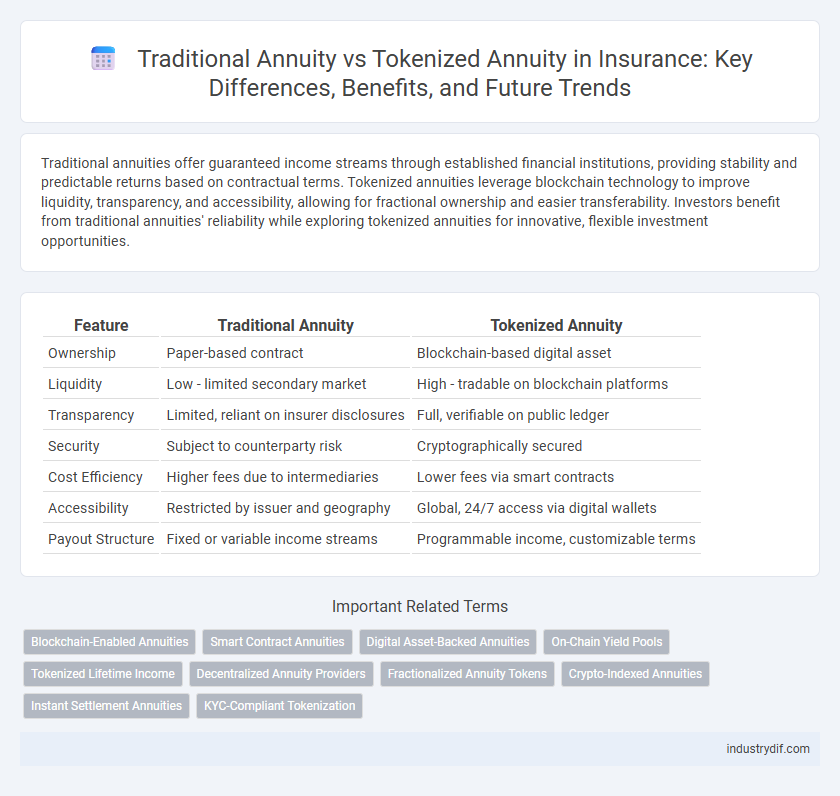

Traditional annuities offer guaranteed income streams through established financial institutions, providing stability and predictable returns based on contractual terms. Tokenized annuities leverage blockchain technology to improve liquidity, transparency, and accessibility, allowing for fractional ownership and easier transferability. Investors benefit from traditional annuities' reliability while exploring tokenized annuities for innovative, flexible investment opportunities.

Table of Comparison

| Feature | Traditional Annuity | Tokenized Annuity |

|---|---|---|

| Ownership | Paper-based contract | Blockchain-based digital asset |

| Liquidity | Low - limited secondary market | High - tradable on blockchain platforms |

| Transparency | Limited, reliant on insurer disclosures | Full, verifiable on public ledger |

| Security | Subject to counterparty risk | Cryptographically secured |

| Cost Efficiency | Higher fees due to intermediaries | Lower fees via smart contracts |

| Accessibility | Restricted by issuer and geography | Global, 24/7 access via digital wallets |

| Payout Structure | Fixed or variable income streams | Programmable income, customizable terms |

Introduction to Annuities in Insurance

Annuities in insurance serve as financial products designed to provide a steady income stream, typically post-retirement, by converting a lump sum or series of payments into future disbursements. Traditional annuities involve direct contracts with insurance companies, offering predictable returns and regulatory protections. Tokenized annuities leverage blockchain technology to enhance transparency, liquidity, and accessibility, representing a modern evolution in annuity investment options.

What is a Traditional Annuity?

A traditional annuity is a financial product offered by insurance companies that provides a guaranteed income stream in exchange for an initial lump-sum payment or series of payments. It is primarily designed to offer retirees stable, predictable cash flow over a specified period or for life, minimizing longevity risk. Traditional annuities rely on established actuarial principles and regulatory oversight to ensure contractual obligations are met.

What is a Tokenized Annuity?

A tokenized annuity is a digitalized insurance product that leverages blockchain technology to represent ownership rights through secure, tradable tokens, enhancing transparency and liquidity. Unlike traditional annuities, which are typically paper-based and illiquid, tokenized annuities enable fractional ownership, faster settlement, and real-time transferability on decentralized platforms. This innovation reduces administrative costs while providing investors with greater flexibility and access to global markets.

Key Differences Between Traditional and Tokenized Annuities

Traditional annuities involve a contract with an insurance company that guarantees fixed periodic payments, typically backed by the insurer's reserves and regulated under established financial laws. Tokenized annuities leverage blockchain technology to represent ownership digitally, enabling fractionalization, increased liquidity, and real-time transferability on decentralized platforms. The key differences include transparency, speed of transaction settlement, accessibility to smaller investors, and the potential reduction in administrative costs due to automation and smart contract execution.

Benefits of Traditional Annuities

Traditional annuities provide guaranteed income streams backed by established insurance companies, offering financial security during retirement. They come with familiar regulatory protections, ensuring policyholder safety and predictable returns. These annuities also provide tax-deferred growth, enabling investors to accumulate savings efficiently over time.

Advantages of Tokenized Annuities

Tokenized annuities offer enhanced liquidity compared to traditional annuities by enabling fractional ownership and seamless peer-to-peer transfers on blockchain platforms. They provide transparent, real-time tracking of asset performance and reduce administrative costs through automated smart contracts. Increased accessibility attracts a broader range of investors, allowing for diversification and more personalized retirement income strategies.

Risks and Challenges of Tokenized Annuities

Tokenized annuities face significant regulatory uncertainty as blockchain-based financial products often lack clear legal frameworks, increasing compliance risks for investors and issuers. Cybersecurity threats, including hacking and smart contract vulnerabilities, pose substantial risks to the safety of tokenized assets compared to traditional annuities protected by established financial institutions. Liquidity challenges also arise as tokenized annuities operate on emerging platforms with limited secondary markets, potentially hindering investors' ability to liquidate or transfer their holdings efficiently.

Regulatory Considerations for Tokenized Annuities

Tokenized annuities face complex regulatory considerations due to their classification as digital assets, requiring compliance with securities laws, anti-money laundering (AML) regulations, and know-your-customer (KYC) requirements. Regulatory bodies such as the SEC and FINRA closely monitor tokenized annuities to ensure investor protection and transparency, often leading to stricter disclosure and reporting mandates. The evolving legal landscape demands issuers to engage in continuous dialogue with regulators to navigate licensing, custody, and cross-border transaction challenges effectively.

Future Trends in Annuity Products

Tokenized annuities leverage blockchain technology to enhance transparency, liquidity, and fractional ownership, addressing limitations inherent in traditional annuity products such as illiquidity and complex transfer processes. Future trends indicate a growing adoption of digital assets within annuity structures, driven by increased demand for customizable, low-cost investment options and improved operational efficiency through smart contracts. Insurers are expected to integrate decentralized finance (DeFi) protocols to offer real-time pricing and automated payouts, revolutionizing how annuities are bought, managed, and traded.

Choosing Between Traditional and Tokenized Annuities

Choosing between traditional and tokenized annuities involves evaluating liquidity, transparency, and accessibility factors. Traditional annuities offer established regulatory protection and predictable payouts, while tokenized annuities provide enhanced liquidity through blockchain technology and real-time asset transfers. Investors seeking innovative financial products may prioritize the decentralized nature and fractional ownership features of tokenized annuities over the conventional stability of traditional annuities.

Related Important Terms

Blockchain-Enabled Annuities

Blockchain-enabled annuities leverage distributed ledger technology to enhance transparency, security, and efficiency compared to traditional annuities, which rely on centralized systems and manual processes. Tokenized annuities provide greater liquidity and faster settlement by digitizing ownership rights on the blockchain, enabling seamless peer-to-peer transactions and programmable smart contracts.

Smart Contract Annuities

Smart contract annuities leverage blockchain technology to automate payouts and ensure transparency, reducing administrative costs and eliminating intermediaries compared to traditional annuities. Tokenized annuities offer enhanced liquidity and real-time tracking, enabling policyholders to trade or manage their contracts efficiently within decentralized finance ecosystems.

Digital Asset-Backed Annuities

Digital asset-backed annuities leverage blockchain technology to provide enhanced transparency and liquidity compared to traditional annuities, which are typically backed by fixed financial instruments like bonds. These tokenized annuities facilitate fractional ownership and real-time trading of digital assets, offering investors greater flexibility and potential for higher returns within the insurance sector.

On-Chain Yield Pools

Traditional annuities rely on fixed or variable payouts managed by insurance companies, whereas tokenized annuities leverage on-chain yield pools to generate potentially higher returns through decentralized finance protocols. On-chain yield pools enhance liquidity and transparency, enabling real-time tracking of asset performance and reducing counterparty risk inherent in traditional annuities.

Tokenized Lifetime Income

Tokenized lifetime income offers enhanced liquidity and transparency compared to traditional annuities by leveraging blockchain technology to fractionalize ownership and automate income distributions. This innovation enables policyholders to access real-time asset valuation and secondary markets, providing greater flexibility and security in retirement planning.

Decentralized Annuity Providers

Decentralized annuity providers leverage blockchain technology to offer tokenized annuities, enhancing transparency and security compared to traditional annuities managed by centralized insurers. Tokenized annuities enable fractional ownership and real-time trading on decentralized platforms, providing increased liquidity and accessibility for investors.

Fractionalized Annuity Tokens

Traditional annuities provide fixed payouts based on a lump-sum investment, whereas tokenized annuities utilize blockchain technology to create fractionalized annuity tokens, enabling investors to own divisible shares of an annuity contract. Fractionalized annuity tokens enhance liquidity and accessibility by allowing smaller investments, real-time transfers, and transparent tracking of ownership on decentralized platforms.

Crypto-Indexed Annuities

Crypto-indexed annuities blend traditional annuity structures with blockchain technology, enabling secure, transparent investment growth tied to cryptocurrency market performance. These tokenized annuities offer increased liquidity, real-time valuation, and reduced administrative costs compared to conventional fixed or variable annuities.

Instant Settlement Annuities

Traditional annuities typically involve lengthy settlement periods and manual processing, while tokenized annuities leverage blockchain technology for instant settlement, enhancing transparency and reducing transaction costs. Instant settlement annuities eliminate waiting times, enabling policyholders to access funds immediately through secure, automated smart contracts within decentralized finance ecosystems.

KYC-Compliant Tokenization

KYC-compliant tokenization enhances transparency and regulatory adherence in tokenized annuities by securely verifying investor identities, outperforming the traditional annuity model which relies on manual, paper-based KYC processes prone to delays and errors. This digital transformation streamlines onboarding, reduces fraud risk, and allows seamless secondary market trading, offering greater liquidity and accessibility compared to conventional annuities.

Traditional Annuity vs Tokenized Annuity Infographic

industrydif.com

industrydif.com