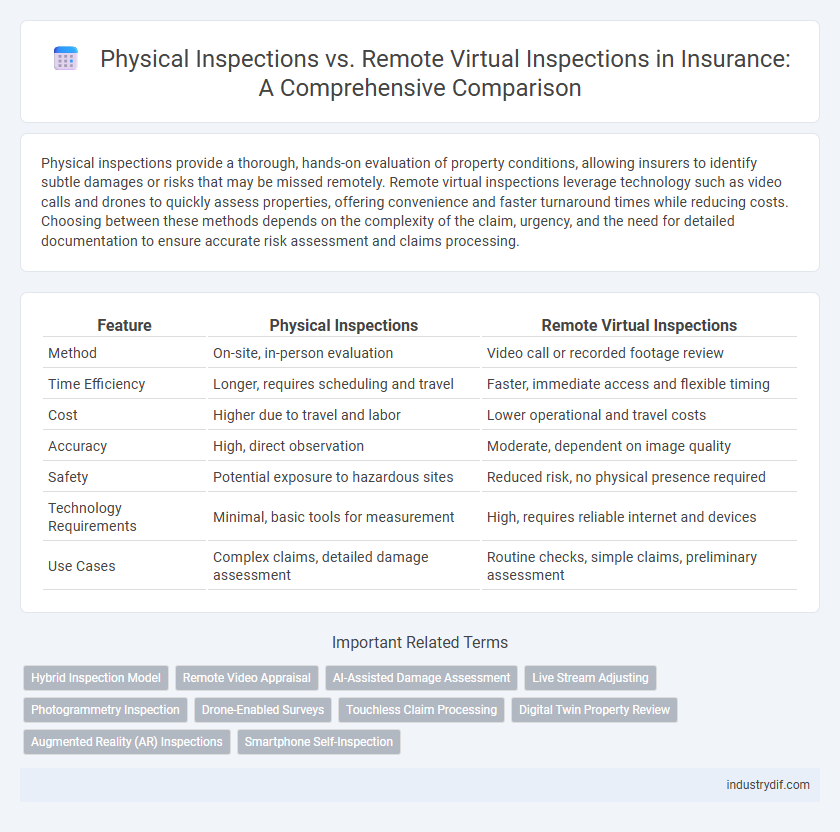

Physical inspections provide a thorough, hands-on evaluation of property conditions, allowing insurers to identify subtle damages or risks that may be missed remotely. Remote virtual inspections leverage technology such as video calls and drones to quickly assess properties, offering convenience and faster turnaround times while reducing costs. Choosing between these methods depends on the complexity of the claim, urgency, and the need for detailed documentation to ensure accurate risk assessment and claims processing.

Table of Comparison

| Feature | Physical Inspections | Remote Virtual Inspections |

|---|---|---|

| Method | On-site, in-person evaluation | Video call or recorded footage review |

| Time Efficiency | Longer, requires scheduling and travel | Faster, immediate access and flexible timing |

| Cost | Higher due to travel and labor | Lower operational and travel costs |

| Accuracy | High, direct observation | Moderate, dependent on image quality |

| Safety | Potential exposure to hazardous sites | Reduced risk, no physical presence required |

| Technology Requirements | Minimal, basic tools for measurement | High, requires reliable internet and devices |

| Use Cases | Complex claims, detailed damage assessment | Routine checks, simple claims, preliminary assessment |

Overview: Physical Inspections vs Remote Virtual Inspections

Physical inspections involve on-site evaluations by trained professionals to assess property conditions, damage, or risk factors, ensuring comprehensive and accurate data collection. Remote virtual inspections use video technology and digital tools to conduct real-time assessments, increasing efficiency and reducing travel costs while maintaining a high level of detail. Both methods aim to improve claim processing and underwriting accuracy, but remote virtual inspections offer scalability and faster turnaround times in the insurance industry.

Key Differences Between Physical and Virtual Inspections

Physical inspections require on-site visits by insurance adjusters to assess property damage, allowing direct interaction with the insured and real-time observation of conditions. Remote virtual inspections utilize digital tools such as video calls and photos to evaluate claims quickly, reducing time and costs but potentially limiting the accuracy of damage assessment. Key differences include the immediacy of physical presence versus the convenience and speed of remote technology, impacting claim processing efficiency and customer experience.

Technology Advancements in Remote Virtual Inspections

Technology advancements in remote virtual inspections have revolutionized the insurance industry by enabling real-time, high-resolution video assessments and AI-driven damage analysis. These innovations streamline claim processing while reducing the need for on-site visits, improving efficiency and customer satisfaction. Enhanced mobile devices, drones, and IoT sensors further support accurate data collection without physical presence.

Cost Implications: Physical vs Remote Virtual Inspections

Physical inspections in insurance typically incur higher costs due to travel expenses, labor hours, and equipment usage, often ranging from $150 to $300 per inspection. Remote virtual inspections leverage digital technology, significantly reducing these expenses by minimizing onsite visits and enabling quicker assessment turnaround times. Insurers report up to 40% cost savings with remote inspections, improving operational efficiency without compromising accuracy.

Accuracy and Reliability in Inspection Methods

Physical inspections provide direct, hands-on evaluation of insured properties, offering high accuracy through real-time assessment of damages, structural integrity, and environmental factors. Remote virtual inspections utilize high-resolution images and video feeds, enabling insurers to quickly gather data and reduce human error, but may miss subtle details visible only in person. Combining both methods enhances reliability by leveraging comprehensive physical verification with the efficiency of remote technology.

Compliance and Regulatory Considerations

Physical inspections ensure thorough regulatory compliance by allowing on-site verification of insured assets, aligning with stringent industry standards and legal requirements. Remote virtual inspections leverage digital tools and real-time video, offering efficiency while maintaining compliance through secure data handling and documented evidence protocols. Insurers must balance traditional physical audits with virtual methods to satisfy evolving regulatory frameworks and protect policyholder interests.

Customer Experience and Convenience

Physical inspections offer hands-on assessments providing thorough risk evaluation, but they often require customers to schedule appointments and accommodate on-site visits, which can be time-consuming and inconvenient. Remote virtual inspections leverage digital technology, allowing customers to complete evaluations from their location with greater flexibility, enhancing convenience and reducing wait times. This shift not only improves customer satisfaction by minimizing disruptions but also enables faster claim processing and policy underwriting.

Risk Assessment and Fraud Detection Capabilities

Physical inspections enable in-depth risk assessment through direct observation of property conditions, identifying hidden damages or hazards that might not be visible remotely. Remote virtual inspections leverage advanced imaging technologies and AI-driven analytics to detect anomalies and inconsistencies, enhancing fraud detection by analyzing data patterns and reducing subjective errors. Combining both methods optimizes comprehensive risk evaluation and strengthens fraud prevention strategies in the insurance industry.

Data Security and Privacy in Virtual Inspections

Remote virtual inspections enhance data security and privacy by integrating end-to-end encryption and secure cloud storage, reducing risks associated with physical document handling. Advanced authentication protocols and real-time monitoring ensure that only authorized personnel access sensitive client information during virtual assessments. These measures create a safer environment compared to traditional physical inspections, mitigating the chances of data breaches and unauthorized disclosures.

Future Trends in Insurance Inspection Practices

Physical inspections in insurance are being increasingly supplemented by remote virtual inspections, leveraging advanced technologies like AI, drones, and high-resolution imaging to enhance accuracy and efficiency. Future trends emphasize integrating real-time data analytics and machine learning to enable predictive risk assessments and faster claims processing. This shift reduces operational costs and improves customer experience by offering quicker, safer, and more flexible inspection options.

Related Important Terms

Hybrid Inspection Model

The hybrid inspection model in insurance combines physical inspections with remote virtual inspections to enhance accuracy, reduce costs, and speed up claim processing. Leveraging technology such as drones, mobile apps, and video calls allows insurers to maintain thorough assessments while benefiting from increased flexibility and customer convenience.

Remote Video Appraisal

Remote video appraisal enhances efficiency in insurance claim processing by enabling real-time, high-resolution visual assessments without the need for physical site visits, reducing costs and speeding up settlements. Advanced remote virtual inspections leverage AI-driven analytics and secure video streaming to improve accuracy in damage evaluation while maintaining compliance with industry standards.

AI-Assisted Damage Assessment

AI-assisted damage assessment in remote virtual inspections enhances accuracy and efficiency by utilizing machine learning algorithms to analyze images and sensor data in real-time. This technology reduces the need for physical inspections, lowers operational costs, and speeds up claims processing while improving risk evaluation.

Live Stream Adjusting

Live stream adjusting in insurance remote virtual inspections enhances claim accuracy by enabling real-time interaction between adjusters and policyholders, reducing the need for physical inspections. This technology accelerates claim processing, minimizes fraud risk, and improves customer satisfaction through immediate, transparent communication.

Photogrammetry Inspection

Photogrammetry inspection leverages high-resolution images and advanced software to create detailed 3D models of insured properties, enabling precise damage assessment without requiring physical presence. This remote virtual inspection method enhances accuracy and efficiency while reducing costs and safety risks associated with traditional physical inspections.

Drone-Enabled Surveys

Drone-enabled surveys in insurance claims offer precise, high-resolution aerial imagery that enhances risk assessment and damage evaluation while reducing the need for time-consuming physical inspections. These remote virtual inspections improve safety by minimizing onsite personnel exposure and expedite claim processing through real-time data transmission and automated analytics.

Touchless Claim Processing

Touchless claim processing leverages remote virtual inspections to expedite claim assessments, reducing the need for physical presence and minimizing contact. This digital approach enhances efficiency, improves customer safety, and enables faster settlement by utilizing high-resolution images and real-time video feeds for accurate damage evaluation.

Digital Twin Property Review

Digital Twin Property Review leverages advanced 3D modeling and IoT data to create accurate virtual replicas, enabling insurers to conduct remote virtual inspections with greater precision and efficiency compared to traditional physical inspections. This technology reduces inspection time, minimizes human error, and improves risk assessment by providing real-time, detailed property analytics.

Augmented Reality (AR) Inspections

Augmented Reality (AR) inspections in insurance combine physical inspections with advanced remote virtual capabilities, enabling adjusters to overlay digital information on real-world environments for precise damage assessments. This technology improves accuracy, speeds up claim processing, and reduces the need for in-person visits, enhancing overall operational efficiency.

Smartphone Self-Inspection

Smartphone self-inspection enhances insurance claims processing by enabling policyholders to capture accurate, real-time images and videos of physical damages, reducing the need for in-person physical inspections and accelerating claim settlements. This remote virtual inspection method leverages advanced mobile technology and AI analysis to increase efficiency, minimize fraud, and improve customer satisfaction.

Physical Inspections vs Remote Virtual Inspections Infographic

industrydif.com

industrydif.com