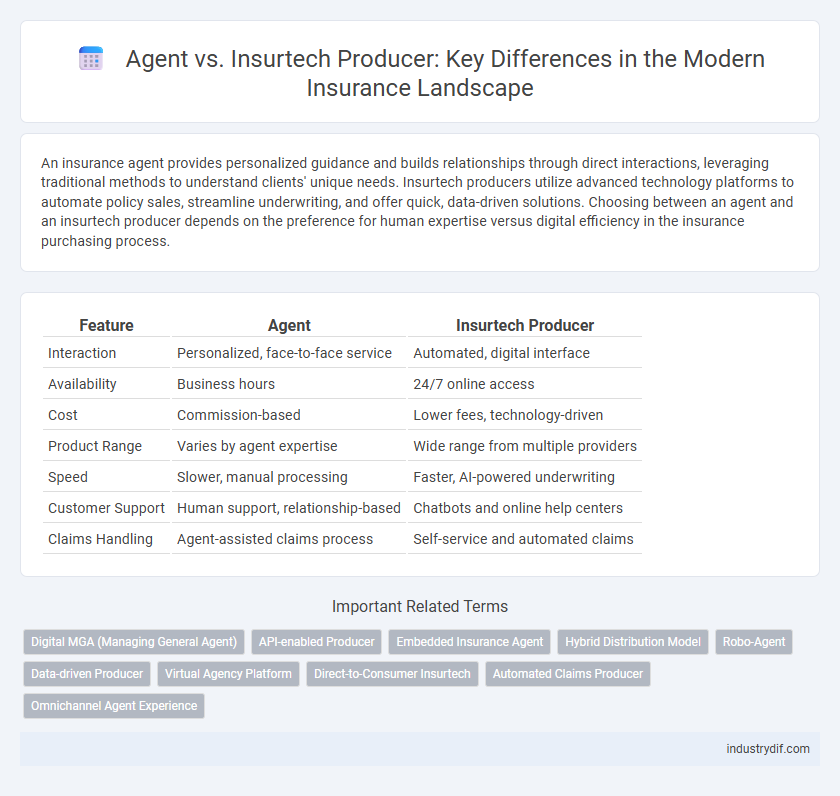

An insurance agent provides personalized guidance and builds relationships through direct interactions, leveraging traditional methods to understand clients' unique needs. Insurtech producers utilize advanced technology platforms to automate policy sales, streamline underwriting, and offer quick, data-driven solutions. Choosing between an agent and an insurtech producer depends on the preference for human expertise versus digital efficiency in the insurance purchasing process.

Table of Comparison

| Feature | Agent | Insurtech Producer |

|---|---|---|

| Interaction | Personalized, face-to-face service | Automated, digital interface |

| Availability | Business hours | 24/7 online access |

| Cost | Commission-based | Lower fees, technology-driven |

| Product Range | Varies by agent expertise | Wide range from multiple providers |

| Speed | Slower, manual processing | Faster, AI-powered underwriting |

| Customer Support | Human support, relationship-based | Chatbots and online help centers |

| Claims Handling | Agent-assisted claims process | Self-service and automated claims |

Defining Insurance Agents and Insurtech Producers

Insurance agents traditionally serve as licensed intermediaries who directly connect clients with insurance providers, offering personalized advice, policy recommendations, and claim support. Insurtech producers leverage digital platforms and advanced technologies to streamline insurance distribution, often automating underwriting and customer interactions for rapid policy issuance. Both roles are essential within the insurance ecosystem, with agents focusing on personalized service and insurtech producers emphasizing technological efficiency and scalability.

Roles and Responsibilities in the Insurance Industry

Insurance agents act as licensed intermediaries who directly sell policies and provide personalized risk assessment, claims assistance, and ongoing customer service. Insurtech producers leverage digital platforms and data-driven tools to streamline policy distribution, enhance underwriting accuracy, and improve customer engagement through automation and real-time analytics. While agents prioritize relationship-building and tailored advice, insurtech producers focus on operational efficiency and scalability within the insurance value chain.

Key Differences Between Agents and Insurtech Producers

Agents represent insurance companies directly, providing personalized service and tailored policy recommendations based on individual client needs, while insurtech producers utilize technology platforms to streamline the purchasing process and offer automated, data-driven solutions. Agents rely heavily on interpersonal relationships and expertise in complex insurance products, whereas insurtech producers focus on efficiency, speed, and digital user experience, often targeting tech-savvy consumers seeking convenience. The key difference lies in the balance between personalized human interaction and scalable technological innovation within the insurance distribution model.

Technology Integration: Traditional vs. Digital Approaches

Insurance agents rely on personalized, face-to-face interactions and manual processes to build trust and customize policies, often using legacy software for client management. Insurtech producers leverage advanced digital platforms, artificial intelligence, and automation to streamline underwriting, claims processing, and customer engagement, enabling faster and more efficient service delivery. Technology integration in insurtech emphasizes data analytics and seamless online experiences, contrasting with traditional agents' reliance on human expertise and physical paperwork.

Client Experience and Customer Support Comparison

Traditional insurance agents provide personalized client experience through face-to-face interactions and tailored advice, fostering trust and long-term relationships. Insurtech producers leverage advanced technology and data analytics to offer faster, more convenient customer support with automated processes and 24/7 accessibility. Clients choosing insurtech often benefit from streamlined policy management and instant claims processing, while agents excel in complex case navigation and empathetic guidance.

Regulatory and Compliance Considerations

Insurance agents must adhere to state-specific licensing requirements and maintain ongoing compliance with regulatory bodies such as the National Association of Insurance Commissioners (NAIC). Insurtech producers, while also subject to licensing laws, often navigate evolving regulatory landscapes due to their technological innovations and data-driven approaches, requiring stringent adherence to cybersecurity and data privacy regulations like GDPR and HIPAA. Both entities face continuous oversight but insurtech producers encounter unique compliance challenges related to algorithm transparency and digital consumer consent protocols.

Commission Structures and Compensation Models

Insurance agents often earn commissions based on policy sales, with variable rates depending on the product type and insurer agreements, incentivizing personalized client service and long-term relationship-building. Insurtech producers utilize technology-driven platforms to streamline sales processes, sometimes adopting fixed-fee or hybrid compensation models combining lower base commissions with performance bonuses tied to customer retention and digital engagement metrics. Understanding these distinct commission structures highlights the evolving landscape of insurance sales where traditional agents emphasize personalized service, while insurtech producers focus on efficiency and scalability through innovative compensation approaches.

Scalability and Market Reach

Traditional insurance agents often face scalability challenges due to reliance on personalized, one-on-one client interactions, limiting their market reach to local or regional levels. Insurtech producers leverage digital platforms and automation, enabling rapid scaling and access to a broader, often global customer base. This technological integration reduces operational costs and accelerates policy distribution, significantly enhancing market penetration.

Trust, Personalization, and Relationship Building

Insurance agents excel in building trust through personalized interactions and long-term relationship management, leveraging deep knowledge of client needs. Insurtech producers utilize advanced technology and data analytics to offer tailored insurance solutions quickly but may lack the human touch essential for emotional trust. Combining the strengths of traditional agents' personal rapport with insurtech's efficiency can enhance customer satisfaction and loyalty in insurance services.

Future Trends: Impact of Insurtech on Insurance Distribution

Insurtech producers leverage advanced technologies like AI, big data, and automation to streamline insurance distribution, scaling customer reach beyond traditional agent models. The integration of digital platforms enables personalized policy offerings and faster underwriting processes, reshaping consumer expectations and driving industry innovation. Future trends indicate a convergence where traditional agents adopt Insurtech tools to enhance efficiency and maintain relevance in a rapidly evolving digital insurance marketplace.

Related Important Terms

Digital MGA (Managing General Agent)

Digital MGAs leverage advanced technology platforms to streamline underwriting and policy management, offering faster service and enhanced data analytics compared to traditional insurance agents. Insurtech producers, operating through digital MGAs, optimize risk assessment and customer acquisition by integrating artificial intelligence and automated workflows, transforming the insurance distribution landscape.

API-enabled Producer

API-enabled producers leverage advanced technology platforms to streamline policy issuance, quoting, and underwriting processes, enhancing efficiency beyond traditional insurance agents. This innovation enables seamless integration with insurance carriers, driving real-time data exchange and faster customer service while reducing operational costs.

Embedded Insurance Agent

Embedded insurance agents integrate insurance offerings seamlessly within digital platforms, enabling consumers to purchase coverage effortlessly during their buying journey. Unlike traditional insurtech producers who develop technology-driven insurance solutions, embedded agents focus on real-time personalization and customer engagement within third-party ecosystems to enhance policy accessibility and conversion rates.

Hybrid Distribution Model

The hybrid distribution model combines traditional insurance agents' personalized service with insurtech producers' digital efficiency, enhancing customer engagement and operational scalability. This approach leverages data analytics and automated processes from insurtech while maintaining the trusted relationships and expert advice provided by agents.

Robo-Agent

Robo-agents in insurance utilize AI algorithms to streamline policy recommendations and claims processing, reducing human error and operational costs. Unlike traditional agents, these insurtech producers leverage machine learning and big data analytics to offer personalized coverage with enhanced efficiency and scalability.

Data-driven Producer

Data-driven insurance producers leverage advanced analytics and customer insights to optimize policy recommendations and risk assessment, outperforming traditional agents who rely on experience and personal networks. Insurtech producers enhance efficiency through real-time data integration and automated underwriting processes, delivering personalized coverage and accelerated claim resolutions.

Virtual Agency Platform

Virtual agency platforms revolutionize insurance distribution by enabling insurtech producers to operate seamlessly without physical offices, leveraging digital tools to expand market reach and streamline client interactions. Unlike traditional agents, who rely on face-to-face engagement, insurtech producers use these platforms to automate quoting, underwriting, and policy management, enhancing efficiency and customer experience.

Direct-to-Consumer Insurtech

Direct-to-Consumer Insurtech producers leverage data analytics and digital platforms to streamline policy purchasing, offering customers personalized, real-time insurance quotes without traditional agent mediation. Unlike agents who rely on personal relationships and manual underwriting, insurtech models optimize customer acquisition and claims processing through automated algorithms and AI-driven risk assessment.

Automated Claims Producer

Automated claims producers leverage AI and machine learning to streamline insurance claim processing, reducing manual errors and accelerating settlement times compared to traditional agents. This technology enhances customer experience by providing faster, more accurate claim evaluations and personalized policy adjustments.

Omnichannel Agent Experience

An omnichannel agent experience integrates traditional insurance agents with digital insurtech platforms, enhancing customer engagement through seamless access across mobile apps, websites, and in-person consultations. This hybrid approach boosts efficiency by leveraging data analytics and automated tools while maintaining personalized service, driving higher policy sales and improved client retention.

Agent vs Insurtech Producer Infographic

industrydif.com

industrydif.com