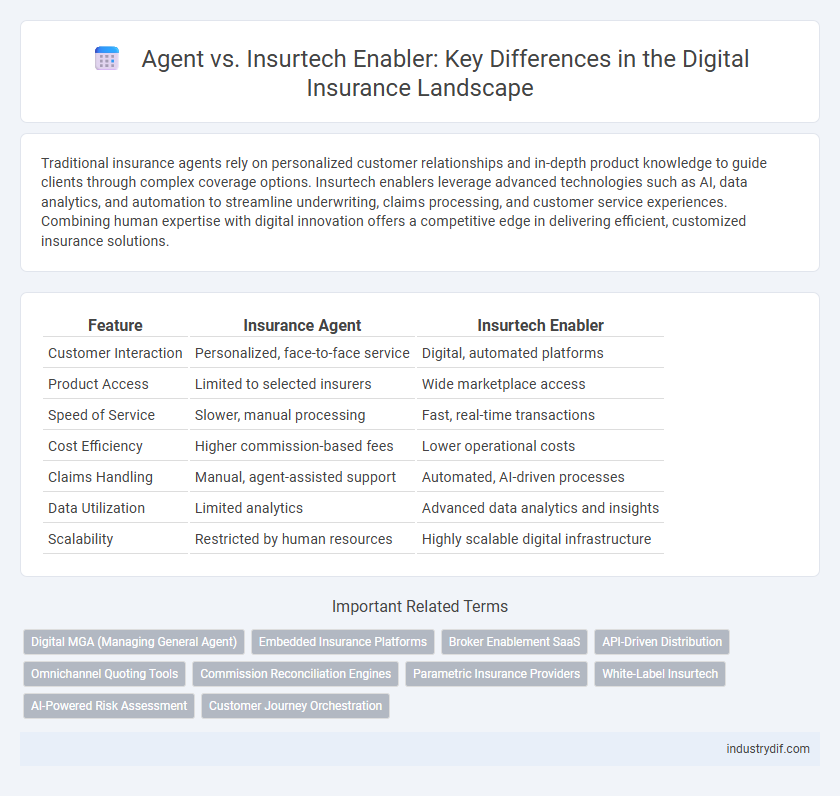

Traditional insurance agents rely on personalized customer relationships and in-depth product knowledge to guide clients through complex coverage options. Insurtech enablers leverage advanced technologies such as AI, data analytics, and automation to streamline underwriting, claims processing, and customer service experiences. Combining human expertise with digital innovation offers a competitive edge in delivering efficient, customized insurance solutions.

Table of Comparison

| Feature | Insurance Agent | Insurtech Enabler |

|---|---|---|

| Customer Interaction | Personalized, face-to-face service | Digital, automated platforms |

| Product Access | Limited to selected insurers | Wide marketplace access |

| Speed of Service | Slower, manual processing | Fast, real-time transactions |

| Cost Efficiency | Higher commission-based fees | Lower operational costs |

| Claims Handling | Manual, agent-assisted support | Automated, AI-driven processes |

| Data Utilization | Limited analytics | Advanced data analytics and insights |

| Scalability | Restricted by human resources | Highly scalable digital infrastructure |

Defining Insurance Agents and Insurtech Enablers

Insurance agents act as intermediaries, representing insurance companies to sell policies, provide personalized guidance, and manage client relationships, emphasizing human interaction and trust-building. Insurtech enablers leverage advanced technologies such as AI, big data, and digital platforms to streamline underwriting, claims processing, and customer engagement, driving efficiency and innovation in the insurance sector. The synergy between traditional agents and insurtech enablers enhances risk assessment, policy customization, and overall customer experience.

Key Functions of Traditional Insurance Agents

Traditional insurance agents play a critical role in providing personalized risk assessment, policy recommendations, and claims assistance tailored to individual client needs. They establish trust through face-to-face interactions, manage customer relationships, and offer expert guidance on complex insurance products. Unlike insurtech enablers, agents emphasize human connection and customized service in policy underwriting and client advocacy.

Role of Insurtech Enablers in Modern Insurance

Insurtech enablers revolutionize the insurance industry by integrating advanced technologies like AI, big data analytics, and blockchain to streamline underwriting, claims processing, and customer experience. These platforms support agents by providing real-time data insights, automating routine tasks, and enhancing policy personalization, thereby increasing efficiency and accuracy. Their role extends to fostering innovation, enabling insurers to rapidly deploy new products while maintaining regulatory compliance in a dynamic market.

Technology Adoption in Insurance Distribution

Insurance agents continue to play a vital role in personalized customer service and complex policy customization, leveraging their expertise and trustworthiness. Insurtech enablers accelerate digital transformation by integrating AI, data analytics, and automation to streamline insurance distribution, increasing efficiency and customer engagement. Technology adoption in insurance distribution fosters hybrid models where agents utilize digital tools, enhancing scalability and real-time decision-making.

Customer Experience: Agent vs Insurtech Platforms

Insurance agents provide personalized, face-to-face interactions that build trust and cater to individual customer needs, enhancing customer satisfaction through tailored advice. Insurtech platforms leverage AI-driven analytics and seamless digital interfaces to offer quick policy comparisons, instant claims processing, and 24/7 accessibility, optimizing convenience and efficiency. Customers increasingly expect a hybrid model combining human empathy with technological innovation for superior, frictionless insurance experiences.

Cost Efficiency and Operational Models

Insurance agents provide personalized service through direct client interaction, often incurring higher costs due to commissions and physical presence. Insurtech enablers leverage digital platforms and automation, significantly reducing operational expenses while streamlining policy management and claims processing. Cost efficiency in insurtech models stems from scalable technology infrastructure and data analytics, enabling faster decision-making and lower customer acquisition costs compared to traditional agent-based distribution.

Regulatory Compliance: Agents vs Insurtech

Insurance agents navigate complex regulatory landscapes by ensuring personalized compliance with local and national insurance laws, leveraging their expertise to address individual client needs effectively. Insurtech enablers utilize advanced technology platforms to automate regulatory compliance processes, enhancing accuracy and efficiency while minimizing human error across large-scale operations. Both agents and insurtech solutions play crucial roles in maintaining regulatory adherence, with agents providing tailored insights and insurtech driving scalable compliance management.

Personalized Services: Human Touch vs Automation

Insurance agents excel in delivering personalized services through empathetic communication and tailored advice based on deep client understanding. Insurtech enablers leverage automation and AI-driven data analytics to offer customized insurance solutions swiftly, enhancing efficiency and scalability. Combining human touch with technological innovation maximizes client satisfaction and optimizes policy management.

Market Trends and Future Outlook

Insurance agents remain vital for personalized service and trusted client relationships, particularly in complex product segments like life and health insurance. Insurtech enablers leverage AI, big data, and blockchain to streamline underwriting, claims processing, and customer onboarding, driving efficiency and reducing operational costs. Market trends indicate a hybrid model combining human expertise with cutting-edge technology will dominate, enhancing customer experience while enabling scalable growth in the insurance industry.

Choosing the Right Insurance Channel

Selecting the right insurance channel depends on individual needs and preferences, where traditional agents offer personalized advice and trust built through human interaction, while insurtech enablers provide streamlined digital experiences with faster quotes and policy management. Agents excel in navigating complex policies and customizing coverage, making them ideal for clients seeking tailored expertise. Insurtech platforms leverage advanced algorithms and data analytics to optimize pricing and claims processing, appealing to tech-savvy customers prioritizing convenience and efficiency.

Related Important Terms

Digital MGA (Managing General Agent)

Digital Managing General Agents (MGAs) leverage advanced insurtech platforms to streamline underwriting, policy management, and claims processing, enhancing efficiency and customer experience compared to traditional agents. These Digital MGAs act as enablers by integrating automated data analytics, API-driven distribution, and real-time risk assessment, driving innovation in the insurance value chain.

Embedded Insurance Platforms

Embedded insurance platforms powered by insurtech enablers streamline policy integration within digital ecosystems, enhancing customer experience through seamless, real-time coverage options. Traditional insurance agents focus on personalized service and relationship building, while insurtech platforms leverage APIs and automation to embed insurance products directly into non-insurance transactions, driving efficiency and scalability.

Broker Enablement SaaS

Broker Enablement SaaS platforms revolutionize traditional insurance distribution by empowering agents with advanced digital tools, seamless policy management, and real-time analytics, enhancing customer engagement and operational efficiency. Unlike conventional agents, insurtech enablers leverage AI-driven automation and cloud-based solutions to streamline underwriting, claims processing, and personalized product recommendations, significantly boosting broker productivity and market competitiveness.

API-Driven Distribution

API-driven distribution enhances insurtech enablers by streamlining insurance product integration and enabling real-time data exchange, resulting in faster policy issuance and improved customer experience. Traditional agents rely on direct client interaction and manual processes, whereas insurtech platforms leverage APIs to automate underwriting, claims processing, and personalized coverage recommendations.

Omnichannel Quoting Tools

Omnichannel quoting tools empower both traditional insurance agents and insurtech enablers by streamlining policy comparison and purchase across multiple platforms, enhancing customer experience and operational efficiency. These tools integrate data analytics, AI-driven personalization, and seamless channel transition, enabling real-time quotes and improved conversion rates in the insurance marketplace.

Commission Reconciliation Engines

Commission reconciliation engines streamline the settlement of agent commissions with carrier data, reducing errors and accelerating payments in traditional insurance models. Insurtech enablers leverage advanced algorithms and real-time data integration to enhance transparency and automate commission tracking, delivering greater efficiency compared to manual reconciliation processes.

Parametric Insurance Providers

Parametric insurance providers leverage advanced data analytics and IoT technology to deliver rapid, automatic payouts based on predefined event triggers, reducing claims processing time compared to traditional agents. This insurtech enabler model enhances transparency and efficiency while empowering insurers to offer tailored parametric products without extensive manual intervention.

White-Label Insurtech

White-label insurtech solutions empower traditional insurance agents by integrating advanced digital platforms that enhance policy distribution, claims processing, and customer engagement without extensive technological investment. This collaboration enables agents to maintain personalized client relationships while leveraging cutting-edge automation and data analytics to optimize underwriting and risk management.

AI-Powered Risk Assessment

AI-powered risk assessment empowers insurtech enablers to analyze vast datasets for precise underwriting, surpassing traditional agents' reliance on experience and manual evaluation. This technology enhances accuracy and speed, reducing human bias and enabling dynamic, real-time risk pricing in insurance markets.

Customer Journey Orchestration

Insurance agents personalize customer journey orchestration through direct interaction, leveraging trust and nuanced understanding of client needs to tailor policies effectively. Insurtech enablers optimize this process by integrating advanced analytics and automation, enhancing customer experiences with real-time insights and seamless multi-channel engagement.

Agent vs Insurtech Enabler Infographic

industrydif.com

industrydif.com