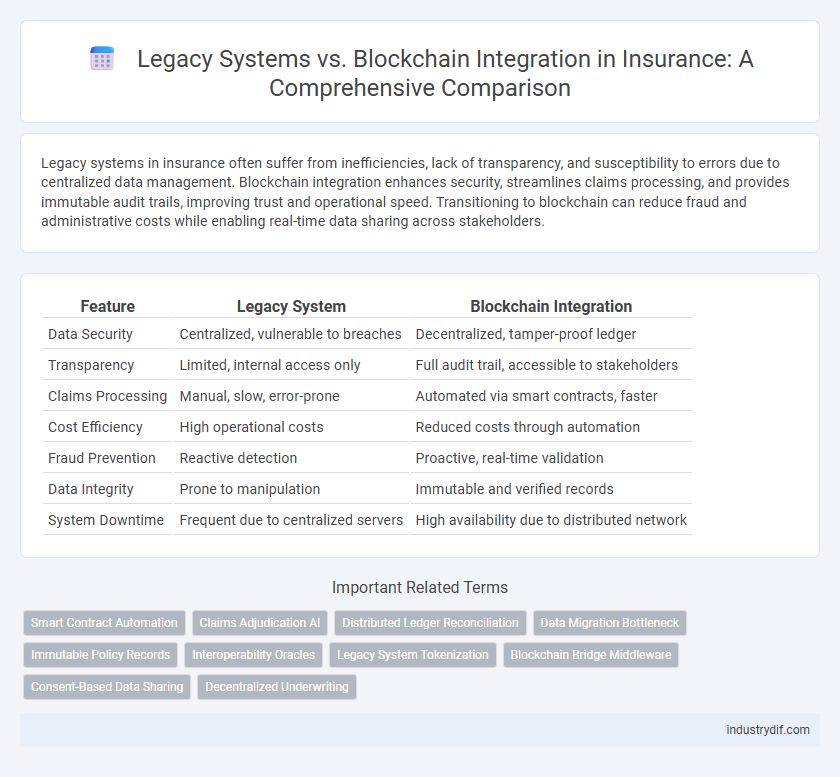

Legacy systems in insurance often suffer from inefficiencies, lack of transparency, and susceptibility to errors due to centralized data management. Blockchain integration enhances security, streamlines claims processing, and provides immutable audit trails, improving trust and operational speed. Transitioning to blockchain can reduce fraud and administrative costs while enabling real-time data sharing across stakeholders.

Table of Comparison

| Feature | Legacy System | Blockchain Integration |

|---|---|---|

| Data Security | Centralized, vulnerable to breaches | Decentralized, tamper-proof ledger |

| Transparency | Limited, internal access only | Full audit trail, accessible to stakeholders |

| Claims Processing | Manual, slow, error-prone | Automated via smart contracts, faster |

| Cost Efficiency | High operational costs | Reduced costs through automation |

| Fraud Prevention | Reactive detection | Proactive, real-time validation |

| Data Integrity | Prone to manipulation | Immutable and verified records |

| System Downtime | Frequent due to centralized servers | High availability due to distributed network |

Defining Legacy Systems in Insurance

Legacy systems in insurance refer to outdated technology infrastructures and software applications that support core business functions like policy administration, claims processing, and customer data management. These systems often rely on centralized databases and batch processing, leading to inefficiencies, data silos, and limited interoperability with modern platforms. Despite their reliability, legacy systems struggle with scalability, real-time data access, and integration challenges, which blockchain integration aims to overcome.

Understanding Blockchain Technology in Insurance

Blockchain technology in insurance enhances data transparency, security, and fraud reduction compared to legacy systems that rely on centralized databases vulnerable to tampering. Smart contracts automate policy management and claims processing, significantly reducing administrative costs and errors. Integrating blockchain enables real-time data sharing among multiple stakeholders while ensuring immutability and auditability of insurance records.

Key Differences: Legacy Systems vs Blockchain

Legacy insurance systems rely on centralized databases and manual reconciliation processes, leading to slower transactions and increased risk of errors. Blockchain integration offers decentralized ledger technology that enhances data transparency, security, and real-time verification of insurance claims. Key differences include immutability of records, automation through smart contracts, and improved traceability, which reduce fraud and operational costs significantly.

Common Challenges with Legacy Insurance Systems

Legacy insurance systems often struggle with data silos, outdated technology stacks, and lack of real-time processing capabilities, leading to inefficiencies in claims management and customer service. These systems typically have limited interoperability, making integration with modern digital platforms and blockchain solutions complex and costly. Security vulnerabilities and high maintenance costs further hinder scalability and innovation within traditional insurance infrastructures.

Blockchain Integration: Benefits for Insurers

Blockchain integration in insurance enhances data transparency and security by creating immutable transaction records, reducing fraud and improving trust among stakeholders. Smart contracts automate claims processing, accelerating settlements and cutting operational costs. Insurers benefit from improved customer experience through faster, more accurate underwriting and seamless policy management.

Data Security and Compliance Considerations

Legacy insurance systems often struggle with data security vulnerabilities due to outdated protocols and limited encryption capabilities, increasing the risk of breaches and non-compliance with regulations like GDPR and HIPAA. Blockchain integration enhances data security by offering immutable ledgers, end-to-end encryption, and decentralized access control, ensuring transparent audit trails and adherence to compliance standards. Insurers adopting blockchain technology can better safeguard sensitive customer information while facilitating real-time compliance monitoring and reporting.

Cost Implications: Legacy Maintenance vs Blockchain Adoption

Legacy insurance systems incur high ongoing maintenance costs due to outdated infrastructure and frequent manual interventions, leading to inefficiencies and increased operational expenses. Blockchain adoption offers long-term cost savings by automating claims processing, enhancing transparency, and reducing fraud, although initial implementation demands significant investment and integration efforts. Evaluating cost implications requires balancing immediate legacy maintenance expenses against the potential for reduced overhead and improved accuracy through blockchain technology.

Impact on Claims Processing and Underwriting

Legacy systems in insurance often create bottlenecks in claims processing due to manual data entry and siloed information, resulting in delayed settlements and increased error rates. Blockchain integration enhances data transparency and immutability, enabling real-time verification of claims and automated underwriting through smart contracts. This shift reduces fraud, accelerates claim approvals, and improves risk assessment accuracy, leading to more efficient and trustworthy insurance operations.

Case Studies: Blockchain Adoption in Insurance

Case studies in insurance demonstrate blockchain integration enhances legacy systems by improving data transparency, reducing fraud, and expediting claim processing. Leading insurers like AIG and AXA implemented blockchain to create immutable records and automate smart contracts, resulting in increased operational efficiency and customer trust. These real-world examples highlight blockchain's potential to transform underwriting and policy management by securely linking disparate legacy databases.

Future Trends: Modernizing Insurance with Blockchain

Legacy systems in insurance often struggle with data silos and inefficiencies, prompting a shift toward blockchain integration for enhanced transparency and security. Blockchain enables immutable ledgers, streamlined claims processing, and improved fraud detection, aligning with the industry's digital transformation goals. Future trends highlight hybrid models combining legacy infrastructure with blockchain to optimize operational efficiency and customer trust in insurance services.

Related Important Terms

Smart Contract Automation

Smart contract automation in insurance enhances efficiency by reducing manual processing errors and enabling real-time claim settlements, which legacy systems often fail to support due to their rigid and siloed architecture. Integrating blockchain technology facilitates immutable transaction records and decentralized data verification, streamlining underwriting and policy management processes that legacy infrastructure cannot easily accommodate.

Claims Adjudication AI

Legacy systems in insurance struggle with slow, error-prone claims adjudication processes due to manual data handling and siloed databases, limiting AI-driven automation. Blockchain integration enhances claims adjudication AI by enabling secure, transparent, and real-time data sharing across stakeholders, significantly improving accuracy, fraud detection, and operational efficiency.

Distributed Ledger Reconciliation

Legacy insurance systems rely on centralized databases that often lead to slow and error-prone reconciliation processes, increasing operational risks and costs. Blockchain integration with distributed ledger technology enables real-time, transparent reconciliation across multiple parties, reducing discrepancies and enhancing trust in insurance transactions.

Data Migration Bottleneck

Legacy insurance systems often face significant data migration bottlenecks due to rigid data formats and limited interoperability, causing delays and increased costs during blockchain integration. Blockchain adoption demands seamless data transfer and real-time verification, which legacy infrastructures struggle to support without substantial reengineering or middleware solutions.

Immutable Policy Records

Legacy systems in insurance often struggle with data integrity and slow reconciliation processes, whereas blockchain integration ensures immutable policy records through decentralized ledger technology, enhancing transparency and reducing fraud. This immutability provides insurers and policyholders with tamper-proof, real-time access to accurate insurance records, streamlining claims processing and regulatory compliance.

Interoperability Oracles

Legacy insurance systems often struggle with limited interoperability, hindering seamless data exchange across platforms. Blockchain integration leverages interoperable oracles to securely connect diverse systems, enabling real-time data verification and enhancing claims processing accuracy.

Legacy System Tokenization

Legacy system tokenization in insurance enhances data security by converting sensitive information into secure tokens, reducing fraud risk and ensuring compliance with regulatory standards. Integrating blockchain technology with legacy systems enables real-time data verification, improves transaction transparency, and streamlines claims processing, ultimately optimizing operational efficiency.

Blockchain Bridge Middleware

Blockchain bridge middleware enhances legacy insurance systems by enabling seamless data exchange and secure transaction validation between disparate platforms. This integration improves policy management, fraud detection, and claims processing through decentralized ledger technology, ensuring transparency and operational efficiency.

Consent-Based Data Sharing

Legacy systems in insurance often rely on centralized databases with limited transparency, posing challenges for secure and efficient consent-based data sharing; blockchain integration enhances data integrity by enabling decentralized, tamper-proof records that allow policyholders to control and authorize access in real time. Smart contracts on blockchain automate consent management, reducing processing times and compliance risks while improving trust between insurers and customers through transparent data exchange.

Decentralized Underwriting

Decentralized underwriting through blockchain integration transforms legacy insurance systems by enabling transparent, tamper-proof risk assessment and automated smart contract execution, reducing fraud and operational inefficiencies. This innovation enhances data accuracy and trust among stakeholders, promoting faster claims processing and more equitable premium pricing.

Legacy System vs Blockchain Integration Infographic

industrydif.com

industrydif.com