Actuaries and data science actuaries both analyze risk and uncertainty for insurance purposes, but data science actuaries incorporate advanced machine learning techniques and big data analytics to enhance predictive modeling. Traditional actuaries rely heavily on statistical methods and historical data to assess insurance premiums and reserves, while data science actuaries leverage algorithms and artificial intelligence to identify patterns and improve decision-making accuracy. Insurance companies benefit from combining actuarial expertise with data science to develop more precise risk assessments and innovative product pricing strategies.

Table of Comparison

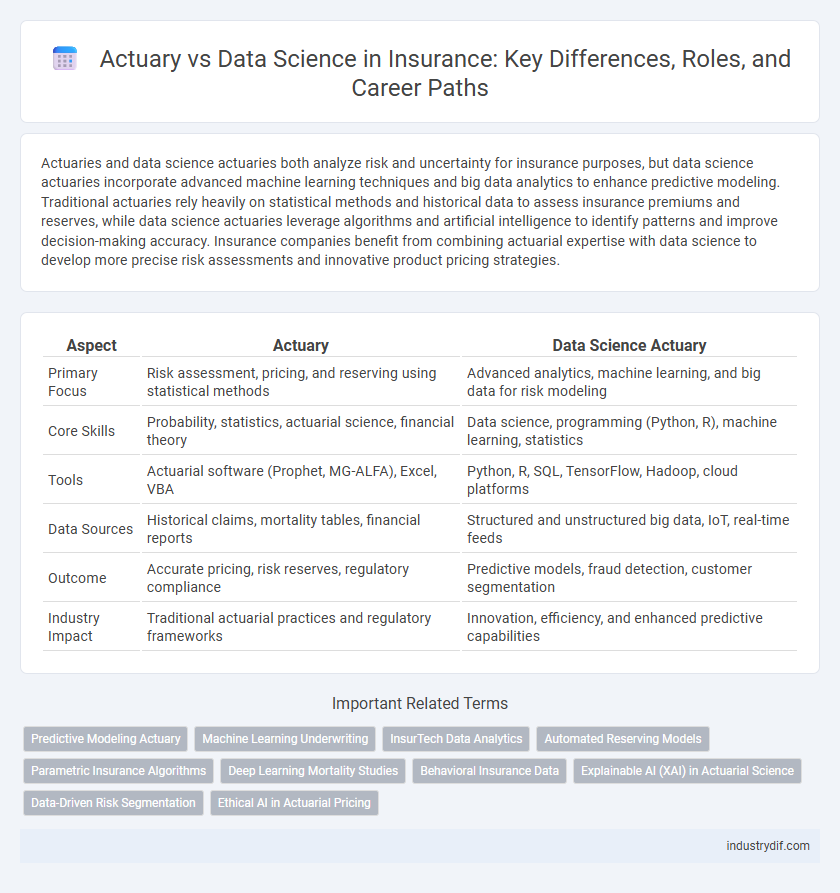

| Aspect | Actuary | Data Science Actuary |

|---|---|---|

| Primary Focus | Risk assessment, pricing, and reserving using statistical methods | Advanced analytics, machine learning, and big data for risk modeling |

| Core Skills | Probability, statistics, actuarial science, financial theory | Data science, programming (Python, R), machine learning, statistics |

| Tools | Actuarial software (Prophet, MG-ALFA), Excel, VBA | Python, R, SQL, TensorFlow, Hadoop, cloud platforms |

| Data Sources | Historical claims, mortality tables, financial reports | Structured and unstructured big data, IoT, real-time feeds |

| Outcome | Accurate pricing, risk reserves, regulatory compliance | Predictive models, fraud detection, customer segmentation |

| Industry Impact | Traditional actuarial practices and regulatory frameworks | Innovation, efficiency, and enhanced predictive capabilities |

Introduction to Actuaries and Data Scientists

Actuaries apply mathematical, statistical, and financial theories to assess risk in insurance, pension, and investment fields, ensuring financial stability and regulatory compliance. Data science actuaries integrate advanced data analytics, machine learning, and big data techniques to enhance predictive accuracy, optimize underwriting, and improve pricing models. The blend of traditional actuarial skills with data science methods drives innovation in risk assessment and decision-making within the insurance industry.

Core Responsibilities: Actuary vs Data Scientist

Actuaries focus on evaluating financial risks using mathematical models, statistical techniques, and expertise in insurance, pensions, and investment to predict future events and inform premium pricing. Data scientists in insurance analyze large datasets with advanced algorithms, machine learning, and data mining to uncover patterns, optimize claims processing, and improve customer segmentation. While both roles use data analysis, actuaries center on risk assessment and regulatory compliance, whereas data scientists emphasize predictive analytics and operational efficiency.

Required Skills and Qualifications

Actuaries require strong expertise in mathematics, statistics, and financial theory, with professional certifications such as the Society of Actuaries (SOA) or Casualty Actuarial Society (CAS) credentials being essential. Data Science Actuaries combine traditional actuarial knowledge with proficiency in programming languages like Python and R, machine learning techniques, and big data analytics to enhance risk assessment and predictive modeling. Both roles demand strong analytical capabilities, but Data Science Actuaries must also be adept at leveraging advanced data visualization tools and handling unstructured data for more comprehensive insights.

Analytical Methods and Tools Used

Actuaries primarily use traditional statistical models and actuarial software such as SAS, Excel, and R to evaluate insurance risks, calculate premiums, and forecast future claims. Data Science Actuaries incorporate advanced machine learning algorithms, Python, big data platforms, and predictive analytics to enhance risk assessment, identify patterns, and optimize pricing strategies. Both roles rely heavily on probability theory and quantitative analysis, but Data Science Actuaries leverage cutting-edge technology to handle larger datasets and deliver more granular insights.

Role in Insurance Industry Decision Making

Actuaries specialize in risk assessment, utilizing statistical models to evaluate insurance liabilities and premium calculations, ensuring financial stability for insurers. Data science actuaries integrate advanced machine learning techniques and big data analytics to enhance predictive accuracy and uncover deeper insights into customer behavior and market trends. These roles collectively drive informed decision-making in underwriting, pricing strategies, and risk management within the insurance industry.

Data Sources and Management Practices

Actuaries rely on traditional insurance data sources such as claims history, policyholder demographics, and financial records, while Data Science Actuaries integrate diverse big data sources including social media, IoT devices, and unstructured data. Effective data management practices for Data Science Actuaries involve advanced techniques like data cleaning, normalization, and real-time data processing using cloud-based platforms and machine learning algorithms. This enhanced data integration and management improve risk modeling accuracy and enable more dynamic insurance pricing strategies.

Regulatory and Ethical Considerations

Regulatory frameworks for traditional actuaries emphasize compliance with insurance laws, financial reporting standards, and risk management, ensuring policyholder protection and solvency of insurers. Data science actuaries must navigate ethical concerns related to algorithmic bias, data privacy, and transparency in predictive modeling to maintain fairness and trust in automated insurance decision-making. Both roles require adherence to professional codes and continuous monitoring to align with evolving regulations and ethical standards in the insurance industry.

Career Pathways and Opportunities

Actuaries traditionally focus on assessing financial risks using mathematics, statistics, and financial theory to inform insurance pricing, reserving, and risk management. Data Science Actuaries leverage advanced data analytics, machine learning, and big data technologies to enhance predictive modeling and uncover deeper insights within insurance datasets. Career pathways for traditional actuaries often lead to roles in pricing, underwriting, and risk analysis, while data science actuaries have opportunities to specialize in digital transformation, predictive analytics, and strategic innovation within insurance firms.

Impact of Technology and Automation

Technology and automation have revolutionized the actuarial profession by enhancing the precision and speed of risk assessment models. Data science actuaries utilize advanced machine learning algorithms and big data analytics to uncover deeper insights and generate predictive models that traditional actuarial methods may overlook. This integration significantly improves underwriting efficiency, pricing accuracy, and claims forecasting within the insurance industry.

Future Trends: Actuary vs Data Scientist in Insurance

Future trends in insurance highlight a growing integration of actuarial science and data science, with traditional actuaries increasingly adopting advanced analytics and machine learning techniques to enhance risk assessment and pricing accuracy. Data scientists complement this by leveraging big data and predictive modeling to uncover insights and optimize underwriting processes. The convergence of these roles fosters innovation in insurance products and personalized customer experiences while maintaining regulatory compliance.

Related Important Terms

Predictive Modeling Actuary

Predictive Modeling Actuaries specialize in leveraging advanced statistical techniques and machine learning algorithms to forecast future insurance risks and claims, enhancing pricing accuracy and risk assessment. Unlike traditional actuaries who focus on historical data analysis and reserving, Predictive Modeling Actuaries integrate big data analytics to optimize underwriting strategies and improve financial forecasting.

Machine Learning Underwriting

Actuaries specializing in machine learning underwriting leverage algorithms to analyze large insurance datasets, enhancing risk assessment accuracy beyond traditional statistical methods. Data science actuaries integrate predictive modeling and artificial intelligence to optimize underwriting decisions, driving efficiency and profitability in insurance portfolio management.

InsurTech Data Analytics

Actuaries leverage statistical models and risk theory to evaluate insurance liabilities and pricing, while Data Science Actuaries integrate machine learning algorithms and big data analytics to enhance predictive accuracy in InsurTech applications. The fusion of traditional actuarial science with advanced data analytics drives innovation in underwriting, claims management, and personalized policy offerings.

Automated Reserving Models

Actuaries specializing in Automated Reserving Models leverage advanced data science techniques and machine learning algorithms to enhance the accuracy of insurance loss reserves, reducing reliance on traditional deterministic methods. This integration of data science enables more dynamic, real-time risk assessment and capital allocation, optimizing financial stability and regulatory compliance within insurance companies.

Parametric Insurance Algorithms

Actuaries specializing in parametric insurance harness advanced algorithms to model risk based on predefined triggering events, enabling rapid claim settlements through objective data parameters. Data science actuaries integrate machine learning techniques with traditional actuarial models to enhance the accuracy and efficiency of parametric insurance pricing and risk assessment.

Deep Learning Mortality Studies

Actuaries specializing in deep learning mortality studies leverage advanced neural network models to predict mortality rates with higher precision by analyzing vast, complex datasets from insurance claims and health records. Data science actuaries integrate machine learning techniques, including deep learning, to enhance traditional actuarial models, optimizing risk assessments and improving predictive accuracy in life insurance underwriting and pricing.

Behavioral Insurance Data

Actuaries specializing in behavioral insurance data integrate psychological and social behavior patterns with traditional risk models to enhance predictive accuracy and customer profiling. Data science actuaries apply machine learning algorithms and statistical techniques to analyze large-scale behavioral insurance datasets, optimizing underwriting processes and personalized policy pricing.

Explainable AI (XAI) in Actuarial Science

Explainable AI (XAI) in actuarial science enhances transparency and trust by allowing actuaries to interpret complex models, bridging traditional actuarial methods with advanced data science techniques. Data science actuaries leverage XAI to improve risk assessment accuracy and regulatory compliance while maintaining clarity in decision-making processes.

Data-Driven Risk Segmentation

Data Science Actuaries leverage advanced machine learning algorithms and big data analytics to enhance risk segmentation, enabling more precise identification of policyholder risk profiles compared to traditional actuarial methods. This data-driven approach improves predictive accuracy and supports dynamic pricing strategies, optimizing underwriting and portfolio management in the insurance industry.

Ethical AI in Actuarial Pricing

Ethical AI in actuarial pricing ensures transparent, unbiased risk assessment by integrating fairness and accountability into algorithmic decision-making. Actuaries leveraging data science techniques address ethical considerations by combining traditional actuarial principles with advanced machine learning models to promote responsible, equitable insurance pricing.

Actuary vs Data Science Actuary Infographic

industrydif.com

industrydif.com