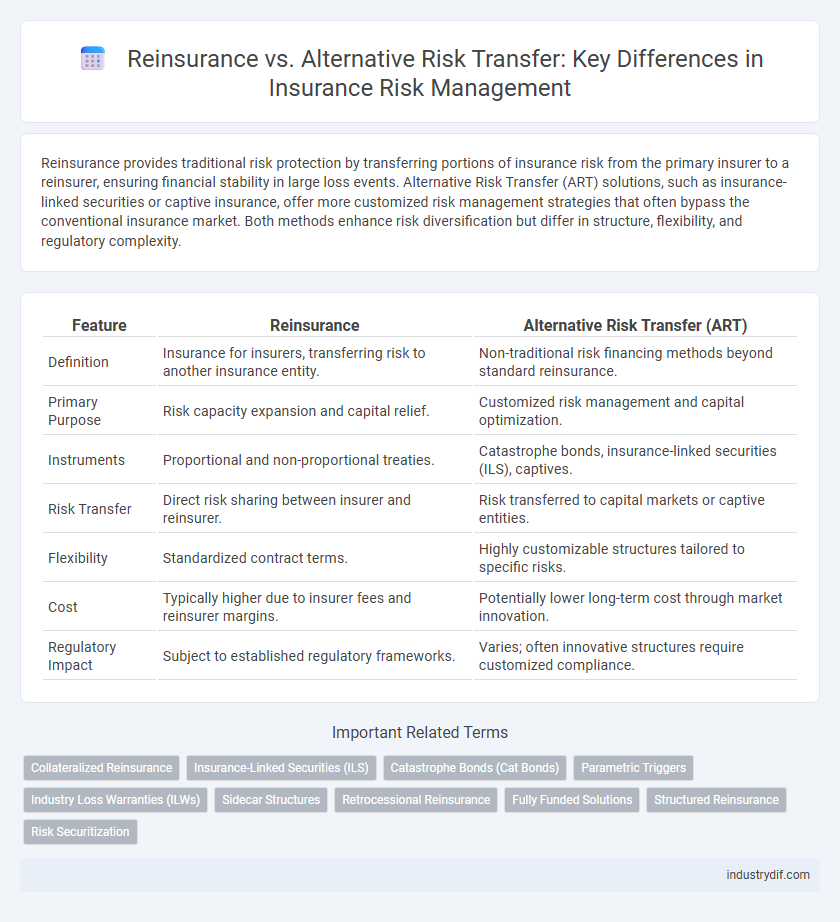

Reinsurance provides traditional risk protection by transferring portions of insurance risk from the primary insurer to a reinsurer, ensuring financial stability in large loss events. Alternative Risk Transfer (ART) solutions, such as insurance-linked securities or captive insurance, offer more customized risk management strategies that often bypass the conventional insurance market. Both methods enhance risk diversification but differ in structure, flexibility, and regulatory complexity.

Table of Comparison

| Feature | Reinsurance | Alternative Risk Transfer (ART) |

|---|---|---|

| Definition | Insurance for insurers, transferring risk to another insurance entity. | Non-traditional risk financing methods beyond standard reinsurance. |

| Primary Purpose | Risk capacity expansion and capital relief. | Customized risk management and capital optimization. |

| Instruments | Proportional and non-proportional treaties. | Catastrophe bonds, insurance-linked securities (ILS), captives. |

| Risk Transfer | Direct risk sharing between insurer and reinsurer. | Risk transferred to capital markets or captive entities. |

| Flexibility | Standardized contract terms. | Highly customizable structures tailored to specific risks. |

| Cost | Typically higher due to insurer fees and reinsurer margins. | Potentially lower long-term cost through market innovation. |

| Regulatory Impact | Subject to established regulatory frameworks. | Varies; often innovative structures require customized compliance. |

Understanding Reinsurance: Definition and Purpose

Reinsurance is a risk management tool where insurance companies transfer portions of their risk portfolios to other insurers to reduce the likelihood of paying a large obligation resulting from an insurance claim. This process enhances the primary insurer's capacity to underwrite more policies and stabilizes loss experience by spreading risk exposure. Understanding reinsurance involves recognizing its role in maintaining solvency, improving capital management, and protecting insurance companies from catastrophic losses.

Exploring Alternative Risk Transfer (ART) Methods

Alternative Risk Transfer (ART) methods provide innovative solutions beyond traditional reinsurance by utilizing financial instruments such as catastrophe bonds, insurance-linked securities, and risk retention groups. These methods enable insurers to transfer or share risk with capital markets, enhancing capacity and diversifying risk exposures. ART strategies support improved risk management, cost efficiency, and tailored coverage in a dynamic insurance landscape.

Key Differences Between Reinsurance and ART

Reinsurance primarily involves transferring risk from an insurance company to another insurer, typically to manage large exposures and stabilize losses, whereas Alternative Risk Transfer (ART) utilizes non-traditional mechanisms such as financial markets and capital instruments to finance risk. Reinsurance contracts are often standardized and regulated, whereas ART solutions are customized, incorporating derivatives, insurance-linked securities, and captive insurance structures. The key difference lies in reinsurance's reliance on traditional insurance principles compared to ART's innovative approaches that enhance risk financing flexibility and capital efficiency.

Advantages of Traditional Reinsurance Solutions

Traditional reinsurance solutions offer substantial financial stability by spreading risk across multiple parties, thereby reducing an insurer's exposure to catastrophic losses. These established arrangements provide regulatory familiarity and transparency, facilitating compliance and fostering trust with stakeholders. Moreover, traditional reinsurance delivers long-term capacity support and expertise, enhancing underwriting discipline and claims management.

Benefits and Risks of Alternative Risk Transfer

Alternative Risk Transfer (ART) offers insurance companies enhanced flexibility by utilizing capital markets and financial instruments to manage risk beyond traditional reinsurance limits. Benefits include improved risk diversification, cost-effectiveness, and access to broader funding sources, while risks involve potential complexity, regulatory challenges, and market volatility exposure. Unlike conventional reinsurance, ART solutions require sophisticated risk modeling and may lead to liquidity constraints during extreme loss events.

Types of Reinsurance Agreements

Reinsurance agreements primarily include proportional treaties, where premiums and losses are shared between the ceding insurer and reinsurer, and non-proportional contracts, such as excess of loss, which provide coverage after a specified loss threshold. Alternative Risk Transfer (ART) techniques, including catastrophe bonds and finite reinsurance, offer innovative methods to manage capital and risk beyond traditional reinsurance structures. Understanding the distinctions among these reinsurance types is essential for optimizing risk distribution and capital efficiency in insurance portfolios.

Popular ART Instruments: Cat Bonds, ILS, and More

Popular Alternative Risk Transfer (ART) instruments include catastrophe bonds (cat bonds) and insurance-linked securities (ILS), which provide innovative ways for insurers to transfer risk to capital market investors. Cat bonds enable insurers to raise funds contingent on the occurrence of specific catastrophic events, offering risk diversification beyond traditional reinsurance markets. Insurance-linked securities, encompassing a broad range of financial products, attract capital by linking payouts to insurance losses, enhancing liquidity and risk management efficiency in the insurance sector.

When to Choose Reinsurance vs Alternative Risk Transfer

Choose reinsurance when transferring large, high-severity risks requiring regulatory capital relief and long-term financial stability, especially for traditional insurance portfolios. Opt for alternative risk transfer (ART) solutions when seeking customized, innovative financing strategies that leverage capital markets to manage complex or non-traditional risks. Reinsurance suits well-established risk profiles, while ART is preferred for flexible, multi-layered risk management beyond conventional coverage.

Regulatory Considerations for Reinsurance and ART

Regulatory considerations for reinsurance primarily emphasize compliance with solvency requirements, ceding limitations, and reporting standards set by insurance authorities to ensure market stability and policyholder protection. Alternative Risk Transfer (ART) transactions often navigate a complex regulatory landscape involving securities laws, tax regulations, and bespoke contractual arrangements that differ significantly from traditional reinsurance frameworks. Understanding jurisdiction-specific regulatory approval processes and capital treatment is essential for both reinsurance and ART to maintain legal compliance and strategic financial management.

Future Trends in Risk Transfer Mechanisms

Future trends in risk transfer mechanisms highlight a shift towards greater integration of alternative risk transfer (ART) solutions alongside traditional reinsurance to enhance capital efficiency and risk diversification. Increasing adoption of insurance-linked securities (ILS), parametric insurance, and blockchain technology indicate a growing focus on transparency, speed, and customization in risk management. Advancements in data analytics and artificial intelligence further drive innovative structuring and pricing models, enabling insurers to tailor ART products and optimize portfolio resilience in volatile markets.

Related Important Terms

Collateralized Reinsurance

Collateralized reinsurance involves securing reinsurance obligations with collateral to guarantee payment, enhancing counterparty risk management compared to traditional reinsurance. Alternative Risk Transfer (ART) methods, such as insurance-linked securities, provide market-based solutions, but collateralized reinsurance remains a preferred approach for ensuring claim settlements through direct asset backing.

Insurance-Linked Securities (ILS)

Insurance-Linked Securities (ILS) represent a key component of Alternative Risk Transfer (ART), providing capital market investors direct exposure to insurance risks, unlike traditional reinsurance where risk is transferred between insurers. ILS instruments, such as catastrophe bonds, enable risk diversification and liquidity by converting insurance liabilities into tradable securities, thereby enhancing risk management flexibility beyond conventional reinsurance contracts.

Catastrophe Bonds (Cat Bonds)

Reinsurance provides traditional risk-sharing by transferring portions of risk portfolios to other insurers, while alternative risk transfer (ART) instruments like catastrophe bonds (Cat Bonds) enable insurers to raise capital directly from investors, offering payoff structures linked to specific predefined catastrophic events. Cat Bonds distribute catastrophe risk to the capital markets, enhancing risk capacity and liquidity for insurers facing high-severity natural disasters such as hurricanes or earthquakes.

Parametric Triggers

Parametric triggers in reinsurance provide predefined, objective criteria such as wind speed or earthquake magnitude to expedite claim payouts, reducing loss adjustment expenses and settlement times. In alternative risk transfer (ART), parametric triggers enable innovative financing solutions by linking payouts directly to measurable events, enhancing risk transfer efficiency and capital market participation.

Industry Loss Warranties (ILWs)

Industry Loss Warranties (ILWs) serve as a pivotal tool in reinsurance, offering protection based on the insurer's aggregate industry loss exceeding a specified threshold, contrasting with Alternative Risk Transfer (ART) mechanisms that often utilize more customized financial instruments or securitizations. ILWs provide market-driven indemnification efficiently aligning insurer losses with industry-wide catastrophe outcomes, while ART structures emphasize bespoke risk transfer solutions incorporating derivatives, catastrophe bonds, and other capital market innovations.

Sidecar Structures

Sidecar structures in reinsurance provide a specialized vehicle for insurers to transfer risk to capital markets, enabling direct access to alternative risk transfer solutions without traditional reinsurance intermediaries. These structures enhance risk capacity and capital efficiency by allowing investors to assume a portion of underwriting risk while offering insurers flexibility in managing volatility and balance sheet optimization.

Retrocessional Reinsurance

Retrocession in reinsurance involves insurers transferring portions of risk portfolios to other reinsurers to manage large exposures, providing a traditional method for risk mitigation. Alternative Risk Transfer (ART) offers innovative financial instruments like catastrophe bonds or insurance-linked securities, but retrocessional reinsurance remains essential for its capacity to enhance risk diversification and stability among global reinsurance markets.

Fully Funded Solutions

Fully funded solutions in reinsurance involve predefined capital reserves to cover potential claims, ensuring financial stability and predictable cash flow for insurers. Alternative risk transfer (ART) mechanisms, while also using fully funded approaches, often diversify risk through capital market instruments and bespoke contracts, offering more flexible yet complex risk-financing options.

Structured Reinsurance

Structured reinsurance involves tailored risk transfer solutions that combine traditional reinsurance with financial engineering techniques, enhancing capital efficiency and risk management for insurers. Unlike alternative risk transfer, which leverages capital markets and insurance-linked securities, structured reinsurance remains firmly rooted in bilateral agreements, providing customized coverage with flexible terms.

Risk Securitization

Risk securitization in reinsurance involves transferring insurance risks to capital markets through instruments like catastrophe bonds, providing insurers with additional capital relief and risk diversification. Alternative Risk Transfer (ART) techniques utilize financial markets and instruments beyond traditional reinsurance, enhancing risk financing efficiency by converting insured risks into tradable securities.

Reinsurance vs Alternative Risk Transfer Infographic

industrydif.com

industrydif.com