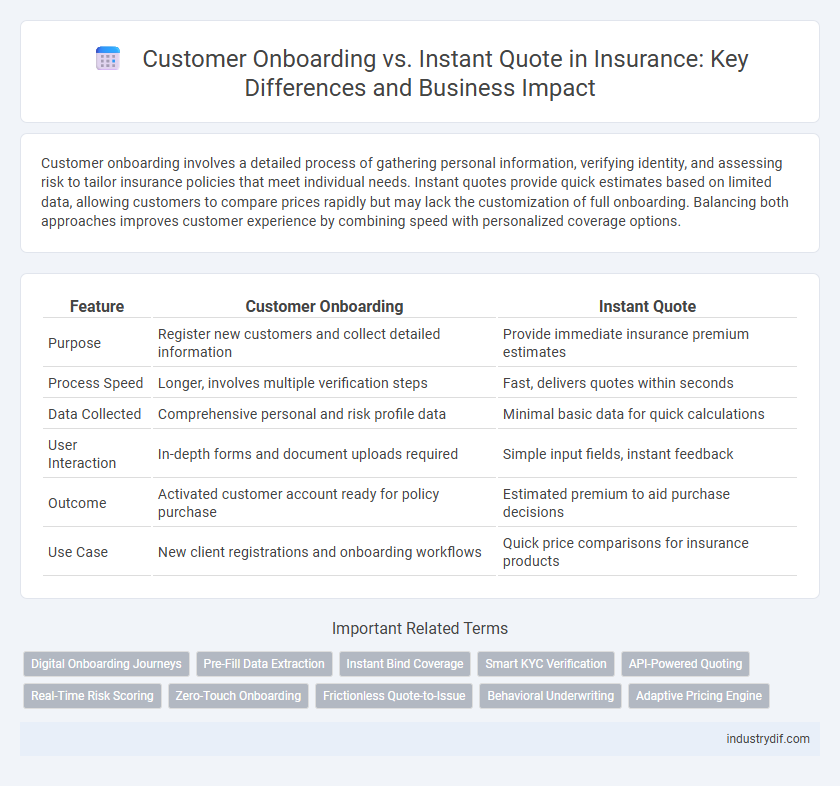

Customer onboarding involves a detailed process of gathering personal information, verifying identity, and assessing risk to tailor insurance policies that meet individual needs. Instant quotes provide quick estimates based on limited data, allowing customers to compare prices rapidly but may lack the customization of full onboarding. Balancing both approaches improves customer experience by combining speed with personalized coverage options.

Table of Comparison

| Feature | Customer Onboarding | Instant Quote |

|---|---|---|

| Purpose | Register new customers and collect detailed information | Provide immediate insurance premium estimates |

| Process Speed | Longer, involves multiple verification steps | Fast, delivers quotes within seconds |

| Data Collected | Comprehensive personal and risk profile data | Minimal basic data for quick calculations |

| User Interaction | In-depth forms and document uploads required | Simple input fields, instant feedback |

| Outcome | Activated customer account ready for policy purchase | Estimated premium to aid purchase decisions |

| Use Case | New client registrations and onboarding workflows | Quick price comparisons for insurance products |

Understanding Customer Onboarding in Insurance

Customer onboarding in insurance involves the comprehensive process of gathering detailed client information, verifying identities, and assessing risk profiles to tailor suitable policy options. This structured approach ensures compliance with regulatory requirements and enhances customer trust through personalized service. Effective onboarding streamlines policy issuance, reduces fraud, and improves long-term client retention compared to the simpler instant quote method.

What is an Instant Quote?

An Instant Quote in insurance provides potential customers with immediate, real-time pricing based on their input data, enabling quick decision-making without lengthy applications. This tool leverages automated algorithms and underwriting criteria to deliver personalized premium estimates within seconds. Unlike traditional customer onboarding, which involves a comprehensive data collection process, instant quotes streamline the initial engagement by offering transparency and speed.

Key Differences Between Onboarding and Instant Quote

Customer onboarding in insurance involves a comprehensive process of collecting detailed personal and risk information to tailor policies and ensure regulatory compliance, while instant quotes provide a rapid, preliminary estimate based on basic input data without full underwriting. Onboarding requires identity verification, document submission, and sometimes background checks, enabling customized coverage and accurate pricing, whereas instant quotes prioritize speed and convenience for initial decision-making. The key difference lies in onboarding's depth and formality compared to the instant quote's speed and simplicity, impacting user experience and policy precision.

Benefits of Streamlined Customer Onboarding

Streamlined customer onboarding in insurance accelerates policy activation by automating data collection and verification, reducing manual errors and processing times. It enhances customer experience through personalized engagement and clear communication, leading to higher satisfaction and retention rates. Efficient onboarding also lowers operational costs by minimizing administrative workload and enabling real-time data integration.

Advantages of Providing Instant Quotes

Providing instant quotes streamlines the insurance purchasing process by offering immediate pricing transparency based on customer data, increasing engagement and satisfaction. This real-time feedback reduces the drop-off rates often seen during traditional customer onboarding, accelerating decision-making and policy acquisition. Insurers benefit from enhanced lead conversion and operational efficiency by minimizing manual underwriting and administrative delays.

Technology's Role in Modern Insurance Onboarding

Technology revolutionizes modern insurance onboarding by enabling seamless data integration, real-time risk assessment, and automated customer verification. Instant quote systems leverage AI algorithms and machine learning to provide accurate pricing within seconds, enhancing customer experience and operational efficiency. Digital platforms streamline the entire onboarding process, reducing paperwork and accelerating policy issuance.

Automated Instant Quote Systems: Pros and Cons

Automated instant quote systems in insurance accelerate customer onboarding by providing real-time price estimates based on user-input data, significantly reducing wait times and enhancing the customer experience. These systems improve efficiency and scalability but may lack the nuanced understanding of complex cases, potentially leading to inaccurate quotes or overlooked coverage options. Balancing automation with human oversight ensures both speed and personalized service for optimal customer satisfaction.

Impact on Customer Experience and Satisfaction

Customer onboarding in insurance provides a personalized experience by collecting detailed information, enabling tailored policy recommendations that increase customer trust and satisfaction. Instant quotes offer rapid access to pricing, reducing wait times and meeting the demand for convenience, which enhances overall user experience. Combining both approaches effectively balances thoroughness with speed, significantly improving customer retention and engagement.

Balancing Personalization and Speed in Insurance

Balancing personalization and speed in insurance involves integrating advanced data analytics with AI-driven instant quote tools to enhance customer onboarding experiences. Personalized risk assessments and tailored policy recommendations improve customer satisfaction while maintaining rapid processing times that meet consumer expectations for immediacy. Leveraging automation and interactive digital platforms ensures efficient data collection without sacrificing the depth of customer engagement, essential for competitive advantage in the insurance market.

Future Trends: Integrating Onboarding with Instant Quotes

Future trends in insurance emphasize the integration of customer onboarding with instant quote capabilities to streamline the user experience and reduce drop-off rates. Leveraging AI-driven platforms allows insurers to collect comprehensive customer data during the onboarding process while simultaneously generating personalized, real-time quotes. This seamless fusion enhances engagement, improves risk assessment accuracy, and accelerates policy issuance.

Related Important Terms

Digital Onboarding Journeys

Digital onboarding journeys streamline customer onboarding by integrating instant quote tools, enabling prospective policyholders to receive tailored insurance quotes within minutes while seamlessly submitting necessary documentation and personal information online. This fusion of instant quote capabilities with comprehensive digital onboarding enhances user experience, reduces dropout rates, and accelerates policy issuance, setting a new standard in insurance customer acquisition.

Pre-Fill Data Extraction

Customer onboarding in insurance focuses on pre-fill data extraction to streamline the application process by automatically capturing personal and policy-related information, enhancing accuracy and reducing manual entry errors. In contrast, instant quotes leverage pre-fill data from existing databases to provide real-time premium estimates, improving user experience and accelerating decision-making.

Instant Bind Coverage

Instant bind coverage enables customers to activate their insurance policy immediately upon receiving a quote, eliminating delays common in traditional customer onboarding processes. This seamless integration of quoting and binding accelerates policy issuance, enhancing customer satisfaction and reducing operational friction for insurers.

Smart KYC Verification

Smart KYC verification streamlines customer onboarding by rapidly authenticating identities, reducing fraud risk, and enhancing compliance with regulatory standards. Instant quote systems rely on accurate KYC data to generate personalized insurance rates instantly, improving user experience and accelerating policy purchases.

API-Powered Quoting

API-powered quoting accelerates customer onboarding by delivering instant, accurate insurance quotes tailored to individual profiles. This seamless integration reduces friction, enhances user experience, and boosts conversion rates by providing real-time pricing and coverage options during the onboarding process.

Real-Time Risk Scoring

Real-time risk scoring enhances customer onboarding by instantly evaluating insurance applicants' risk profiles, enabling personalized policy recommendations and accurate pricing. Instant quotes leverage this technology to deliver immediate, tailored offers, reducing approval times and improving customer satisfaction rates.

Zero-Touch Onboarding

Zero-touch onboarding streamlines the customer insurance journey by automating data collection and verification, reducing manual input and accelerating policy issuance. Unlike instant quotes that provide immediate pricing, zero-touch onboarding ensures a seamless, personalized experience with minimal customer effort and enhanced accuracy in risk assessment.

Frictionless Quote-to-Issue

Customer onboarding streamlines user data collection to create personalized insurance profiles, while instant quotes provide real-time pricing tailored to individual risk factors. Integrating these processes enables a frictionless quote-to-issue experience, reducing dropout rates and accelerating policy issuance.

Behavioral Underwriting

Behavioral underwriting leverages real-time customer data during onboarding to assess risk more accurately than traditional instant quote methods, enhancing personalized insurance pricing. Integrating behavioral insights into customer onboarding improves risk prediction and reduces underwriting time compared to the limited data considered in instant quotes.

Adaptive Pricing Engine

Customer onboarding leverages an adaptive pricing engine to tailor insurance premiums based on real-time data, enhancing personalized policy quotes and improving customer satisfaction. Instant quote systems utilize adaptive pricing algorithms to rapidly assess risk factors and provide competitive, customized insurance pricing, streamlining the buying process and increasing conversion rates.

Customer Onboarding vs Instant Quote Infographic

industrydif.com

industrydif.com