Underwriting involves a detailed assessment of risk to determine the terms and pricing of an insurance policy, typically conducted manually by underwriters. Embedded underwriting integrates this evaluation directly into digital platforms, enabling real-time risk assessment and policy issuance without intermediate steps. This streamlined approach enhances customer experience by accelerating approvals and reducing administrative costs.

Table of Comparison

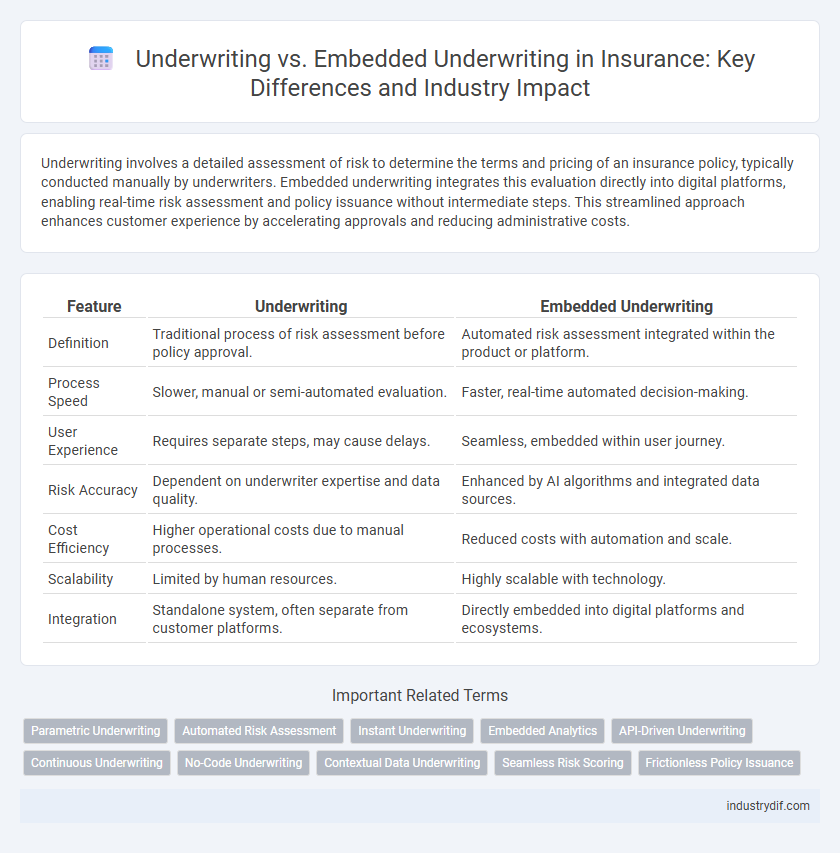

| Feature | Underwriting | Embedded Underwriting |

|---|---|---|

| Definition | Traditional process of risk assessment before policy approval. | Automated risk assessment integrated within the product or platform. |

| Process Speed | Slower, manual or semi-automated evaluation. | Faster, real-time automated decision-making. |

| User Experience | Requires separate steps, may cause delays. | Seamless, embedded within user journey. |

| Risk Accuracy | Dependent on underwriter expertise and data quality. | Enhanced by AI algorithms and integrated data sources. |

| Cost Efficiency | Higher operational costs due to manual processes. | Reduced costs with automation and scale. |

| Scalability | Limited by human resources. | Highly scalable with technology. |

| Integration | Standalone system, often separate from customer platforms. | Directly embedded into digital platforms and ecosystems. |

Definition of Underwriting

Underwriting is the process by which insurers assess the risk of insuring a client and determine the terms and pricing of the insurance policy. Traditional underwriting involves manual evaluation of medical records, financial data, and other risk factors to decide coverage eligibility. Embedded underwriting integrates risk assessment directly into digital platforms, enabling real-time, automated policy issuance without extensive manual review.

What is Embedded Underwriting?

Embedded underwriting integrates the risk assessment and approval process directly within digital platforms, enabling real-time insurance coverage decisions without manual intervention. Unlike traditional underwriting, which often involves lengthy evaluations by underwriters, embedded underwriting automates data collection and analysis through APIs and machine learning algorithms. This innovation enhances efficiency, reduces processing time, and improves customer experience by delivering instant policy issuance within the user's digital journey.

Key Differences Between Underwriting and Embedded Underwriting

Underwriting involves a thorough risk assessment process where insurers evaluate applicants based on detailed medical, financial, and lifestyle information to determine eligibility and premiums. Embedded underwriting integrates these evaluations directly into digital platforms or applications, enabling instant decision-making through automated data analysis with minimal human intervention. Key differences include the traditional underwriting's manual, time-intensive approach versus embedded underwriting's streamlined, technology-driven process enhancing efficiency and customer experience.

Traditional Underwriting Processes

Traditional underwriting processes involve a thorough evaluation of an applicant's medical history, lifestyle, and financial information to assess risk and determine premium rates accurately. This manual approach often requires extensive paperwork, medical exams, and third-party reports, leading to longer approval times and increased administrative costs. In contrast, embedded underwriting integrates real-time data collection and automated risk assessment within digital platforms, streamlining decision-making and enhancing customer experience without compromising accuracy.

Advantages of Embedded Underwriting

Embedded underwriting streamlines the insurance application process by integrating risk assessment directly into digital platforms, reducing the need for manual intervention and accelerating policy issuance. This approach enhances customer experience through real-time feedback and immediate coverage decisions, increasing conversion rates and operational efficiency. Moreover, embedded underwriting leverages advanced data analytics and automation, resulting in more accurate risk evaluation and personalized premium pricing.

Technological Innovations in Embedded Underwriting

Technological innovations in embedded underwriting leverage artificial intelligence, machine learning, and real-time data integration to streamline risk assessment and policy issuance directly within customer platforms. This approach contrasts with traditional underwriting by automating decision-making processes and reducing manual intervention, resulting in faster, more accurate coverage determinations. Embedded underwriting enhances customer experience through seamless policy activation while maintaining rigorous risk evaluation standards powered by advanced analytics and IoT data sources.

Impact on Customer Experience

Traditional underwriting involves manual evaluation processes that can delay policy issuance and frustrate customers with lengthy wait times. Embedded underwriting integrates assessment seamlessly within digital platforms, accelerating approval and providing a smoother, more personalized experience. This automation reduces friction, enhances transparency, and increases overall customer satisfaction by delivering faster coverage decisions.

Risk Assessment in Underwriting vs Embedded Underwriting

Risk assessment in traditional underwriting involves a comprehensive evaluation of an applicant's health, lifestyle, and financial background to determine policy eligibility and premium rates. Embedded underwriting integrates risk assessment directly into the sales process through automated data analysis and real-time decision-making, enabling faster policy issuance with minimal manual intervention. This seamless approach leverages AI and big data to enhance accuracy and streamline risk evaluation compared to conventional underwriting methods.

Regulatory Considerations

Underwriting involves thorough risk assessment and compliance with strict regulatory frameworks to ensure policyholder protection and market stability. Embedded underwriting integrates this process into digital platforms, requiring adherence to both traditional insurance regulations and additional data privacy and cybersecurity standards. Regulatory bodies emphasize transparency, consumer consent, and real-time compliance monitoring to address the complexities of embedded underwriting schemes.

Future Trends in Insurance Underwriting

Future trends in insurance underwriting emphasize the integration of embedded underwriting through APIs and AI-driven data analytics, enabling real-time risk assessment and personalized policy pricing. Traditional underwriting processes evolve as insurers harness predictive modeling and machine learning to streamline decision-making and improve accuracy. The shift towards automated, embedded underwriting solutions supports seamless customer experiences and faster policy issuance in digital insurance ecosystems.

Related Important Terms

Parametric Underwriting

Parametric underwriting leverages predefined parameters and data triggers to automate risk assessment, enhancing accuracy and efficiency compared to traditional underwriting methods. Embedded underwriting integrates parametric models directly into digital platforms, enabling real-time policy issuance and personalized insurance solutions.

Automated Risk Assessment

Automated risk assessment in traditional underwriting involves evaluating applications through algorithms that analyze financial, medical, and behavioral data to determine policy eligibility and pricing. Embedded underwriting integrates these automated evaluations directly within the customer journey, enabling real-time risk assessment and instant policy issuance without manual intervention.

Instant Underwriting

Instant underwriting accelerates risk assessment by using automated algorithms and real-time data analysis, enabling immediate policy approval and enhancing customer experience. Embedded underwriting integrates these instant evaluations directly into digital platforms, streamlining the application process and reducing manual intervention in insurance services.

Embedded Analytics

Embedded underwriting integrates advanced analytics directly into the insurance application process, enabling real-time risk assessment and personalized policy pricing. By leveraging embedded analytics, insurers enhance decision accuracy, streamline operations, and improve customer experience through data-driven insights seamlessly embedded within underwriting workflows.

API-Driven Underwriting

API-driven underwriting streamlines risk assessment by automating data exchange between insurers and third-party sources, enabling faster and more accurate policy issuance compared to traditional underwriting methods. Embedded underwriting integrates this automated process directly into digital platforms, allowing real-time policy approval within customer applications and enhancing user experience while reducing operational costs.

Continuous Underwriting

Continuous underwriting enhances risk assessment by integrating real-time data analysis, reducing the reliance on periodic reviews typical of traditional underwriting. Embedded underwriting automates this process within insurance products, allowing continuous monitoring and dynamic premium adjustments based on ongoing risk factors and behavioral insights.

No-Code Underwriting

No-code underwriting streamlines the insurance risk assessment process by enabling automated decision-making without traditional coding, enhancing efficiency and accuracy compared to embedded underwriting, which integrates underwriting rules within existing systems. This approach allows insurers to rapidly adapt to regulatory changes and tailor risk models, reducing operational costs and accelerating policy issuance.

Contextual Data Underwriting

Contextual data underwriting leverages real-time external information such as social behavior, health metrics, and environmental factors to enhance risk assessment accuracy, distinguishing it from traditional underwriting that relies primarily on static historical data. Embedded underwriting integrates this contextual data directly within digital platforms, enabling seamless automated policy issuance and personalized pricing without manual intervention.

Seamless Risk Scoring

Underwriting involves manual evaluation of risk factors to determine insurance premiums, while embedded underwriting integrates automated risk scoring directly into digital platforms for real-time policy issuance. Seamless risk scoring leverages AI-driven algorithms and data analytics to streamline decision-making, reduce processing time, and enhance accuracy in coverage assessment.

Frictionless Policy Issuance

Underwriting involves manually assessing risk factors to determine insurance eligibility, while embedded underwriting automates risk evaluation directly within digital platforms for seamless policy issuance. This frictionless approach accelerates customer onboarding, reduces processing time, and enhances accuracy by integrating real-time data analysis during underwriting.

Underwriting vs Embedded Underwriting Infographic

industrydif.com

industrydif.com