Insurance brokers offer personalized advice and tailored coverage options by directly interacting with clients, ensuring a human touch in complex risk assessment. Insurtech leverages advanced technology platforms to provide faster, more efficient policy management and claims processing, enhancing customer convenience and reducing costs. Choosing between a broker and insurtech depends on the need for personalized guidance versus digital efficiency in insurance services.

Table of Comparison

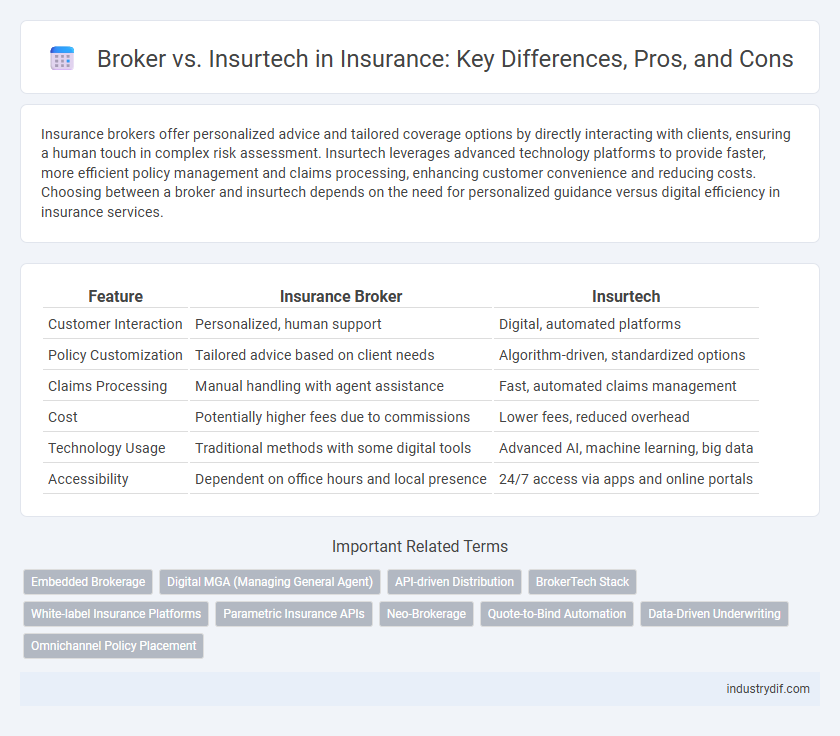

| Feature | Insurance Broker | Insurtech |

|---|---|---|

| Customer Interaction | Personalized, human support | Digital, automated platforms |

| Policy Customization | Tailored advice based on client needs | Algorithm-driven, standardized options |

| Claims Processing | Manual handling with agent assistance | Fast, automated claims management |

| Cost | Potentially higher fees due to commissions | Lower fees, reduced overhead |

| Technology Usage | Traditional methods with some digital tools | Advanced AI, machine learning, big data |

| Accessibility | Dependent on office hours and local presence | 24/7 access via apps and online portals |

Understanding Insurance Brokers

Insurance brokers act as intermediaries between clients and insurance companies, providing personalized advice and helping to identify the best policies tailored to individual needs. They possess in-depth knowledge of various insurance products, enabling clients to navigate complex terms and conditions while ensuring optimal coverage. Unlike Insurtech platforms that rely on automated algorithms and digital interfaces, brokers deliver human expertise and personalized service crucial for complex or high-value insurance decisions.

Defining Insurtech Companies

Insurtech companies leverage advanced technology such as AI, big data, and blockchain to innovate insurance products, improve underwriting accuracy, and streamline claims processing. Unlike traditional brokers who focus on personalized client relationships and risk assessment, insurtech firms emphasize automation, digital platforms, and scalable solutions to enhance customer experience. These companies disrupt conventional insurance models by offering on-demand policies, faster service, and data-driven pricing strategies.

Traditional Brokerage Model Explained

The traditional brokerage model relies on human brokers who act as intermediaries between clients and insurance providers, offering personalized advice and tailored policy options. Brokers leverage deep industry knowledge to navigate complex insurance products, ensuring clients receive coverage that fits their unique needs. This model emphasizes relationship-building and trust, often involving manual processes and face-to-face consultations.

Innovative Approaches by Insurtech

Insurtech leverages advanced technologies such as AI, machine learning, and blockchain to streamline underwriting, claims processing, and customer engagement, offering faster and more personalized insurance solutions compared to traditional brokers. These digital platforms utilize data analytics to assess risks more accurately and enable real-time pricing, enhancing transparency and efficiency in policy management. By automating routine tasks and providing seamless user interfaces, insurtech companies reduce operational costs while improving customer satisfaction and accessibility.

Key Differences: Broker vs Insurtech

Insurance brokers act as intermediaries who provide personalized advice, comparing multiple insurance policies to find the best coverage tailored to clients' needs. Insurtech companies leverage technology such as AI, big data, and automation to streamline insurance processes, offering faster service, digital claims handling, and often lower costs. While brokers emphasize human expertise and bespoke solutions, insurtech focuses on efficiency, scalability, and innovative digital platforms.

Benefits of Working with Brokers

Working with insurance brokers offers personalized advice tailored to individual risk profiles and coverage needs, ensuring optimal protection. Brokers access multiple insurance carriers, providing competitive pricing and diverse policy options that insurtech platforms may lack. Their expert negotiation skills and claims advocacy enhance customer support, delivering a more comprehensive and trusted insurance experience.

Advantages of Using Insurtech Solutions

Insurtech solutions leverage advanced technologies like AI and big data to streamline insurance processes, providing faster claim approvals and personalized policy recommendations. These digital platforms improve customer experience through 24/7 accessibility and automated support, reducing operational costs for insurers and lower premiums for policyholders. Integration of blockchain enhances security and transparency, making insurtech a powerful alternative to traditional brokers in today's insurance market.

Impact on Customer Experience

Brokers traditionally offer personalized advice and tailored insurance solutions, enhancing customer trust and satisfaction through human interaction. Insurtech leverages advanced technologies like AI and automation to streamline processes, providing faster quotes, easier claims, and 24/7 accessibility. Combining broker expertise with insurtech innovations significantly elevates customer experience by ensuring both personalized service and operational efficiency.

Regulatory Challenges and Compliance

Brokers face stringent regulatory requirements including licensure, fiduciary duties, and adherence to state-specific insurance laws, which create a complex compliance landscape. Insurtech companies encounter evolving regulations around data privacy, cybersecurity, and the use of AI in underwriting and claims processing. Navigating these regulatory challenges requires brokers and insurtech firms to invest heavily in compliance technologies and legal expertise to mitigate risks and avoid penalties.

The Future Landscape: Collaboration or Competition?

The future landscape of insurance will likely feature a dynamic interplay between brokers and insurtech companies, where collaboration harnesses brokers' personalized expertise and insurtech's advanced data analytics and automation. Insurtech innovations such as AI-driven risk assessment and blockchain-based claims processing enhance efficiency, while brokers offer tailored advice and human trust crucial for complex policies. Industry forecasts predict hybrid models becoming dominant, blending digital platforms with broker networks to optimize customer experience and market reach.

Related Important Terms

Embedded Brokerage

Embedded brokerage integrates insurance brokerage services directly within digital platforms, streamlining policy purchase and claims processing for consumers. This approach leverages insurtech innovations to enhance customer experience, reduce costs, and provide tailored coverage solutions compared to traditional broker-mediated insurance.

Digital MGA (Managing General Agent)

Digital MGAs leverage advanced technology platforms to streamline underwriting, policy management, and claims processing, offering faster, more personalized insurance solutions compared to traditional brokers. In contrast, brokers primarily act as intermediaries between clients and insurers, relying on established relationships and manual processes rather than automated digital tools to tailor coverage options.

API-driven Distribution

API-driven distribution enables insurtech platforms to streamline insurance product offerings by integrating multiple carriers seamlessly, enhancing customer access and operational efficiency. Traditional brokers, while relying on personal relationships and expertise, increasingly adopt API technologies to maintain competitiveness and offer real-time pricing and policy management.

BrokerTech Stack

BrokerTech stacks integrate CRM systems, data analytics, and automation tools to streamline client management and policy issuance, enhancing the efficiency and personalization of traditional insurance brokers. Insurtech companies leverage advanced AI, machine learning, and digital platforms to disrupt underwriting, claims processing, and customer engagement, but BrokerTech remains crucial for combining technology with human expertise in complex risk assessments and customized insurance solutions.

White-label Insurance Platforms

White-label insurance platforms enable insurtech firms to offer customized insurance products without building infrastructure from scratch, streamlining market entry and reducing operational costs. Traditional brokers benefit from these platforms by expanding their digital presence and delivering tailored policies efficiently, blending personalized service with advanced technology.

Parametric Insurance APIs

Parametric Insurance APIs enable seamless integration of automated, data-driven claims processing that enhances efficiency compared to traditional broker-mediated insurance models. Insurtech platforms leverage these APIs to deliver real-time risk assessment and instant payouts, transforming customer experience and operational scalability in the insurance industry.

Neo-Brokerage

Neo-brokerage in insurance leverages advanced digital platforms and AI algorithms to streamline policy comparison, purchasing, and claims processing, disrupting traditional brokers who rely on personalized human interaction. Insurtech startups driving neo-brokerage emphasize seamless customer experience, real-time premium adjustments, and automated underwriting, offering greater efficiency and data-driven insights than conventional brokerage models.

Quote-to-Bind Automation

Quote-to-bind automation in insurance significantly accelerates the policy issuance process by reducing manual intervention through digital workflows, artificial intelligence, and real-time data integration. While traditional brokers rely on personalized service and negotiation, insurtech platforms leverage automated quoting engines and seamless binding capabilities to enhance efficiency, minimize errors, and improve customer experience.

Data-Driven Underwriting

Data-driven underwriting leverages advanced analytics and artificial intelligence to assess risk more accurately and efficiently than traditional brokers, who rely heavily on experience and manual processes. Insurtech companies utilize vast datasets and machine learning models to personalize policies, reduce fraud, and streamline claims, significantly enhancing underwriting precision and customer satisfaction.

Omnichannel Policy Placement

Insurance brokers leverage personalized expertise and established client relationships to navigate complex coverage needs, while insurtech platforms excel in omnichannel policy placement by integrating digital tools such as AI-driven quote comparison, mobile apps, and seamless online purchasing experiences to streamline access and improve efficiency. Combining broker insights with insurtech's omnichannel capabilities enhances customer engagement and accelerates policy issuance through real-time data synchronization across multiple channels.

Broker vs Insurtech Infographic

industrydif.com

industrydif.com