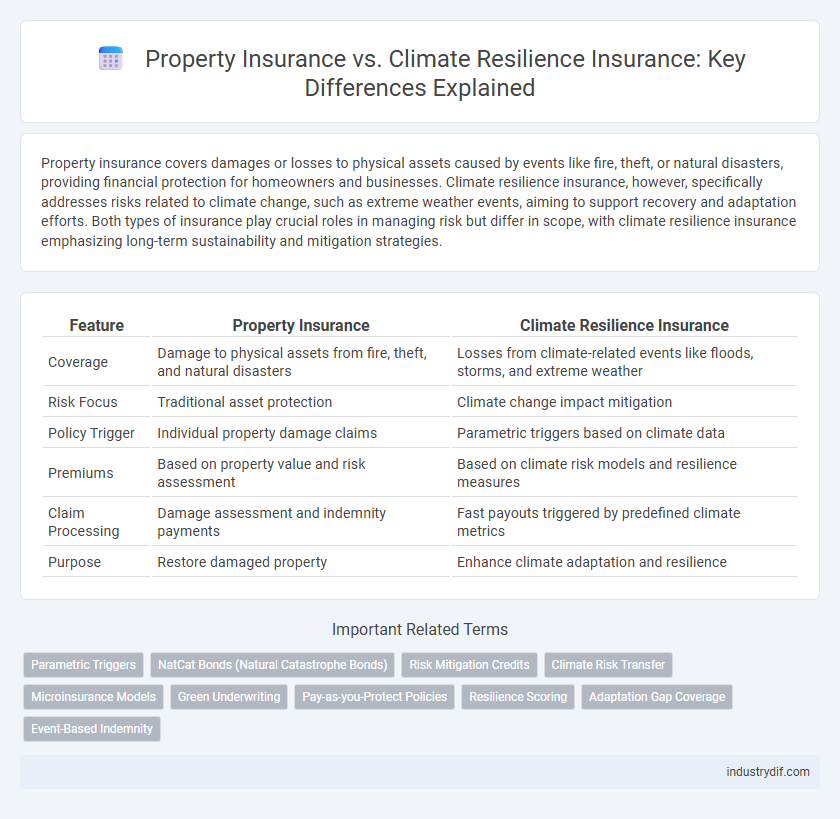

Property insurance covers damages or losses to physical assets caused by events like fire, theft, or natural disasters, providing financial protection for homeowners and businesses. Climate resilience insurance, however, specifically addresses risks related to climate change, such as extreme weather events, aiming to support recovery and adaptation efforts. Both types of insurance play crucial roles in managing risk but differ in scope, with climate resilience insurance emphasizing long-term sustainability and mitigation strategies.

Table of Comparison

| Feature | Property Insurance | Climate Resilience Insurance |

|---|---|---|

| Coverage | Damage to physical assets from fire, theft, and natural disasters | Losses from climate-related events like floods, storms, and extreme weather |

| Risk Focus | Traditional asset protection | Climate change impact mitigation |

| Policy Trigger | Individual property damage claims | Parametric triggers based on climate data |

| Premiums | Based on property value and risk assessment | Based on climate risk models and resilience measures |

| Claim Processing | Damage assessment and indemnity payments | Fast payouts triggered by predefined climate metrics |

| Purpose | Restore damaged property | Enhance climate adaptation and resilience |

Defining Property Insurance and Climate Resilience Insurance

Property insurance provides financial protection against risks such as theft, fire, and natural disasters that directly damage physical assets like homes and businesses. Climate resilience insurance specifically targets losses resulting from climate-related events, including floods, hurricanes, and wildfires, promoting recovery and adaptation in vulnerable regions. Both types of insurance are essential for mitigating financial exposure, but climate resilience insurance emphasizes proactive risk management tied to evolving environmental conditions.

Key Differences Between Property and Climate Resilience Insurance

Property insurance primarily covers damage or loss to physical assets caused by perils such as fire, theft, and natural disasters, providing financial compensation based on the insured property's value. Climate resilience insurance goes beyond traditional coverage by incorporating risk assessment tied to climate change impacts, promoting adaptive measures that reduce vulnerability to extreme weather events and long-term environmental shifts. While property insurance focuses on compensation post-damage, climate resilience insurance emphasizes proactive risk reduction and sustainable recovery strategies in the face of evolving climate threats.

Coverage Scope: Traditional vs. Climate-Focused Policies

Property insurance typically covers damages from common risks like fire, theft, and natural disasters under clearly defined perils, ensuring broad protection for residential and commercial assets. Climate resilience insurance, by contrast, focuses on emerging climate-related risks such as extreme weather events, flood-related damages, and long-term environmental changes, providing adaptive coverage tailored to evolving climate patterns. This climate-focused approach often includes preventive measures and risk mitigation incentives to enhance insured parties' resilience against future climate impacts.

Risk Assessment Methods in Property vs. Climate Resilience Insurance

Property insurance risk assessment primarily relies on historical loss data, structural vulnerability analysis, and conventional hazard modeling to estimate potential damages. Climate resilience insurance incorporates dynamic climate models, forward-looking scenario analysis, and environmental stress testing to evaluate risks posed by evolving climate patterns. This approach enhances predictive accuracy by integrating real-time climate data and adaptive risk factors beyond traditional property insurance methods.

Premium Calculations and Cost Implications

Property insurance premium calculations primarily depend on factors such as property value, location, construction materials, and historical claim data, which establish the baseline risk and cost. Climate resilience insurance integrates advanced climate risk models, incorporating variables like flood projections, wildfire frequency, and extreme weather event likelihood, resulting in premiums that reflect dynamic environmental threats and encourage proactive mitigation. Costs for climate resilience insurance tend to be higher initially but offer long-term savings by reducing potential disaster losses and incentivizing investments in climate-adaptive property improvements.

Claims Processes: Standard vs. Climate Event Responses

Property insurance claims processes typically follow standardized assessment protocols and predefined damage evaluation criteria, facilitating faster settlements for common risks like fire or theft. Climate resilience insurance claims involve specialized procedures that address complex, large-scale climate events such as floods, hurricanes, and wildfires, often requiring advanced climate impact analytics and adaptive response frameworks. Insurers incorporating climate resilience models enhance claim accuracy and expedite recovery by integrating real-time environmental data and predictive risk mapping during the claims adjustment process.

Policyholder Responsibilities and Commitment

Policyholders under property insurance must maintain and protect their assets according to standard safety regulations to ensure coverage validity. Climate resilience insurance requires an active commitment to implementing adaptive measures that reduce vulnerability to climate-related risks. Both types emphasize proactive risk management but climate resilience insurance demands continuous engagement in sustainability and mitigation efforts.

Industry Trends Driving Climate Resilience Insurance

Rising global climate risks and increasing frequency of natural disasters drive rapid growth in climate resilience insurance, emphasizing proactive risk management over traditional property insurance's reactive coverage. Insurers are integrating advanced climate modeling and sustainability metrics to tailor policies that incentivize adaptive infrastructure and reduce long-term losses. Regulatory pressures and evolving stakeholder expectations further accelerate adoption of climate resilience insurance solutions across real estate, agriculture, and critical infrastructure sectors.

Regulatory and Compliance Considerations

Property insurance policies must align with regional regulatory frameworks governing property damage, loss assessment, and claim settlements, ensuring compliance with local insurance acts and consumer protection laws. Climate resilience insurance requires adherence to evolving environmental regulations, including mandatory reporting on climate-related risks and compliance with international climate agreements, which influence premium calculations and coverage terms. Regulatory bodies increasingly mandate that insurers incorporate climate risk disclosures and resilience measures, promoting transparency and encouraging policyholders to adopt sustainable practices.

Future Outlook: The Evolving Insurance Landscape

Property insurance continues to adapt to increasing climate-related risks by incorporating more comprehensive coverage options and advanced risk assessment technologies. Climate resilience insurance is emerging as a vital product, emphasizing proactive risk mitigation and incentivizing sustainable practices to reduce long-term losses. The future insurance landscape will likely prioritize dynamic, data-driven models that integrate climate science to enhance coverage accuracy and affordability.

Related Important Terms

Parametric Triggers

Parametric triggers in property insurance rely on predefined thresholds of physical parameters like wind speed or rainfall to initiate payouts, providing faster claim settlements compared to traditional indemnity methods. Climate resilience insurance integrates advanced parametric models that account for evolving climate risk data, enhancing coverage accuracy and encouraging proactive infrastructure adaptation.

NatCat Bonds (Natural Catastrophe Bonds)

Natural Catastrophe Bonds (NatCat Bonds) provide a financial mechanism for property insurance by transferring risk from insurers to investors, enabling property insurers to manage large-scale losses from natural disasters. Climate Resilience Insurance, enhanced by NatCat Bonds, focuses on proactive risk reduction and recovery funding, supporting communities facing climate-induced catastrophes beyond traditional property damage coverage.

Risk Mitigation Credits

Property insurance offers financial protection against structures and belongings damaged by unforeseen events, while climate resilience insurance incorporates risk mitigation credits that reward policyholders for implementing adaptive measures such as flood barriers or fire-resistant materials. These credits reduce premiums by quantifying proactive efforts to minimize climate-related risks, incentivizing sustainable risk management practices amidst increasing environmental uncertainties.

Climate Risk Transfer

Climate Resilience Insurance focuses on proactive climate risk transfer by integrating adaptive strategies to mitigate financial losses from extreme weather events, unlike traditional Property Insurance that primarily offers compensation after damage occurs. This innovative approach enhances long-term asset protection and supports sustainable recovery by addressing climate vulnerabilities before they impact insured properties.

Microinsurance Models

Microinsurance models in property insurance primarily provide affordable, basic coverage for low-income households against common risks such as fire, theft, or natural disasters. Climate resilience insurance, integrated within microinsurance frameworks, offers adaptive solutions that not only mitigate immediate losses from climate-related events but also support recovery and long-term resilience through payout triggers based on weather indices or environmental data.

Green Underwriting

Property Insurance primarily covers physical damages to assets from traditional risks, while Climate Resilience Insurance emphasizes adaptive measures and financial protection against climate-induced hazards by incorporating green underwriting criteria. Green underwriting integrates environmental risk assessments and sustainability factors to promote investments in climate-resilient properties, reducing long-term exposure and fostering eco-friendly infrastructure development.

Pay-as-you-Protect Policies

Pay-as-you-protect policies in property insurance offer flexible premium payments aligned with real-time risk factors, enhancing affordability and customization. Climate resilience insurance integrates these plans to incentivize proactive risk reduction measures, mitigating losses from extreme weather events and climate change impacts.

Resilience Scoring

Property insurance primarily covers physical damage and loss from events like fire, theft, or natural disasters, while climate resilience insurance incorporates resilience scoring to assess a property's ability to withstand climate-related risks and reduce potential claims. Resilience scoring evaluates factors such as building materials, infrastructure robustness, and adaptive measures, providing insurers with data-driven insights to price policies more accurately and encourage proactive risk management.

Adaptation Gap Coverage

Property insurance traditionally covers damages from sudden events like fires or storms, but often excludes long-term climate risks, creating an adaptation gap. Climate resilience insurance specifically addresses this gap by incorporating coverage for gradual environmental changes and adaptive measures, helping policyholders manage risks associated with climate change impacts.

Event-Based Indemnity

Property insurance provides financial compensation for direct losses caused by covered perils such as fire or theft, whereas climate resilience insurance specifically addresses event-based indemnity by covering damages from climate-related events like floods, hurricanes, or droughts, promoting adaptive risk management. Event-based indemnity in climate resilience insurance often includes parametric triggers linked to quantifiable climate indicators, ensuring faster payouts and enhanced recovery for policyholders facing increasingly frequent and severe weather events.

Property Insurance vs Climate Resilience Insurance Infographic

industrydif.com

industrydif.com