A low loss ratio indicates effective risk management and profitability, while data-driven insights enable insurers to analyze claims patterns and customer behavior for improved underwriting accuracy. Leveraging predictive analytics and machine learning, companies can optimize pricing strategies and reduce unexpected losses. Integrating loss ratio metrics with advanced data analytics enhances decision-making, fostering sustainable growth in competitive insurance markets.

Table of Comparison

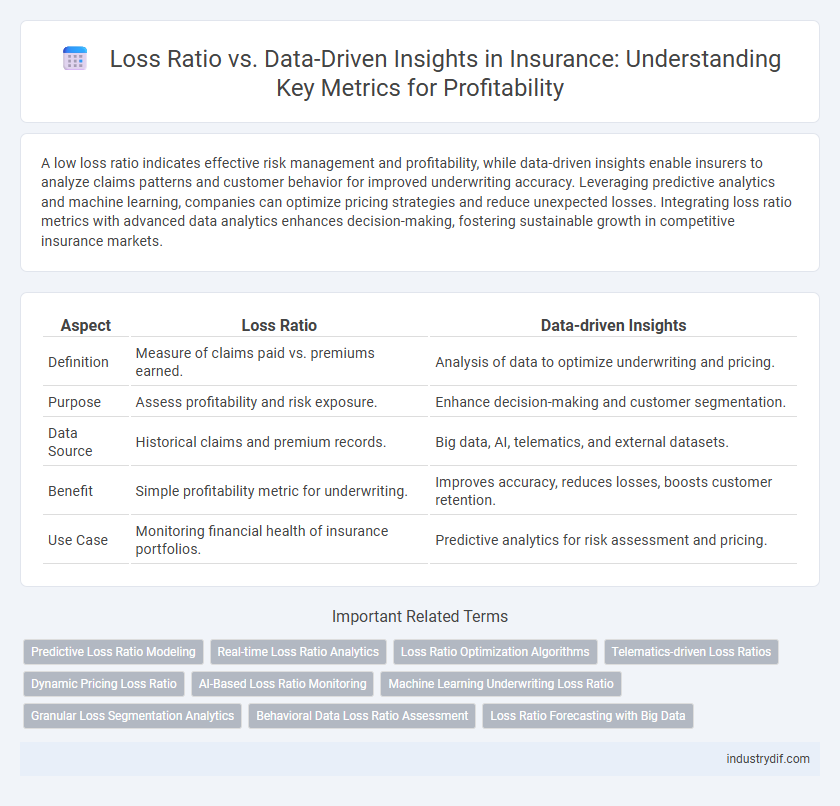

| Aspect | Loss Ratio | Data-driven Insights |

|---|---|---|

| Definition | Measure of claims paid vs. premiums earned. | Analysis of data to optimize underwriting and pricing. |

| Purpose | Assess profitability and risk exposure. | Enhance decision-making and customer segmentation. |

| Data Source | Historical claims and premium records. | Big data, AI, telematics, and external datasets. |

| Benefit | Simple profitability metric for underwriting. | Improves accuracy, reduces losses, boosts customer retention. |

| Use Case | Monitoring financial health of insurance portfolios. | Predictive analytics for risk assessment and pricing. |

Understanding Loss Ratio in Insurance

Loss ratio in insurance measures the percentage of claims paid out compared to premiums earned, serving as a critical indicator of an insurer's profitability and risk management effectiveness. Data-driven insights enhance the understanding of loss ratio by analyzing historical claim patterns, identifying high-risk segments, and optimizing pricing strategies. Leveraging advanced analytics, insurers can predict future losses more accurately and implement targeted interventions to maintain sustainable loss ratios.

The Role of Data-Driven Insights in the Insurance Sector

Loss ratio analysis in the insurance sector benefits significantly from data-driven insights, which enable precise risk assessment and underwriting decisions. Advanced analytics and machine learning models identify patterns in claims data, improving predictions of future losses and minimizing unexpected payouts. Incorporating real-time data enhances portfolio management, driving more accurate pricing strategies and optimizing overall profitability.

Comparing Traditional Metrics to Modern Analytics

Loss ratio, a traditional metric measuring claims paid versus premiums earned, often provides a limited snapshot of insurance performance. Data-driven insights leverage advanced analytics and machine learning to uncover patterns, predict risks, and optimize underwriting beyond what loss ratio alone can reveal. Combining these modern analytics with loss ratio creates a comprehensive framework for more accurate risk assessment and improved profitability in the insurance industry.

The Impact of Loss Ratio on Underwriting Strategies

Loss ratio serves as a critical metric in shaping underwriting strategies, reflecting the relationship between claims paid and premiums earned. Data-driven insights enable insurers to analyze loss ratios with precision, identifying risk patterns and optimizing premium pricing. By integrating loss ratio analysis with advanced analytics, underwriters can enhance risk selection, improve profitability, and reduce exposure to high-risk policies.

Leveraging Big Data for Accurate Risk Assessment

Loss ratio analysis enhanced by data-driven insights enables insurers to identify patterns and anomalies that traditional methods may overlook. Leveraging big data techniques, including machine learning algorithms and predictive analytics, improves risk assessment accuracy by integrating diverse data sources such as claims history, customer behavior, and external factors. This approach reduces underwriting errors, optimizes premium pricing, and ultimately enhances profitability through precise loss forecasting.

Data Sources Enhancing Insurance Decision-Making

Loss ratio analysis relies heavily on comprehensive data sources such as claims history, policyholder behavior, and external risk factors to evaluate underwriting profitability accurately. Integrating data-driven insights from telematics, social media, and IoT devices enhances predictive modeling and risk assessment capabilities in insurance decision-making. Leveraging diverse data inputs allows insurers to optimize pricing strategies and improve loss ratio management effectively.

Real-Time Analytics vs Historical Loss Ratios

Real-time analytics revolutionize insurance by providing dynamic, up-to-the-minute loss ratio data that enhances risk assessment accuracy and premium pricing. Unlike traditional reliance on historical loss ratios, which reflect past trends and may overlook emerging patterns, data-driven insights enable proactive identification of claim anomalies and shifting risk factors. Leveraging advanced machine learning algorithms on streaming data empowers insurers to optimize underwriting decisions and improve portfolio performance continuously.

Predictive Modeling’s Influence on Loss Ratios

Predictive modeling leverages vast datasets and advanced analytics to forecast claim probabilities, enabling insurers to set more accurate premiums and mitigate high loss ratios. By integrating historical claims data and risk indicators, predictive tools enhance underwriting precision, reducing unexpected losses and improving overall policy profitability. This data-driven approach transforms traditional loss ratio management into a dynamic process, aligning pricing strategies with real-time risk assessments.

Challenges in Transitioning from Loss Ratio to Data-Driven Approaches

Transitioning from traditional loss ratio analysis to data-driven insights presents challenges such as data quality issues, integration complexities, and the need for advanced analytical skills within insurance teams. Legacy systems often hinder seamless data aggregation, while inconsistent data formats complicate accurate risk assessment. Insurers must invest in technology and training to overcome these barriers and fully leverage predictive analytics for improved underwriting and claims management.

Future Trends: Integrating Loss Ratio with Advanced Analytics

Integrating loss ratio with advanced analytics enables insurers to predict risk more accurately, optimize pricing strategies, and enhance underwriting performance. Future trends highlight the adoption of AI-driven models that analyze real-time claims data and customer behavior to reduce loss ratios and improve profitability. Leveraging data-driven insights transforms traditional loss ratio metrics into dynamic tools for strategic decision-making in the insurance industry.

Related Important Terms

Predictive Loss Ratio Modeling

Predictive loss ratio modeling leverages advanced data-driven insights and machine learning algorithms to accurately forecast insurance claims, enabling insurers to optimize risk assessment and pricing strategies. By analyzing historical claims, policyholder behavior, and external factors, predictive models significantly improve the precision of loss ratio estimations, reducing underwriting losses and enhancing profitability.

Real-time Loss Ratio Analytics

Real-time loss ratio analytics empower insurers to monitor claim performance dynamically, enabling early identification of underwriting risks and pricing inefficiencies. Leveraging data-driven insights, companies optimize risk assessment and improve profitability by adjusting strategies based on up-to-the-minute loss ratio trends.

Loss Ratio Optimization Algorithms

Loss ratio optimization algorithms leverage advanced data-driven insights to accurately predict claim frequencies and costs, enabling insurers to adjust premiums and underwriting strategies effectively. These algorithms integrate real-time data analytics and machine learning to minimize loss ratios while maintaining competitive pricing and customer satisfaction.

Telematics-driven Loss Ratios

Telematics-driven loss ratios leverage real-time driving data to provide insurers with precise risk assessments, resulting in more accurate premium pricing and reduced claims costs. Integrating data-driven insights from telematics improves underwriting efficiency and enhances policyholder segmentation, ultimately optimizing loss ratio management in insurance portfolios.

Dynamic Pricing Loss Ratio

Dynamic pricing loss ratio leverages data-driven insights to adjust premiums in real-time, optimizing risk assessment and improving underwriting accuracy. By continuously analyzing claims, customer behavior, and market trends, insurers can reduce loss ratios and enhance profitability while maintaining competitive pricing.

AI-Based Loss Ratio Monitoring

AI-based loss ratio monitoring leverages machine learning algorithms to analyze vast datasets, detecting patterns and anomalies that traditional methods may overlook. This data-driven approach enhances predictive accuracy, enabling insurers to optimize underwriting decisions and reduce claims expenses, ultimately improving overall loss ratio performance.

Machine Learning Underwriting Loss Ratio

Machine learning underwriting improves loss ratio by analyzing vast datasets to predict risk more accurately, reducing claims frequency and severity. Leveraging data-driven insights enables insurers to optimize pricing strategies, enhance risk selection, and minimize underwriting losses effectively.

Granular Loss Segmentation Analytics

Granular loss segmentation analytics enables insurers to precisely identify loss ratio patterns across specific customer segments, policy types, and claim categories, improving underwriting accuracy and risk management. Leveraging data-driven insights from detailed loss segmentation drives targeted strategies that reduce loss ratios and enhance overall profitability.

Behavioral Data Loss Ratio Assessment

Behavioral data loss ratio assessment leverages real-time customer interactions and patterns to predict claim occurrences more accurately, reducing underwriting risks and improving profitability. Integrating behavioral analytics into loss ratio calculations enhances precision by identifying fraud tendencies and policyholder risk profiles based on empirical data rather than historical averages.

Loss Ratio Forecasting with Big Data

Loss ratio forecasting leverages big data analytics to analyze historical claims, policyholder behavior, and external risk factors, enhancing accuracy in predicting future losses. Integrating data-driven insights enables insurers to optimize underwriting strategies, improve pricing models, and mitigate financial risks effectively.

Loss Ratio vs Data-driven Insights Infographic

industrydif.com

industrydif.com