Travel insurance offers comprehensive coverage including medical emergencies, trip cancellations, lost luggage, and more, providing broad protection for various travel-related risks. Flight delay insurance specifically covers financial losses incurred due to delayed flights, such as additional accommodation and meal expenses, but does not encompass other travel mishaps. Choosing between the two depends on whether travelers prefer extensive protection or targeted coverage for flight disruptions.

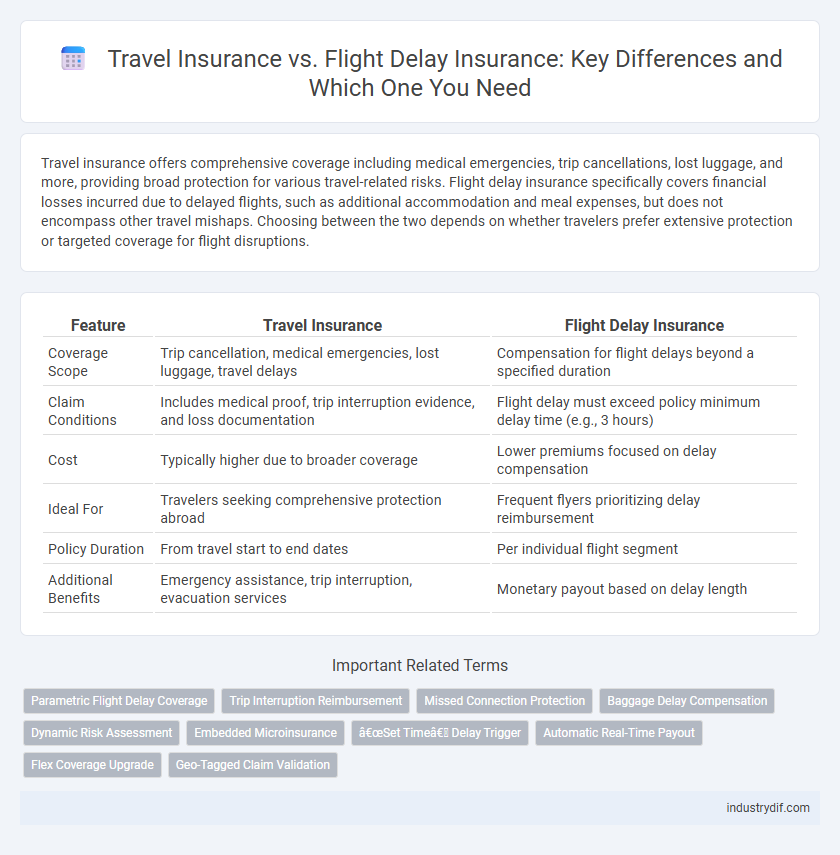

Table of Comparison

| Feature | Travel Insurance | Flight Delay Insurance |

|---|---|---|

| Coverage Scope | Trip cancellation, medical emergencies, lost luggage, travel delays | Compensation for flight delays beyond a specified duration |

| Claim Conditions | Includes medical proof, trip interruption evidence, and loss documentation | Flight delay must exceed policy minimum delay time (e.g., 3 hours) |

| Cost | Typically higher due to broader coverage | Lower premiums focused on delay compensation |

| Ideal For | Travelers seeking comprehensive protection abroad | Frequent flyers prioritizing delay reimbursement |

| Policy Duration | From travel start to end dates | Per individual flight segment |

| Additional Benefits | Emergency assistance, trip interruption, evacuation services | Monetary payout based on delay length |

Understanding Travel Insurance: Key Features

Travel insurance typically covers a broad range of risks including trip cancellations, medical emergencies, lost luggage, and flight delays, offering comprehensive protection for travelers. Key features include coverage limits, exclusions, and the ability to claim reimbursement for unforeseen expenses incurred during travel disruptions. Flight delay insurance, often a subset of travel insurance, specifically compensates for expenses caused by delayed flights but lacks the extensive coverage found in full travel insurance policies.

What Is Flight Delay Insurance?

Flight delay insurance specifically covers expenses incurred when a flight is delayed beyond a certain threshold, reimbursing costs such as meals, accommodations, and transportation. Unlike general travel insurance, which provides broader protection including trip cancellations, medical emergencies, and lost luggage, flight delay insurance targets the financial impact of specific delays during air travel. This specialized coverage is ideal for travelers frequently facing tight schedules or connecting flights at risk of disruption.

Coverage Comparison: Travel vs. Flight Delay Insurance

Travel insurance offers comprehensive coverage including trip cancellations, medical emergencies, lost luggage, and flight delays, providing broad protection for various travel-related risks. Flight delay insurance specifically covers financial losses resulting from delayed flights, reimbursing expenses such as meals, accommodation, and alternative transportation during the delay period. Comparing coverage, travel insurance ensures extensive protection across multiple aspects of the trip, whereas flight delay insurance targets delays alone, making it a more focused but limited option.

Major Benefits of Travel Insurance

Travel insurance provides comprehensive coverage, including trip cancellations, medical emergencies, lost luggage, and flight delays, ensuring protection beyond just delayed flights. It covers unforeseen events like illness or accidents during travel, offering financial reimbursement for medical expenses globally. This broad scope makes travel insurance essential for safeguarding overall trip investments and traveler well-being.

When Does Flight Delay Insurance Apply?

Flight delay insurance applies specifically when a covered flight is delayed beyond the policy's stipulated waiting period, typically two to four hours, resulting in additional expenses such as meals, accommodations, or alternative transportation. It usually requires proof of delay from the airline and covers only the costs directly related to the delay rather than broader trip interruptions. Unlike comprehensive travel insurance, flight delay insurance does not cover medical emergencies, cancellations, or lost baggage.

Typical Exclusions in Both Policies

Travel insurance typically excludes coverage for pre-existing medical conditions, high-risk activities, and trip cancellations due to change of mind, while flight delay insurance often excludes delays caused by weather conditions, strikes, or air traffic control restrictions. Both policies generally do not cover losses resulting from war, terrorism, or government actions. Understanding these common exclusions helps travelers select the most appropriate insurance based on their specific risk factors and travel plans.

Cost Differences Between Travel and Flight Delay Insurance

Travel insurance typically covers a wide range of risks such as trip cancellation, medical emergencies, and lost luggage, resulting in higher premiums compared to flight delay insurance. Flight delay insurance specifically compensates for expenses incurred due to delayed or canceled flights, making it more affordable and focused. Cost differences generally reflect the broader coverage and higher risk factors associated with comprehensive travel insurance versus the limited scope of flight delay protection.

Claims Process: Travel Insurance vs. Flight Delay Insurance

Travel insurance claims require detailed documentation including proof of trip cancellation, medical reports, or lost baggage receipts, often involving multiple claim types under one policy. Flight delay insurance claims focus specifically on verifying airline delay through official flight status records and boarding passes, streamlining payout for missed connections or additional expenses. The complexity of travel insurance claims typically results in longer processing times compared to the more straightforward and faster claims procedure of flight delay insurance.

Choosing the Right Insurance for Your Trip

Choosing the right insurance for your trip involves understanding the specific coverage each policy offers. Travel insurance provides comprehensive protection, including trip cancellation, medical emergencies, and lost luggage, whereas flight delay insurance focuses solely on compensating for delays impacting your travel schedule. Evaluating your trip's needs and potential risks ensures you select the insurance that offers the most relevant benefits and financial security.

Frequently Asked Questions: Travel vs. Flight Delay Insurance

Travel insurance typically covers a wide range of risks including trip cancellation, medical emergencies, and lost luggage, while flight delay insurance specifically compensates for delays in scheduled flights. Common questions often address coverage scope, reimbursement conditions, and claims processes, highlighting that flight delay insurance is a subset focused solely on punctuality issues. Choosing between the two depends on the traveler's priorities for protection against broader travel disruptions versus isolated flight delays.

Related Important Terms

Parametric Flight Delay Coverage

Parametric flight delay coverage provides automatic compensation based on predefined delay thresholds without requiring proof of actual expenses, differing from traditional travel insurance that reimburses specific losses after claim verification. This focused solution enhances traveler convenience by delivering swift payouts for delays caused by flight disruptions, weather, or air traffic control issues.

Trip Interruption Reimbursement

Travel insurance typically covers trip interruption reimbursement by compensating for unexpected events such as illness, natural disasters, or emergencies that force travelers to cut their trips short. Flight delay insurance, however, specifically reimburses passengers for expenses incurred due to flight delays but often excludes broader trip interruption scenarios covered by comprehensive travel insurance policies.

Missed Connection Protection

Travel insurance typically offers comprehensive coverage including missed connection protection, reimbursing expenses due to unexpected delays or cancellations impacting subsequent flights. Flight delay insurance specifically targets delays of the booked flight but often lacks broader missed connection benefits, making travel insurance more reliable for coverage of extended itinerary disruptions.

Baggage Delay Compensation

Travel insurance typically offers comprehensive coverage, including baggage delay compensation that reimburses essential purchases after a specified delay period, while flight delay insurance focuses primarily on compensating passengers for the inconvenience caused by flight schedule disruptions without extensive baggage protection. Baggage delay compensation under travel insurance often covers expenses like clothing and toiletries during delays exceeding 6 to 12 hours, providing broader financial protection compared to the limited scope of flight delay insurance.

Dynamic Risk Assessment

Travel insurance offers comprehensive coverage including trip cancellations, medical emergencies, and baggage loss, while flight delay insurance specifically covers additional expenses caused by flight delays such as accommodation and meals. Dynamic risk assessment in these policies continuously evaluates changing factors like weather conditions, airline reliability, and geopolitical events to adjust coverage and premiums in real time.

Embedded Microinsurance

Embedded microinsurance within travel insurance offers seamless protection against common risks like trip cancellations, medical emergencies, and flight delays, providing comprehensive coverage with minimal customer effort. Flight delay insurance, a subset of embedded microinsurance, specifically compensates for delays and missed connections, enhancing traveler confidence and reducing financial losses without requiring separate policies.

“Set Time” Delay Trigger

Travel insurance typically covers flight delays after a predefined set time, such as a minimum wait of 3 or 4 hours, ensuring compensation for prolonged disruptions, while flight delay insurance often specializes in more flexible trigger times, sometimes as short as 1 hour, providing quicker reimbursement for shorter delays. Understanding the specific "set time" delay trigger in each policy is crucial to ensure coverage aligns with your travel needs and delay risk tolerance.

Automatic Real-Time Payout

Travel insurance offers comprehensive coverage including trip cancellations, medical emergencies, and lost luggage, while flight delay insurance specifically targets compensation for delayed flights. Flight delay insurance features automatic real-time payout systems that instantly reimburse passengers for delays exceeding a predefined threshold without requiring lengthy claims processes.

Flex Coverage Upgrade

Flex Coverage Upgrade enhances travel insurance by extending protection to unforeseen flight delays, offering compensation for expenses like accommodations and meals. Unlike standard flight delay insurance, this upgrade integrates seamlessly with broader travel policies, ensuring comprehensive coverage for trip interruptions while accommodating dynamic itinerary changes.

Geo-Tagged Claim Validation

Travel insurance often includes geo-tagged claim validation to verify insured events during a trip, while flight delay insurance specifically uses geo-tag data to confirm actual flight delays at departure and arrival locations. Geo-tagged claim validation enhances accuracy and reduces fraud by cross-referencing passenger location data with flight and travel timelines.

Travel Insurance vs Flight Delay Insurance Infographic

industrydif.com

industrydif.com