A broker provides personalized insurance advice and custom policy recommendations based on in-depth knowledge and client interaction, ensuring tailored coverage. Robo-advisors use algorithms and data analysis to offer automated, cost-effective insurance options with minimal human involvement. Choosing between a broker and a robo-advisor depends on the preference for human expertise versus efficiency and lower fees.

Table of Comparison

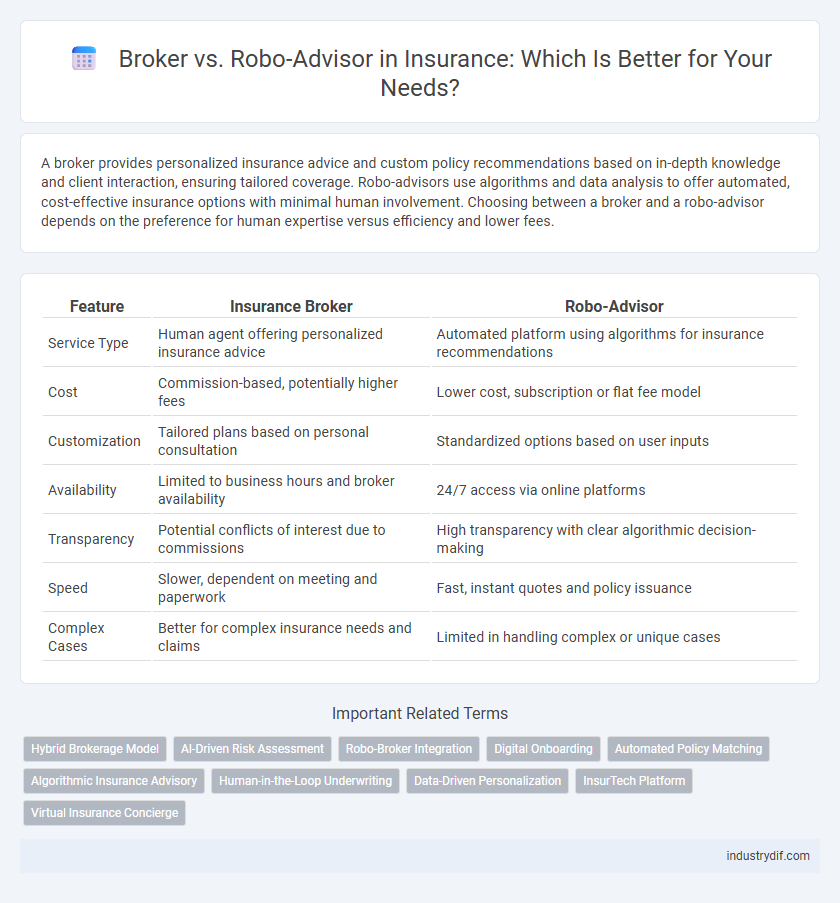

| Feature | Insurance Broker | Robo-Advisor |

|---|---|---|

| Service Type | Human agent offering personalized insurance advice | Automated platform using algorithms for insurance recommendations |

| Cost | Commission-based, potentially higher fees | Lower cost, subscription or flat fee model |

| Customization | Tailored plans based on personal consultation | Standardized options based on user inputs |

| Availability | Limited to business hours and broker availability | 24/7 access via online platforms |

| Transparency | Potential conflicts of interest due to commissions | High transparency with clear algorithmic decision-making |

| Speed | Slower, dependent on meeting and paperwork | Fast, instant quotes and policy issuance |

| Complex Cases | Better for complex insurance needs and claims | Limited in handling complex or unique cases |

Understanding Insurance Brokers

Insurance brokers act as licensed professionals who evaluate clients' unique needs and negotiate policies from multiple insurers to secure optimal coverage and pricing. Their personalized service includes risk assessment, claims assistance, and regulatory compliance guidance, ensuring tailored protection beyond automated recommendations. Unlike robo-advisors that use algorithms, brokers provide human expertise and advocacy, crucial for complex insurance products and nuanced financial situations.

What is a Robo-Advisor in Insurance?

A robo-advisor in insurance is an automated digital platform that uses algorithms and data analysis to provide personalized insurance recommendations and policy management without human intervention. These platforms streamline the insurance purchasing process by assessing risk profiles, comparing coverage options, and suggesting optimal policies based on real-time data. Robo-advisors enhance efficiency and accessibility for consumers seeking tailored insurance solutions with minimal manual input.

Key Differences: Broker vs Robo-Advisor

Brokers provide personalized insurance guidance through human interaction, enabling customized coverage tailored to individual needs and complex situations. Robo-advisors utilize algorithms and digital platforms to offer automated, low-cost insurance recommendations based on data analysis and user inputs. Brokers excel in relationship-driven service and nuanced advice, while robo-advisors prioritize efficiency, accessibility, and streamlined policy management.

How Brokers Add Value to Insurance Decisions

Brokers add value to insurance decisions by offering personalized advice tailored to individual client needs, leveraging their expertise to assess complex risk factors and coverage options. They facilitate direct human interaction, enabling nuanced discussions that automated robo-advisors may overlook, especially in cases requiring in-depth policy customization. Brokers also provide ongoing support and advocacy during claims processes, ensuring clients receive optimal outcomes beyond initial purchase decisions.

Benefits of Using Robo-Advisors for Insurance

Robo-advisors in insurance provide cost-effective and efficient policy management by leveraging advanced algorithms to offer personalized recommendations based on individual risk profiles. They enable 24/7 access to insurance options and instant quotes, streamlining the decision-making process while reducing time spent on comparisons. Automated updates and portfolio rebalancing ensure continuous alignment with changing market conditions and personal circumstances, enhancing overall insurance coverage optimization.

Human Insight vs Algorithmic Precision

Insurance brokers leverage human insight to assess nuanced client needs and tailor policies with personalized recommendations. Robo-advisors utilize algorithmic precision and vast data analysis to deliver cost-effective, automated insurance solutions rapidly. Combining broker expertise with robo-advisor technology can optimize risk evaluation and customer experience.

Cost Comparison: Brokers and Robo-Advisors

Traditional insurance brokers typically charge commission fees ranging from 5% to 15% of the policy premium, which can increase overall insurance costs. Robo-advisors offer automated insurance recommendations with fees generally between 0.25% and 0.50%, providing a more cost-efficient alternative for budget-conscious consumers. Cost savings with robo-advisors are amplified through algorithm-driven portfolio management and reduced human overhead.

Personalization and Customer Experience

Brokers offer personalized insurance advice tailored to individual client needs through direct human interaction, enhancing trust and nuanced understanding. Robo-advisors utilize algorithms and AI to provide quick, data-driven insurance recommendations, ensuring efficiency but often lacking the emotional insight brokers deliver. The customer experience differs as brokers excel in customized service and relationship building, while robo-advisors prioritize streamlined, accessible digital solutions.

Regulatory Compliance and Reliability

Insurance brokers provide personalized guidance while adhering strictly to regulatory compliance standards set by entities like the National Association of Insurance Commissioners (NAIC), ensuring tailored and legally sound coverage recommendations. Robo-advisors rely on automated algorithms to offer insurance solutions, which may streamline processes but often face limitations in regulatory oversight and adaptability to complex compliance requirements. The trustworthiness of brokers is grounded in direct human assessment and accountability, whereas robo-advisors prioritize efficiency but can present challenges in transparency and adherence to evolving insurance regulations.

Which Option Suits Your Insurance Needs?

Choosing between a broker and a robo-advisor depends on your insurance needs, budget, and preference for personalized service. Brokers offer tailored advice and can navigate complex policies, ideal for clients with unique or high-value insurance requirements. Robo-advisors provide cost-effective, automated policy comparisons suited for straightforward coverage and tech-savvy users seeking quick decisions.

Related Important Terms

Hybrid Brokerage Model

The hybrid brokerage model in insurance merges the personalized expertise of brokers with the efficiency and algorithm-driven insights of robo-advisors, optimizing client portfolio management and policy selection. This approach enhances risk assessment accuracy and streamlines underwriting processes, offering tailored insurance solutions while maintaining cost-effectiveness.

AI-Driven Risk Assessment

AI-driven risk assessment in insurance enables brokers to leverage advanced data analytics and personalized insights for tailored policy recommendations, enhancing client trust and retention. Robo-advisors utilize machine learning algorithms to quickly evaluate risk factors and offer cost-effective, streamlined insurance options, making coverage more accessible and efficient.

Robo-Broker Integration

Robo-broker integration in insurance combines the personalized expertise of human brokers with the efficiency and data-driven algorithms of robo-advisors, enhancing customer experience and optimizing policy recommendations. This hybrid approach leverages AI for rapid risk assessment and cost analysis while allowing brokers to provide tailored advice and complex problem-solving.

Digital Onboarding

Digital onboarding through brokers combines personalized human guidance with technology, enhancing customer trust and tailored insurance solutions. Robo-advisors streamline insurance onboarding using AI-driven algorithms for faster policy comparison and instant quotes, optimizing user experience with minimal manual intervention.

Automated Policy Matching

Automated policy matching in insurance leverages advanced algorithms to analyze client profiles and recommend tailored coverage options, streamlining the selection process compared to traditional brokers who rely on personal expertise. Robo-advisors provide faster, data-driven policy recommendations with minimal human intervention, enhancing efficiency and reducing bias in insurance plan selection.

Algorithmic Insurance Advisory

Algorithmic insurance advisory leverages advanced machine learning models to analyze vast datasets and provide personalized policy recommendations, outperforming traditional brokers in speed and consistency. Robo-advisors utilize real-time data integration and predictive analytics to optimize coverage options and pricing, reducing human biases and operational costs.

Human-in-the-Loop Underwriting

Human-in-the-loop underwriting integrates experienced insurance brokers with AI-driven robo-advisors to enhance risk assessment accuracy and personalized policy recommendations. This collaborative approach ensures nuanced decision-making, combining algorithmic efficiency with expert judgment for optimized insurance coverage and customer satisfaction.

Data-Driven Personalization

Brokers leverage extensive industry experience and personalized client interactions to tailor insurance solutions, while robo-advisors utilize advanced algorithms and big data analytics to deliver instant, data-driven personalization that optimizes policy recommendations. The integration of AI-powered insights in robo-advisors enhances risk assessment and premium customization, offering scalable and efficient choices compared to traditional broker methods.

InsurTech Platform

InsurTech platforms leverage advanced algorithms and big data analytics to provide personalized insurance solutions through robo-advisors, offering cost-effective, 24/7 accessibility and streamlined policy management. Insurance brokers deliver tailored, expert guidance and complex risk assessments, ensuring customized coverage and human-driven negotiation that robo-advisors may lack.

Virtual Insurance Concierge

A virtual insurance concierge combines the personalized service of a broker with the efficiency of a robo-advisor, using AI to analyze policy options and customize coverage recommendations tailored to individual needs. This technology-driven approach ensures faster quote comparisons, streamlined claims processing, and 24/7 customer support, enhancing decision-making in insurance purchasing.

Broker vs Robo-Advisor Infographic

industrydif.com

industrydif.com