Premium calculation traditionally relies on demographic factors such as age, gender, and driving history to estimate risk and determine insurance costs. Telematics-based pricing uses real-time data collected from devices installed in vehicles, tracking driving behavior like speed, braking, and mileage for a more personalized and accurate premium assessment. This approach encourages safer driving habits by directly linking premiums to individual performance rather than statistical averages.

Table of Comparison

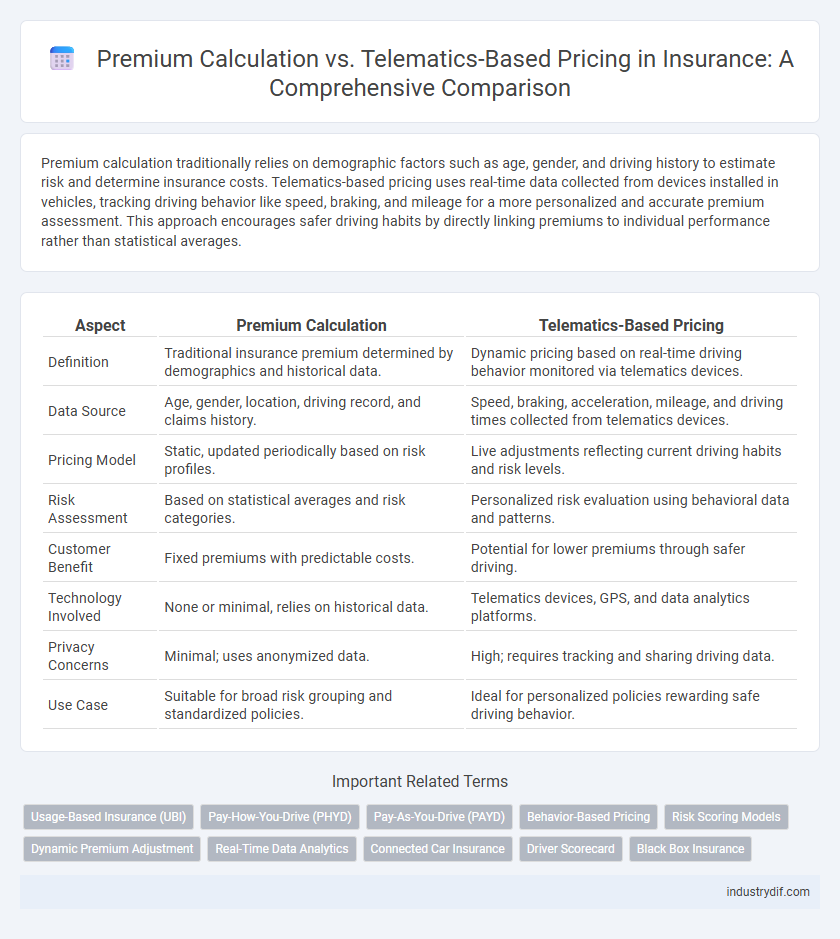

| Aspect | Premium Calculation | Telematics-Based Pricing |

|---|---|---|

| Definition | Traditional insurance premium determined by demographics and historical data. | Dynamic pricing based on real-time driving behavior monitored via telematics devices. |

| Data Source | Age, gender, location, driving record, and claims history. | Speed, braking, acceleration, mileage, and driving times collected from telematics devices. |

| Pricing Model | Static, updated periodically based on risk profiles. | Live adjustments reflecting current driving habits and risk levels. |

| Risk Assessment | Based on statistical averages and risk categories. | Personalized risk evaluation using behavioral data and patterns. |

| Customer Benefit | Fixed premiums with predictable costs. | Potential for lower premiums through safer driving. |

| Technology Involved | None or minimal, relies on historical data. | Telematics devices, GPS, and data analytics platforms. |

| Privacy Concerns | Minimal; uses anonymized data. | High; requires tracking and sharing driving data. |

| Use Case | Suitable for broad risk grouping and standardized policies. | Ideal for personalized policies rewarding safe driving behavior. |

Understanding Traditional Premium Calculation Methods

Traditional premium calculation methods rely on factors such as driver age, gender, vehicle type, location, and historical claim data to assess risk and determine insurance costs. Actuaries analyze extensive datasets to estimate the probability of future claims, ensuring premiums align with expected losses and administrative expenses. This approach provides standardized pricing but often lacks personalization compared to telematics-based models.

How Telematics-Based Pricing Works

Telematics-based pricing calculates insurance premiums by analyzing real-time driving behavior data collected through devices installed in vehicles or mobile apps. Key factors such as speed, acceleration, braking patterns, and mileage influence risk assessment, enabling personalized and dynamic premium adjustments. This data-driven approach enhances accuracy in pricing, rewarding safe driving habits with lower insurance costs.

Key Differences Between Standard and Telematics Insurance

Standard insurance premiums are typically calculated using demographic factors such as age, gender, and driving history, relying on broad statistical data to estimate risk. Telematics-based pricing uses real-time driving behavior data collected through devices or smartphone apps, enabling insurers to tailor premiums based on individual driving patterns like speed, distance, and braking habits. The key difference lies in the dynamic, usage-based nature of telematics pricing versus the static, generalized risk assessment in traditional premium calculation models.

Data Sources in Conventional vs. Telematic Models

Conventional insurance premium calculation primarily relies on historical data such as age, gender, location, and claim history to assess risk and determine rates. Telematics-based pricing integrates real-time driving data collected from devices or smartphone apps, including speed, braking patterns, and distance traveled, enabling more personalized and dynamic risk assessment. The shift to telematics allows insurers to move beyond static demographic factors and use behavioral data, improving pricing accuracy and incentivizing safer driving habits.

Risk Assessment Techniques: Manual vs. Data-Driven

Risk assessment in premium calculation traditionally relies on manual techniques such as questionnaires and historical claims analysis, which can be subjective and limited in scope. Telematics-based pricing employs data-driven methods, leveraging real-time driving data, GPS tracking, and behavioral analytics for more accurate and personalized risk profiles. This shift enhances underwriting precision, reduces fraud, and allows insurers to offer competitive, usage-based premiums tailored to individual risk patterns.

Impact on Customer Segmentation and Personalization

Premium calculation based on traditional risk factors often relies on demographic and historical data, limiting the precision of customer segmentation and personalization. Telematics-based pricing leverages real-time driving behavior data, enabling insurers to create highly granular segments and tailor premiums that reflect individual risk profiles more accurately. This shift enhances customized insurance products, improves customer satisfaction, and drives more competitive pricing strategies in the insurance market.

Accuracy and Fairness in Premium Determination

Premium calculation traditionally relies on aggregated historical data and generalized risk factors, often leading to broad estimates that may not accurately reflect individual behavior. Telematics-based pricing uses real-time driving data, enabling insurers to assess risk with greater precision and tailor premiums according to actual driving patterns. This approach enhances fairness by rewarding safe drivers with lower premiums while ensuring riskier drivers pay rates commensurate with their behavior.

Regulatory and Privacy Considerations

Premium calculation models must comply with strict regulatory frameworks that govern data usage, ensuring transparency and fairness in insurance pricing. Telematics-based pricing relies on real-time driving behavior data, raising significant privacy concerns related to data collection, storage, and consent under laws such as GDPR and CCPA. Insurers integrating telematics must implement robust cybersecurity measures and clear privacy policies to maintain regulatory compliance and protect customer trust.

Pros and Cons of Telematics-Based Pricing for Insurers

Telematics-based pricing enables insurers to assess risk more accurately by using real-time driving data, which can lead to more personalized premiums and encourage safer driving behavior. However, it requires significant investment in technology and data infrastructure, and raises concerns about data privacy and regulatory compliance. The approach may also alienate customers uncomfortable with constant monitoring, potentially limiting market adoption.

Future Trends: The Evolution of Insurance Pricing Models

Premium calculation is evolving with telematics-based pricing, leveraging real-time data from devices to assess risk more accurately. Future trends indicate a shift towards personalized insurance rates driven by machine learning algorithms analyzing driver behavior, weather patterns, and traffic conditions. This integration enhances risk management, reduces fraudulent claims, and provides dynamic pricing models tailored to individual policyholders.

Related Important Terms

Usage-Based Insurance (UBI)

Premium calculation in traditional insurance relies on historical data and demographic factors, whereas telematics-based pricing under Usage-Based Insurance (UBI) leverages real-time driving behavior data collected through GPS and in-vehicle sensors to dynamically adjust rates. UBI enhances risk assessment accuracy by monitoring metrics such as speed, braking patterns, and mileage, leading to personalized premiums that reflect actual usage and driving habits.

Pay-How-You-Drive (PHYD)

Premium calculation in traditional insurance relies on static factors such as age, location, and driving history, whereas telematics-based pricing leverages real-time driving behavior data collected through devices or mobile apps. Pay-How-You-Drive (PHYD) models specifically adjust insurance premiums dynamically by monitoring metrics like speed, braking, and mileage, promoting safer driving habits and providing personalized rate reductions.

Pay-As-You-Drive (PAYD)

Premium calculation in traditional insurance relies on static factors such as age, location, and driving history, whereas telematics-based pricing for Pay-As-You-Drive (PAYD) insurance dynamically adjusts premiums based on actual mileage and driving behavior data collected through GPS and onboard devices. This model enhances pricing accuracy, incentivizes safer driving, and offers potential cost savings by charging customers primarily for the miles they drive.

Behavior-Based Pricing

Behavior-based pricing in insurance leverages telematics data to assess driving habits such as speed, braking patterns, and mileage, enabling more accurate premium calculation tailored to individual risk profiles. This approach contrasts with traditional premium methods by prioritizing real-time, behavior-driven insights over generalized demographic factors, resulting in fairer pricing and potential cost savings for safe drivers.

Risk Scoring Models

Premium calculation traditionally relies on demographic and historical claims data to assess risk, whereas telematics-based pricing leverages real-time driving behavior through sensors to generate more accurate risk scoring models. These innovative models incorporate factors such as speed, acceleration, braking patterns, and mileage, enabling insurers to personalize premiums based on individual driver risk profiles and reduce adverse selection.

Dynamic Premium Adjustment

Dynamic premium adjustment in telematics-based pricing uses real-time driving data such as speed, braking patterns, and mileage to personalize insurance costs, enhancing accuracy over traditional premium calculation methods that rely on static demographic and historical data. This approach enables insurers to continuously update premiums based on actual risk behaviors, promoting fairer pricing and incentivizing safer driving habits.

Real-Time Data Analytics

Premium calculation traditionally relies on historical data and demographic factors, while telematics-based pricing leverages real-time data analytics from devices like GPS and accelerometers to assess driving behavior dynamically. This approach enables insurers to offer personalized premiums based on actual risk patterns, enhancing accuracy and incentivizing safer driving habits.

Connected Car Insurance

Connected car insurance uses telematics-based pricing by analyzing real-time driving data such as speed, braking patterns, and mileage to tailor premiums more accurately compared to traditional premium calculation methods that rely on static factors like age, gender, and driving history. This dynamic approach enhances risk assessment, incentivizes safer driving behaviors, and often results in more personalized and potentially lower insurance costs.

Driver Scorecard

Premium calculation traditionally relies on demographic data and historical claims, whereas telematics-based pricing leverages real-time driving behavior captured through driver scorecards to personalize insurance costs. The driver scorecard assesses factors such as speed, braking, and acceleration, enabling insurers to more accurately predict risk and reward safe driving habits.

Black Box Insurance

Premium calculation in traditional insurance relies on historical data and demographic factors, whereas telematics-based pricing utilizes real-time driving behavior captured by black box devices to determine personalized rates. Black box insurance enhances risk assessment accuracy by monitoring metrics such as speed, braking patterns, and mileage, enabling insurers to offer dynamic premiums that reward safe driving habits.

Premium Calculation vs Telematics-Based Pricing Infographic

industrydif.com

industrydif.com