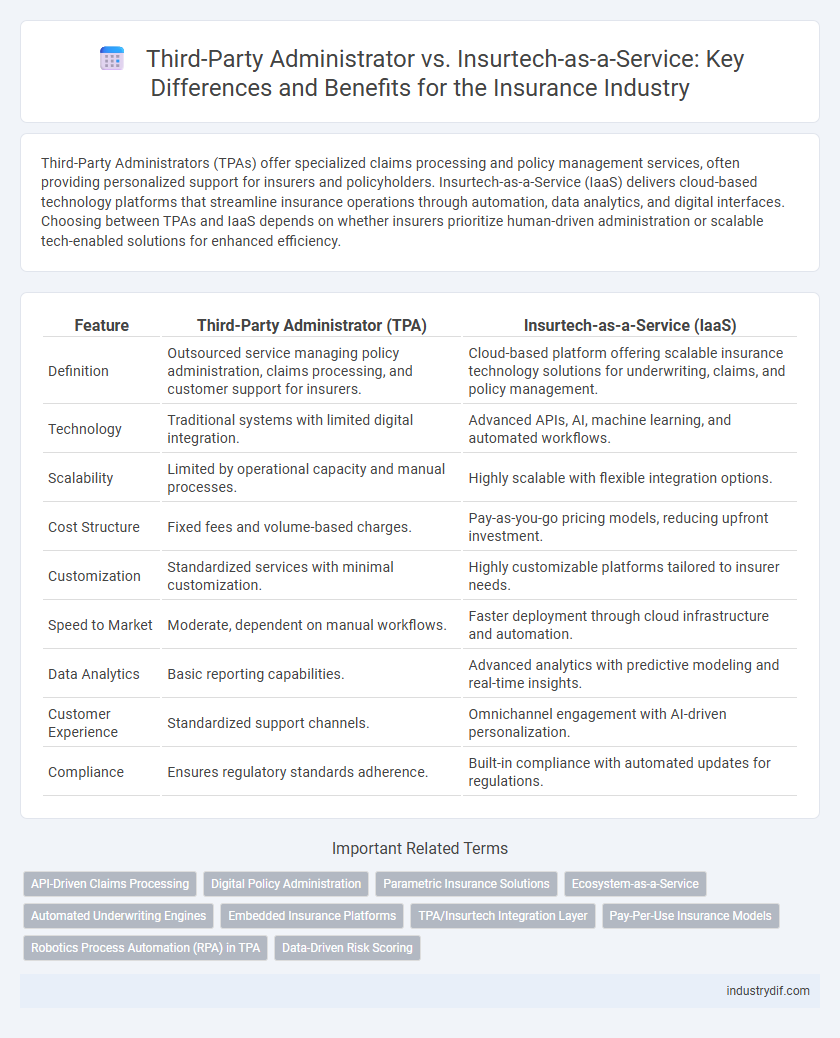

Third-Party Administrators (TPAs) offer specialized claims processing and policy management services, often providing personalized support for insurers and policyholders. Insurtech-as-a-Service (IaaS) delivers cloud-based technology platforms that streamline insurance operations through automation, data analytics, and digital interfaces. Choosing between TPAs and IaaS depends on whether insurers prioritize human-driven administration or scalable tech-enabled solutions for enhanced efficiency.

Table of Comparison

| Feature | Third-Party Administrator (TPA) | Insurtech-as-a-Service (IaaS) |

|---|---|---|

| Definition | Outsourced service managing policy administration, claims processing, and customer support for insurers. | Cloud-based platform offering scalable insurance technology solutions for underwriting, claims, and policy management. |

| Technology | Traditional systems with limited digital integration. | Advanced APIs, AI, machine learning, and automated workflows. |

| Scalability | Limited by operational capacity and manual processes. | Highly scalable with flexible integration options. |

| Cost Structure | Fixed fees and volume-based charges. | Pay-as-you-go pricing models, reducing upfront investment. |

| Customization | Standardized services with minimal customization. | Highly customizable platforms tailored to insurer needs. |

| Speed to Market | Moderate, dependent on manual workflows. | Faster deployment through cloud infrastructure and automation. |

| Data Analytics | Basic reporting capabilities. | Advanced analytics with predictive modeling and real-time insights. |

| Customer Experience | Standardized support channels. | Omnichannel engagement with AI-driven personalization. |

| Compliance | Ensures regulatory standards adherence. | Built-in compliance with automated updates for regulations. |

Overview of Third-Party Administrators (TPAs)

Third-Party Administrators (TPAs) play a crucial role in insurance by managing claims processing, policy administration, and customer service on behalf of insurers. They offer specialized expertise, reduce operational costs, and improve efficiency through tailored administrative solutions. TPAs act as intermediaries, facilitating smooth interactions between insurance companies, policyholders, and healthcare providers.

What Is Insurtech-as-a-Service?

Insurtech-as-a-Service (IaaS) is a cloud-based platform that delivers comprehensive insurance technology solutions, enabling insurers and third-party administrators to streamline policy management, claims processing, and customer engagement. Unlike traditional Third-Party Administrators (TPAs) that primarily handle administrative tasks, IaaS integrates advanced analytics, AI-driven underwriting, and digital customer interfaces to enhance operational efficiency and scalability. This service model empowers insurance companies to innovate rapidly without the costs and complexities of developing in-house technology infrastructure.

Core Functions: TPA vs Insurtech Solutions

Third-Party Administrators (TPAs) primarily manage claims processing, policy administration, and customer service on behalf of insurers, providing operational support and compliance adherence. Insurtech-as-a-Service platforms integrate advanced technologies such as AI-driven underwriting, automated policy issuance, and real-time data analytics, streamlining workflow and enhancing customer engagement. The core distinction lies in TPAs focusing on traditional administrative tasks, while insurtech solutions optimize these functions through scalable, technology-enabled services.

Technology Integration in Claims Management

Third-Party Administrators (TPAs) rely on traditional claims management systems, often resulting in slower processing and limited data analytics capabilities. Insurtech-as-a-Service platforms leverage advanced API integrations, AI-driven automation, and real-time data analytics to streamline claims workflows and enhance customer experience. This technology integration significantly reduces claim settlement times while improving accuracy and fraud detection.

Compliance and Regulatory Considerations

Third-Party Administrators (TPAs) must navigate complex compliance landscapes, ensuring adherence to state and federal insurance regulations while managing claims and policy administration. Insurtech-as-a-Service platforms leverage advanced technology to streamline regulatory reporting and enhance real-time compliance monitoring through automated workflows and data analytics. Both models require robust data security measures aligned with frameworks like HIPAA and GDPR to maintain regulatory compliance and protect sensitive customer information.

Cost Efficiency: TPAs vs Insurtech Platforms

Third-Party Administrators (TPAs) typically incur higher operational costs due to manual processes and legacy systems, whereas Insurtech-as-a-Service platforms leverage automation and cloud technology to significantly reduce overhead expenses. Insurtech platforms enhance cost efficiency by streamlining claims processing, underwriting, and policy management through AI-driven analytics and real-time data integration. Businesses adopting Insurtech solutions can achieve faster scalability and lower total cost of ownership compared to traditional TPA models.

Scalability and Flexibility in Service Delivery

Third-Party Administrators (TPAs) provide established scalability through customized, hands-on management of insurance processes, enabling insurers to efficiently handle fluctuating claim volumes and policy administration. Insurtech-as-a-Service (IaaS) leverages cloud-based platforms and API integrations to offer superior flexibility, allowing rapid adaptation to market changes and seamless onboarding of new insurance products. The combination of TPA's operational expertise with IaaS's technological agility enhances scalability and responsiveness in service delivery across diverse insurance portfolios.

Data Security and Privacy Standards

Third-Party Administrators (TPAs) often rely on established data security frameworks such as HIPAA and SOC 2 to safeguard sensitive policyholder information, ensuring compliance with industry regulations. In contrast, Insurtech-as-a-Service providers leverage advanced encryption technologies, blockchain, and AI-driven anomaly detection to enhance privacy and reduce the risk of data breaches. Both models prioritize stringent access controls and continuous monitoring but Insurtech platforms typically offer more scalable and automated security solutions tailored to dynamic digital insurance environments.

Customer Experience: Traditional vs Digital Approaches

Traditional Third-Party Administrators (TPAs) often rely on manual processes and legacy systems, which can lead to slower claim resolutions and limited transparency for customers. Insurtech-as-a-Service platforms leverage digital tools such as AI-driven chatbots, real-time data analytics, and automated workflows to enhance responsiveness and provide a seamless user experience. These digital approaches significantly improve customer satisfaction by offering personalized interactions, faster claim adjudication, and 24/7 accessibility.

Future Trends in Insurance Administration

Future trends in insurance administration emphasize the growing integration of Insurtech-as-a-Service platforms, which provide scalable, cloud-based solutions enhancing automation, data analytics, and customer experience. Third-Party Administrators (TPAs) remain essential for managing claims and policy servicing but face increasing competition from agile Insurtech models that streamline operations and enable real-time decision-making. Embracing AI-driven underwriting, blockchain for transparent record-keeping, and omnichannel customer engagement will define the competitive edge in insurance administration moving forward.

Related Important Terms

API-Driven Claims Processing

API-driven claims processing in Third-Party Administrator (TPA) models enhances operational efficiency by enabling seamless integration with insurers and healthcare providers, reducing claim settlement times and errors. In contrast, Insurtech-as-a-Service platforms leverage advanced APIs combined with AI and automation to offer scalable, real-time claims adjudication, improving customer experience and enabling rapid innovation in insurance claims management.

Digital Policy Administration

Third-Party Administrators (TPAs) provide outsourced claims processing and policy administration services, often limited by legacy systems and manual workflows. Insurtech-as-a-Service platforms leverage cloud-native, AI-driven digital policy administration to streamline underwriting, real-time policy management, and data analytics, enhancing efficiency and customer experience.

Parametric Insurance Solutions

Third-Party Administrators (TPAs) in parametric insurance solutions streamline claims processing and policy management through established industry networks, ensuring reliability and compliance. Insurtech-as-a-Service platforms offer scalable, technology-driven parametric insurance models that leverage real-time data and automation for faster payouts, enhanced customer experience, and reduced operational costs.

Ecosystem-as-a-Service

Third-Party Administrators (TPAs) traditionally manage claims processing, policy administration, and customer service for insurance carriers, providing operational efficiency but limited technological innovation. Ecosystem-as-a-Service within Insurtech-as-a-Service platforms integrates advanced data analytics, AI-driven underwriting, and seamless third-party APIs, creating a dynamic insurance ecosystem that enhances customer experience and accelerates digital transformation.

Automated Underwriting Engines

Third-Party Administrators (TPAs) traditionally handle claims processing and policy management, while Insurtech-as-a-Service platforms leverage Automated Underwriting Engines to streamline risk assessment and policy issuance through advanced AI algorithms and real-time data analytics. Automated Underwriting Engines enhance underwriting accuracy and speed by integrating machine learning models that analyze vast datasets, reducing manual intervention and operational costs for insurers.

Embedded Insurance Platforms

Embedded insurance platforms seamlessly integrate Third-Party Administrator (TPA) services with insurtech-as-a-service models, enhancing real-time policy management and claims processing through advanced APIs and AI-driven automation. This fusion enables insurers to offer personalized coverage embedded within digital ecosystems, reducing operational costs while improving customer engagement and data analytics capabilities.

TPA/Insurtech Integration Layer

The Third-Party Administrator (TPA) serves as a crucial bridge managing claims processing, policy administration, and customer service, while the Insurtech-as-a-Service model provides advanced digital tools and APIs that enhance this TPA function through seamless integration layers. This integration layer enables real-time data exchange, automation, and scalable customization, driving efficiency and agility in insurance operations.

Pay-Per-Use Insurance Models

Third-Party Administrators (TPAs) enable streamlined claims processing and policy management in traditional insurance frameworks, while Insurtech-as-a-Service platforms innovate pay-per-use insurance models by leveraging real-time data analytics and modular APIs for customized coverage. Pay-per-use insurance enhances customer flexibility through usage-based premiums, which Insurtech solutions optimize by integrating IoT devices and AI-driven risk assessment to reduce costs and improve risk accuracy compared to conventional TPA methods.

Robotics Process Automation (RPA) in TPA

Third-Party Administrators (TPAs) leverage Robotics Process Automation (RPA) to streamline claims processing, reduce manual errors, and enhance operational efficiency, enabling faster turnaround times and improved customer satisfaction. Insurtech-as-a-Service platforms integrate advanced RPA alongside AI-driven analytics, offering scalable, end-to-end automation solutions that surpass traditional TPA capabilities by optimizing underwriting, policy administration, and compliance workflows.

Data-Driven Risk Scoring

Third-Party Administrators (TPAs) rely on traditional claims processing and historical data analytics, often leading to slower and less precise risk assessments. In contrast, Insurtech-as-a-Service platforms leverage advanced AI algorithms and real-time data integration to deliver dynamic, data-driven risk scoring, enhancing underwriting accuracy and accelerating decision-making.

Third-Party Administrator vs Insurtech-as-a-Service Infographic

industrydif.com

industrydif.com