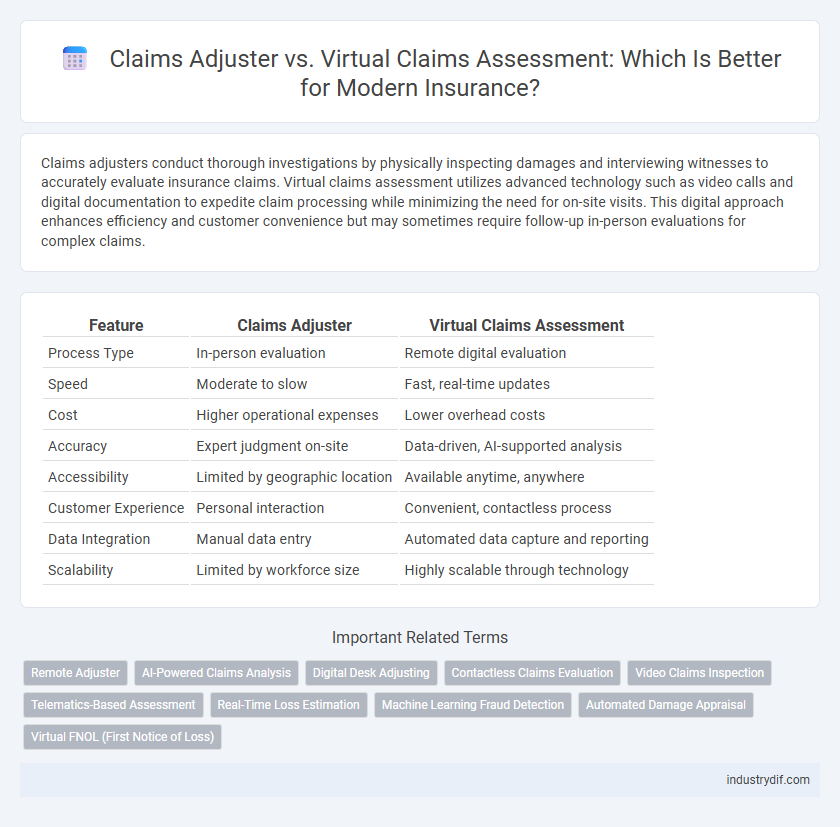

Claims adjusters conduct thorough investigations by physically inspecting damages and interviewing witnesses to accurately evaluate insurance claims. Virtual claims assessment utilizes advanced technology such as video calls and digital documentation to expedite claim processing while minimizing the need for on-site visits. This digital approach enhances efficiency and customer convenience but may sometimes require follow-up in-person evaluations for complex claims.

Table of Comparison

| Feature | Claims Adjuster | Virtual Claims Assessment |

|---|---|---|

| Process Type | In-person evaluation | Remote digital evaluation |

| Speed | Moderate to slow | Fast, real-time updates |

| Cost | Higher operational expenses | Lower overhead costs |

| Accuracy | Expert judgment on-site | Data-driven, AI-supported analysis |

| Accessibility | Limited by geographic location | Available anytime, anywhere |

| Customer Experience | Personal interaction | Convenient, contactless process |

| Data Integration | Manual data entry | Automated data capture and reporting |

| Scalability | Limited by workforce size | Highly scalable through technology |

Understanding the Role of a Claims Adjuster

A claims adjuster evaluates insurance claims by investigating accidents, assessing damages, and determining policy coverage to ensure fair settlements. They conduct on-site inspections, interview claimants and witnesses, and analyze documentation to validate claims accurately. Virtual claims assessment uses digital tools to streamline this process, but the claims adjuster's expertise remains essential for interpreting complex details and negotiating settlements.

What is Virtual Claims Assessment?

Virtual claims assessment is a digital process where insurance claims are evaluated remotely using technology such as video inspections, digital documentation, and real-time communication tools. This method enhances accuracy and efficiency by enabling claims adjusters to review damages and gather evidence without physical site visits. Virtual claims assessments reduce processing time, lower costs, and improve customer convenience in the insurance claims workflow.

Key Differences Between Claims Adjusters and Virtual Assessments

Claims adjusters conduct in-person evaluations of insurance claims to assess damages and verify coverage, relying on physical inspections and direct interactions. Virtual claims assessments utilize digital tools and remote technology such as video calls, photos, and AI analytics to evaluate claims efficiently without onsite visits. Key differences include the immediacy and convenience of virtual assessments versus the thoroughness and personal judgment of traditional claims adjusters.

Advantages of Traditional Claims Adjusters

Traditional claims adjusters offer personalized, on-site inspections that enable accurate damage assessment through direct observation and interaction with policyholders. Their expertise in navigating complex claims and mitigating potential fraud ensures thorough and reliable evaluations. Face-to-face communication strengthens trust and facilitates nuanced negotiations for fair settlements.

Benefits of Virtual Claims Assessment

Virtual claims assessment accelerates the claims process by enabling adjusters to evaluate damages remotely through high-resolution images and video. This method reduces the need for physical site visits, lowering operational costs and improving efficiency. Policyholders experience faster claim resolutions and increased convenience without compromising assessment accuracy.

Technology’s Impact on Claims Processing

Technology's impact on claims processing has revolutionized traditional claims adjuster roles by introducing virtual claims assessment platforms that utilize AI, machine learning, and digital imaging to expedite damage evaluation and improve accuracy. Virtual claims assessments reduce the need for in-person inspections, enabling faster claim settlements and enhanced customer satisfaction through remote data collection and real-time communication. The integration of advanced analytics and automated workflows streamlines claims handling, minimizes human error, and optimizes resource allocation in the insurance industry.

Efficiency and Accuracy in Claims Evaluation

Claims adjusters leverage on-site evaluations and personal interactions to ensure thorough damage assessment, which can enhance accuracy but may delay the claims process. Virtual claims assessment employs advanced imaging technology and AI-driven analytics to expedite evaluations, significantly improving efficiency while maintaining high accuracy levels. Integrating both methods can optimize claims evaluation by balancing detailed inspections with rapid data processing.

Customer Experience: In-Person vs. Virtual Assessments

Claims adjusters conducting in-person assessments offer immediate, tactile evaluation of damages, enhancing accuracy and fostering personal trust with customers. Virtual claims assessments leverage technology to expedite the process, providing convenience and reducing wait times, which improves overall customer satisfaction. Both methods impact the insurance claims experience differently, with in-person interactions emphasizing detailed inspection and virtual assessments prioritizing speed and accessibility.

Challenges and Limitations of Each Approach

Claims adjusters provide hands-on investigation and in-depth on-site evaluations but face challenges such as time-consuming processes and limited scalability in handling large claim volumes. Virtual claims assessment speeds up claim processing through digital tools and remote evaluations but encounters limitations including technology reliability issues, potential inaccuracies without physical inspection, and reduced personal interaction affecting claimant satisfaction. Both methods require balancing efficiency and accuracy to optimize claims resolution while addressing their inherent operational constraints.

The Future of Claims Management in Insurance

Claims adjusters have traditionally handled in-person evaluations, but virtual claims assessment leverages AI and real-time data analytics to expedite claim resolutions and improve accuracy. The future of claims management in insurance centers on integrating virtual platforms with advanced machine learning algorithms to enhance fraud detection and customer experience. This shift reduces operational costs and accelerates settlement times, positioning insurers for greater efficiency and scalability.

Related Important Terms

Remote Adjuster

Remote claims adjusters leverage digital tools and virtual technology to evaluate insurance claims efficiently without the need for physical site visits, reducing processing time and operational costs. Virtual claims assessments enable real-time documentation and verification, enhancing accuracy and customer satisfaction compared to traditional claims adjuster methods.

AI-Powered Claims Analysis

AI-powered claims analysis enhances virtual claims assessment by rapidly processing vast datasets and identifying patterns to improve accuracy and efficiency. Unlike traditional claims adjusters, AI-driven platforms deliver real-time damage evaluations and fraud detection, reducing claim settlement times and operational costs.

Digital Desk Adjusting

Digital desk adjusting streamlines the insurance claims process by enabling claims adjusters to evaluate and settle claims remotely through virtual claims assessment platforms. This technology reduces processing time, enhances accuracy with real-time data access, and improves customer experience by minimizing in-person inspections.

Contactless Claims Evaluation

Contactless claims evaluation using virtual claims assessment leverages advanced technology to expedite claim processing while minimizing in-person interactions, enhancing safety and efficiency. Claims adjusters now utilize digital tools such as video inspections and AI-driven damage analysis to provide accurate, remote assessments that reduce turnaround times and improve customer satisfaction.

Video Claims Inspection

Video claims inspection enhances traditional claims adjuster processes by enabling real-time, remote evaluation of damage through high-resolution video feeds, accelerating claim settlements and reducing costs. This virtual claims assessment leverages advanced technologies such as AI and mobile devices to improve accuracy, minimize fraud, and improve customer satisfaction in insurance claims handling.

Telematics-Based Assessment

Telematics-Based Assessment leverages real-time vehicle data such as speed, acceleration, and location to provide accurate and immediate evaluations during claims processing. Unlike traditional claims adjusters who rely on manual inspections and reports, telematics enables virtual claims assessment to expedite damage analysis and improve claim accuracy through data-driven insights.

Real-Time Loss Estimation

Claims adjusters perform on-site inspections to evaluate damages and verify loss details, providing accurate assessments through physical presence. Virtual claims assessment leverages real-time loss estimation technology, enabling faster, remote damage evaluation using AI-powered imaging and data analytics to expedite claim settlements.

Machine Learning Fraud Detection

Machine learning fraud detection enhances virtual claims assessment by rapidly analyzing large datasets to identify patterns indicative of fraudulent activity. Claims adjusters benefit from these AI-driven insights, enabling more accurate and efficient evaluations while reducing human error and operational costs.

Automated Damage Appraisal

Claims adjusters traditionally perform in-person inspections to evaluate damage, but virtual claims assessments leverage automated damage appraisal technologies like AI-powered image analysis and remote sensing to accelerate claim processing and improve accuracy. Automated damage appraisal reduces human error, expedites settlements, and enhances customer satisfaction by providing real-time, data-driven evaluations without the need for physical presence.

Virtual FNOL (First Notice of Loss)

Virtual FNOL streamlines the claims process by enabling immediate digital reporting and initial damage assessment, reducing response times and improving accuracy compared to traditional claims adjusters. This technology leverages AI and real-time data capture to enhance efficiency, minimize human error, and accelerate claim resolution in insurance workflows.

Claims Adjuster vs Virtual Claims Assessment Infographic

industrydif.com

industrydif.com