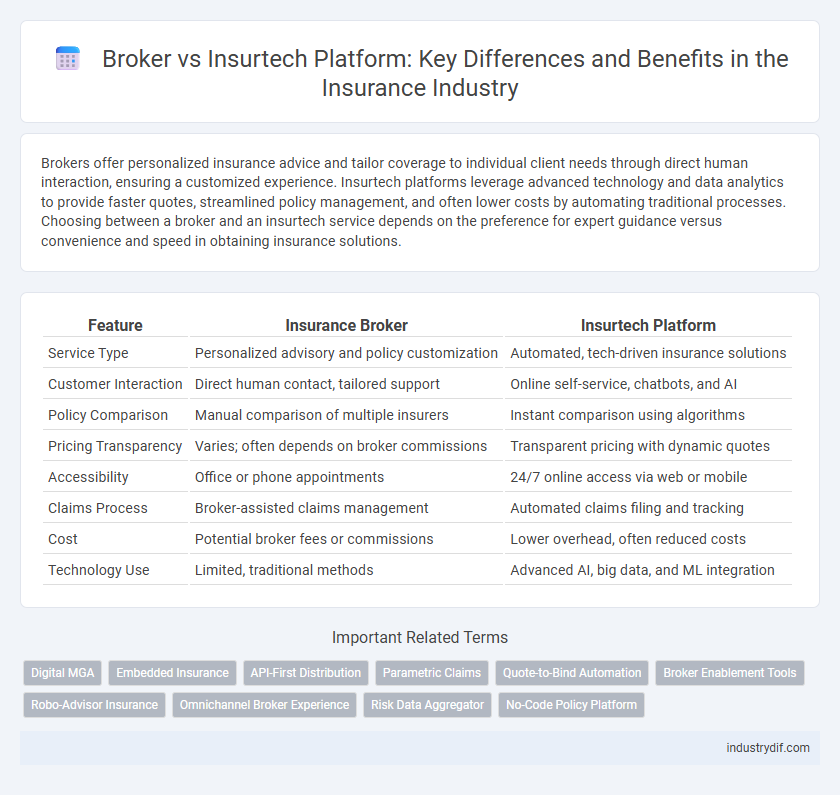

Brokers offer personalized insurance advice and tailor coverage to individual client needs through direct human interaction, ensuring a customized experience. Insurtech platforms leverage advanced technology and data analytics to provide faster quotes, streamlined policy management, and often lower costs by automating traditional processes. Choosing between a broker and an insurtech service depends on the preference for expert guidance versus convenience and speed in obtaining insurance solutions.

Table of Comparison

| Feature | Insurance Broker | Insurtech Platform |

|---|---|---|

| Service Type | Personalized advisory and policy customization | Automated, tech-driven insurance solutions |

| Customer Interaction | Direct human contact, tailored support | Online self-service, chatbots, and AI |

| Policy Comparison | Manual comparison of multiple insurers | Instant comparison using algorithms |

| Pricing Transparency | Varies; often depends on broker commissions | Transparent pricing with dynamic quotes |

| Accessibility | Office or phone appointments | 24/7 online access via web or mobile |

| Claims Process | Broker-assisted claims management | Automated claims filing and tracking |

| Cost | Potential broker fees or commissions | Lower overhead, often reduced costs |

| Technology Use | Limited, traditional methods | Advanced AI, big data, and ML integration |

Definitions: What Is an Insurance Broker vs an Insurtech Platform?

An insurance broker is a licensed professional who acts as an intermediary between clients and insurance companies, helping individuals or businesses find tailored insurance policies. An insurtech platform leverages advanced digital technologies and data analytics to provide streamlined insurance services, often enabling direct purchasing, automated claims, and personalized risk assessments online. Both serve to simplify insurance access, but brokers emphasize personalized human expertise, while insurtech platforms prioritize automation and efficiency through technology.

Key Differences Between Brokers and Insurtech Platforms

Brokers provide personalized insurance advice by directly interacting with clients, tailoring policies based on individual needs and risk profiles. Insurtech platforms leverage advanced technology like AI and data analytics to automate policy comparison, purchasing, and management, offering increased efficiency and often lower costs. The key difference lies in the human expertise and customized service of brokers versus the scalable, algorithm-driven processes of insurtech platforms.

How Brokers Operate in the Insurance Market

Insurance brokers operate by acting as intermediaries between clients and insurance companies, leveraging their expertise to assess risks and identify suitable policies. They personalize coverage options based on client needs, negotiate terms, and provide ongoing support throughout the claims process. Brokers maintain relationships with multiple insurers, ensuring access to diverse products and competitive pricing tailored to individual or business requirements.

The Technology Behind Insurtech Platforms

Insurtech platforms leverage advanced technologies such as artificial intelligence, machine learning, and big data analytics to streamline insurance processes, enhance risk assessment, and personalize customer experiences. These platforms integrate APIs, cloud computing, and blockchain to facilitate real-time policy management, automated claims processing, and secure data transactions. In contrast, traditional brokers rely heavily on manual workflows and face-to-face interactions, limiting scalability and efficiency in comparison to the tech-driven capabilities of insurtech solutions.

Customer Experience: Human Touch vs Digital Convenience

Traditional insurance brokers offer personalized advice and tailored coverage through human interaction, enhancing trust and understanding in complex policy decisions. Insurtech platforms prioritize digital convenience with streamlined online processes, instant quotes, and 24/7 accessibility, appealing to tech-savvy customers seeking speed and simplicity. Balancing the human touch with seamless technology improves overall customer experience by combining empathy with efficiency.

Cost Comparison: Traditional Brokers vs Insurtech Solutions

Traditional insurance brokers often incur higher operational costs due to personalized services and commission-based models, leading to increased premiums for policyholders. Insurtech platforms leverage automation and digital interfaces to minimize administrative expenses, resulting in more competitive pricing and streamlined policy management. Cost comparison reveals that insurtech solutions typically offer lower fees and enhanced transparency, making them a cost-effective alternative to traditional brokers.

Regulatory Considerations for Brokers and Insurtechs

Brokers must comply with stringent licensing, fiduciary duties, and anti-money laundering regulations, ensuring transparent client representation and risk disclosure. Insurtech platforms face evolving regulatory frameworks emphasizing data privacy, cybersecurity standards, and the integration of AI-driven underwriting practices. Regulatory bodies increasingly scrutinize both models to balance consumer protection with innovation, mandating adherence to local insurance laws and digital compliance requirements.

Advantages and Limitations of Insurance Brokers

Insurance brokers offer personalized advice and tailored policy selection, leveraging their expertise and relationships with multiple insurers to negotiate better coverage options. Limitations include potential higher costs due to commission-based models and slower service response compared to digital insurtech platforms. Brokers provide human interaction and claim support, but may lack the seamless, automated experience and real-time data analytics offered by insurtech solutions.

Benefits and Challenges of Insurtech Platforms

Insurtech platforms offer streamlined insurance purchasing with real-time data analytics, enhancing customer experience through personalized policy recommendations and faster claims processing. These platforms reduce administrative costs and improve transparency but face challenges including regulatory compliance complexities and limited human interaction that may affect trust-building. The scalability and integration of AI-driven solutions in insurtech foster innovation while requiring ongoing investment in cybersecurity to safeguard sensitive customer data.

Choosing the Right Option: Factors to Consider

Choosing between a broker and an insurtech platform depends on personalized service needs and technological efficiency. Brokers provide tailored advice and human interaction, ideal for complex insurance products, while insurtech platforms offer fast, cost-effective access using AI and data analytics. Factors such as policy customization, claim support, transparency, and ease of use should guide your decision for optimal insurance coverage.

Related Important Terms

Digital MGA

Digital Managing General Agents (MGAs) leverage advanced insurtech platforms to streamline underwriting and claims processing, offering faster, data-driven insurance solutions compared to traditional brokers. These digital MGAs enhance customer experience by integrating AI, automation, and real-time analytics, optimizing risk assessment and policy customization in the digital insurance marketplace.

Embedded Insurance

Embedded insurance integrates coverage options directly into the purchase process through digital platforms, offering seamless customer experiences without the need for traditional brokers. Insurtech platforms leverage APIs and data analytics to embed tailored insurance products into e-commerce, travel, and automotive services, reducing acquisition costs and enhancing real-time risk assessment.

API-First Distribution

API-first distribution enhances insurtech platforms by enabling seamless integration with multiple insurance providers, delivering real-time quotes and policy management directly through digital channels. Traditional brokers often rely on manual processes and legacy systems, limiting scalability and speed compared to the automated, data-driven capabilities of API-driven insurtech solutions.

Parametric Claims

Parametric claims leverage predefined triggers and data inputs to enable instantaneous, automated payouts through insurtech platforms, reducing the need for manual claims processing traditionally handled by brokers. Insurtech platforms utilize IoT sensors and satellite data to streamline parametric insurance, enhancing transparency and efficiency compared to conventional broker-mediated claims management.

Quote-to-Bind Automation

Quote-to-bind automation in insurtech platforms streamlines the insurance purchasing process by integrating real-time data analytics, risk assessment algorithms, and instant policy issuance, significantly reducing human intervention and processing time compared to traditional brokers. While brokers offer personalized advice and nuanced risk evaluation, insurtech platforms excel in scalability, efficiency, and cost reduction through automated workflows and digital underwriting technologies.

Broker Enablement Tools

Broker enablement tools in insurtech platforms enhance traditional insurance brokers' efficiency by automating policy management, lead generation, and client communication. These digital solutions integrate AI-driven analytics and CRM systems, enabling brokers to offer personalized insurance products and improve customer retention.

Robo-Advisor Insurance

Robo-advisor insurance platforms leverage artificial intelligence and machine learning algorithms to provide personalized policy recommendations, enhancing efficiency and customer experience compared to traditional brokers. These digital platforms reduce operational costs while offering 24/7 accessibility and data-driven risk assessments, transforming the insurance brokerage landscape.

Omnichannel Broker Experience

Omnichannel broker experience integrates traditional insurance brokers with advanced insurtech platforms, enabling seamless client interactions across digital, mobile, and in-person channels. This hybrid approach enhances personalized service delivery, increases operational efficiency, and leverages data analytics to optimize risk assessment and policy management.

Risk Data Aggregator

Risk data aggregators streamline the insurance process by collecting and analyzing vast amounts of customer and market data, enabling insurtech platforms to offer more accurate risk assessments and personalized policy recommendations. Unlike traditional brokers, insurtech platforms leverage these data insights to enhance efficiency, reduce underwriting costs, and improve claims management through AI-driven analytics.

No-Code Policy Platform

No-code policy platforms empower insurance brokers to rapidly create and customize insurance products without coding, enhancing agility and reducing time-to-market. This digital innovation bridges traditional broker expertise with insurtech efficiency, streamlining policy issuance and improving customer experience through automation and intuitive interfaces.

Broker vs Insurtech Platform Infographic

industrydif.com

industrydif.com