Claims adjusters conduct in-person investigations to assess damages and verify claims, offering thorough, hands-on evaluations. Virtual adjusters utilize technology such as video conferencing and digital documentation to expedite claim processing and reduce response time. Choosing between the two depends on the complexity of the claim, with virtual adjusters enhancing efficiency for straightforward cases and traditional adjusters providing detailed assessments for more intricate situations.

Table of Comparison

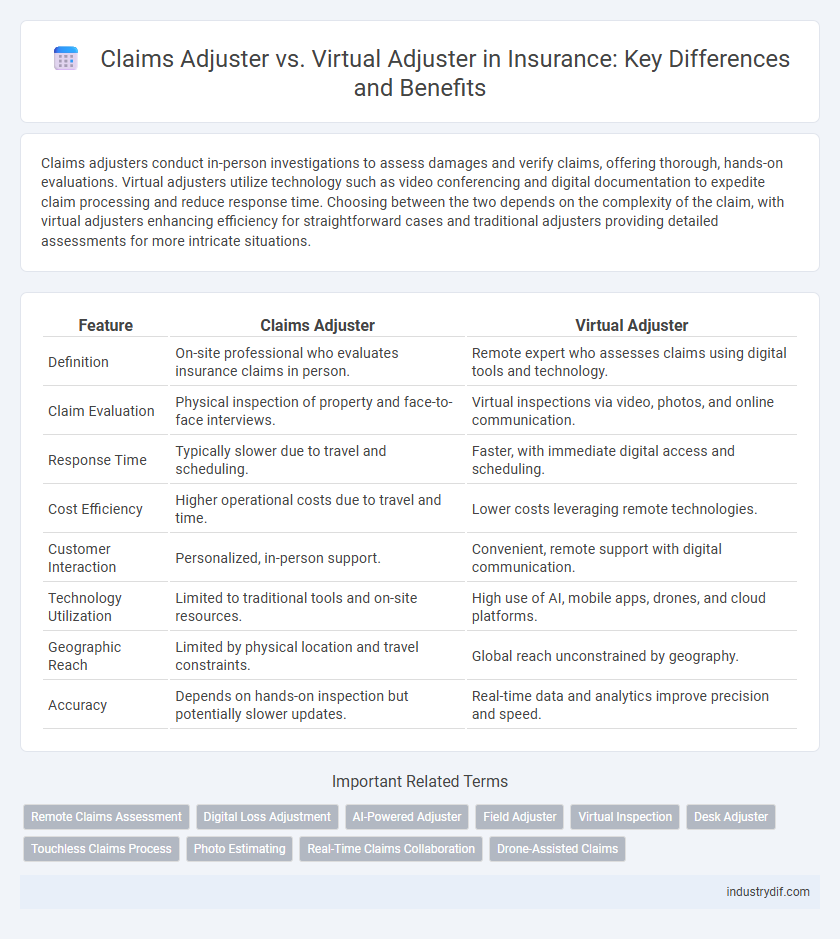

| Feature | Claims Adjuster | Virtual Adjuster |

|---|---|---|

| Definition | On-site professional who evaluates insurance claims in person. | Remote expert who assesses claims using digital tools and technology. |

| Claim Evaluation | Physical inspection of property and face-to-face interviews. | Virtual inspections via video, photos, and online communication. |

| Response Time | Typically slower due to travel and scheduling. | Faster, with immediate digital access and scheduling. |

| Cost Efficiency | Higher operational costs due to travel and time. | Lower costs leveraging remote technologies. |

| Customer Interaction | Personalized, in-person support. | Convenient, remote support with digital communication. |

| Technology Utilization | Limited to traditional tools and on-site resources. | High use of AI, mobile apps, drones, and cloud platforms. |

| Geographic Reach | Limited by physical location and travel constraints. | Global reach unconstrained by geography. |

| Accuracy | Depends on hands-on inspection but potentially slower updates. | Real-time data and analytics improve precision and speed. |

Understanding the Role of a Claims Adjuster

A claims adjuster investigates insurance claims by assessing damages, interviewing witnesses, and reviewing policy terms to determine payout eligibility and amounts. Virtual adjusters perform these duties remotely using digital tools and virtual inspections, enabling faster claim processing and enhanced customer convenience. Both roles require strong analytical skills and knowledge of insurance policies to ensure accurate and fair claim settlements.

What is a Virtual Adjuster?

A Virtual Adjuster is an insurance claims professional who uses digital tools and remote technology to assess and process claims without needing to be physically present at the loss site. Virtual Adjusters leverage video inspections, mobile apps, and real-time communication platforms to evaluate damage, verify claim details, and expedite settlement processes efficiently. This approach enhances customer convenience, reduces response times, and lowers operational costs compared to traditional in-person Claims Adjusters.

Key Responsibilities: Claims Adjuster vs Virtual Adjuster

Claims adjusters traditionally conduct in-person investigations, assess damages, interview claimants, and authenticate policy details to determine claim validity and settlement amounts. Virtual adjusters handle these responsibilities remotely using digital tools, including video inspections, electronic document submission, and real-time communication platforms, enabling quicker claim processing and enhanced customer accessibility. Both roles require thorough evaluation skills but differ in execution methods, with virtual adjusters leveraging technology for efficiency and geographic flexibility.

Workflow Differences: Traditional vs Virtual Adjusters

Claims adjusters traditionally conduct in-person inspections, gathering physical evidence and interacting face-to-face with claimants and service providers, which can extend claim processing times due to travel and scheduling constraints. Virtual adjusters utilize digital tools such as video calls, drones, and mobile apps to remotely assess damages, enabling faster data collection and real-time collaboration with stakeholders. This virtual workflow optimizes efficiency by reducing delays, increasing flexibility, and streamlining communication for quicker claim resolutions.

Technology Integration in Virtual Adjusting

Virtual adjusters leverage advanced technology integration such as AI-powered tools, real-time data analytics, and drone inspections to expedite claims processing and improve accuracy. Unlike traditional claims adjusters who perform physical site visits, virtual adjusters utilize mobile apps and remote imaging software to assess damages quickly and securely. This technological enhancement reduces claim settlement time, lowers operational costs, and enhances customer satisfaction in the insurance industry.

Communication Methods: In-Person vs Remote Adjustments

Claims adjusters traditionally conduct in-person assessments, offering direct interaction with policyholders and on-site property evaluations to ensure accurate damage appraisals. Virtual adjusters utilize digital communication tools such as video calls, mobile apps, and photo submissions to remotely assess claims, increasing efficiency and reducing response times. Remote adjustments optimize claim processing by leveraging technology, but in-person methods remain essential for complex cases requiring detailed inspections and personal engagement.

Efficiency and Turnaround Times

Claims adjusters physically assess damages on-site, often requiring travel and in-person evaluations, which can extend turnaround times. Virtual adjusters leverage digital tools, including video inspections and real-time data sharing, significantly enhancing efficiency by reducing the need for on-site visits. Faster claim processing through virtual adjustment methods leads to improved customer satisfaction and reduced operational costs.

Cost Implications for Insurers

Claims adjusters traditionally incur higher operational costs due to travel, lodging, and time spent onsite, increasing insurer expenses. Virtual adjusters leverage digital tools and remote inspections, significantly reducing overhead and accelerating claim settlements. Insurers benefit from lower fixed costs, enhanced scalability, and improved efficiency with virtual adjusters driving cost-effective claims management.

Challenges and Limitations of Virtual Adjusting

Virtual adjusters face challenges such as limited access to physical evidence, making it difficult to assess damages accurately compared to traditional claims adjusters who conduct on-site inspections. Technological barriers and inconsistent internet connectivity can hinder the virtual claims evaluation process, affecting timely decision-making. Privacy concerns and the inability to interact directly with claimants may also limit the effectiveness of virtual adjusting in complex claims.

Future Trends: The Evolution of Claims Adjustment

Claims adjusters are increasingly integrating artificial intelligence and remote inspection technologies to enhance the accuracy and efficiency of damage assessments, signaling a shift toward virtual adjusters who utilize drones, mobile apps, and AI algorithms for real-time claims processing. This evolution reduces claim settlement times and improves customer satisfaction by enabling faster, data-driven decision-making and providing more transparent communication throughout the claims lifecycle. Industry experts predict that hybrid models combining human expertise with virtual tools will dominate the future of claims adjustment to address the growing complexity and volume of insurance claims.

Related Important Terms

Remote Claims Assessment

Claims adjusters perform on-site inspections for accurate damage evaluation, while virtual adjusters leverage digital tools and remote technology to assess claims efficiently without physical visits. Remote claims assessment using virtual adjusters enhances speed, reduces costs, and improves customer satisfaction through real-time video inspections and AI-powered damage analysis.

Digital Loss Adjustment

Digital loss adjustment revolutionizes claims processing by enabling virtual adjusters to assess damages remotely using advanced technologies such as AI-powered damage analysis and real-time video inspections, significantly reducing settlement times and operational costs. Unlike traditional claims adjusters who perform on-site evaluations, virtual adjusters leverage cloud-based platforms and mobile apps to provide faster, more accurate, and scalable claims resolutions within the insurance industry.

AI-Powered Adjuster

AI-powered virtual adjusters leverage machine learning algorithms and real-time data analysis to streamline claim assessments more efficiently than traditional claims adjusters. These digital tools reduce processing time and enhance accuracy by automating damage evaluation and fraud detection in insurance claims.

Field Adjuster

Field adjusters physically inspect property damage to assess insurance claims, providing detailed, on-site evaluations that ensure accurate settlements. Virtual adjusters leverage digital tools and remote technology for faster claim processing but may lack the comprehensive, hands-on insight that field adjusters deliver.

Virtual Inspection

Virtual adjusters leverage advanced digital tools and video technology to conduct remote inspections, enabling faster and more efficient claims processing compared to traditional claims adjusters. This virtual inspection approach reduces travel time and costs while providing real-time data and images to accurately assess damages and expedite settlements.

Desk Adjuster

A Desk Adjuster processes insurance claims remotely, reviewing documentation and conducting interviews without visiting the loss site, which enhances efficiency in managing straightforward or complex cases. Virtual Adjusters use digital tools and communication to perform similar tasks, but Desk Adjusters primarily focus on detailed claim analysis from the office, leveraging extensive policy knowledge and negotiation skills.

Touchless Claims Process

Claims adjusters traditionally handle in-person inspections to assess damages and verify claims, often requiring physical presence and manual documentation. Virtual adjusters utilize advanced digital tools and AI-driven platforms to enable a touchless claims process, accelerating claim resolution while minimizing customer contact and operational costs.

Photo Estimating

Claims adjusters assess insurance claims by inspecting damages in person, while virtual adjusters leverage photo estimating technology to evaluate losses remotely, enhancing efficiency and reducing claim processing time. Photo estimating software analyzes uploaded images to generate accurate repair cost estimates, streamlining the claims workflow and minimizing the need for on-site inspections.

Real-Time Claims Collaboration

Claims adjusters and virtual adjusters both manage insurance claims but differ significantly in real-time collaboration capabilities; virtual adjusters leverage digital platforms to facilitate immediate communication and data sharing among stakeholders, enhancing claim accuracy and resolution speed. Real-time claims collaboration through virtual adjusters reduces processing delays by enabling instant updates, remote inspections, and seamless coordination between policyholders, contractors, and insurers.

Drone-Assisted Claims

Drone-assisted claims enable virtual adjusters to conduct remote property inspections with enhanced accuracy and speed, reducing the need for on-site visits compared to traditional claims adjusters. Integrating aerial drone technology allows for precise damage assessments, minimizes human risk, and accelerates claim settlements in the insurance industry.

Claims Adjuster vs Virtual Adjuster Infographic

industrydif.com

industrydif.com