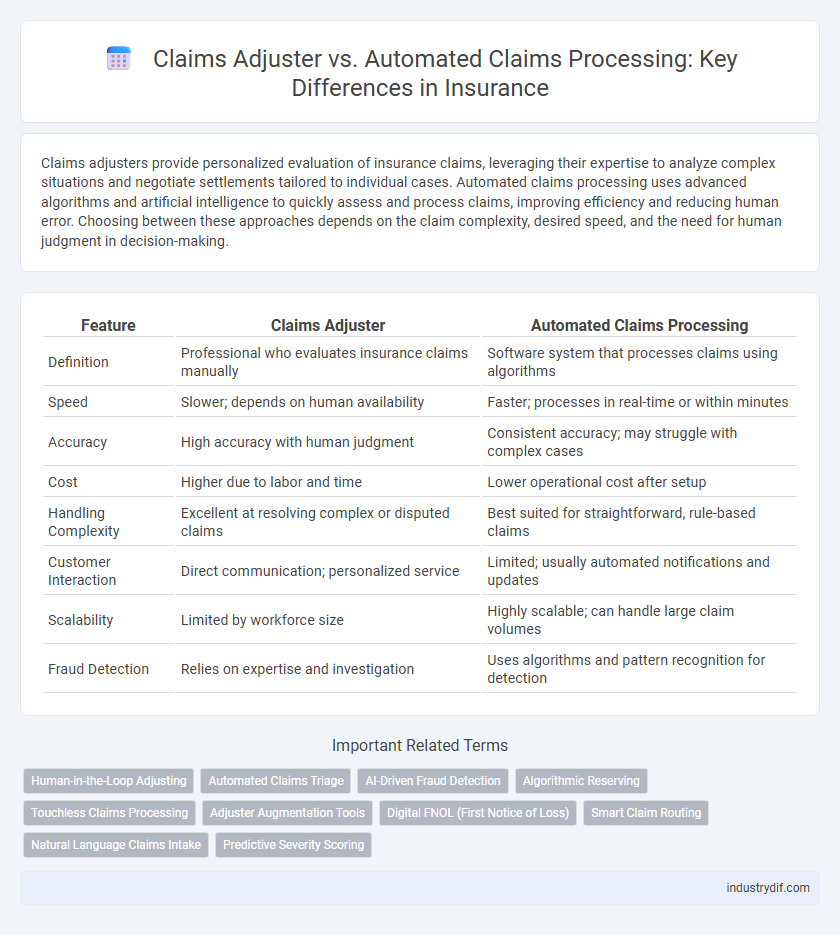

Claims adjusters provide personalized evaluation of insurance claims, leveraging their expertise to analyze complex situations and negotiate settlements tailored to individual cases. Automated claims processing uses advanced algorithms and artificial intelligence to quickly assess and process claims, improving efficiency and reducing human error. Choosing between these approaches depends on the claim complexity, desired speed, and the need for human judgment in decision-making.

Table of Comparison

| Feature | Claims Adjuster | Automated Claims Processing |

|---|---|---|

| Definition | Professional who evaluates insurance claims manually | Software system that processes claims using algorithms |

| Speed | Slower; depends on human availability | Faster; processes in real-time or within minutes |

| Accuracy | High accuracy with human judgment | Consistent accuracy; may struggle with complex cases |

| Cost | Higher due to labor and time | Lower operational cost after setup |

| Handling Complexity | Excellent at resolving complex or disputed claims | Best suited for straightforward, rule-based claims |

| Customer Interaction | Direct communication; personalized service | Limited; usually automated notifications and updates |

| Scalability | Limited by workforce size | Highly scalable; can handle large claim volumes |

| Fraud Detection | Relies on expertise and investigation | Uses algorithms and pattern recognition for detection |

Introduction to Claims Adjuster vs Automated Claims Processing

Claims adjusters evaluate insurance claims by thoroughly investigating damages, estimating costs, and negotiating settlements to ensure accurate compensation. Automated claims processing uses artificial intelligence and machine learning algorithms to quickly analyze claims data, assess risks, and process payments with minimal human intervention. Comparing claims adjuster expertise and automated system efficiency highlights the balance between personalized assessment and speed in modern insurance claim management.

Defining the Role of a Claims Adjuster

A claims adjuster evaluates insurance claims by investigating facts, assessing damage, and determining liability to ensure fair settlement. This role requires in-depth knowledge of policy terms and strong negotiation skills to handle disputes and verify the legitimacy of claims. Unlike automated claims processing, which uses algorithms to speed up claim approvals, claims adjusters provide nuanced judgment critical for complex or contested claims.

What is Automated Claims Processing?

Automated claims processing utilizes advanced algorithms and artificial intelligence to evaluate, validate, and settle insurance claims without manual intervention. This technology reduces processing time, minimizes human error, and enhances accuracy by analyzing claim data against policy terms instantly. By streamlining workflows, automated claims systems improve customer satisfaction and operational efficiency within insurance companies.

Key Differences between Human and Automated Claims Handling

Claims adjusters evaluate insurance claims through detailed investigation and personal judgment, ensuring accurate assessments of damages and liability based on individual circumstances. Automated claims processing leverages AI-driven algorithms and data analytics to rapidly assess claims, prioritize workflows, and detect fraud with consistent efficiency. Human handlers excel at complex decision-making and empathy, while automated systems provide scalability, speed, and reduced operational costs.

Benefits of Using Claims Adjusters

Claims adjusters provide personalized assessment and investigation of insurance claims, enhancing accuracy and reducing fraud risk. Their expertise enables tailored settlement negotiations, ensuring fair compensation for policyholders. Unlike automated claims processing, adjusters handle complex cases with nuanced judgment and empathy, improving customer satisfaction and trust.

Advantages of Automated Claims Processing

Automated claims processing accelerates claim resolution by utilizing AI algorithms that analyze data with high accuracy and minimal human error. This technology reduces operational costs and enhances customer satisfaction through faster payouts and seamless communication. Integration with advanced analytics enables proactive fraud detection, improving overall risk management compared to traditional claims adjusters.

Challenges with Manual Claims Adjustment

Manual claims adjustment often faces significant challenges such as human error, time-consuming documentation, and inconsistent decision-making. Claims adjusters must thoroughly investigate and validate each claim, increasing the risk of delays and higher operational costs. These inefficiencies contrast sharply with automated claims processing, which leverages AI and data analytics to enhance accuracy and expedite claim settlements.

Limitations of Automation in Claims Management

Automated claims processing enhances efficiency by quickly analyzing large volumes of data and identifying fraudulent patterns, yet it struggles with complex cases requiring nuanced judgment and empathy. Claims adjusters provide critical human oversight, interpreting unique circumstances and making discretionary decisions that software cannot replicate. Limitations of automation include difficulty handling ambiguous information, adapting to exceptional scenarios, and addressing customer service nuances essential for fair claim resolutions.

Choosing the Right Solution: Human, Automated, or Hybrid

Choosing the right insurance claims solution depends on factors like claim complexity, volume, and customer expectations. Human claims adjusters excel in nuanced cases requiring judgment, empathy, and negotiation, while automated claims processing offers speed and consistency for routine claims. A hybrid approach leverages AI-driven automation for standard tasks combined with expert adjusters managing exceptions, optimizing cost-efficiency and customer satisfaction.

The Future of Claims Processing in the Insurance Industry

Claims adjusters play a critical role in evaluating and investigating insurance claims to ensure accurate settlements, but automated claims processing is transforming the industry by utilizing AI and machine learning for faster, more consistent decisions. The future of claims processing in insurance lies in hybrid models that combine human expertise with advanced automation to improve efficiency, reduce fraud, and enhance customer satisfaction. Increasing adoption of real-time data analytics and predictive algorithms will further optimize claim outcomes while lowering operational costs.

Related Important Terms

Human-in-the-Loop Adjusting

Human-in-the-loop adjusting combines the expertise of claims adjusters with automated claims processing to enhance accuracy and efficiency in evaluating insurance claims. This hybrid approach leverages machine learning algorithms for preliminary data analysis while relying on skilled adjusters to handle complex cases and make nuanced decisions.

Automated Claims Triage

Automated claims triage leverages artificial intelligence and machine learning algorithms to quickly categorize and prioritize insurance claims based on severity, fraud risk, and complexity, significantly reducing processing times and improving accuracy compared to traditional claims adjusters. This technology enables insurers to allocate human resources more efficiently by handling routine claims automatically while escalating complex cases to expert adjusters for detailed evaluation.

AI-Driven Fraud Detection

Claims adjusters leverage AI-driven fraud detection algorithms to analyze patterns and anomalies in insurance claims, enhancing accuracy and reducing false positives. Automated claims processing integrates machine learning models to swiftly identify potentially fraudulent activities, streamlining investigations and minimizing financial losses for insurers.

Algorithmic Reserving

Algorithmic reserving in automated claims processing leverages machine learning models to predict claim liabilities with enhanced accuracy, reducing human error inherent in traditional claims adjuster assessments. This technology enables real-time data analysis and dynamic reserve adjustments, optimizing risk management and improving insurer financial stability.

Touchless Claims Processing

Touchless claims processing leverages advanced AI algorithms to automate claims adjustment, significantly reducing manual intervention and accelerating settlement times. Claims adjusters collaborate with these systems by validating complex cases while routine claims are efficiently handled through fully automated workflows, enhancing overall accuracy and operational efficiency.

Adjuster Augmentation Tools

Claims adjuster augmentation tools leverage AI and machine learning algorithms to enhance accuracy and efficiency in damage assessments, enabling adjusters to process complex claims faster while maintaining personalized customer interactions. Integrating these tools with automated claims processing systems significantly reduces manual errors and operational costs, supporting adjusters in making informed decisions and improving overall claims management workflows.

Digital FNOL (First Notice of Loss)

Digital FNOL enhances the claims adjuster process by enabling real-time data capture and automated damage assessment, which accelerates claim resolution and reduces human error. Automated claims processing leverages AI-driven algorithms and image recognition to streamline FNOL submission, improving efficiency while allowing adjusters to focus on complex claim investigations.

Smart Claim Routing

Smart claim routing enhances claims adjuster efficiency by automatically categorizing and directing claims to the most qualified adjuster based on claim type, complexity, and adjuster expertise. Automated claims processing reduces human error and accelerates resolution times, while smart routing ensures optimal resource allocation, improving overall claims management and customer satisfaction.

Natural Language Claims Intake

Claims adjusters leverage expertise to evaluate and negotiate insurance claims, providing personalized assessment and resolution. Automated claims processing utilizes natural language claims intake to streamline data extraction, enhance accuracy, and accelerate settlement timelines through AI-driven algorithms.

Predictive Severity Scoring

Claims adjusters rely on expertise and qualitative assessment to evaluate insurance claims, while automated claims processing leverages predictive severity scoring algorithms that analyze historical data and risk factors to forecast claim outcomes with greater efficiency. Integrating predictive severity scoring enhances accuracy in claim triage, reduces processing time, and minimizes human error, transforming risk management in insurance operations.

Claims Adjuster vs Automated Claims Processing Infographic

industrydif.com

industrydif.com