Captive insurance provides companies with a tailored risk management solution by allowing them to create their own insurance subsidiary to fund risks internally. Insurance-linked securities (ILS) transfer risk to capital markets by enabling investors to assume specific insurance risks through tradable financial instruments. Both alternatives enhance risk diversification and capital efficiency but differ in structure, regulatory environment, and investor involvement.

Table of Comparison

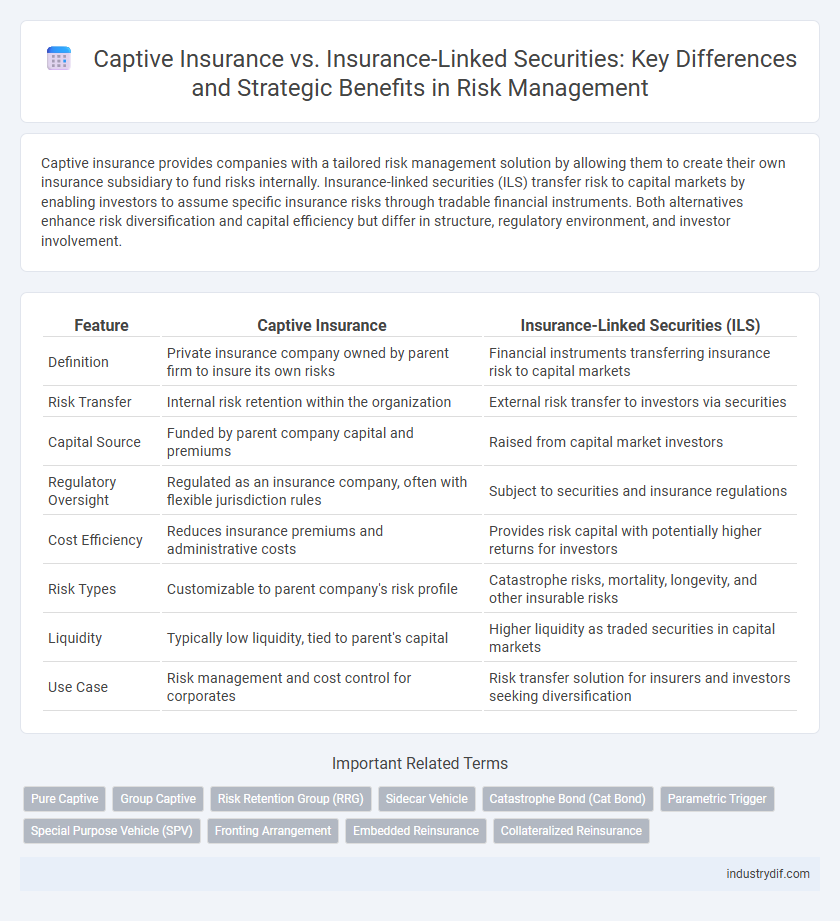

| Feature | Captive Insurance | Insurance-Linked Securities (ILS) |

|---|---|---|

| Definition | Private insurance company owned by parent firm to insure its own risks | Financial instruments transferring insurance risk to capital markets |

| Risk Transfer | Internal risk retention within the organization | External risk transfer to investors via securities |

| Capital Source | Funded by parent company capital and premiums | Raised from capital market investors |

| Regulatory Oversight | Regulated as an insurance company, often with flexible jurisdiction rules | Subject to securities and insurance regulations |

| Cost Efficiency | Reduces insurance premiums and administrative costs | Provides risk capital with potentially higher returns for investors |

| Risk Types | Customizable to parent company's risk profile | Catastrophe risks, mortality, longevity, and other insurable risks |

| Liquidity | Typically low liquidity, tied to parent's capital | Higher liquidity as traded securities in capital markets |

| Use Case | Risk management and cost control for corporates | Risk transfer solution for insurers and investors seeking diversification |

Introduction to Captive Insurance and Insurance-Linked Securities (ILS)

Captive insurance involves a company creating its own insurance subsidiary to underwrite risks, offering customized coverage and cost control advantages. Insurance-linked securities (ILS) transfer insurance risk to capital market investors through tradable financial instruments, enhancing risk distribution and liquidity. Both mechanisms provide innovative risk management solutions by leveraging internal resources or capital market access.

Key Features of Captive Insurance

Captive insurance involves a company creating its own licensed insurance subsidiary to underwrite risks, providing tailored coverage and cost control often unavailable in traditional markets. Key features include risk retention, direct access to reinsurance markets, and enhanced cash flow management through premium allocation and claims handling. This structure supports improved risk management strategies and potential tax advantages by aligning the insurer's interests with those of the insured company.

Key Features of Insurance-Linked Securities (ILS)

Insurance-linked securities (ILS) are financial instruments that transfer insurance risk to capital market investors, offering benefits such as risk diversification, high yields, and low correlation with traditional asset classes. Key features include parametric triggers, which enable payouts based on predefined event parameters rather than actual losses, and the ability to securitize catastrophic risks like hurricanes or earthquakes. ILS provide transparency through detailed risk modeling and standardized legal frameworks, making them attractive for both insurers seeking alternative risk transfer and investors looking for portfolio diversification.

Risk Transfer Mechanisms: Captives vs. ILS

Captive insurance transfers risk by allowing companies to create their own insurance entities, providing tailored coverage and control over risk management. Insurance-linked securities (ILS) transfer risk to capital market investors by securitizing insurance risks, such as catastrophe bonds, offering liquidity and diversification. Both mechanisms optimize risk transfer but differ in risk ownership, capital requirements, and market access.

Regulatory Considerations for Captive Insurance and ILS

Regulatory considerations for captive insurance involve strict compliance with domicile-specific rules, solvency requirements, and ongoing reporting mandates designed to ensure financial stability and protect policyholders. Insurance-linked securities (ILS) are subject to securities regulations overseen by entities such as the SEC, requiring transparent disclosure, investor protection measures, and adherence to capital market frameworks. Risk transfer efficiency and regulatory arbitrage opportunities differentiate captive insurance structures from ILS, making regulatory alignment a critical factor in strategic risk management decisions.

Capital and Investment Requirements

Captive insurance necessitates significant upfront capital investments to establish and maintain regulatory compliance, often requiring reserves aligned with the parent company's risk profile. Insurance-linked securities (ILS) attract diverse investors by structuring capital in tradable instruments, reducing the need for direct capital allocation from insurers and enabling risk transfer to the capital markets. The distinct capital requirements define captive insurance as a more capital-intensive, internal risk management tool, while ILS leverage external investment pools for scalable risk financing.

Cost Efficiency: Comparing Captives and ILS

Captive insurance offers cost efficiency through reduced premiums, tailored coverage, and direct risk management, minimizing reliance on external insurers. Insurance-linked securities (ILS) provide capital market funding and risk transfer but often involve higher issuance costs and market volatility affecting overall expense. Analyzing historical data reveals captives typically deliver lower total cost of risk in stable environments, while ILS excel in liquidity and diversification during peak stress periods.

Use Cases and Ideal Applications

Captive insurance is ideal for companies seeking tailored risk management solutions and cost control through self-insurance, primarily benefiting medium to large corporations with predictable risk profiles. Insurance-linked securities (ILS) offer capital market funding for catastrophe and niche risks, making them suitable for investors and insurers looking to transfer risk outside traditional insurance markets. Captives excel in operational risk retention while ILS serve as effective tools for diversifying risk and tapping into alternative capital sources.

Advantages and Challenges of Each Structure

Captive insurance offers companies enhanced risk management control, potential cost savings, and tailored coverage, but faces challenges such as regulatory compliance and capital requirements. Insurance-linked securities provide access to capital markets, risk diversification, and liquidity, yet include complexity in structuring, market volatility exposure, and investor demand uncertainty. Evaluating both structures requires balancing operational control with financial flexibility to optimize risk transfer strategies.

Future Trends in Captive Insurance and ILS

Future trends in captive insurance include increased adoption of advanced risk modeling technologies and expansion into emerging markets, enhancing customization and cost efficiency for businesses. Insurance-linked securities (ILS) are projected to grow with innovation in catastrophe bonds and parametric triggers, broadening investor participation and improving capital market integration. Both captive insurance and ILS markets are expected to leverage artificial intelligence and blockchain for enhanced transparency, risk assessment, and claims processing.

Related Important Terms

Pure Captive

Pure captive insurance companies provide specialized risk management solutions by insuring only the risks of their parent company, minimizing external market dependencies and enhancing cost control. In contrast, insurance-linked securities transfer risk to capital markets, offering liquidity and diversification but introducing market-driven pricing and potential volatility.

Group Captive

Group captive insurance enables organizations to pool resources and share risks within a controlled environment, offering customized coverage and cost savings compared to traditional insurance models. Insurance-linked securities transfer specific risks to capital markets, providing liquidity and risk diversification but lack the collaborative risk-sharing advantages inherent in group captives.

Risk Retention Group (RRG)

Risk Retention Groups (RRGs) allow businesses to self-insure by pooling risks within a homogeneous industry, providing more control and cost savings compared to traditional insurance or captives. Unlike Insurance-linked Securities (ILS) that transfer risk to capital markets, RRGs retain underwriting risk among members, making them ideal for specialized risk retention under federal liability frameworks.

Sidecar Vehicle

Sidecar vehicles in insurance-linked securities provide a structured mechanism for reinsurers to access capital markets, allowing investors to assume specific catastrophe risks while retaining operational control. Captive insurance companies typically do not use sidecars, as they focus on self-insurance and risk management within a single corporate group, contrasting with the external risk transfer model sidecars offer.

Catastrophe Bond (Cat Bond)

Captive insurance enables companies to self-insure risks through a wholly-owned subsidiary, offering tailored coverage and potential cost savings, while catastrophe bonds (Cat Bonds), a type of insurance-linked security (ILS), transfer specific catastrophe risks to investors, providing capital relief and risk diversification. Cat Bonds are triggered by predefined events like hurricanes or earthquakes, allowing insurers to mitigate exposure without impacting balance sheets directly.

Parametric Trigger

Parametric triggers in captive insurance provide automated, predefined payout structures based on measurable events, reducing claims processing time and increasing transparency. Insurance-linked securities use parametric triggers to transfer catastrophe risks to investors, enabling rapid capital flow upon event occurrence while minimizing moral hazard.

Special Purpose Vehicle (SPV)

Special Purpose Vehicles (SPVs) serve distinct roles in Captive Insurance and Insurance-linked Securities (ILS); in Captive Insurance, SPVs are commonly used to isolate risk and manage underwriting for a parent company, while in ILS, SPVs facilitate the transfer of insurance risk to capital market investors by issuing securities tied to specific insurance risks. Structuring these SPVs effectively enhances risk management flexibility and capital efficiency, crucial for optimizing insurance coverage and investment returns.

Fronting Arrangement

Fronting arrangements in captive insurance involve a licensed insurer issuing policies while the captive reinsures the risk, enabling compliance with regulatory requirements and access to broader markets. In contrast, insurance-linked securities (ILS) bypass traditional carriers by transferring risks directly to capital markets, offering investors exposure to insurance risks without fronting structures.

Embedded Reinsurance

Embedded reinsurance within Captive Insurance enables businesses to directly manage risk by forming a self-insurance structure that controls underwriting and claims, enhancing financial stability with customized coverage solutions. Conversely, Insurance-linked Securities (ILS) transfer risks to capital markets via tradable instruments like catastrophe bonds, providing liquidity and risk diversification but lacking the operational control inherent in captive models.

Collateralized Reinsurance

Collateralized reinsurance, a key component of both captive insurance and insurance-linked securities (ILS), involves the posting of collateral to secure reinsurance obligations, enhancing credit protection for cedents. While captive insurance uses collateralized reinsurance to manage risk internally within a single entity, ILS structures collateralized reinsurance to transfer risk to capital market investors, providing liquidity and diversification benefits.

Captive Insurance vs Insurance-linked Securities Infographic

industrydif.com

industrydif.com