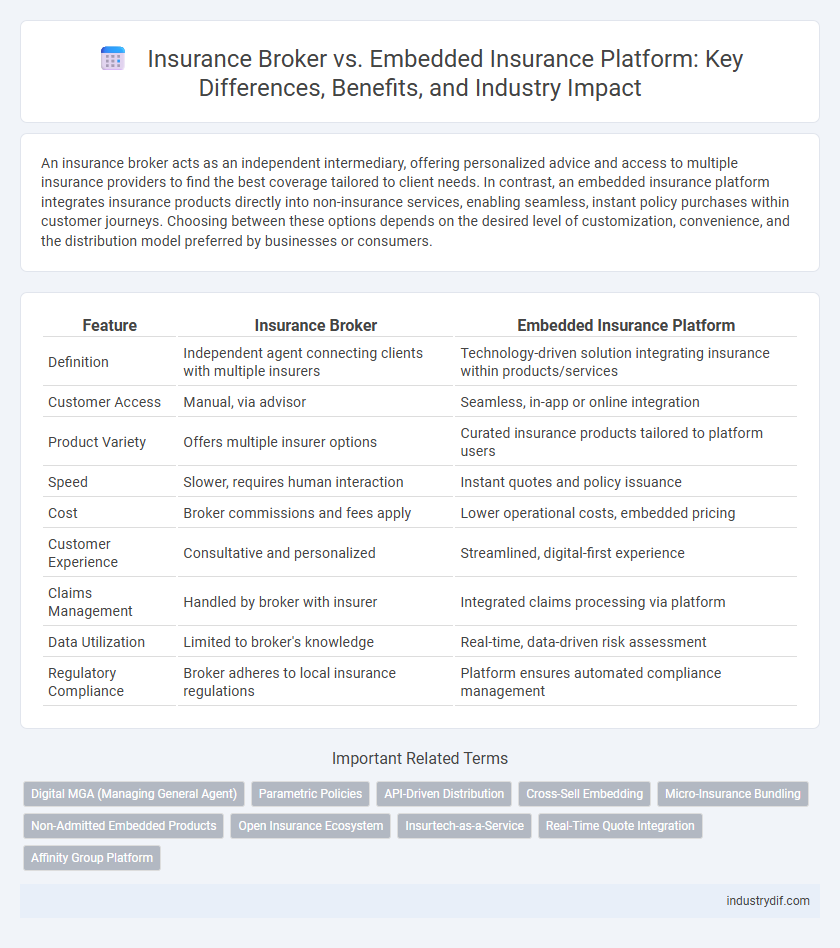

An insurance broker acts as an independent intermediary, offering personalized advice and access to multiple insurance providers to find the best coverage tailored to client needs. In contrast, an embedded insurance platform integrates insurance products directly into non-insurance services, enabling seamless, instant policy purchases within customer journeys. Choosing between these options depends on the desired level of customization, convenience, and the distribution model preferred by businesses or consumers.

Table of Comparison

| Feature | Insurance Broker | Embedded Insurance Platform |

|---|---|---|

| Definition | Independent agent connecting clients with multiple insurers | Technology-driven solution integrating insurance within products/services |

| Customer Access | Manual, via advisor | Seamless, in-app or online integration |

| Product Variety | Offers multiple insurer options | Curated insurance products tailored to platform users |

| Speed | Slower, requires human interaction | Instant quotes and policy issuance |

| Cost | Broker commissions and fees apply | Lower operational costs, embedded pricing |

| Customer Experience | Consultative and personalized | Streamlined, digital-first experience |

| Claims Management | Handled by broker with insurer | Integrated claims processing via platform |

| Data Utilization | Limited to broker's knowledge | Real-time, data-driven risk assessment |

| Regulatory Compliance | Broker adheres to local insurance regulations | Platform ensures automated compliance management |

Definition of Insurance Broker vs Embedded Insurance Platform

An Insurance Broker is an independent professional who connects clients with multiple insurance providers to find tailored coverage options, offering personalized advice and comparative analysis. An Embedded Insurance Platform integrates insurance products directly into non-insurance customer journeys, enabling seamless policy purchases within digital ecosystems such as e-commerce or travel booking sites. The key difference lies in the distribution method: brokers act as intermediaries offering choice and expertise, while embedded platforms provide real-time insurance solutions embedded within a customer's purchase experience.

Key Differences Between Insurance Brokers and Embedded Insurance

Insurance brokers act as intermediaries who independently offer a variety of insurance products from multiple carriers, providing personalized advice and tailored coverage options to clients. Embedded insurance platforms integrate insurance products directly into non-insurance digital services or transactions, enabling seamless purchase of coverage within the customer's original buying journey. The key difference lies in brokers facilitating choice and customization through personal interaction, while embedded platforms prioritize convenience and real-time insurance embedding into other service ecosystems.

How Insurance Brokers Operate

Insurance brokers operate as independent intermediaries who assess clients' needs, compare policies from multiple insurers, and provide tailored advice to secure the best coverage. They negotiate terms and handle claims on behalf of policyholders, ensuring personalized service and unbiased product recommendations. Brokers rely on deep market knowledge, regulatory compliance, and strong insurer relationships to maximize value for their clients.

How Embedded Insurance Platforms Work

Embedded insurance platforms integrate insurance products directly into the purchase process of non-insurance goods or services, enabling seamless coverage selection at the point of sale. These platforms use APIs to connect insurers with merchants, allowing real-time underwriting, pricing, and policy issuance without customer redirection. By embedding insurance into digital ecosystems, these platforms enhance customer experience, reduce friction, and increase policy uptake.

Pros and Cons: Insurance Broker Model

The Insurance Broker model offers personalized consulting, access to multiple insurers, and tailored coverage options, enhancing customer choice and competitive pricing. However, brokers may involve higher commission costs, potential conflicts of interest, and slower policy issuance compared to automated platforms. This model benefits clients seeking expert advice but may lack the seamless integration and efficiency of embedded insurance platforms.

Pros and Cons: Embedded Insurance Platform Model

Embedded Insurance Platform models streamline the purchasing process by integrating insurance products directly within partner platforms, enhancing customer convenience and driving higher conversion rates. However, these platforms often face regulatory challenges and require significant technological investment for seamless integration and data security. Limited flexibility in product customization can restrict insurer control compared to traditional broker models, potentially impacting the range of offerings available to customers.

Customer Experience Comparison

Insurance brokers offer personalized advice and tailored policy options by acting as intermediaries between customers and multiple insurers, enhancing trust and satisfaction through human interaction. Embedded insurance platforms streamline the buying process by integrating coverage options directly into the customer journey on digital platforms, providing convenience and faster access but limited customization. Customers benefit from brokers' expertise and hands-on support, while embedded platforms excel in seamless digital experiences and instant policy issuance.

Regulatory Considerations and Compliance

Insurance brokers must comply with strict regulatory requirements, including licensing, fiduciary duties, and consumer protection laws, ensuring transparent client representation. Embedded insurance platforms face complex compliance challenges integrating insurance products within non-insurance environments, requiring adherence to both insurance regulations and the host platform's industry standards. Both models demand ongoing monitoring and risk management to maintain regulatory compliance and protect consumer interests effectively.

Impact on Distribution Channels

Insurance brokers provide personalized advice and access to multiple insurers, enhancing customer choice and trust while maintaining traditional distribution channels. Embedded insurance platforms integrate insurance products directly into non-insurance services, streamlining the buying process and expanding reach through digital ecosystems. This shift accelerates distribution efficiency and customer acquisition by embedding insurance at the point of need, transforming traditional sales models.

Choosing the Right Model for Your Business

Selecting the right insurance distribution method depends on your business goals and customer experience priorities. Insurance brokers offer personalized advice and flexibility across multiple carriers, while embedded insurance platforms integrate coverage seamlessly within digital products for convenience and instant access. Evaluating factors like customer engagement, operational control, and scalability will help determine whether a broker model or an embedded insurance platform best aligns with your strategic objectives.

Related Important Terms

Digital MGA (Managing General Agent)

A Digital MGA leverages an embedded insurance platform to streamline policy distribution by integrating insurance products directly into partner ecosystems, enhancing customer experience and operational efficiency compared to traditional insurance brokers who act as intermediaries. Embedded insurance platforms enable Digital MGAs to harness data analytics and automation for tailored risk assessment and faster underwriting processes, driving scalability and cost reductions in insurance service delivery.

Parametric Policies

Parametric policies offered through embedded insurance platforms enable instant claims settlement by triggering payouts based on predefined parameters, enhancing customer experience compared to traditional insurance brokers who rely on claim assessments. Embedded platforms utilize real-time data integration and automation to streamline parametric insurance products, reducing administrative costs and accelerating coverage delivery.

API-Driven Distribution

API-driven distribution enhances insurance brokers' ability to offer personalized coverage by integrating multiple carriers' products seamlessly, while embedded insurance platforms streamline the purchase process by embedding policies directly into customer journeys via APIs, optimizing real-time risk assessment and policy issuance. Both models leverage APIs to increase efficiency and scalability, but brokers prioritize product comparison and advisory services, whereas embedded platforms focus on seamless integration and instant underwriting within digital ecosystems.

Cross-Sell Embedding

Insurance brokers leverage personalized client relationships to cross-sell diverse insurance products by understanding unique customer risks and preferences, maximizing policy uptake. Embedded insurance platforms integrate seamlessly with non-insurance services, offering contextual cross-sell opportunities at the point of sale, enhancing customer convenience and conversion rates.

Micro-Insurance Bundling

Insurance brokers offer personalized advice and access to a wide range of micro-insurance products, enabling tailored coverage for niche markets. Embedded insurance platforms integrate micro-insurance bundling directly into digital ecosystems, streamlining purchase processes and enhancing customer convenience through real-time underwriting and automated claims management.

Non-Admitted Embedded Products

Non-admitted embedded insurance products are typically offered through embedded insurance platforms, which integrate directly with digital services, bypassing traditional licensed insurance brokers and their state-admitted carrier requirements. These platforms enable rapid product deployment and customization while navigating compliance challenges associated with surplus lines and non-admitted risk carriers.

Open Insurance Ecosystem

Insurance brokers offer personalized policy selection and claims support by directly interacting with multiple insurers, enhancing customer choice within an open insurance ecosystem. Embedded insurance platforms integrate insurance products seamlessly into non-insurance services through APIs, driving broader market reach and real-time data exchange across the open insurance ecosystem.

Insurtech-as-a-Service

Insurance brokers offer personalized risk assessment and policy placement by leveraging human expertise, while embedded insurance platforms integrate seamlessly into third-party apps or websites to provide on-demand coverage. Insurtech-as-a-Service accelerates market entry by delivering scalable technology solutions that empower embedded platforms with automated underwriting, real-time data analytics, and dynamic pricing models.

Real-Time Quote Integration

Real-time quote integration in insurance brokers enables personalized policy comparisons by accessing multiple carrier databases instantly, enhancing customer choice and transparency. Embedded insurance platforms streamline this process within partner apps, delivering immediate, context-specific quotes that improve user experience and conversion rates.

Affinity Group Platform

An affinity group platform leverages embedded insurance technology to seamlessly integrate tailored insurance products within member services, enhancing customer experience and increasing policy uptake. Insurance brokers provide personalized guidance and market expertise, while embedded platforms automate policy distribution, reduce friction, and enable scalable partnerships with affinity groups.

Insurance Broker vs Embedded Insurance Platform Infographic

industrydif.com

industrydif.com