Traditional insurance policies require separate purchase and management processes, often involving lengthy paperwork and multiple touchpoints. Embedded insurance integrates coverage seamlessly within the purchase of products or services, offering real-time protection and simplified claims handling. This integration enhances customer experience by reducing friction and increasing convenience, aligning insurance closely with everyday transactions.

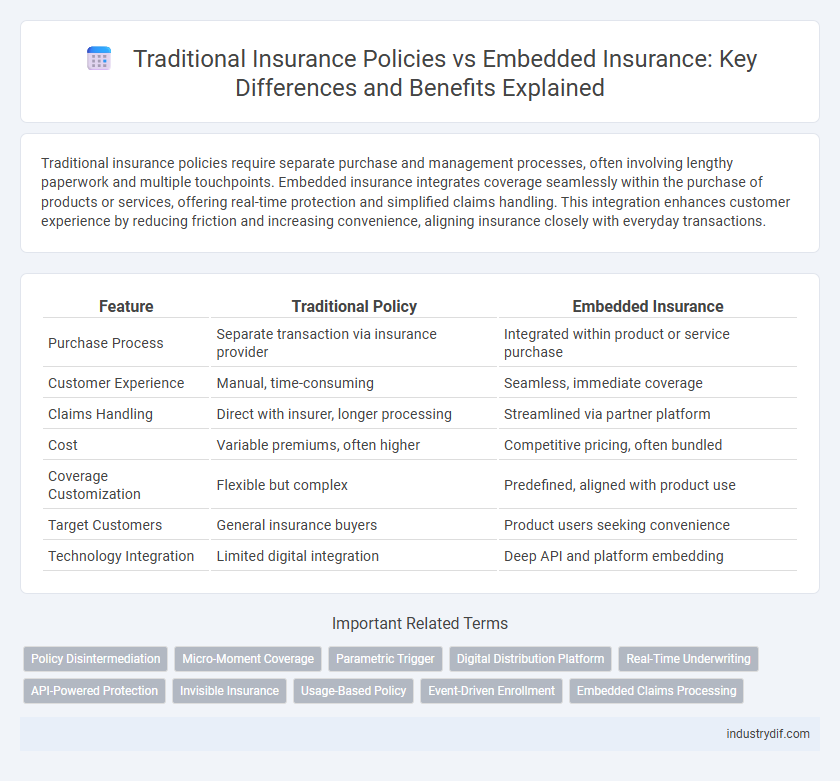

Table of Comparison

| Feature | Traditional Policy | Embedded Insurance |

|---|---|---|

| Purchase Process | Separate transaction via insurance provider | Integrated within product or service purchase |

| Customer Experience | Manual, time-consuming | Seamless, immediate coverage |

| Claims Handling | Direct with insurer, longer processing | Streamlined via partner platform |

| Cost | Variable premiums, often higher | Competitive pricing, often bundled |

| Coverage Customization | Flexible but complex | Predefined, aligned with product use |

| Target Customers | General insurance buyers | Product users seeking convenience |

| Technology Integration | Limited digital integration | Deep API and platform embedding |

Overview of Traditional Insurance Policies

Traditional insurance policies involve standalone contracts where policyholders purchase coverage directly from insurers, often requiring separate transactions and documentation. These policies typically include comprehensive terms, fixed premiums, and coverage limits tailored to specific risks such as auto, health, or property insurance. The claim process in traditional insurance can be time-consuming, involving detailed assessments and approvals by the insurer before payouts are made.

Understanding Embedded Insurance

Embedded Insurance integrates coverage directly into the purchase of products or services, offering seamless protection without separate policy management. Unlike traditional policies requiring standalone applications and claims processes, embedded insurance simplifies user experience and boosts uptake by bundling insurance within transactions. This model leverages digital platforms and APIs to deliver contextual, on-demand insurance, enhancing accessibility and convenience for consumers.

Key Differences Between Traditional and Embedded Insurance

Traditional insurance policies require separate purchase and active management by the customer, often involving extensive paperwork and long approval times. Embedded insurance integrates coverage directly into the purchase of a product or service, offering seamless protection without additional effort from the buyer. Key differences include immediacy of coverage, customer experience, and the reduction of friction in the insurance acquisition process.

Advantages of Traditional Insurance Models

Traditional insurance models offer comprehensive coverage options that are widely recognized and trusted by consumers, ensuring financial protection against diverse risks. These policies provide personalized service through direct interaction with agents or brokers, allowing tailored risk assessment and customized plans. Established regulatory oversight and claims processes enhance transparency and reliability, fostering consumer confidence in traditional insurance products.

Benefits of Embedded Insurance Solutions

Embedded insurance integrates coverage directly into the purchase of products or services, enhancing customer convenience and streamlining the buying process. This approach reduces friction by offering instant protection without needing separate applications, increasing policy uptake rates. Insurers benefit from access to richer data and new distribution channels, leading to improved risk assessment and tailored pricing models.

Customer Experience: Traditional vs Embedded

Traditional insurance policies often require customers to navigate complex paperwork and multiple touchpoints, leading to longer processing times and potential frustration. Embedded insurance integrates coverage seamlessly into the purchase journey, offering instant protection and streamlined claims through digital platforms. This approach enhances customer experience by reducing friction, improving transparency, and increasing convenience at the point of sale.

Distribution Channels: Agency vs Embedded

Traditional insurance policies primarily rely on agent-driven distribution channels, where licensed agents facilitate personalized policy sales and customer service. Embedded insurance integrates coverage directly into non-insurance platforms like e-commerce or travel services, streamlining purchase experiences without relying on traditional intermediaries. This shift from agency-centric to embedded channels enhances accessibility, reduces friction, and leverages digital ecosystems for seamless insurance distribution.

Cost Implications for Consumers

Traditional insurance policies often involve higher upfront costs and separate premiums, resulting in less transparency and increased administrative fees for consumers. Embedded insurance integrates coverage directly into product or service purchases, reducing overall expenses by eliminating redundancy and leveraging partner economies of scale. Consumers benefit from lower premiums and simplified billing, making embedded insurance a more cost-effective solution compared to traditional standalone policies.

Regulatory Considerations in Both Models

Traditional insurance policies require compliance with established regulatory frameworks that govern underwriting, claims handling, and capital requirements, often involving separate licensing for insurers and agents. Embedded insurance integrates coverage within third-party platforms, presenting challenges around jurisdictional regulations, consumer protection laws, and transparency, which often necessitate evolving regulatory approaches. Regulators increasingly emphasize clarity in disclosure, data privacy, and risk management to ensure embedded insurance products meet the same standards as traditional policies while fostering innovation.

Future Trends in Insurance Distribution

Traditional insurance policies rely on direct sales channels and agents, limiting customer reach and engagement. Embedded insurance integrates coverage seamlessly into non-insurance products and services, leveraging digital platforms and ecosystems to enhance convenience and personalization. Future trends in insurance distribution emphasize increased adoption of embedded insurance, AI-driven underwriting, and API-based partnerships to deliver real-time, tailored insurance solutions.

Related Important Terms

Policy Disintermediation

Traditional insurance policies rely heavily on intermediaries such as agents and brokers, leading to increased costs and slower claim processing. Embedded insurance integrates coverage directly into product offerings through digital platforms, enabling policy disintermediation by removing middlemen and enhancing customer convenience and efficiency.

Micro-Moment Coverage

Traditional insurance policies often involve lengthy processes and limited flexibility, whereas embedded insurance integrates coverage seamlessly within the purchase journey, enabling real-time micro-moment protection tailored to specific needs. Micro-moment coverage through embedded insurance enhances customer experience by offering targeted, instant risk protection exactly when and where it matters most.

Parametric Trigger

Traditional insurance policies rely on claim assessments and adjusters to evaluate losses, often causing delays and disputes, whereas embedded insurance with parametric triggers automates payouts based on predefined metrics like weather data or natural disaster indices, ensuring faster, transparent compensation. Parametric insurance in embedded models minimizes uncertainty by using objective triggers such as rainfall levels or earthquake magnitude, optimizing risk transfer and enhancing customer experience.

Digital Distribution Platform

Traditional insurance policies often rely on legacy systems and manual underwriting processes, limiting scalability and customer experience on digital distribution platforms. Embedded insurance integrates seamlessly with e-commerce and fintech apps through APIs, enabling real-time risk assessment and instant policy issuance, driving higher adoption rates and operational efficiency.

Real-Time Underwriting

Real-time underwriting in embedded insurance leverages automated data integration and AI algorithms to assess risk instantly during the purchase process, enhancing efficiency and customer experience compared to the slower, manual evaluations typical of traditional policies. This shift enables insurers to offer personalized coverage dynamically, reducing underwriting costs and accelerating policy issuance.

API-Powered Protection

API-powered protection in embedded insurance seamlessly integrates coverage options into digital platforms, enabling real-time risk assessment and instant policy issuance without disrupting user experience. Traditional policies rely on manual underwriting and separate purchase processes, limiting agility and personalization compared to the dynamic, data-driven capabilities of embedded insurance solutions.

Invisible Insurance

Invisible insurance integrates seamlessly into existing products or services, eliminating the need for separate policy purchases and enhancing customer convenience. Traditional policies require explicit selection and payment, often creating friction and delays, while embedded insurance offers instant coverage without disrupting the user experience.

Usage-Based Policy

Usage-based insurance policies leverage real-time data and telematics to tailor premiums based on actual user behavior, contrasting with traditional policies that rely on generalized risk assessments. Embedded insurance integrates these dynamic, usage-driven policies seamlessly into products or services, enhancing customer convenience and personalized coverage.

Event-Driven Enrollment

Event-driven enrollment in traditional insurance policies typically requires manual application processes triggered by specific life events, while embedded insurance automates coverage activation by integrating directly with partner platforms, ensuring seamless and immediate protection at the point of sale. This real-time, context-sensitive approach enhances customer experience and increases policy uptake by eliminating delays and administrative barriers.

Embedded Claims Processing

Embedded claims processing streamlines insurance settlement by integrating claims management directly within partner platforms, reducing claim submission friction and accelerating payout times. This approach contrasts with traditional policies, where claims require separate, manual procedures, often leading to slower resolution and customer dissatisfaction.

Traditional Policy vs Embedded Insurance Infographic

industrydif.com

industrydif.com