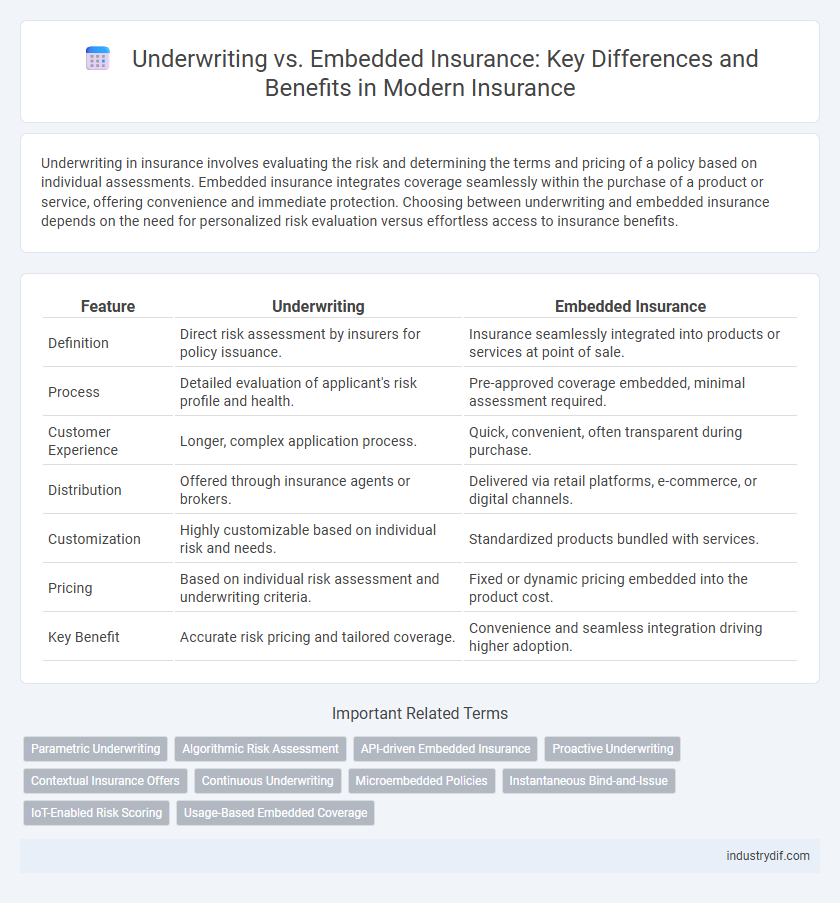

Underwriting in insurance involves evaluating the risk and determining the terms and pricing of a policy based on individual assessments. Embedded insurance integrates coverage seamlessly within the purchase of a product or service, offering convenience and immediate protection. Choosing between underwriting and embedded insurance depends on the need for personalized risk evaluation versus effortless access to insurance benefits.

Table of Comparison

| Feature | Underwriting | Embedded Insurance |

|---|---|---|

| Definition | Direct risk assessment by insurers for policy issuance. | Insurance seamlessly integrated into products or services at point of sale. |

| Process | Detailed evaluation of applicant's risk profile and health. | Pre-approved coverage embedded, minimal assessment required. |

| Customer Experience | Longer, complex application process. | Quick, convenient, often transparent during purchase. |

| Distribution | Offered through insurance agents or brokers. | Delivered via retail platforms, e-commerce, or digital channels. |

| Customization | Highly customizable based on individual risk and needs. | Standardized products bundled with services. |

| Pricing | Based on individual risk assessment and underwriting criteria. | Fixed or dynamic pricing embedded into the product cost. |

| Key Benefit | Accurate risk pricing and tailored coverage. | Convenience and seamless integration driving higher adoption. |

Understanding Underwriting in Insurance

Underwriting in insurance involves assessing risks to determine policy terms, coverage limits, and premium pricing based on detailed evaluation of applicant information and risk factors. This process ensures insurers accurately price policies to balance risk and profitability while protecting against potential losses. Understanding underwriting enables businesses and consumers to navigate insurance products with clearer expectations of coverage and cost implications.

What Is Embedded Insurance?

Embedded insurance integrates coverage directly into the purchase of a product or service, allowing consumers to obtain insurance seamlessly without separate transactions. This approach leverages technology to offer personalized policies at the point of sale, enhancing convenience and reducing friction. By embedding insurance, companies can streamline risk assessment and underwriting processes within their platforms, resulting in faster, more efficient coverage solutions.

Key Differences Between Underwriting and Embedded Insurance

Underwriting involves assessing risk and setting premium prices based on detailed analysis of an individual policyholder's profile, while embedded insurance integrates coverage seamlessly into the purchase of products or services without requiring separate underwriting processes. Key differences include the traditional, individualized risk evaluation in underwriting versus the streamlined, automated approach in embedded insurance that enhances customer experience. Underwriting typically provides customized policies and pricing, whereas embedded insurance offers convenience and immediacy through partnerships with retailers or platforms.

How Underwriting Impacts Risk Assessment

Underwriting plays a critical role in risk assessment by evaluating an applicant's risk profile through detailed analysis of factors such as age, health, occupation, and lifestyle, which directly influences policy terms and premium pricing. This rigorous evaluation process allows insurers to mitigate potential losses by accurately identifying high-risk individuals and customizing coverage accordingly. In contrast, embedded insurance often streamlines underwriting to facilitate seamless integration but may rely on broader risk pools, potentially affecting precision in risk assessment.

The Role of Technology in Embedded Insurance

Technology drives embedded insurance by seamlessly integrating coverage options into digital platforms such as e-commerce, ride-sharing, and travel booking apps, enhancing real-time risk assessment and automated policy issuance. Advanced algorithms and API connectivity enable insurers to tailor products dynamically based on user data, improving underwriting accuracy and customer experience simultaneously. This innovation reduces friction in the purchase process and accelerates claims management, positioning embedded insurance as a transformative force compared to traditional underwriting methods.

Benefits of Automated Underwriting Processes

Automated underwriting processes streamline risk assessment by leveraging advanced algorithms and real-time data analytics, resulting in faster policy approvals and reduced human error. This efficiency enhances customer experience while lowering operational costs and increasing scalability for insurers. Embedded insurance benefits from these automated systems by seamlessly integrating tailored coverage options at the point of sale, improving market penetration and customer convenience.

Embedded Insurance: Enhancing Customer Experience

Embedded insurance integrates coverage seamlessly into the purchase process of products or services, eliminating the need for separate underwriting steps that can delay protection. This approach enhances customer experience by offering immediate, tailored insurance options that align with the buyer's needs, driving convenience and higher satisfaction rates. By streamlining insurance delivery, embedded insurance reduces friction and fosters greater trust and engagement between customers and providers.

Challenges Facing Underwriting in Modern Insurance

Underwriting in modern insurance faces challenges such as increasing data complexity, evolving risk profiles, and the demand for faster policy issuance. Traditional underwriting processes struggle to incorporate real-time data and leverage advanced analytics, leading to inefficiencies and potential inaccuracies. Embedded insurance models offer seamless integration and automation, highlighting the need for underwriting to adapt with innovative technologies and flexible risk assessment methods.

Future Trends: Underwriting vs Embedded Insurance

Underwriting in insurance will increasingly integrate artificial intelligence and machine learning to enhance risk assessment precision and speed, while embedded insurance is expected to expand through seamless API-driven partnerships across digital platforms, providing customers with real-time, context-specific coverage. The convergence of these technologies enables personalized insurance products that anticipate user needs, reduce friction, and foster proactive risk management. Future trends indicate a shift towards hybrid models combining advanced underwriting analytics with embedded insurance's accessibility to drive innovation in customer experience and operational efficiency.

How Insurtech is Redefining Insurance Delivery

Insurtech is revolutionizing underwriting by leveraging AI and data analytics to accelerate risk assessment and enhance pricing accuracy, enabling more personalized insurance products. Embedded insurance integrates coverage seamlessly into customer journeys across e-commerce, travel, and automotive platforms, reducing friction and increasing accessibility. This combination transforms insurance delivery by providing real-time, context-driven protection embedded directly within consumers' everyday purchasing experiences.

Related Important Terms

Parametric Underwriting

Parametric underwriting in insurance leverages predefined triggers based on objective data, such as weather conditions or flight delays, to automate risk assessment and streamline claim settlements. Embedded insurance integrates these parametric models directly within product offerings, enhancing customer experience by providing instant, transparent coverage linked to specific events without traditional paperwork.

Algorithmic Risk Assessment

Algorithmic risk assessment in underwriting leverages machine learning models to evaluate applicant data, enhancing accuracy in predicting claim likelihood and setting premiums. Embedded insurance integrates algorithmic risk evaluation directly within digital platforms, enabling seamless, real-time policy issuance and personalized coverage based on user interactions.

API-driven Embedded Insurance

API-driven embedded insurance integrates underwriting processes directly into digital platforms, enabling real-time risk assessment and policy issuance without interrupting the customer journey. This seamless integration enhances customer experience, reduces operational costs, and accelerates time-to-market for insurers by automating data exchange and underwriting decisions.

Proactive Underwriting

Proactive underwriting leverages advanced data analytics and real-time risk assessment to tailor insurance policies precisely to individual profiles, reducing claim frequency and improving profitability. Embedded insurance integrates coverage seamlessly within product offerings, but proactive underwriting ensures dynamic risk evaluation, enhancing policy accuracy and customer experience beyond static embedded models.

Contextual Insurance Offers

Underwriting in insurance involves assessing risk and determining premiums based on individual policyholder information, while embedded insurance integrates coverage offers directly within the purchase of a product or service, providing contextual insurance offers at the point of sale. Contextual insurance offers leverage real-time data and user intent to deliver personalized insurance options that enhance customer experience and increase conversion rates.

Continuous Underwriting

Continuous underwriting enables real-time risk assessment and policy adjustments throughout the coverage period, enhancing the precision and responsiveness of traditional underwriting methods. Embedded insurance integrates this continuous underwriting process seamlessly within customer journeys, providing personalized coverage without interrupting the user experience.

Microembedded Policies

Microembedded policies integrate underwriting processes directly into digital platforms, enabling real-time risk assessment and personalized coverage without traditional insurance intermediaries. This approach improves efficiency by automating underwriting decisions, reducing costs, and offering tailored microinsurance products seamlessly within everyday transactions.

Instantaneous Bind-and-Issue

Instantaneous bind-and-issue in underwriting enables immediate policy approval and activation, reducing processing time and enhancing customer experience. Embedded insurance integrates this real-time underwriting within digital platforms, allowing seamless, on-the-spot coverage purchase at the point of sale.

IoT-Enabled Risk Scoring

IoT-enabled risk scoring transforms underwriting by providing real-time, granular data that enhances risk assessment accuracy and pricing precision. Embedded insurance leverages this IoT data to offer personalized coverage options seamlessly integrated into products, reducing friction and improving customer experience.

Usage-Based Embedded Coverage

Usage-based embedded insurance integrates real-time data analytics and telematics within underwriting processes to tailor coverage dynamically based on individual risk profiles. This approach enhances risk assessment accuracy and customer personalization by embedding insurance seamlessly into everyday activities such as driving or device usage.

Underwriting vs Embedded Insurance Infographic

industrydif.com

industrydif.com