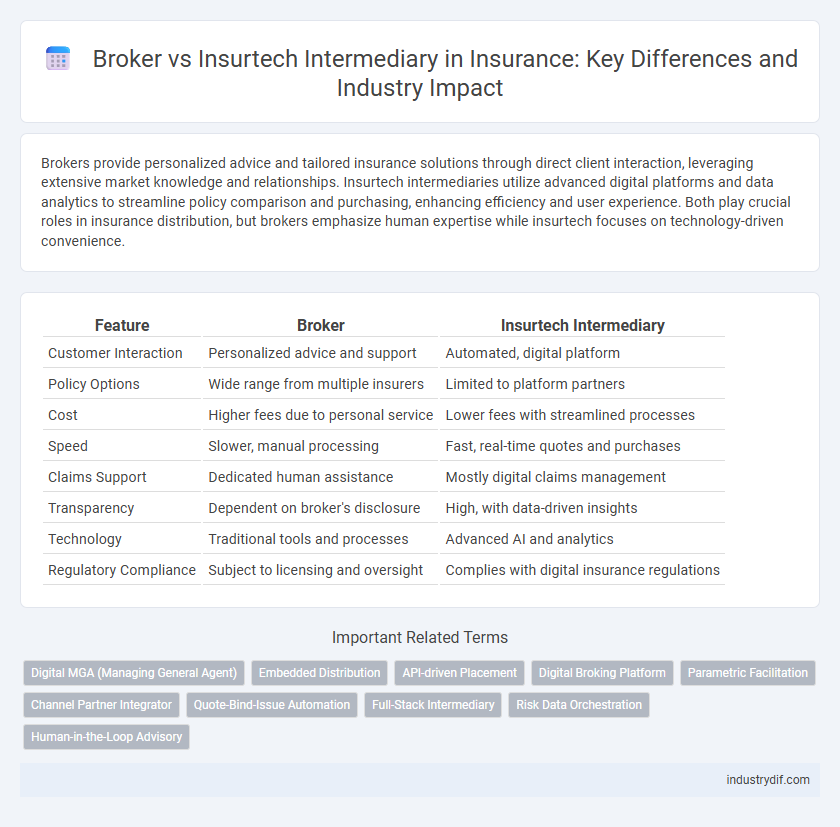

Brokers provide personalized advice and tailored insurance solutions through direct client interaction, leveraging extensive market knowledge and relationships. Insurtech intermediaries utilize advanced digital platforms and data analytics to streamline policy comparison and purchasing, enhancing efficiency and user experience. Both play crucial roles in insurance distribution, but brokers emphasize human expertise while insurtech focuses on technology-driven convenience.

Table of Comparison

| Feature | Broker | Insurtech Intermediary |

|---|---|---|

| Customer Interaction | Personalized advice and support | Automated, digital platform |

| Policy Options | Wide range from multiple insurers | Limited to platform partners |

| Cost | Higher fees due to personal service | Lower fees with streamlined processes |

| Speed | Slower, manual processing | Fast, real-time quotes and purchases |

| Claims Support | Dedicated human assistance | Mostly digital claims management |

| Transparency | Dependent on broker's disclosure | High, with data-driven insights |

| Technology | Traditional tools and processes | Advanced AI and analytics |

| Regulatory Compliance | Subject to licensing and oversight | Complies with digital insurance regulations |

Definition of Broker in Insurance

An insurance broker is a licensed professional who acts as an intermediary between clients and insurance companies, providing expert advice and helping clients find the best coverage tailored to their needs. Brokers work independently from insurers, offering unbiased comparisons of multiple policies to secure competitive rates and comprehensive protection. Their role includes risk assessment, policy recommendations, and claims assistance, ensuring clients receive personalized service throughout the insurance lifecycle.

What is an Insurtech Intermediary?

An insurtech intermediary leverages advanced digital technologies like AI, big data, and blockchain to streamline insurance distribution and enhance customer experience. Unlike traditional brokers who rely on personal relationships and manual processes, insurtech intermediaries offer automated platforms for policy comparison, purchasing, and claims processing. This approach reduces costs, improves transparency, and enables faster decision-making in the insurance value chain.

Key Differences Between Brokers and Insurtech Intermediaries

Brokers act as licensed agents representing multiple insurance companies, offering personalized advice and customized policies tailored to individual client needs. Insurtech intermediaries leverage digital platforms and advanced algorithms to streamline the insurance purchasing process, emphasizing automation, speed, and user convenience. While brokers provide human expertise and negotiation, insurtech intermediaries focus on technological efficiency and data-driven risk assessments.

Role of Technology in Insurance Distribution

Insurtech intermediaries leverage advanced digital platforms, AI algorithms, and data analytics to streamline the insurance distribution process, offering personalized policy recommendations and faster quote generation. Traditional brokers rely heavily on human expertise and personal relationships, which can slow down customer engagement and limit scalability. The integration of technology in insurtech enhances transparency, reduces operational costs, and enables real-time risk assessment, transforming how insurance products are marketed and sold.

Advantages of Using Insurance Brokers

Insurance brokers offer personalized risk assessment and tailored policy recommendations that insurtech intermediaries often lack due to automated algorithms. Brokers provide expert advice and direct communication, ensuring clients fully understand complex coverage options and receive advocacy during claims processing. This human-centric approach increases trust and often results in more comprehensive and cost-effective insurance solutions.

Benefits of Insurtech Intermediaries

Insurtech intermediaries leverage advanced technologies like AI and big data to offer personalized insurance solutions with greater efficiency and speed compared to traditional brokers. They provide enhanced transparency, streamlined claims processing, and cost-effective policies by automating underwriting and risk assessment. Access to digital platforms enables customers to compare policies effortlessly and receive real-time support, improving overall user experience and satisfaction.

Customer Experience: Broker vs Insurtech

Brokers provide personalized customer experience through tailored advice and direct human interaction, enhancing trust and understanding of complex insurance needs. Insurtech intermediaries leverage AI-driven platforms and digital tools to offer seamless, fast, and accessible insurance solutions with real-time policy management and claims processing. The digital efficiency of insurtech improves convenience, while brokers excel in bespoke service for customers demanding customized coverage and expert guidance.

Regulatory Landscape: Brokers and Insurtechs

Brokers operate under well-established regulatory frameworks requiring licensing, fiduciary duties, and compliance with consumer protection laws, ensuring transparency and accountability in policy sales. Insurtech intermediaries navigate evolving regulations that address digital distribution, data privacy, and automated advice, often facing jurisdiction-specific challenges due to rapid innovation. Regulatory bodies increasingly emphasize balancing innovation facilitation with robust consumer safeguards, creating a complex compliance landscape for both traditional brokers and emerging insurtech firms.

Future Trends in Insurance Intermediation

Future trends in insurance intermediation spotlight the rising influence of insurtech intermediaries leveraging artificial intelligence, big data analytics, and blockchain to enhance customer experience and streamline policy management. Traditional brokers are evolving by integrating digital tools and personalized advisory services to maintain relevance in a technology-driven market. The convergence of human expertise and automated platforms is shaping a hybrid model that maximizes efficiency, transparency, and risk assessment accuracy.

Choosing Between Broker and Insurtech: What’s Best for You?

Choosing between a traditional insurance broker and an insurtech intermediary depends on your preference for personalized service versus digital convenience. Brokers offer tailored advice and hands-on support through complex insurance needs, while insurtech platforms leverage AI and automation for faster policy comparisons and streamlined purchasing. Evaluating factors like coverage options, pricing transparency, and customer experience will guide you to the best fit for your insurance goals.

Related Important Terms

Digital MGA (Managing General Agent)

Digital MGAs leverage advanced data analytics and automated underwriting processes to streamline insurance distribution, offering faster policy issuance and personalized coverage compared to traditional brokers. Unlike conventional intermediaries, these insurtech-driven MGAs enhance customer experience by integrating digital platforms with real-time risk assessment and seamless claims management.

Embedded Distribution

Embedded distribution integrates insurance products directly into non-insurance platforms, allowing insurtech intermediaries to offer seamless, technology-driven access, whereas traditional brokers rely on personalized advice and manual policy placement. Insurtech intermediaries leverage APIs and data analytics for real-time underwriting and pricing, enhancing customer experience and operational efficiency compared to conventional broker models.

API-driven Placement

API-driven placement enables insurtech intermediaries to streamline insurance transactions through automated, real-time data integration, enhancing efficiency and reducing manual errors compared to traditional brokers reliant on manual processes. This technological advantage allows insurtech platforms to offer dynamic pricing, instant policy issuance, and seamless connectivity with multiple insurers, transforming risk distribution and customer experience.

Digital Broking Platform

Digital broking platforms leverage advanced insurtech solutions to streamline insurance transactions, offering real-time comparisons, personalized policy recommendations, and automated claims processing. Unlike traditional brokers, these platforms utilize AI-driven algorithms and cloud technology to enhance efficiency, transparency, and customer experience in the insurance marketplace.

Parametric Facilitation

Parametric facilitation in insurance leverages real-time data triggers enabling insurtech intermediaries to automate claim settlements faster than traditional brokers, who rely on manual assessments and documentation. This innovation enhances transparency and efficiency, significantly improving customer experience by reducing claim processing time and operational costs.

Channel Partner Integrator

Broker channel partners leverage personalized client relationships and deep insurance expertise to tailor coverage solutions, while Insurtech intermediaries utilize advanced technology platforms to streamline policy distribution and enhance customer experience. Channel Partner Integrators play a crucial role in bridging traditional broker networks with innovative Insurtech solutions, enabling seamless data exchange and expanding market reach.

Quote-Bind-Issue Automation

Insurance brokers facilitate personalized risk assessment and policy customization through direct client interaction, while insurtech intermediaries leverage Quote-Bind-Issue automation platforms to streamline underwriting processes, reduce issuance time, and enhance digital customer experiences. Insurtech solutions integrate AI-driven algorithms and APIs to provide real-time quotes, instant binding, and immediate policy issuance, optimizing operational efficiency and scalability in the insurance value chain.

Full-Stack Intermediary

A Full-Stack Intermediary in insurance integrates end-to-end digital solutions, combining policy distribution, underwriting, and claims management within a single platform, enhancing efficiency and customer experience beyond traditional brokers. Insurtech intermediaries leverage advanced data analytics, AI, and automation to streamline processes, reduce costs, and offer personalized insurance products, positioning Full-Stack Intermediaries as disruptive leaders in the evolving insurance market.

Risk Data Orchestration

Insurance brokers traditionally leverage personalized client relationships and manual risk assessment methods, while insurtech intermediaries optimize Risk Data Orchestration through advanced analytics, AI algorithms, and real-time data integration, enhancing precision and efficiency in underwriting. This shift enables insurtech platforms to offer dynamic risk profiles and tailored coverage options by aggregating diverse data sources, outperforming conventional brokerage models in predictive accuracy and scalability.

Human-in-the-Loop Advisory

Human-in-the-loop advisory in insurance brokers ensures personalized risk assessment and tailored policy recommendations through expert client interactions, while insurtech intermediaries leverage AI-driven algorithms for real-time data analysis and automated policy suggestions, combining technology with human oversight to enhance decision accuracy and customer experience. This hybrid approach optimizes premium pricing and claims handling by integrating traditional expertise with advanced digital tools in the insurance distribution process.

Broker vs Insurtech intermediary Infographic

industrydif.com

industrydif.com