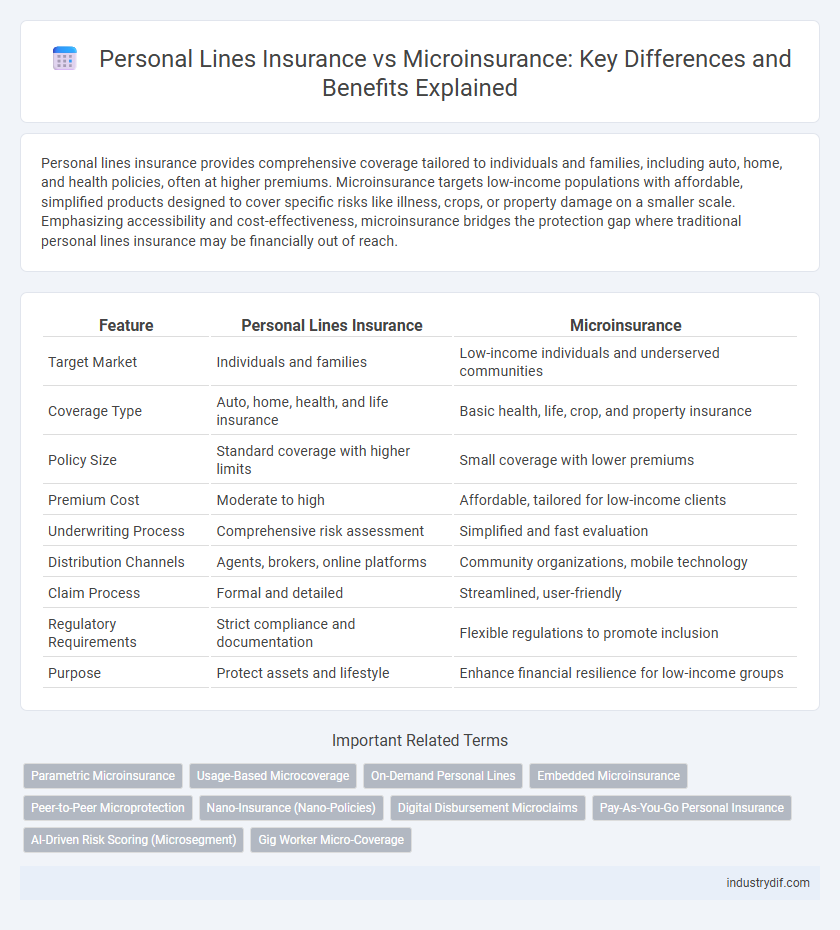

Personal lines insurance provides comprehensive coverage tailored to individuals and families, including auto, home, and health policies, often at higher premiums. Microinsurance targets low-income populations with affordable, simplified products designed to cover specific risks like illness, crops, or property damage on a smaller scale. Emphasizing accessibility and cost-effectiveness, microinsurance bridges the protection gap where traditional personal lines insurance may be financially out of reach.

Table of Comparison

| Feature | Personal Lines Insurance | Microinsurance |

|---|---|---|

| Target Market | Individuals and families | Low-income individuals and underserved communities |

| Coverage Type | Auto, home, health, and life insurance | Basic health, life, crop, and property insurance |

| Policy Size | Standard coverage with higher limits | Small coverage with lower premiums |

| Premium Cost | Moderate to high | Affordable, tailored for low-income clients |

| Underwriting Process | Comprehensive risk assessment | Simplified and fast evaluation |

| Distribution Channels | Agents, brokers, online platforms | Community organizations, mobile technology |

| Claim Process | Formal and detailed | Streamlined, user-friendly |

| Regulatory Requirements | Strict compliance and documentation | Flexible regulations to promote inclusion |

| Purpose | Protect assets and lifestyle | Enhance financial resilience for low-income groups |

Understanding Personal Lines Insurance

Personal Lines Insurance covers individual policyholders for risks related to their homes, vehicles, and personal belongings, offering tailored protection against losses and liabilities. It includes homeowners, auto, renters, and personal liability insurance, designed to safeguard everyday assets and financial well-being. Understanding the scope of Personal Lines Insurance helps consumers recognize the level of coverage needed compared to more limited, low-cost Microinsurance options.

Defining Microinsurance in Modern Markets

Microinsurance targets low-income individuals and underserved communities, offering affordable coverage tailored to their specific risks such as health, agriculture, and property loss. Unlike traditional personal lines insurance that focuses on standard policies for middle- and upper-income groups, microinsurance uses innovative distribution channels and simplified claim processes to increase accessibility. Its role in modern markets is expanding rapidly, driven by digital technology and evolving financial inclusion strategies.

Key Differences Between Personal Lines and Microinsurance

Personal lines insurance offers comprehensive coverage tailored to individual needs, often featuring higher premiums and broader protections such as home, auto, and health insurance. Microinsurance targets low-income populations with affordable, simplified policies that focus on essential risks like life, health, and property, usually with lower coverage limits and reduced administrative costs. The key differences lie in the target market, policy complexity, coverage scope, and premium affordability.

Target Audiences for Personal Lines vs Microinsurance

Personal Lines insurance primarily targets middle to upper-income individuals and families seeking coverage for personal assets such as homes, vehicles, and health. Microinsurance is designed for low-income populations, particularly in emerging markets, offering affordable, accessible protection against specific risks like health emergencies, crop failures, or accidents. The distinct target audiences reflect differences in product complexity, coverage scope, and premium affordability tailored to economic capabilities.

Coverage Scope: Personal Lines vs Microinsurance

Personal Lines insurance offers broad coverage tailored to individual needs, including auto, home, and health policies with higher limits and comprehensive protections. Microinsurance provides limited, affordable coverage designed for low-income individuals, focusing on essential risks like hospitalization, accidents, or crop failure with simplified terms. The coverage scope of Personal Lines is extensive with customized benefits, while Microinsurance targets critical protections to ensure basic financial security.

Pricing Models and Premium Structures

Personal lines insurance typically utilizes risk-based pricing models that assess individual factors such as age, driving history, and property characteristics to determine premiums, resulting in tailored coverage costs. Microinsurance employs simplified premium structures often based on flat rates or indexed variables to ensure affordability and accessibility for low-income populations. Pricing in personal lines aims for precision and risk alignment, while microinsurance prioritizes scalability and ease of payment within constrained financial contexts.

Distribution Channels in Personal Lines and Microinsurance

Personal lines insurance relies heavily on established distribution channels such as agents, brokers, and online platforms to reach individual consumers effectively. Microinsurance distribution channels often leverage community-based organizations, mobile technology, and direct outreach to penetrate low-income and underserved markets. Digital tools and innovative micro-distribution models enhance accessibility and affordability in microinsurance, contrasting with the traditional multi-channel approach typical in personal lines insurance.

Regulatory Considerations for Both Insurance Types

Regulatory frameworks for Personal Lines insurance typically involve strict consumer protection laws, comprehensive product disclosures, and solvency requirements to ensure policyholder security. Microinsurance regulations prioritize accessibility and affordability, often allowing simplified underwriting and relaxed capital standards to accommodate low-income populations. Both types require compliance with local insurance authorities, but microinsurance frequently benefits from regulatory exemptions or streamlined approval processes to foster market development and social inclusion.

Technology’s Role in Personal Lines and Microinsurance

Technology revolutionizes personal lines insurance by enabling seamless digital policy management, real-time risk assessment through AI algorithms, and personalized customer experiences via mobile apps. Microinsurance leverages mobile money platforms and IoT devices to provide low-cost, accessible coverage to underserved populations, enhancing claim processing efficiency with blockchain technology. Data analytics and machine learning drive both sectors to optimize pricing models and improve fraud detection, increasing overall operational efficiency.

Industry Trends: Future of Personal Lines and Microinsurance

The insurance industry is witnessing a shift as Personal Lines adapt to digital transformation, leveraging AI and data analytics to enhance customer personalization and claims processing. Microinsurance is expanding rapidly in emerging markets, driven by mobile technology penetration and growing demand for affordable, accessible coverage among low-income populations. Both sectors are poised to converge through innovative platforms that offer flexible, on-demand policies, reshaping the future landscape of personal risk protection.

Related Important Terms

Parametric Microinsurance

Personal lines insurance covers individuals' assets like homes and cars with traditional indemnity models, whereas parametric microinsurance offers streamlined coverage with predefined trigger events and fixed payouts, ideal for low-income populations facing natural disasters. This parametric approach reduces claim processing time and operational costs, enhancing accessibility and financial resilience for underserved communities in emerging markets.

Usage-Based Microcoverage

Usage-based microcoverage in insurance tailors personal lines policies by leveraging real-time data from devices like telematics or smartphones to offer affordable, pay-as-you-go protection. This innovative approach enhances risk assessment and customer engagement while expanding access to insurance for low-income or underserved populations.

On-Demand Personal Lines

On-demand personal lines insurance offers flexible, usage-based coverage tailored to individual lifestyles, providing instant policy activation and cancellation through digital platforms, distinct from traditional microinsurance which targets low-income populations with minimal, basic coverage. This innovative model enhances customer convenience and cost-efficiency by aligning premiums directly with real-time risk exposure and personal needs.

Embedded Microinsurance

Embedded microinsurance integrates low-cost, tailored coverage into everyday transactions, offering a seamless protection solution for underserved individuals compared to traditional personal lines insurance. This innovative approach leverages digital platforms and partnerships with retailers or service providers to enhance accessibility, affordability, and customer experience in microinsurance markets.

Peer-to-Peer Microprotection

Peer-to-peer microprotection in microinsurance leverages community-based risk sharing to offer affordable, customized coverage for individuals often underserved by traditional personal lines insurance. This model reduces administrative costs and fosters trust through social networks, enabling scalable protection for low-income populations with limited access to conventional insurance products.

Nano-Insurance (Nano-Policies)

Nano-insurance offers ultra-small coverage amounts designed to provide affordable, on-demand protection, distinguishing itself from traditional personal lines insurance that targets broader risk portfolios with higher premiums. This microinsurance innovation leverages digital platforms to deliver highly accessible, pay-as-you-go nano-policies ideal for low-income individuals seeking minimal but essential financial security.

Digital Disbursement Microclaims

Digital disbursement in microinsurance enables faster, more efficient microclaims processing compared to traditional personal lines insurance, enhancing accessibility and reducing administrative costs. Leveraging mobile platforms and blockchain technology, digital microclaims facilitate instant payouts and improve customer engagement within underserved markets.

Pay-As-You-Go Personal Insurance

Pay-as-you-go personal insurance within microinsurance offers flexible, affordable coverage tailored to low-income individuals by charging premiums based on actual usage or risk exposure. This model contrasts with traditional personal lines insurance by minimizing upfront costs and enhancing accessibility for underserved populations in emerging markets.

AI-Driven Risk Scoring (Microsegment)

Personal lines insurance leverages traditional risk scoring methods, while microinsurance increasingly adopts AI-driven risk scoring to enable precise microsegment identification, improving affordability and accessibility for low-income populations. This AI-powered approach enhances underwriting accuracy by analyzing granular data patterns, reducing costs, and enabling personalized coverage in microinsurance markets.

Gig Worker Micro-Coverage

Gig worker micro-coverage offers tailored insurance solutions with affordable premiums and flexible terms specifically designed for the unpredictable income and work patterns of gig economy participants. Unlike traditional personal lines insurance, microinsurance provides limited but essential protections such as health, accident, and income loss coverage, addressing gaps faced by freelance drivers, delivery personnel, and task-based workers.

Personal Lines vs Microinsurance Infographic

industrydif.com

industrydif.com