Actuaries specialize in assessing financial risks and uncertainty in insurance using mathematical models and statistical methods to price policies and ensure company solvency. Data scientists analyze large datasets with advanced algorithms and machine learning to uncover trends and improve decision-making across insurance operations. While both roles rely on data analysis, actuaries focus more on risk prediction and regulatory compliance, whereas data scientists emphasize innovation and optimizing business strategies.

Table of Comparison

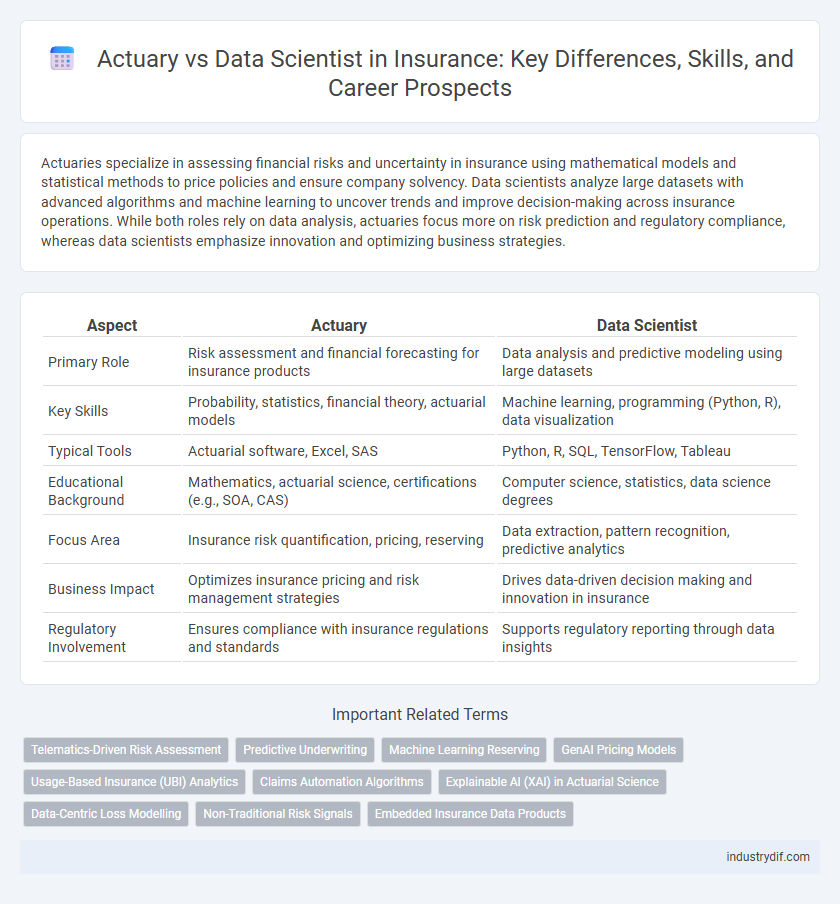

| Aspect | Actuary | Data Scientist |

|---|---|---|

| Primary Role | Risk assessment and financial forecasting for insurance products | Data analysis and predictive modeling using large datasets |

| Key Skills | Probability, statistics, financial theory, actuarial models | Machine learning, programming (Python, R), data visualization |

| Typical Tools | Actuarial software, Excel, SAS | Python, R, SQL, TensorFlow, Tableau |

| Educational Background | Mathematics, actuarial science, certifications (e.g., SOA, CAS) | Computer science, statistics, data science degrees |

| Focus Area | Insurance risk quantification, pricing, reserving | Data extraction, pattern recognition, predictive analytics |

| Business Impact | Optimizes insurance pricing and risk management strategies | Drives data-driven decision making and innovation in insurance |

| Regulatory Involvement | Ensures compliance with insurance regulations and standards | Supports regulatory reporting through data insights |

Defining the Roles: Actuary vs Data Scientist

Actuaries in insurance specialize in assessing risk through statistical analysis and financial theory to calculate premiums, reserves, and predict future claim probabilities using models grounded in probability and statistics. Data scientists leverage large datasets, machine learning algorithms, and advanced analytics to extract insights, optimize underwriting processes, and improve customer segmentation beyond traditional actuarial methods. Both roles rely on quantitative skills but differ as actuaries focus on regulatory compliance and financial implications, while data scientists prioritize data-driven innovation and predictive modeling in insurance.

Core Competencies and Skillsets

Actuaries in insurance specialize in risk assessment using statistical models, probability theories, and financial mathematics to forecast future events and ensure policy profitability. Data scientists leverage machine learning algorithms, programming languages like Python and R, and big data analytics to extract insights from complex datasets, enhancing decision-making beyond traditional actuarial methods. While actuaries focus on regulatory compliance and financial stability, data scientists emphasize predictive analytics and data-driven innovation within insurance operations.

Key Tools and Methodologies Used

Actuaries primarily utilize statistical software such as SAS, R, and Excel for risk assessment and predictive modeling based on historical insurance data. Data scientists leverage machine learning frameworks like Python, TensorFlow, and Hadoop to analyze large datasets, develop algorithmic models, and uncover complex patterns. Both professions employ SQL for data extraction, but actuaries focus more on deterministic models while data scientists emphasize probabilistic and artificial intelligence methods.

Education and Professional Qualifications

Actuaries typically require a strong foundation in mathematics, statistics, and economics, combined with professional certifications such as the Society of Actuaries (SOA) or Casualty Actuarial Society (CAS) credentials, which involve passing rigorous multi-level exams. Data Scientists in insurance often hold degrees in computer science, statistics, or related fields, and their qualifications emphasize proficiency in programming, machine learning, and data analysis tools, frequently supported by certifications from platforms like Coursera or edX. Both roles demand continuous education, but actuaries face a more structured certification process, while data scientists rely on a diverse skill set and specialized training to analyze complex insurance data.

Typical Responsibilities in the Insurance Sector

Actuaries in the insurance sector primarily focus on risk assessment, pricing insurance policies, and calculating reserves using statistical models and financial theory to ensure the company's solvency. Data scientists analyze large datasets to identify trends, improve customer segmentation, and optimize marketing strategies through machine learning and predictive analytics. Both roles contribute to decision-making but actuaries emphasize financial stability and regulatory compliance, while data scientists enhance operational efficiency and innovation.

Data Sources and Analytical Approaches

Actuaries primarily rely on historical insurance data, such as claims records, policyholder information, and mortality tables, using statistical models and deterministic methods to assess risk and calculate premiums. Data scientists in insurance integrate diverse datasets, including social media, IoT sensor data, and real-time market trends, leveraging machine learning algorithms and big data analytics to uncover complex patterns and enhance predictive accuracy. The actuarial approach emphasizes regulatory compliance and conservative risk estimation, while data scientists prioritize innovation and adaptive modeling for dynamic risk assessment.

Risk Assessment and Predictive Modeling

Actuaries specialize in risk assessment by applying statistical methods and financial theory to evaluate the probability and financial impact of uncertain future events, crucial for setting insurance premiums and reserves. Data scientists utilize advanced predictive modeling techniques, including machine learning algorithms and big data analytics, to uncover patterns and forecast risks more dynamically in insurance portfolios. Both roles complement each other, with actuaries providing domain expertise and regulatory insights while data scientists enhance predictive accuracy and operational efficiency.

Regulatory and Compliance Considerations

Actuaries in insurance adhere strictly to regulatory frameworks like Solvency II and the NAIC Model Act, ensuring compliance through actuarial standards of practice and risk-based capital requirements. Data scientists focus on leveraging big data analytics and machine learning while maintaining compliance with data privacy regulations such as GDPR and HIPAA, which impact data governance and model transparency. Both roles require maintaining audit trails and validating models to meet regulatory scrutiny and ensure operational transparency.

Career Growth and Industry Demand

Actuaries in the insurance industry experience steady career growth due to their expertise in risk assessment, regulatory compliance, and financial forecasting. Data scientists are increasingly in demand for their ability to leverage big data, machine learning, and predictive analytics to optimize underwriting and claims management. Both careers offer high salary potential and strong job security, but data scientists benefit from broader applications across emerging technologies and cross-industry opportunities.

Future Trends: Convergence and Collaboration

Actuaries and data scientists are increasingly collaborating as insurance companies leverage advanced analytics, machine learning, and predictive modeling to enhance risk assessment and pricing accuracy. The convergence of actuarial expertise in traditional risk theory with the data scientist's proficiency in big data and AI drives innovation in product development and fraud detection. Future trends in insurance emphasize integrated teams combining actuarial judgment with data science techniques to optimize decision-making and improve customer personalization.

Related Important Terms

Telematics-Driven Risk Assessment

Actuaries leverage telematics data to develop statistically robust models that quantify insurance risk with regulatory compliance, while data scientists apply machine learning algorithms to analyze real-time telematics information for dynamic risk prediction and personalized policy pricing. The integration of actuarial expertise and data science techniques enhances telematics-driven risk assessment by combining predictive accuracy with domain-specific validation in insurance underwriting.

Predictive Underwriting

Actuaries leverage statistical models and domain expertise to assess risk and calculate premiums, while data scientists apply machine learning algorithms to analyze large datasets for uncovering hidden patterns in predictive underwriting. Combining actuarial knowledge with data science techniques enhances accuracy in risk prediction, improves underwriting decisions, and optimizes policy pricing in insurance.

Machine Learning Reserving

Machine learning reserving leverages actuaries' expertise in risk assessment combined with data scientists' skills in algorithm development to enhance predictive accuracy in insurance claim forecasting. Integrating advanced machine learning models, actuaries optimize reserve estimation by analyzing large datasets, improving financial stability and regulatory compliance.

GenAI Pricing Models

Actuaries leverage GenAI pricing models to enhance risk assessment by integrating historical insurance data with predictive analytics, improving premium accuracy and reserving strategies. Data scientists, focusing on advanced machine learning techniques within GenAI frameworks, optimize pricing models through large-scale data processing and real-time trend analysis to drive competitive market positioning.

Usage-Based Insurance (UBI) Analytics

Actuaries leverage statistical models and historical claims data to quantify risk and set premiums in Usage-Based Insurance (UBI), while data scientists apply machine learning algorithms and real-time telematics data to enhance predictive accuracy and personalize policy pricing. Combining actuarial expertise with data science techniques optimizes risk assessment and drives innovation in UBI analytics.

Claims Automation Algorithms

Claims automation algorithms in insurance leverage actuaries' expertise in risk assessment and statistical modeling to enhance predictive accuracy, while data scientists apply advanced machine learning techniques and big data analytics to optimize claims processing efficiency and fraud detection. Integrating actuarial models with data science-driven algorithms accelerates claims adjudication, reduces operational costs, and improves customer satisfaction through faster, more accurate settlements.

Explainable AI (XAI) in Actuarial Science

Explainable AI (XAI) in actuarial science enhances transparency and trust by enabling actuaries to interpret complex predictive models, ensuring compliance with regulatory standards and improving risk assessment accuracy. While data scientists develop advanced machine learning algorithms, actuaries leverage XAI to translate these models into actionable insights for underwriting, pricing, and reserving decisions within insurance companies.

Data-Centric Loss Modelling

Data scientists in insurance leverage data-centric loss modeling techniques to analyze vast datasets, uncover patterns, and improve predictive accuracy for claims forecasting. Unlike actuaries who focus on traditional risk assessment and pricing models, data scientists utilize machine learning algorithms and advanced analytics to optimize loss predictions and enhance decision-making processes.

Non-Traditional Risk Signals

Actuaries rely primarily on historical insurance data, but data scientists integrate non-traditional risk signals such as social media activity, telematics, and IoT devices to enhance risk assessment accuracy. Incorporating these alternative data sources enables insurers to better predict customer behavior, improve underwriting precision, and reduce claim fraud.

Embedded Insurance Data Products

Actuaries leverage statistical models and domain-specific knowledge to assess risk and price embedded insurance data products, ensuring profitability and regulatory compliance. Data scientists enhance these products by applying advanced machine learning algorithms to unstructured data, enabling real-time risk prediction and personalized policy recommendations.

Actuary vs Data Scientist Infographic

industrydif.com

industrydif.com