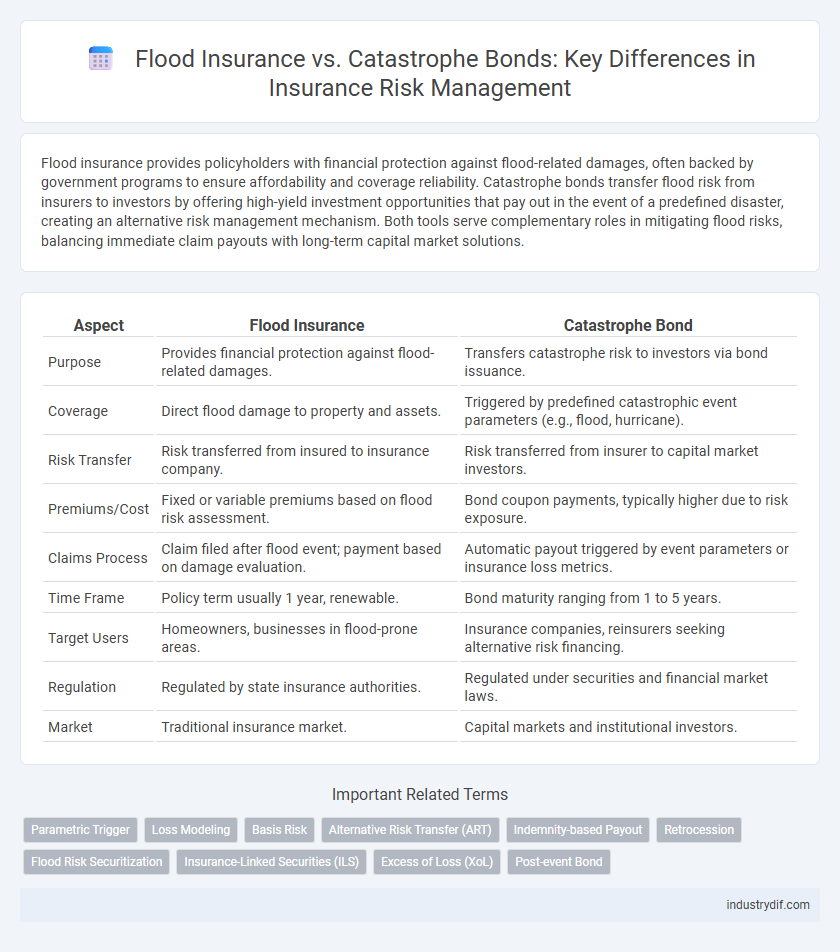

Flood insurance provides policyholders with financial protection against flood-related damages, often backed by government programs to ensure affordability and coverage reliability. Catastrophe bonds transfer flood risk from insurers to investors by offering high-yield investment opportunities that pay out in the event of a predefined disaster, creating an alternative risk management mechanism. Both tools serve complementary roles in mitigating flood risks, balancing immediate claim payouts with long-term capital market solutions.

Table of Comparison

| Aspect | Flood Insurance | Catastrophe Bond |

|---|---|---|

| Purpose | Provides financial protection against flood-related damages. | Transfers catastrophe risk to investors via bond issuance. |

| Coverage | Direct flood damage to property and assets. | Triggered by predefined catastrophic event parameters (e.g., flood, hurricane). |

| Risk Transfer | Risk transferred from insured to insurance company. | Risk transferred from insurer to capital market investors. |

| Premiums/Cost | Fixed or variable premiums based on flood risk assessment. | Bond coupon payments, typically higher due to risk exposure. |

| Claims Process | Claim filed after flood event; payment based on damage evaluation. | Automatic payout triggered by event parameters or insurance loss metrics. |

| Time Frame | Policy term usually 1 year, renewable. | Bond maturity ranging from 1 to 5 years. |

| Target Users | Homeowners, businesses in flood-prone areas. | Insurance companies, reinsurers seeking alternative risk financing. |

| Regulation | Regulated by state insurance authorities. | Regulated under securities and financial market laws. |

| Market | Traditional insurance market. | Capital markets and institutional investors. |

Understanding Flood Insurance: Key Features

Flood insurance provides financial protection against property damage caused by floodwaters, covering structural damage and personal belongings. Key features include coverage limits, waiting periods, and premium rates influenced by flood zone classifications established by the National Flood Insurance Program (NFIP). Policyholders should assess deductibles and exclusions carefully to ensure adequate protection tailored to their flood risk profile.

What Are Catastrophe Bonds?

Catastrophe bonds are risk-linked securities that transfer flood and other disaster risk from insurers to investors, providing a source of capital for insurance claims after major events. These bonds pay high yields but can lose principal if a predefined catastrophe, such as a flood, occurs. Unlike traditional flood insurance, catastrophe bonds enable insurers to manage large-scale risks by tapping into global capital markets, improving financial resilience against extreme losses.

Coverage Differences: Flood Insurance vs Cat Bonds

Flood insurance provides policyholders with direct indemnity for property damage caused specifically by flooding events, ensuring tailored risk coverage within defined geographic areas. Catastrophe bonds transfer flood risk to investors, offering broader financial protection by releasing payouts upon predefined catastrophic triggers, though typically covering aggregated losses rather than individual claims. The fundamental coverage difference lies in flood insurance's detailed, claim-based compensation compared to cat bonds' parametric, event-driven payouts.

Risk Transfer Mechanisms Explained

Flood insurance provides financial protection by transferring the risk of flood-related damages from homeowners to insurers, ensuring coverage against property loss and damage. Catastrophe bonds transfer risk from insurers to the capital markets by allowing investors to absorb losses if a predefined flood event occurs, thus spreading risk beyond traditional insurance pools. Both mechanisms serve as crucial risk transfer tools, with flood insurance offering direct indemnification while catastrophe bonds facilitate alternative risk financing for large-scale flood disasters.

Premium Costs and Pricing Structures

Flood insurance premium costs are typically based on property location, flood risk zones, and coverage limits, with rates regulated by organizations like FEMA's National Flood Insurance Program. Catastrophe bonds have pricing structures influenced by market demand, risk modeling, and investors' return requirements, often resulting in higher initial costs but providing broader risk transfer for insurers. While flood insurance premiums offer predictable periodic payments, catastrophe bonds require upfront capital with pricing tied to the probability and severity of flood events.

Claims Process Comparison

Flood insurance claims typically involve direct assessments by adjusters who evaluate property damage and determine payout based on preset policy limits. Catastrophe bond claims rely on parametric triggers such as rainfall levels or flood height data, enabling faster, model-based payouts without individual loss assessments. The insurance claims process is often slower and more detailed, while catastrophe bond claims prioritize speed and predefined event thresholds for disbursement.

Regulatory Frameworks and Compliance

Flood insurance is governed by stringent regulatory frameworks such as the National Flood Insurance Program (NFIP) in the United States, requiring strict compliance with local floodplain management standards and mandatory disclosures. Catastrophe bonds operate under securities regulations supervised by entities like the SEC, mandating thorough investor disclosures and risk assessments to ensure transparency and adherence to financial compliance standards. Both instruments demand robust compliance mechanisms, but flood insurance emphasizes regulatory adherence to environmental and community resilience guidelines, whereas catastrophe bonds focus on financial and securities law compliance.

Suitability for Businesses and Homeowners

Flood insurance provides direct coverage for property damage caused by flooding, making it essential for homeowners and businesses in high-risk flood zones seeking guaranteed financial protection. Catastrophe bonds offer a risk-transfer mechanism primarily suited for large businesses and insurers looking to offset potential losses from catastrophic events, including floods, through capital market funding. Homeowners typically benefit more from traditional flood insurance policies due to their straightforward claims process and regulatory support, whereas catastrophe bonds serve as a supplementary risk management tool for larger commercial entities.

Advantages and Limitations of Each Option

Flood insurance offers policyholders financial protection against water damage caused by flooding, with standardized coverage and regulatory backing enhancing trust and accessibility. Catastrophe bonds provide insurers and investors with risk transfer mechanisms that can rapidly inject capital post-disaster, although they carry higher complexity and market dependency. While flood insurance ensures predictable indemnity for homeowners, catastrophe bonds offer scalability and liquidity but depend on trigger conditions and investor appetite.

Future Trends in Disaster Risk Financing

Flood insurance is evolving with advanced risk modeling and real-time data integration, enhancing coverage precision and affordability. Catastrophe bonds are increasingly attractive to investors seeking to diversify portfolios while transferring disaster risk, driven by climate change-induced hazard intensification. Emerging trends indicate a hybrid approach combining traditional flood insurance with parametric triggers and catastrophe bonds to improve resilience and financial stability in disaster risk financing.

Related Important Terms

Parametric Trigger

Flood insurance often relies on parametric triggers such as specific rainfall thresholds or river levels to initiate payouts, ensuring rapid claims processing without loss adjustment delays. Catastrophe bonds use similar parametric triggers based on predefined flood metrics, enabling instant investor payouts and transferring risk efficiently from insurers to capital markets.

Loss Modeling

Flood insurance relies on sophisticated loss modeling techniques using hydrological data, historical flood records, and climate projections to estimate potential claims and set premiums accurately. Catastrophe bonds employ probabilistic catastrophe models combining hazard, exposure, and vulnerability data to quantify expected losses, allowing investors and insurers to transfer and manage flood risk efficiently.

Basis Risk

Flood insurance reduces financial loss from flood events but often involves basis risk when actual damages exceed coverage limits or differ from modeled risk parameters. Catastrophe bonds transfer flood risk to investors, minimizing insurer exposure, yet basis risk arises if the bond's payout triggers are misaligned with insured losses, potentially leaving gaps in protection.

Alternative Risk Transfer (ART)

Flood insurance provides traditional risk coverage against water damage with predefined premiums and claims processes, while catastrophe bonds (cat bonds) represent an Alternative Risk Transfer (ART) mechanism allowing insurers to transfer flood risks to capital markets, reducing balance sheet exposure. CAT bonds offer investors high yields linked to specific flood events, creating a market-driven risk-sharing model that complements conventional flood insurance policies.

Indemnity-based Payout

Flood insurance provides indemnity-based payouts directly tied to the actual loss incurred by policyholders due to flood damage, ensuring precise compensation for repair and replacement costs. Catastrophe bonds, in contrast, offer parametric or index-based payouts triggered by predefined event parameters, which may not always reflect the exact loss suffered by insured parties.

Retrocession

Flood insurance provides direct financial protection to policyholders against flood-related damages, while catastrophe bonds serve as risk transfer instruments for insurers seeking to mitigate large-scale losses by transferring risk to capital markets. Retrocession acts as a secondary layer of reinsurance, allowing flood insurance providers and catastrophe bond issuers to manage their exposure further by passing on portions of risk to retrocessionaires, enhancing overall risk diversification and capital efficiency.

Flood Risk Securitization

Flood insurance provides policyholders with financial protection against flood-related damages by transferring flood risk to insurers, whereas catastrophe bonds (cat bonds) enable insurers and governments to securitize flood risk by raising capital from investors who assume the potential losses. Flood risk securitization through cat bonds enhances market liquidity and risk diversification, offering an alternative risk transfer mechanism beyond traditional insurance models.

Insurance-Linked Securities (ILS)

Flood insurance provides policyholders with financial protection against flood-related damages, while catastrophe bonds (cat bonds) represent a form of Insurance-Linked Securities (ILS) that transfer flood risk from insurers to capital market investors. ILS like cat bonds enable insurers to manage flood risk exposure efficiently by tapping into alternative risk transfer mechanisms, enhancing market liquidity and disaster resilience.

Excess of Loss (XoL)

Excess of Loss (XoL) in flood insurance provides coverage above a specified loss threshold, mitigating the insurer's risk exposure during significant flooding events, whereas catastrophe bonds transfer this risk to capital markets by triggering payouts only when losses exceed a defined retention limit. XoL structures allow traditional insurers to retain manageable losses on flood claims, while catastrophe bonds offer alternative risk financing by spreading flood catastrophe risk among investors.

Post-event Bond

Flood insurance provides policyholders with direct compensation for damages after flooding events, ensuring financial recovery through predefined claims processes. Post-event catastrophe bonds transfer the risk to investors by triggering payouts only when specific flood-related losses exceed predetermined thresholds, enabling insurers to quickly access capital for large-scale disaster response.

Flood Insurance vs Catastrophe Bond Infographic

industrydif.com

industrydif.com