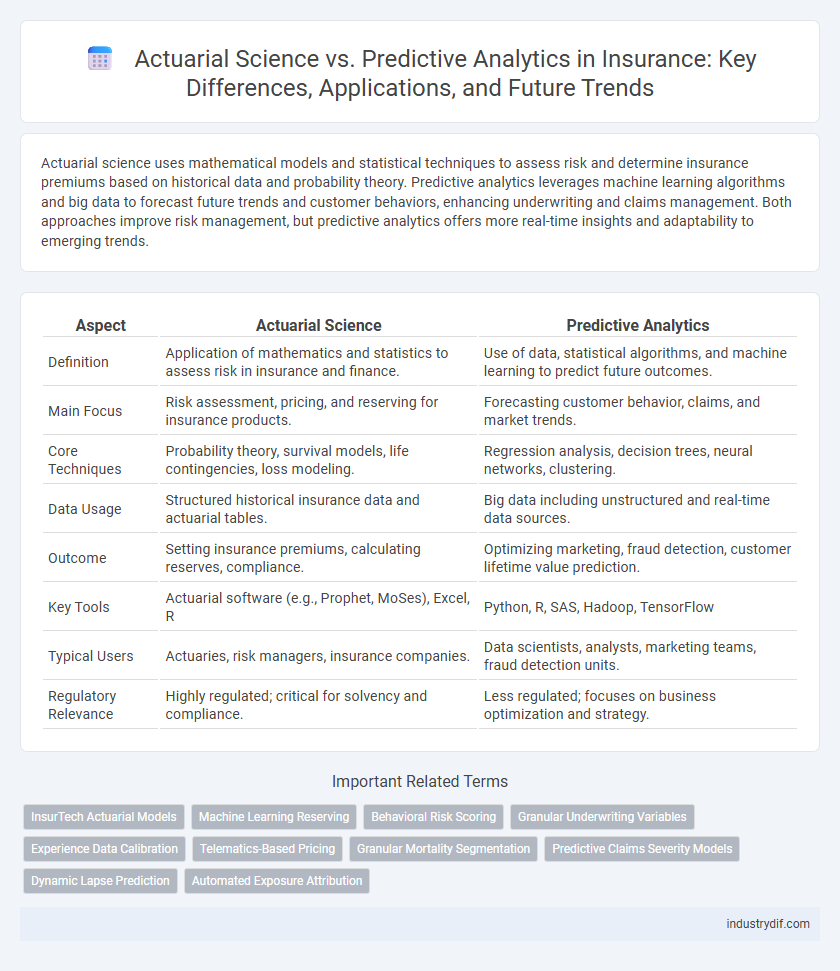

Actuarial science uses mathematical models and statistical techniques to assess risk and determine insurance premiums based on historical data and probability theory. Predictive analytics leverages machine learning algorithms and big data to forecast future trends and customer behaviors, enhancing underwriting and claims management. Both approaches improve risk management, but predictive analytics offers more real-time insights and adaptability to emerging trends.

Table of Comparison

| Aspect | Actuarial Science | Predictive Analytics |

|---|---|---|

| Definition | Application of mathematics and statistics to assess risk in insurance and finance. | Use of data, statistical algorithms, and machine learning to predict future outcomes. |

| Main Focus | Risk assessment, pricing, and reserving for insurance products. | Forecasting customer behavior, claims, and market trends. |

| Core Techniques | Probability theory, survival models, life contingencies, loss modeling. | Regression analysis, decision trees, neural networks, clustering. |

| Data Usage | Structured historical insurance data and actuarial tables. | Big data including unstructured and real-time data sources. |

| Outcome | Setting insurance premiums, calculating reserves, compliance. | Optimizing marketing, fraud detection, customer lifetime value prediction. |

| Key Tools | Actuarial software (e.g., Prophet, MoSes), Excel, R | Python, R, SAS, Hadoop, TensorFlow |

| Typical Users | Actuaries, risk managers, insurance companies. | Data scientists, analysts, marketing teams, fraud detection units. |

| Regulatory Relevance | Highly regulated; critical for solvency and compliance. | Less regulated; focuses on business optimization and strategy. |

Defining Actuarial Science and Predictive Analytics

Actuarial Science involves applying mathematical and statistical methods to assess risk in insurance, pensions, and finance, relying heavily on probability theory and life contingencies. Predictive Analytics uses data mining, machine learning, and statistical algorithms to analyze current and historical data, forecasting future events and customer behaviors. Both fields enhance decision-making in insurance but differ in approach, with actuarial science focusing on long-term risk evaluation and predictive analytics emphasizing short-term predictive insights.

Core Concepts in Actuarial Science

Actuarial science in insurance centers on probability, statistics, and financial theory to evaluate risks and uncertainties in future events, primarily using mortality tables, life contingencies, and loss distributions. Core concepts include survival models, premium calculation, and reserving, which ensure policyholders' solvency and fair pricing. Predictive analytics complements this by leveraging machine learning algorithms and big data to forecast customer behavior and optimize underwriting processes.

Key Principles of Predictive Analytics

Predictive analytics in insurance relies on statistical techniques such as regression analysis, machine learning algorithms, and data mining to forecast future risks and customer behaviors. Core principles include data quality and integration, feature selection, model training, validation, and continuous monitoring to ensure accuracy and relevance. Emphasizing these principles enables insurers to optimize underwriting, pricing, and claims management with data-driven insights.

Comparative Methodologies in Risk Assessment

Actuarial science employs statistical techniques and mathematical models based on historical data to calculate insurance risks and premiums with a focus on long-term financial stability. Predictive analytics uses machine learning algorithms and real-time data to identify emerging risk patterns and customer behaviors, enabling more dynamic and personalized risk assessments. Combining actuarial rigor with predictive flexibility enhances precision in underwriting and claims management within the insurance industry.

Data Sources and Data Management

Actuarial Science in insurance primarily relies on historical policyholder data, claims records, and mortality tables, emphasizing structured datasets for risk assessment and premium calculation. Predictive Analytics incorporates diverse data sources including customer behavior, social media, telematics, and external economic indicators, requiring robust data management systems capable of handling large volumes of unstructured and real-time data. Effective data governance and integration platforms are essential for both disciplines to ensure accuracy, compliance, and actionable insights in risk modeling and decision-making.

Role in Underwriting and Claims Processing

Actuarial Science leverages statistical models and historical data to assess risk and determine appropriate insurance premiums during underwriting, ensuring financial stability and compliance with regulatory standards. Predictive Analytics applies machine learning algorithms and real-time data to identify patterns and forecast future claims, enhancing efficiency and accuracy in claims processing. Both disciplines optimize risk evaluation but differ in methodology, with actuarial science emphasizing mathematical rigor and predictive analytics focusing on data-driven insights.

Integration with Modern Insurance Technologies

Actuarial science leverages statistical models and historical data to assess risk and calculate insurance premiums, forming the backbone of traditional underwriting. Predictive analytics integrates machine learning algorithms and real-time data to enhance risk prediction and customer segmentation, driving personalized insurance products. The fusion of actuarial rigor with predictive analytics in modern insurance platforms enables more accurate pricing, fraud detection, and efficient claims processing through advanced technologies such as IoT and AI.

Skillsets and Tools Required for Each Discipline

Actuarial science in insurance relies heavily on mathematical modeling, statistical analysis, and risk assessment using tools such as Excel, VBA, and actuarial software like Prophet and Moses. Predictive analytics requires expertise in data mining, machine learning algorithms, and programming languages such as Python, R, and SQL, alongside platforms like SAS and TensorFlow for processing big data. Both disciplines demand strong analytical skills, but actuaries focus more on risk quantification and regulatory compliance while predictive analysts emphasize data-driven forecasting and business optimization.

Challenges in Implementation and Adoption

Implementing actuarial science in insurance faces challenges such as integrating complex statistical models with legacy systems and ensuring data accuracy for risk assessment. Predictive analytics adoption struggles with overcoming data privacy concerns, managing large unstructured datasets, and aligning analytical insights with traditional underwriting processes. Both disciplines require significant organizational change management and skilled personnel to bridge technical expertise with practical application.

Future Trends: Bridging Actuarial Science and Predictive Analytics

Future trends in insurance emphasize the integration of actuarial science with predictive analytics to enhance risk assessment accuracy and pricing models. Advanced machine learning algorithms are increasingly incorporated with traditional actuarial methods to analyze complex datasets, improving customer segmentation and fraud detection. This convergence enables insurers to deliver personalized policies and optimize portfolio management in a rapidly evolving market.

Related Important Terms

InsurTech Actuarial Models

InsurTech actuarial models leverage advanced predictive analytics to enhance risk assessment and pricing accuracy by integrating vast datasets, machine learning algorithms, and real-time data processing. Actuarial science traditionally relies on statistical methods and historical data analysis, but InsurTech innovations blend these methodologies to optimize underwriting, fraud detection, and claims management in insurance.

Machine Learning Reserving

Actuarial Science employs traditional statistical techniques for machine learning reserving, focusing on historical loss data and deterministic models to estimate future liabilities. Predictive Analytics leverages advanced machine learning algorithms and big data to enhance reserving accuracy, enabling dynamic risk assessment and real-time forecasting in insurance portfolios.

Behavioral Risk Scoring

Behavioral risk scoring in insurance leverages actuarial science to analyze historical data and statistical models for predicting future claims frequency and severity. Predictive analytics enhances this process by integrating real-time behavioral data and machine learning algorithms to dynamically assess individual risk profiles, improving underwriting accuracy and personalized pricing.

Granular Underwriting Variables

Actuarial Science in insurance relies on historical data and traditional statistical models to evaluate risk using aggregate variables, whereas Predictive Analytics employs machine learning techniques to analyze granular underwriting variables such as individual health metrics, lifestyle factors, and real-time behavior patterns for more precise risk assessment. Leveraging these detailed data points allows insurers to tailor policies, improve pricing accuracy, and enhance risk segmentation beyond standard actuarial methods.

Experience Data Calibration

Experience data calibration in actuarial science involves adjusting models based on historical loss and claim data to ensure accurate premium setting and reserving, emphasizing reliability and regulatory compliance. Predictive analytics enhances calibration by integrating diverse data sources and machine learning techniques to identify emerging risk patterns and improve underwriting precision.

Telematics-Based Pricing

Actuarial science leverages historical data and statistical models to assess risk and set telematics-based pricing, focusing on long-term trends and regulatory compliance. Predictive analytics utilizes real-time telematics data and machine learning algorithms to dynamically adjust insurance premiums, enhancing accuracy and personalization for individual driving behaviors.

Granular Mortality Segmentation

Granular mortality segmentation in actuarial science leverages detailed demographic and behavioral data to refine risk assessment and premium pricing, enabling insurers to more accurately predict mortality rates within specific population subgroups. Predictive analytics enhances this process by applying machine learning algorithms and big data techniques to uncover complex patterns and trends, increasing the precision of mortality forecasts and optimizing portfolio management strategies.

Predictive Claims Severity Models

Predictive claims severity models leverage advanced machine learning algorithms to estimate the potential cost of insurance claims with greater accuracy than traditional actuarial methods, enhancing risk assessment and pricing strategies. These models integrate diverse data sources, such as historical claim records, policyholder behavior, and external environmental factors, to improve loss forecasting and optimize reserve allocations in insurance operations.

Dynamic Lapse Prediction

Dynamic lapse prediction in insurance leverages actuarial science models to analyze historical policyholder behavior and financial risk factors, while predictive analytics employs machine learning algorithms to identify patterns and forecast lapse rates with real-time data integration. Combining these approaches enhances policy retention strategies by accurately anticipating lapses and optimizing tailored interventions.

Automated Exposure Attribution

Automated Exposure Attribution in Actuarial Science leverages statistical models to precisely allocate risk exposure based on historical insurance data, enhancing reserve calculations and pricing accuracy. Predictive Analytics applies machine learning algorithms for dynamic risk segmentation, improving underwriting decisions by identifying exposure patterns and potential claims in real-time.

Actuarial Science vs Predictive Analytics Infographic

industrydif.com

industrydif.com