusters traditionally assess damages and verify claim legitimacy through in-person inspections, while virtual claims handling leverages digital tools and AI to expedite e-claims settlement, reducing processing time by up to 50%. E-claims settlement platforms enhance accuracy and customer satisfaction by enabling real-time damage assessment, automated fraud detection, and seamless communication between claimants and insurers.

Digital Claims Intake

Digital claims intake streamlines the claims adjustment process by enabling insurers to collect and analyze all necessary documentation and information through online portals, reducing the need for in-person interactions by claims adjusters. Virtual claims handling enhances efficiency and accuracy by leveraging AI-powered tools and real-time data, improving customer satisfaction and accelerating claim resolutions.

Touchless Claims Processing

Touchless claims processing leverages advanced AI and automation to streamline claims adjuster tasks, reducing manual intervention and accelerating claim resolutions. Virtual claims handling enhances efficiency by enabling remote assessments and real-time data analysis, minimizing physical inspections and improving customer satisfaction.

Mobile Claims Appraisal

Mobile claims appraisal enhances efficiency by enabling claims adjusters to assess damages remotely using real-time photos and videos submitted via virtual claims handling platforms. This technology reduces processing time, lowers operational costs, and improves customer satisfaction by streamlining the claim settlement process.

Drone-Assisted Assessment

Drone-assisted assessment revolutionizes claims adjuster roles by enabling real-time, high-resolution data collection and damage analysis that reduces on-site visits and accelerates claim resolution. Virtual claims handling leverages drones to enhance accuracy, minimize human error, and improve safety during property inspections, leading to more efficient and cost-effective insurance claim processing.

Self-Service Claims Platforms

Self-service claims platforms empower policyholders to submit and track claims digitally, reducing dependency on traditional claims adjusters and accelerating settlement times. Virtual claims handling integrates AI and automation to streamline assessments, improve accuracy, and enhance customer experience while lowering operational costs.

Claims Adjuster vs Virtual Claims Handling Infographic

industrydif.com

industrydif.com