Loss ratio directly measures the financial health of an insurance company by comparing claims paid to premiums earned, influencing profitability and pricing strategies. Claims automation enhances operational efficiency by using technology to process claims faster and reduce errors, which can lower administrative costs and improve customer satisfaction. Integrating claims automation can lead to a more favorable loss ratio by minimizing fraudulent claims and streamlining settlement processes.

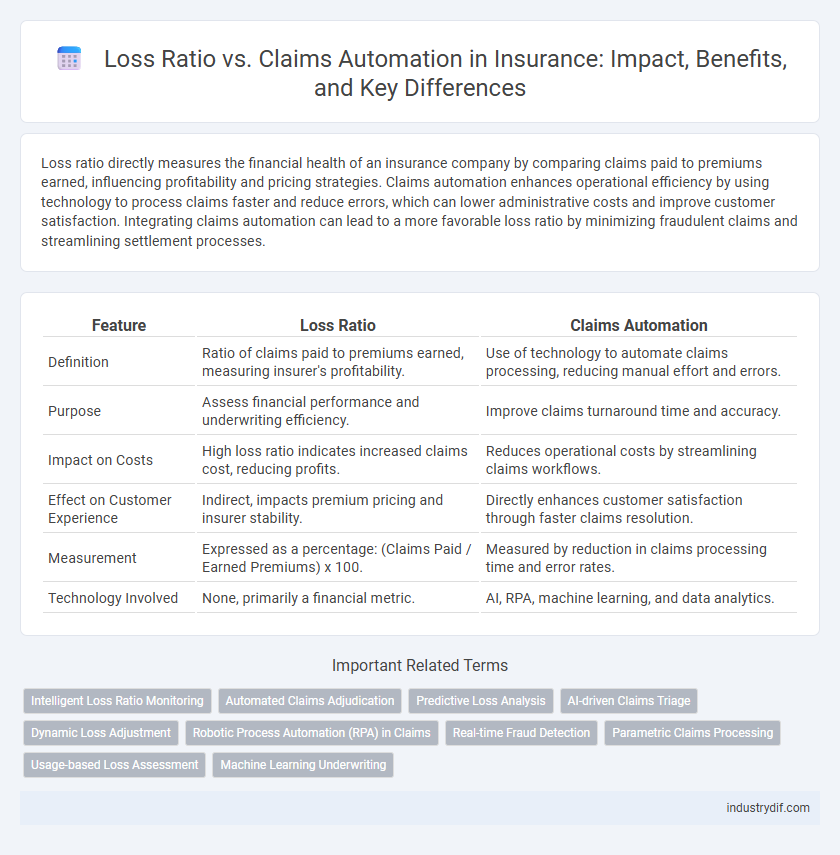

Table of Comparison

| Feature | Loss Ratio | Claims Automation |

|---|---|---|

| Definition | Ratio of claims paid to premiums earned, measuring insurer's profitability. | Use of technology to automate claims processing, reducing manual effort and errors. |

| Purpose | Assess financial performance and underwriting efficiency. | Improve claims turnaround time and accuracy. |

| Impact on Costs | High loss ratio indicates increased claims cost, reducing profits. | Reduces operational costs by streamlining claims workflows. |

| Effect on Customer Experience | Indirect, impacts premium pricing and insurer stability. | Directly enhances customer satisfaction through faster claims resolution. |

| Measurement | Expressed as a percentage: (Claims Paid / Earned Premiums) x 100. | Measured by reduction in claims processing time and error rates. |

| Technology Involved | None, primarily a financial metric. | AI, RPA, machine learning, and data analytics. |

Understanding Loss Ratio in Insurance

Loss ratio in insurance measures the proportion of claims paid out to the premiums earned, serving as a key indicator of profitability and risk management. Claims automation enhances accuracy and speed in processing, directly impacting the loss ratio by reducing manual errors and claim processing costs. Optimizing loss ratio through claims automation leads to improved underwriting decisions and sustainable financial performance.

What Is Claims Automation?

Claims automation in insurance refers to the use of technology, such as artificial intelligence and machine learning, to streamline the claims processing workflow, reducing manual intervention and improving efficiency. By automating tasks like claim submission, validation, and settlement, insurers can lower operational costs and enhance accuracy, directly impacting the loss ratio by minimizing errors and fraudulent claims. Effective claims automation leads to faster claim resolutions, higher customer satisfaction, and better risk management.

Importance of Loss Ratio for Insurers

Loss ratio serves as a critical metric for insurers, reflecting the percentage of claims paid relative to earned premiums and directly impacting profitability. Efficient claims automation reduces processing time and errors, helping maintain optimal loss ratios by minimizing unnecessary payouts and fraud. Insurers rely on accurate loss ratio data to adjust underwriting strategies, set premium rates, and ensure financial stability in competitive markets.

How Claims Automation Impacts Loss Ratio

Claims automation significantly reduces the loss ratio by increasing the accuracy and speed of claims processing, which minimizes costly errors and fraud. Automated claims systems enhance risk assessment and streamline payouts, leading to more precise financial forecasting and lower payout variances. Insurers leveraging claims automation report improved operational efficiency and a notable decline in loss ratio percentages compared to manual processing methods.

Traditional Claims Processing vs Automated Systems

Traditional claims processing often results in higher loss ratios due to manual errors, longer settlement times, and increased administrative costs. Automated claims systems utilize advanced algorithms and machine learning to streamline claim assessments, significantly reducing loss ratios by improving accuracy and speeding up payouts. Insurers adopting automated solutions report up to 30% reductions in loss ratios compared to legacy manual processes.

Key Benefits of Claims Automation

Claims automation significantly improves loss ratios by accelerating the claims processing time, reducing administrative costs, and minimizing human errors. Automated systems enhance accuracy in claim assessments and fraud detection, leading to more precise payouts and lower loss ratios. Insurers benefit from increased operational efficiency, faster customer service, and improved profitability through scalable claims automation solutions.

Challenges in Optimizing Loss Ratio

Challenges in optimizing the loss ratio hinge on balancing accurate claims automation with risk assessment precision. Inefficient claims automation can lead to increased fraud, processing errors, and delayed settlements, which inflate claim costs and worsen the loss ratio. Insurers must integrate advanced data analytics and AI-driven validation systems to minimize inaccuracies and control loss ratio effectively.

Technology Trends in Claims Automation

The integration of artificial intelligence and machine learning in claims automation significantly reduces loss ratios by enhancing fraud detection and expediting claim processing. Advanced data analytics and robotic process automation streamline workflows, leading to improved accuracy and faster settlements. Emerging technologies such as natural language processing and predictive modeling enable insurers to optimize claims handling efficiency and minimize financial losses.

Balancing Cost Efficiency with Customer Experience

Loss ratio directly impacts profitability in insurance by measuring claims paid relative to premiums earned, making claims automation essential for cost control. Implementing advanced claims automation streamlines processing, reduces manual errors, and accelerates settlements, enhancing customer satisfaction. Balancing cost efficiency with superior customer experience requires leveraging data-driven automation tools to optimize loss ratios while maintaining personalized service.

Future Outlook: Loss Ratio Management in the Age of Automation

Advancements in claims automation are transforming loss ratio management by enhancing accuracy and accelerating claim processing, ultimately reducing operational costs and minimizing fraudulent payouts. Predictive analytics combined with machine learning enable insurers to proactively identify high-risk claims and optimize reserve allocation, directly improving loss ratio performance. As automation technologies evolve, insurers will increasingly leverage real-time data integration and AI-driven insights to maintain competitive loss ratios and enhance underwriting effectiveness.

Related Important Terms

Intelligent Loss Ratio Monitoring

Intelligent loss ratio monitoring leverages claims automation to analyze real-time data, identifying trends and outliers that impact underwriting accuracy and profitability. This technology enhances risk assessment by streamlining claims processing, reducing manual errors, and optimizing financial performance through proactive loss control.

Automated Claims Adjudication

Loss ratio improves significantly through automated claims adjudication by reducing manual errors and accelerating claim processing times, leading to more accurate payouts and enhanced fraud detection. Automated claims systems streamline workflow efficiency, allowing insurers to better manage expenses and maintain profitability by minimizing claim overruns.

Predictive Loss Analysis

Predictive Loss Analysis leverages claims automation to enhance the accuracy of loss ratio forecasts by analyzing historical data and identifying patterns in claim occurrences. This integration reduces underwriting risk and improves financial performance by enabling proactive risk management and streamlined claims processing.

AI-driven Claims Triage

AI-driven claims triage significantly improves loss ratio management by rapidly assessing claim severity and automatically routing high-risk cases for detailed review, reducing manual errors and processing time. This automation optimizes resource allocation, enhances predictive accuracy, and minimizes fraudulent claims, leading to lower loss ratios and increased operational efficiency.

Dynamic Loss Adjustment

Dynamic loss adjustment in claims automation significantly enhances accuracy in evaluating loss ratios by leveraging real-time data analytics and machine learning algorithms, allowing insurers to detect fraud, optimize reserve allocation, and expedite claim settlements. Automated processes reduce manual errors and processing times, directly influencing the loss ratio by lowering claim costs and improving underwriting profitability.

Robotic Process Automation (RPA) in Claims

Robotic Process Automation (RPA) in claims processing significantly reduces the loss ratio by automating repetitive tasks such as data extraction, claim validation, and fraud detection, leading to faster claim settlements and reduced operational costs. Enhanced accuracy and efficiency from RPA minimize errors and prevent overpayments, thereby optimizing insurer profitability and improving customer satisfaction.

Real-time Fraud Detection

Loss ratio significantly improves with claims automation by enabling real-time fraud detection through advanced algorithms and machine learning models, which quickly identify suspicious patterns and reduce false payouts. Insurance companies leveraging these technologies experience enhanced accuracy in claim settlements and a substantial decrease in fraud-related financial losses.

Parametric Claims Processing

Parametric claims processing reduces loss ratio by automating insurance payouts based on predefined parameters like weather data, minimizing manual claim assessments and fraud risk. This efficient claims automation accelerates settlement times, improves transparency, and enhances customer satisfaction in parametric insurance models.

Usage-based Loss Assessment

Usage-based loss assessment leverages claims automation to enhance accuracy in tracking insured behavior and risk patterns, significantly reducing the loss ratio by identifying fraudulent or inflated claims quickly. Automated analysis of telematics data enables insurers to adjust premiums dynamically, leading to more precise underwriting and improved profitability.

Machine Learning Underwriting

Machine learning underwriting significantly enhances claims automation by improving accuracy in loss ratio predictions through advanced data analysis and risk assessment algorithms. Leveraging real-time data, insurers can optimize underwriting decisions, reduce claim processing time, and minimize loss ratios by identifying fraudulent claims and high-risk policies more effectively.

Loss Ratio vs Claims Automation Infographic

industrydif.com

industrydif.com