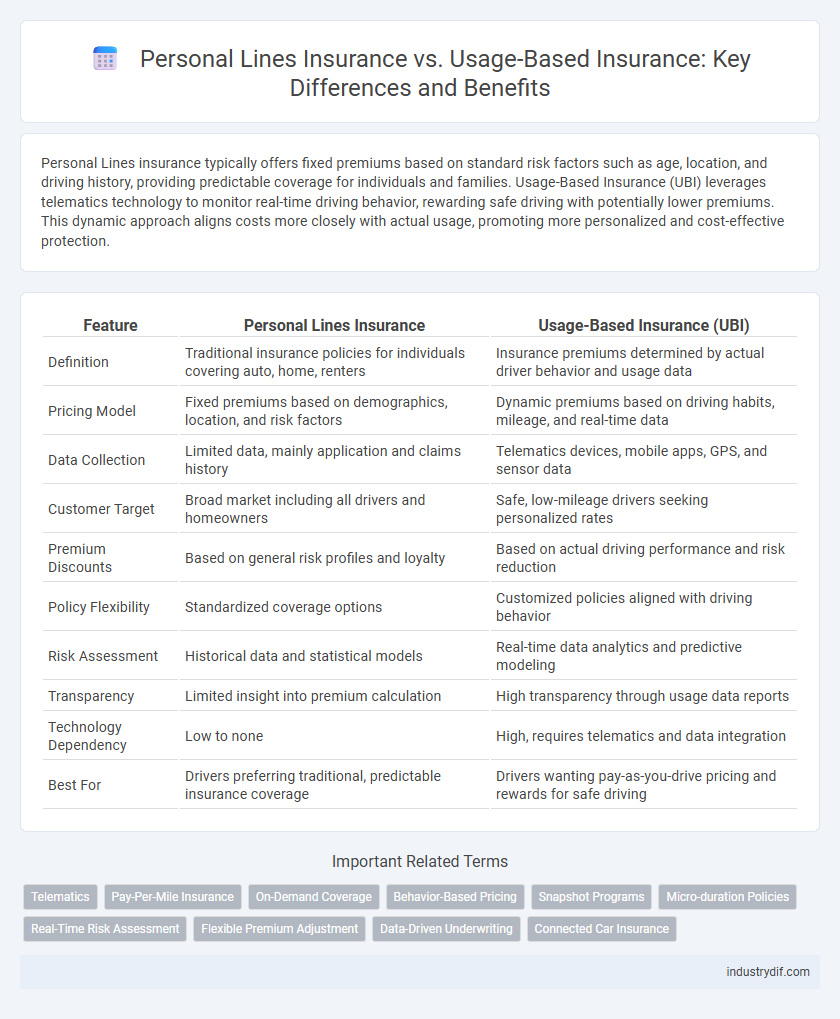

Personal Lines insurance typically offers fixed premiums based on standard risk factors such as age, location, and driving history, providing predictable coverage for individuals and families. Usage-Based Insurance (UBI) leverages telematics technology to monitor real-time driving behavior, rewarding safe driving with potentially lower premiums. This dynamic approach aligns costs more closely with actual usage, promoting more personalized and cost-effective protection.

Table of Comparison

| Feature | Personal Lines Insurance | Usage-Based Insurance (UBI) |

|---|---|---|

| Definition | Traditional insurance policies for individuals covering auto, home, renters | Insurance premiums determined by actual driver behavior and usage data |

| Pricing Model | Fixed premiums based on demographics, location, and risk factors | Dynamic premiums based on driving habits, mileage, and real-time data |

| Data Collection | Limited data, mainly application and claims history | Telematics devices, mobile apps, GPS, and sensor data |

| Customer Target | Broad market including all drivers and homeowners | Safe, low-mileage drivers seeking personalized rates |

| Premium Discounts | Based on general risk profiles and loyalty | Based on actual driving performance and risk reduction |

| Policy Flexibility | Standardized coverage options | Customized policies aligned with driving behavior |

| Risk Assessment | Historical data and statistical models | Real-time data analytics and predictive modeling |

| Transparency | Limited insight into premium calculation | High transparency through usage data reports |

| Technology Dependency | Low to none | High, requires telematics and data integration |

| Best For | Drivers preferring traditional, predictable insurance coverage | Drivers wanting pay-as-you-drive pricing and rewards for safe driving |

Understanding Personal Lines Insurance

Personal lines insurance covers individual and family risks, including auto, home, renters, and life insurance policies tailored to personal needs. It offers fixed premium contracts based on assessed risk factors such as age, location, and driving history, providing predictable coverage and financial protection. Understanding personal lines insurance helps consumers select appropriate coverage limits and deductibles to balance cost and risk effectively.

What is Usage-Based Insurance (UBI)?

Usage-Based Insurance (UBI) is an auto insurance model that calculates premiums based on real-time driving behavior, including factors such as speed, mileage, and braking patterns. Utilizing telematics devices or smartphone apps, UBI provides personalized rates that reflect actual risk rather than traditional demographic data. This innovative approach rewards safe drivers with lower premiums and encourages responsible driving habits through continuous monitoring.

Key Differences Between Personal Lines and UBI

Personal Lines Insurance provides fixed coverage based on traditional factors such as age, location, and driving history, offering predictable premiums for individuals or families. Usage-Based Insurance (UBI) calculates premiums dynamically, leveraging telematics data like miles driven, driving behavior, and time of use to tailor rates more precisely. The key difference lies in Personal Lines' reliance on static risk models versus UBI's real-time, behavior-driven assessment which can lead to more personalized and potentially cost-effective insurance solutions.

Benefits of Personal Lines Insurance

Personal Lines Insurance offers comprehensive coverage tailored to individual needs, providing financial protection for personal assets such as homes, vehicles, and valuables. It typically features predictable premium costs and extensive policy options, allowing customers to select coverage that fits their lifestyle and risk profile. This type of insurance ensures peace of mind through standardized policies and a wide network of trusted insurers and agents.

Advantages of Usage-Based Insurance

Usage-Based Insurance (UBI) offers personalized premium rates by analyzing real-time driving data, promoting fairer pricing compared to traditional Personal Lines policies. It incentivizes safer driving behaviors through feedback and rewards, leading to reduced accident risks and lower claim costs. UBI enhances transparency and engagement between insurers and policyholders via telematics technology, improving customer satisfaction and retention.

Risk Assessment in Personal Lines vs UBI

Personal Lines insurance relies heavily on traditional risk assessment methods such as demographic data, credit scores, and historical claims to determine premiums. Usage-Based Insurance (UBI) leverages telematics and real-time driving behavior data, including speed, braking patterns, and mileage, to offer personalized risk profiles. This data-driven approach in UBI provides more accurate risk assessment, potentially resulting in fairer pricing and incentivizing safer driving habits.

Pricing Models: Fixed vs Usage-Based

Personal lines insurance commonly employs fixed pricing models, where premiums are determined by factors such as age, location, and claim history, providing predictable costs for policyholders. Usage-based insurance (UBI) leverages telematics and real-time driving data to calculate premiums dynamically, rewarding safer driving behaviors with lower costs. This shift to usage-based pricing models enhances risk assessment accuracy and aligns premiums more closely with individual driving habits.

Technology Trends Shaping Usage-Based Insurance

Telematics technology and smartphone applications drive the evolution of Usage-Based Insurance (UBI), enabling real-time data collection on driving behavior, mileage, and location. Advanced analytics and machine learning algorithms process this data to personalize premiums and incentivize safer driving habits. Integration of IoT devices and AI-powered risk assessment tools further optimize underwriting accuracy and claims management in the UBI landscape.

Consumer Suitability: Who Should Choose Which?

Personal Lines insurance offers predictable premiums suited for consumers seeking straightforward coverage for standard risks like home and auto, ideal for individuals with stable driving patterns and moderate risk tolerance. Usage-Based Insurance (UBI) utilizes telematics to track driving behavior, providing cost savings tailored for low-mileage drivers or those with safe driving habits, making it suitable for tech-savvy consumers wanting personalized rates. Evaluating driving frequency, lifestyle, and comfort with data sharing helps consumers decide between traditional personal lines and usage-based models.

The Future of Personal Lines and Usage-Based Insurance

The future of personal lines insurance is increasingly driven by the integration of usage-based insurance (UBI) models that leverage telematics data to personalize premiums and enhance risk assessment accuracy. Advances in IoT devices and AI analytics enable insurers to offer dynamic pricing based on real-time driver behavior, promoting safer driving habits and reducing claims frequency. This shift toward data-driven, customer-centric insurance solutions is expected to dominate the market, transforming traditional underwriting processes and improving overall policyholder satisfaction.

Related Important Terms

Telematics

Telematics technology in Usage-Based Insurance (UBI) enables real-time monitoring of driving behavior, allowing insurers to offer personalized premiums based on actual risk profiles instead of traditional demographic factors. Personal Lines insurance typically relies on static data such as age, location, and vehicle type, whereas telematics-driven UBI leverages GPS, accelerometer, and mileage data to enhance accuracy in risk assessment and reward safe drivers with potential discounts.

Pay-Per-Mile Insurance

Pay-per-mile insurance offers a dynamic alternative to traditional personal lines policies by charging premiums based on actual miles driven, enhancing cost-efficiency for low-mileage drivers. This usage-based insurance model leverages telematics data to provide personalized rates, promoting fair pricing and encouraging safer driving habits.

On-Demand Coverage

On-demand coverage under usage-based insurance offers personalized protection by charging premiums based on actual driving behavior and mileage, contrasting with traditional personal lines insurance that relies on fixed rates regardless of usage. This model provides greater flexibility and cost efficiency, appealing to low-mileage drivers seeking tailored policies that adjust dynamically to their lifestyle.

Behavior-Based Pricing

Behavior-based pricing in personal lines insurance leverages telematics data to tailor premiums according to individual driving habits, rewarding safe drivers with lower rates. Usage-based insurance models enhance risk assessment accuracy by continuously monitoring factors such as mileage, speed, acceleration, and braking patterns, leading to more personalized and fair policy pricing.

Snapshot Programs

Snapshot programs utilize telematics technology to monitor individual driving behaviors, offering personalized premiums based on factors like speed, braking, and mileage in personal lines insurance. This usage-based insurance model promotes safer driving habits while potentially reducing costs for low-risk drivers through real-time data analysis.

Micro-duration Policies

Micro-duration policies in personal lines insurance offer tailored coverage for brief time frames, enhancing flexibility and affordability by aligning premiums with actual usage patterns. Usage-based insurance leverages telematics data to dynamically adjust rates, providing personalized risk assessment and cost efficiency for short-term or sporadic insurance needs.

Real-Time Risk Assessment

Personal Lines insurance traditionally relies on generalized demographic data to determine premiums, whereas Usage-Based Insurance (UBI) leverages telematics and real-time driving behavior data for precise risk assessment. Real-time risk assessment through UBI enables dynamic premium adjustments based on actual usage patterns, enhancing accuracy and incentivizing safer driving habits.

Flexible Premium Adjustment

Personal Lines insurance offers fixed premiums based on risk assessments, while Usage-Based Insurance (UBI) provides flexible premium adjustments by monitoring real-time driving behavior through telematics data. This dynamic pricing model in UBI allows for more personalized premiums that reflect actual usage and driver risk, enhancing cost efficiency and fairness for policyholders.

Data-Driven Underwriting

Personal Lines insurance relies on traditional demographic and historical claims data, whereas Usage-Based Insurance leverages real-time telematics and driving behavior analytics for precise risk assessment. Data-driven underwriting in Usage-Based Insurance enables insurers to offer personalized premiums by continuously analyzing mileage, speed, and driving patterns, enhancing accuracy and customer engagement.

Connected Car Insurance

Connected Car Insurance leverages telematics technology to provide personalized premiums based on real-time driving behavior, distinguishing it from traditional Personal Lines insurance that relies on static risk factors like age or location. This usage-based model enhances risk assessment accuracy and incentivizes safer driving habits, leading to potential cost savings and improved customer engagement.

Personal Lines vs Usage-Based Insurance Infographic

industrydif.com

industrydif.com