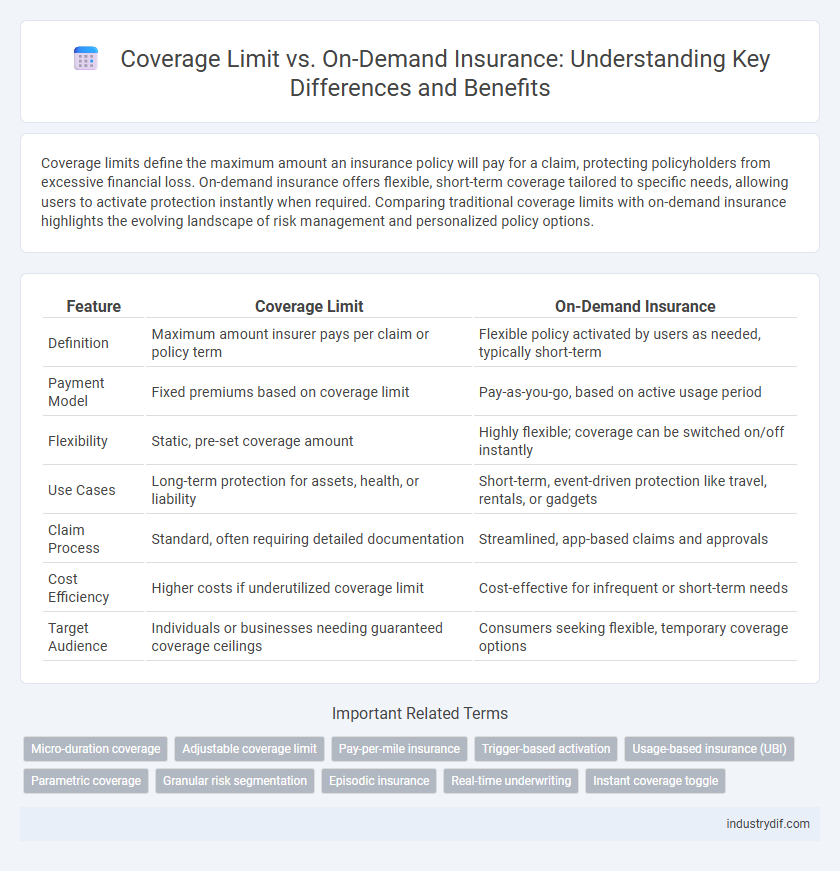

Coverage limits define the maximum amount an insurance policy will pay for a claim, protecting policyholders from excessive financial loss. On-demand insurance offers flexible, short-term coverage tailored to specific needs, allowing users to activate protection instantly when required. Comparing traditional coverage limits with on-demand insurance highlights the evolving landscape of risk management and personalized policy options.

Table of Comparison

| Feature | Coverage Limit | On-Demand Insurance |

|---|---|---|

| Definition | Maximum amount insurer pays per claim or policy term | Flexible policy activated by users as needed, typically short-term |

| Payment Model | Fixed premiums based on coverage limit | Pay-as-you-go, based on active usage period |

| Flexibility | Static, pre-set coverage amount | Highly flexible; coverage can be switched on/off instantly |

| Use Cases | Long-term protection for assets, health, or liability | Short-term, event-driven protection like travel, rentals, or gadgets |

| Claim Process | Standard, often requiring detailed documentation | Streamlined, app-based claims and approvals |

| Cost Efficiency | Higher costs if underutilized coverage limit | Cost-effective for infrequent or short-term needs |

| Target Audience | Individuals or businesses needing guaranteed coverage ceilings | Consumers seeking flexible, temporary coverage options |

Understanding Coverage Limits in Insurance

Coverage limits define the maximum amount an insurance policy will pay for covered losses, directly impacting claim payouts and financial protection. On-demand insurance offers flexible, short-term coverage tailored to specific needs, helping policyholders avoid paying for unnecessary limits. Understanding these limits ensures adequate protection without overpaying, optimizing insurance costs and risk management.

What Is On-Demand Insurance?

On-demand insurance provides flexible, short-term coverage activated only when needed, eliminating the constraints of traditional coverage limits that apply continuously. This insurance model utilizes mobile apps or digital platforms to allow users to purchase tailored policies instantly for specific events or timeframes. By offering protection precisely when risks occur, on-demand insurance enhances cost efficiency and customer control compared to fixed coverage limits.

Key Differences Between Coverage Limit and On-Demand Insurance

Coverage limit defines the maximum amount an insurer will pay for a covered loss or claim, establishing a fixed financial boundary in traditional insurance policies. On-demand insurance offers flexible, short-term coverage activated only when needed, catering to specific, immediate risks without long-term commitments. Key differences include the permanence of coverage limits versus the temporary, usage-based nature of on-demand insurance, impacting cost structure and policy versatility.

Pros and Cons of Traditional Coverage Limits

Traditional coverage limits in insurance offer a fixed maximum payout, providing clear financial boundaries and straightforward policy management for both insurers and policyholders. However, these limits can result in either overpayment for unnecessary coverage or insufficient protection during unexpected high-cost events, leading to potential financial gaps. Unlike on-demand insurance, which offers flexible, usage-based coverage, traditional coverage limits lack adaptability, potentially causing either wasted premiums or coverage shortfalls.

Advantages of On-Demand Insurance Solutions

On-demand insurance offers flexible coverage limits tailored to specific needs and timeframes, reducing unnecessary expenses common with traditional fixed coverage limits. This approach enhances cost efficiency by allowing policyholders to activate protection only when required, minimizing overinsurance and premium costs. Moreover, on-demand insurance provides rapid activation and customization, enabling quick responses to dynamic risk exposures.

How Coverage Limits Affect Your Insurance Premiums

Coverage limits directly influence your insurance premiums by determining the maximum payout your policy provides during a claim, with higher limits leading to increased premium costs due to elevated insurer risk. On-demand insurance offers flexible coverage options that can be adjusted to match specific needs, often allowing policyholders to select coverage limits that balance cost and protection more precisely. Understanding how coverage limits impact premiums enables consumers to tailor their insurance plans, optimizing affordability while ensuring adequate financial protection.

Flexibility of On-Demand Insurance Policies

On-demand insurance policies offer unmatched flexibility by allowing policyholders to activate and deactivate coverage as needed, unlike traditional coverage limits that remain fixed regardless of changing circumstances. This pay-as-you-go model adapts to real-time needs, providing protection tailored to specific events or timeframes without committing to long-term coverage caps. The dynamic nature of on-demand insurance minimizes overpayment and ensures optimal resource allocation by aligning coverage with precise risk exposure.

Choosing Between Coverage Limit and On-Demand Insurance

Selecting between coverage limits and on-demand insurance hinges on the nature of risk exposure and financial flexibility. Coverage limits provide a predefined maximum payout, ideal for predictable, consistent protection needs, while on-demand insurance offers customizable, short-term coverage suited for sporadic or variable risks. Understanding your specific insurance requirements and usage patterns ensures optimal balance between cost efficiency and adequate protection.

Industry Trends: The Rise of On-Demand Insurance

On-demand insurance is rapidly transforming the industry by offering flexible coverage limits tailored to individual needs, diverging from traditional fixed coverage limits. This trend supports consumers seeking personalized protection for specific events or short durations, reflecting a shift toward more dynamic risk management solutions. Insurers leveraging advanced data analytics and mobile technology are driving growth in this segment, meeting the increasing demand for convenience and customization.

Future Outlook: Evolving Coverage Options in Insurance

Coverage limits in traditional insurance policies often set fixed maximum payouts, which can restrict flexibility for policyholders facing diverse risks. On-demand insurance offers dynamic, usage-based coverage that adapts to real-time needs, signaling a significant shift in how policies are structured and accessed. The future outlook in insurance points toward hybrid models combining predefined coverage limits with customizable, on-demand options to enhance personalization and risk management efficiency.

Related Important Terms

Micro-duration coverage

Coverage limits define the maximum payout an insurance policy will provide during its term, whereas on-demand insurance offers flexible, micro-duration coverage tailored to specific, short-term needs. Micro-duration coverage enables policyholders to activate protection for minutes or hours, optimizing cost-efficiency and addressing transient risks without committing to traditional policy periods.

Adjustable coverage limit

Adjustable coverage limits in insurance policies allow policyholders to tailor their protection based on changing needs, providing flexibility beyond fixed coverage limits typically found in traditional insurance. This feature is especially advantageous in on-demand insurance models, enabling users to increase or decrease their coverage instantly without committing to long-term contracts.

Pay-per-mile insurance

Pay-per-mile insurance offers a dynamic coverage model where premiums adjust based on actual miles driven, differing from traditional policies with fixed coverage limits. This on-demand insurance optimizes cost-efficiency for low-mileage drivers by aligning coverage expenses directly with usage, unlike standard policies that maintain a static coverage limit regardless of driving frequency.

Trigger-based activation

Coverage limits define the maximum payout an insurance policy will provide, establishing financial boundaries for claims, whereas on-demand insurance activates based on specific triggers such as time, location, or event, enabling flexible, need-based protection. Trigger-based activation in on-demand insurance dynamically tailors coverage to real-time risk scenarios, reducing unnecessary premiums and enhancing policyholder control.

Usage-based insurance (UBI)

Coverage limits in traditional insurance set fixed maximum payouts regardless of actual usage, whereas on-demand insurance, particularly Usage-Based Insurance (UBI), dynamically adjusts premiums and coverage based on real-time data such as driving behavior or mileage. UBI leverages telematics and IoT technology to optimize risk assessment, offering personalized policies that can lower costs and improve coverage efficiency compared to static limits.

Parametric coverage

Parametric coverage under on-demand insurance offers predefined payout triggers based on specific parameters like weather events, eliminating the uncertainty of traditional coverage limits tied to assessed damages. This streamlined approach ensures rapid claims processing and transparent risk transfer by linking compensation directly to measurable event thresholds rather than subjective loss evaluations.

Granular risk segmentation

Coverage limits set predefined maximum payouts for claims, restricting flexibility in handling diverse risk profiles, whereas on-demand insurance leverages granular risk segmentation to tailor protection dynamically based on specific, real-time exposure levels. This precision in risk assessment enhances cost-efficiency and ensures more accurate alignment of premiums with individual risk characteristics, optimizing coverage effectiveness.

Episodic insurance

Coverage limits in traditional insurance policies set a fixed maximum payout for claims, while on-demand insurance offers flexible, short-term protection tailored to specific needs or events. Episodic insurance, a subset of on-demand insurance, provides coverage only during predefined periods or activities, minimizing costs and maximizing customization for temporary risks.

Real-time underwriting

Coverage limits define the maximum payout an insurance policy will provide, often resulting in fixed protection regardless of evolving risks. On-demand insurance leverages real-time underwriting technology to assess risk instantly, enabling dynamic coverage adjustments that align with the insured's current needs and exposure.

Instant coverage toggle

Coverage limits define the maximum payout an insurance policy offers, while on-demand insurance provides flexible protection activated instantly via a toggle, allowing users to customize their coverage in real time. The instant coverage toggle enhances user control by enabling immediate policy adjustments without waiting for traditional underwriting processes.

Coverage limit vs On-demand insurance Infographic

industrydif.com

industrydif.com