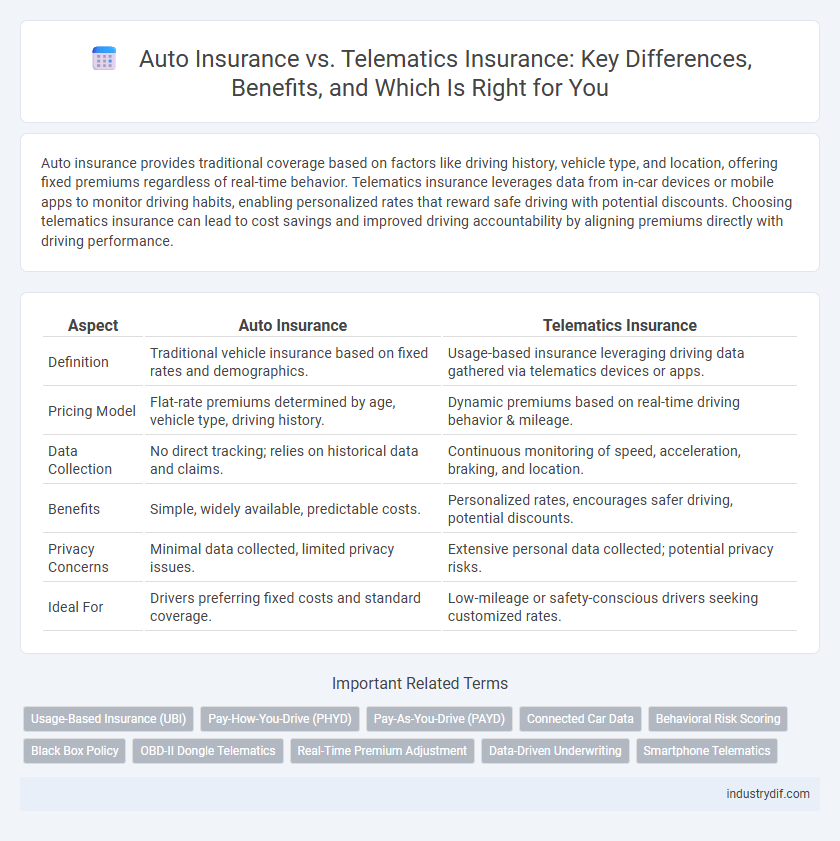

Auto insurance provides traditional coverage based on factors like driving history, vehicle type, and location, offering fixed premiums regardless of real-time behavior. Telematics insurance leverages data from in-car devices or mobile apps to monitor driving habits, enabling personalized rates that reward safe driving with potential discounts. Choosing telematics insurance can lead to cost savings and improved driving accountability by aligning premiums directly with driving performance.

Table of Comparison

| Aspect | Auto Insurance | Telematics Insurance |

|---|---|---|

| Definition | Traditional vehicle insurance based on fixed rates and demographics. | Usage-based insurance leveraging driving data gathered via telematics devices or apps. |

| Pricing Model | Flat-rate premiums determined by age, vehicle type, driving history. | Dynamic premiums based on real-time driving behavior & mileage. |

| Data Collection | No direct tracking; relies on historical data and claims. | Continuous monitoring of speed, acceleration, braking, and location. |

| Benefits | Simple, widely available, predictable costs. | Personalized rates, encourages safer driving, potential discounts. |

| Privacy Concerns | Minimal data collected, limited privacy issues. | Extensive personal data collected; potential privacy risks. |

| Ideal For | Drivers preferring fixed costs and standard coverage. | Low-mileage or safety-conscious drivers seeking customized rates. |

Introduction to Auto Insurance and Telematics Insurance

Auto insurance provides coverage against vehicle damage, theft, and liability, commonly based on fixed premiums determined by factors like driving history, vehicle type, and location. Telematics insurance utilizes real-time data collected via in-car devices or smartphone apps to monitor driving behavior, enabling personalized premiums based on factors such as speed, braking patterns, and mileage. This dynamic pricing model aims to reward safe driving habits and potentially reduce overall insurance costs.

What is Traditional Auto Insurance?

Traditional auto insurance involves a fixed premium based on factors such as age, driving history, vehicle type, and location, rather than real-time driving behavior. This type of policy offers coverage for liabilities, damages, and losses resulting from accidents or theft, with rates calculated using statistical averages. Policyholders pay a predetermined amount regardless of their actual driving patterns, contrasting with usage-based telematics insurance models.

What is Telematics Insurance?

Telematics insurance uses GPS and mobile technology to monitor driving behavior, offering personalized premiums based on real-time data such as speed, acceleration, and braking patterns. Unlike traditional auto insurance, which relies on general risk factors like age, location, and driving history, telematics provides a dynamic assessment of driving habits. This data-driven approach encourages safer driving habits and can result in lower insurance costs for responsible drivers.

Key Differences: Auto Insurance vs Telematics Insurance

Auto insurance provides coverage based on traditional factors such as vehicle type, driver history, and location, offering a fixed premium regardless of driving behavior. Telematics insurance utilizes real-time data collected through a device or app to monitor driving habits, enabling personalized premiums that reward safe driving and encourage risk reduction. Key differences include the dynamic pricing model of telematics insurance versus the static rates of conventional auto insurance and the emphasis on behavioral data for risk assessment.

How Telematics Insurance Works

Telematics insurance uses a device or smartphone app to monitor driving behaviors such as speed, acceleration, braking, and mileage, collecting real-time data to personalize premiums. This usage-based model allows insurers to offer cost savings to safe drivers by analyzing actual driving patterns rather than relying solely on traditional risk factors like age or history. The continuous feedback to drivers encourages safer habits while providing insurers with more accurate risk assessment for auto insurance policies.

Benefits of Telematics-Based Insurance Policies

Telematics-based auto insurance policies offer personalized premiums by analyzing real-time driving behavior, which promotes safer driving habits and reduces accident risks. These policies provide detailed feedback on speed, braking, and mileage, leading to fairer pricing and increased driver accountability. Insurers benefit from improved risk assessment and claims processing efficiency, enhancing overall customer satisfaction.

Drawbacks of Telematics Insurance

Telematics insurance often raises privacy concerns due to continuous monitoring of driving behavior, which some policyholders find intrusive. The accuracy of telematics devices can be affected by technical issues or data errors, potentially leading to unfair premium adjustments. Furthermore, customers with unpredictable driving patterns may face higher costs, reducing the perceived value compared to traditional auto insurance.

Cost Comparison: Auto Insurance vs Telematics Insurance

Telematics insurance often results in lower premiums compared to traditional auto insurance by using real-time driving data to assess risk more accurately. Traditional auto insurance typically bases costs on broader factors like age, driving history, and vehicle type, which can lead to higher average premiums. Policyholders with safe driving habits benefit most from telematics insurance due to personalized cost savings and incentivized responsible behavior.

Who Should Choose Telematics Insurance?

Telematics insurance is ideal for safe drivers, young or inexperienced motorists, and those who drive less frequently, as it offers personalized premiums based on real-time driving behavior data. Individuals seeking to reduce costs through responsible driving and those comfortable with technology and data sharing benefit most from telematics policies. This insurance type is also suitable for fleet operators aiming to monitor driver performance and improve overall safety.

Future Trends in Auto and Telematics Insurance

Future trends in auto and telematics insurance emphasize increasing integration of IoT and AI technologies to enhance risk assessment accuracy and personalize premium pricing. Usage-based insurance models powered by real-time data from telematics devices enable insurers to offer dynamic policies reflecting individual driving behavior and road conditions. Emerging advancements in 5G connectivity and machine learning algorithms will drive more sophisticated predictive analytics, improving claims processing efficiency and fraud detection capabilities.

Related Important Terms

Usage-Based Insurance (UBI)

Usage-Based Insurance (UBI) leverages telematics technology to monitor driving behavior, offering personalized auto insurance premiums based on actual vehicle usage and driving patterns. This approach contrasts traditional auto insurance models by rewarding safer drivers with lower rates and providing real-time data insights to insurers for more accurate risk assessments.

Pay-How-You-Drive (PHYD)

Pay-How-You-Drive (PHYD) telematics insurance uses real-time driving data such as speed, braking patterns, and mileage to personalize auto insurance premiums, rewarding safe driving behavior with lower rates. Traditional auto insurance relies on static factors like age, location, and driving history, lacking the granular risk assessment provided by PHYD technology.

Pay-As-You-Drive (PAYD)

Pay-As-You-Drive (PAYD) telematics insurance calculates premiums based on actual mileage and driving behavior, offering personalized rates that can significantly reduce costs compared to traditional auto insurance's fixed-rate models. This usage-based approach leverages GPS and sensor data, encouraging safer driving habits while aligning insurance payments directly with road usage.

Connected Car Data

Auto insurance typically relies on static factors such as driving history and vehicle type to calculate premiums, while telematics insurance leverages connected car data including real-time driving behavior, speed, braking patterns, and mileage to provide personalized rates. This integration of connected car data enables more accurate risk assessment and incentivizes safer driving habits, potentially reducing overall insurance costs.

Behavioral Risk Scoring

Behavioral risk scoring in auto insurance leverages telematics data such as driving speed, braking patterns, and mileage to provide a personalized risk profile, leading to more accurate premium calculations. Traditional auto insurance relies on demographic and historical data, often resulting in less precise risk assessments compared to telematics-based models that continuously monitor real-time driver behavior.

Black Box Policy

Telematics insurance, often referred to as a Black Box policy, uses a device installed in the vehicle to monitor driving behavior such as speed, braking, and mileage, allowing insurers to offer personalized premiums based on actual usage and risk. Compared to traditional auto insurance, which relies on generalized risk factors and historical data, Black Box policies provide more accurate pricing and can incentivize safer driving habits, potentially lowering overall costs for responsible drivers.

OBD-II Dongle Telematics

OBD-II dongle telematics in auto insurance enables real-time monitoring of driving behavior, providing personalized risk assessments that can lower premiums based on actual usage and driving habits. This data-driven approach contrasts with traditional auto insurance by offering dynamic pricing and improved claims accuracy through detailed trip and vehicle performance metrics.

Real-Time Premium Adjustment

Telematics insurance leverages real-time data from in-car devices to dynamically adjust premiums based on actual driving behavior, offering more personalized rates than traditional auto insurance's static pricing models. This continuous monitoring allows insurers to reward safe driving instantly, potentially lowering costs and enhancing risk assessment accuracy.

Data-Driven Underwriting

Telematics insurance leverages real-time driving data collected through GPS and onboard diagnostics to enable precise, data-driven underwriting, enhancing risk assessment accuracy compared to traditional auto insurance policies. This data-driven approach optimizes premium pricing based on individual driving behavior, promoting safer driving and reducing claims frequency.

Smartphone Telematics

Smartphone telematics in auto insurance leverages mobile device sensors and GPS data to monitor driving behavior, enabling personalized premiums based on real-time risk assessment. This technology enhances accuracy in underwriting and claims processing compared to traditional auto insurance, which relies on static factors like age and driving history.

Auto Insurance vs Telematics Insurance Infographic

industrydif.com

industrydif.com