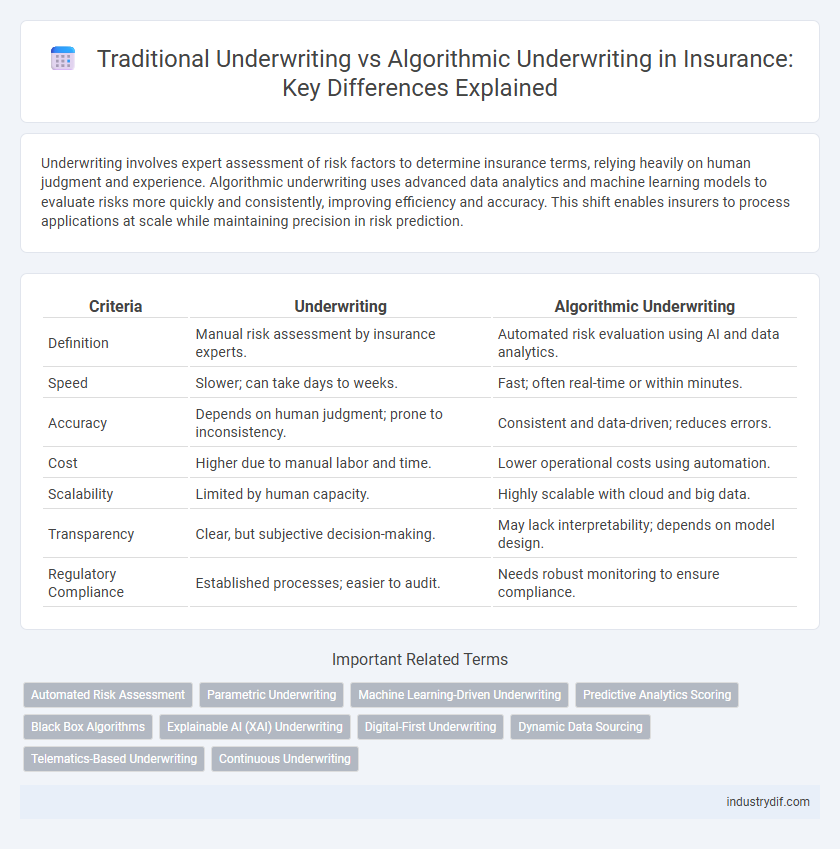

Underwriting involves expert assessment of risk factors to determine insurance terms, relying heavily on human judgment and experience. Algorithmic underwriting uses advanced data analytics and machine learning models to evaluate risks more quickly and consistently, improving efficiency and accuracy. This shift enables insurers to process applications at scale while maintaining precision in risk prediction.

Table of Comparison

| Criteria | Underwriting | Algorithmic Underwriting |

|---|---|---|

| Definition | Manual risk assessment by insurance experts. | Automated risk evaluation using AI and data analytics. |

| Speed | Slower; can take days to weeks. | Fast; often real-time or within minutes. |

| Accuracy | Depends on human judgment; prone to inconsistency. | Consistent and data-driven; reduces errors. |

| Cost | Higher due to manual labor and time. | Lower operational costs using automation. |

| Scalability | Limited by human capacity. | Highly scalable with cloud and big data. |

| Transparency | Clear, but subjective decision-making. | May lack interpretability; depends on model design. |

| Regulatory Compliance | Established processes; easier to audit. | Needs robust monitoring to ensure compliance. |

Understanding Traditional Underwriting in Insurance

Traditional underwriting in insurance involves a detailed risk assessment process performed by underwriters who analyze personal information, financial history, and health data to determine eligibility and premiums. This manual evaluation relies on established guidelines and expert judgment to identify potential risks and prevent adverse selection. Understanding traditional underwriting provides a foundation for comparing its precision and human insight to the efficiency and scalability of algorithmic underwriting models.

Defining Algorithmic Underwriting

Algorithmic underwriting leverages advanced data analytics, machine learning models, and predictive algorithms to assess risk and determine insurance premiums with greater accuracy and efficiency than traditional underwriting methods. This approach uses vast amounts of structured and unstructured data, including behavioral patterns and external data sources, to make real-time, data-driven decisions. It reduces human bias and accelerates the underwriting process while improving risk evaluation and customer experience.

Key Differences Between Human and Algorithmic Underwriting

Underwriting involves human underwriters assessing risk through qualitative judgment and experience, while algorithmic underwriting relies on data-driven models and machine learning to evaluate risk quantitatively. Human underwriting excels in interpreting nuanced information and exceptional cases, whereas algorithmic underwriting offers scalability, speed, and consistency by analyzing vast datasets and identifying patterns. Differences include decision-making transparency, adaptability to unique situations, and reliance on structured data versus expert intuition.

The Role of Data in Algorithmic Underwriting

Algorithmic underwriting leverages vast datasets, including historical claims, credit scores, and behavioral analytics, to enhance risk assessment accuracy. Machine learning models analyze this data to detect patterns and predict potential losses more efficiently than traditional underwriting methods. This data-driven approach enables faster decision-making, reduces human error, and supports dynamic pricing strategies based on real-time risk evaluation.

Efficiency and Speed: Algorithmic vs. Manual Processes

Algorithmic underwriting significantly enhances efficiency by automating risk assessment using advanced data analytics and machine learning models, reducing processing time from days to minutes. Traditional manual underwriting relies on human evaluation and paperwork, often resulting in slower decision-making and increased potential for error. The integration of algorithmic underwriting streamlines workflows, enabling insurers to quickly underwrite policies and improve customer satisfaction through faster turnaround times.

Risk Assessment: Human Judgment vs. Machine Learning

Risk assessment in traditional underwriting relies heavily on human judgment, incorporating subjective insights and experience to evaluate policyholder risk. Algorithmic underwriting leverages machine learning models to analyze vast datasets, identifying patterns and risk factors with greater precision and consistency. This shift enhances risk prediction accuracy while reducing bias and processing time in insurance decision-making.

Cost Implications for Insurers

Underwriting traditionally relies on manual risk assessment, involving significant labor costs and longer processing times, which increase operational expenses for insurers. Algorithmic underwriting leverages machine learning models to rapidly analyze vast datasets, reducing human intervention and lowering administrative costs. This digital approach enables insurers to improve pricing accuracy and enhance profitability by minimizing underwriting errors and accelerating policy issuance.

Impact on Customer Experience

Algorithmic underwriting significantly enhances customer experience by accelerating the risk assessment process, often delivering instant policy decisions compared to traditional underwriting's manual evaluation. This automation reduces human error and biases, providing more consistent and transparent outcomes for customers. As a result, policyholders benefit from faster approvals, personalized pricing, and improved satisfaction in the insurance purchasing journey.

Challenges and Limitations of Algorithmic Underwriting

Algorithmic underwriting faces significant challenges including data limitations, potential bias in training datasets, and lack of transparency in decision-making processes. These factors can lead to inaccuracies, unfair risk assessments, and difficulties in regulatory compliance. Moreover, algorithmic models may struggle with adapting to novel or complex risk scenarios compared to traditional underwriting methods.

The Future of Underwriting in the Insurance Industry

Algorithmic underwriting is revolutionizing the insurance industry by leveraging artificial intelligence and big data to assess risk more accurately and efficiently than traditional underwriting methods. This technological advancement enables faster decision-making, reduces human bias, and improves pricing precision, transforming the future landscape of insurance underwriting. Insurers adopting algorithmic underwriting gain competitive advantages through enhanced customer experience, operational scalability, and predictive analytics capabilities.

Related Important Terms

Automated Risk Assessment

Automated risk assessment in algorithmic underwriting uses advanced machine learning models to analyze large datasets, providing faster and more accurate evaluations compared to traditional manual underwriting methods. This technology reduces human bias and enhances consistency, enabling insurers to streamline policy approvals and optimize risk management strategies.

Parametric Underwriting

Parametric underwriting leverages predefined parameters and algorithmic models to streamline risk assessment, reducing human bias and accelerating policy issuance. This approach enhances accuracy in claims processing by triggering payouts based on objective data points, distinct from traditional underwriting's subjective evaluation.

Machine Learning-Driven Underwriting

Machine learning-driven underwriting enhances traditional insurance risk assessment by leveraging vast datasets and predictive algorithms to improve accuracy and efficiency in policy evaluation. This approach enables dynamic risk profiling and faster decision-making compared to conventional underwriting methods.

Predictive Analytics Scoring

Predictive analytics scoring enhances algorithmic underwriting by leveraging vast datasets and machine learning models to assess risk more accurately than traditional underwriting methods. This advanced approach enables insurers to predict customer behavior, optimize pricing strategies, and improve risk selection with higher precision and efficiency.

Black Box Algorithms

Underwriting traditionally relies on human expertise to assess risk, while algorithmic underwriting utilizes black box algorithms that analyze vast datasets to predict risk without transparent decision-making processes. These opaque models pose challenges in explainability and regulatory compliance, raising concerns over bias and accountability in insurance risk assessment.

Explainable AI (XAI) Underwriting

Explainable AI (XAI) underwriting enhances traditional underwriting by providing transparent, interpretable risk assessments through advanced machine learning models, enabling insurers to justify decisions and comply with regulatory standards. This approach improves accuracy and efficiency while fostering trust among policyholders by revealing how AI algorithms evaluate data such as medical history, credit scores, and claim records.

Digital-First Underwriting

Digital-first underwriting leverages advanced algorithms and real-time data analytics to streamline risk assessment, enhancing accuracy and speed compared to traditional manual underwriting processes. Algorithmic underwriting reduces human bias and operational costs, enabling insurers to underwrite policies more efficiently while improving customer experience through automation and digital integration.

Dynamic Data Sourcing

Underwriting traditionally relies on static data and manual risk assessments, whereas algorithmic underwriting leverages dynamic data sourcing from real-time digital feeds, such as IoT devices, social media, and telematics, to enhance accuracy and speed in risk evaluation. This approach enables insurers to continuously update risk profiles and pricing models, improving decision-making and personalized policy offerings.

Telematics-Based Underwriting

Telematics-based underwriting leverages real-time data from devices such as GPS and accelerometers to assess driving behavior with precision, enabling insurers to personalize risk profiles and premiums more accurately compared to traditional underwriting methods. This approach enhances risk prediction by analyzing metrics like speed, braking patterns, and mileage, resulting in dynamic policy adjustments and improved customer engagement.

Continuous Underwriting

Continuous underwriting leverages real-time data and machine learning algorithms to update risk assessments dynamically, enhancing accuracy and responsiveness compared to traditional static underwriting processes. This algorithmic approach enables insurers to monitor policyholder behavior and environmental factors continuously, reducing fraud and improving personalized premium pricing.

Underwriting vs Algorithmic Underwriting Infographic

industrydif.com

industrydif.com