Fraud detection in insurance relies on analyzing claims data and identifying suspicious patterns to prevent false claims and financial losses. Telematics-based fraud detection enhances this process by utilizing real-time driving data collected from telematics devices, offering more accurate insights into driver behavior and claim validity. This technology reduces fraudulent claims by providing concrete evidence, improving risk assessment and claim verification efficiency.

Table of Comparison

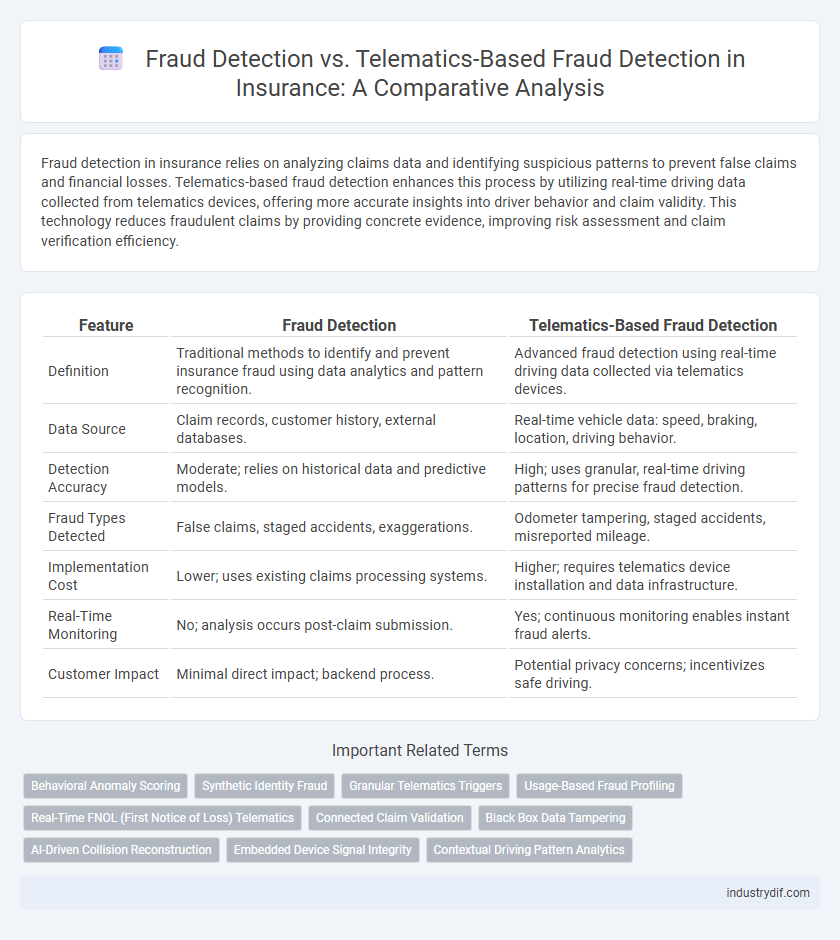

| Feature | Fraud Detection | Telematics-Based Fraud Detection |

|---|---|---|

| Definition | Traditional methods to identify and prevent insurance fraud using data analytics and pattern recognition. | Advanced fraud detection using real-time driving data collected via telematics devices. |

| Data Source | Claim records, customer history, external databases. | Real-time vehicle data: speed, braking, location, driving behavior. |

| Detection Accuracy | Moderate; relies on historical data and predictive models. | High; uses granular, real-time driving patterns for precise fraud detection. |

| Fraud Types Detected | False claims, staged accidents, exaggerations. | Odometer tampering, staged accidents, misreported mileage. |

| Implementation Cost | Lower; uses existing claims processing systems. | Higher; requires telematics device installation and data infrastructure. |

| Real-Time Monitoring | No; analysis occurs post-claim submission. | Yes; continuous monitoring enables instant fraud alerts. |

| Customer Impact | Minimal direct impact; backend process. | Potential privacy concerns; incentivizes safe driving. |

Overview of Insurance Fraud Detection

Insurance fraud detection employs data analytics, machine learning, and pattern recognition to identify suspicious claims and behavior, minimizing financial losses. Telematics-based fraud detection enhances this process by leveraging real-time driving data, such as GPS, speed, and acceleration, to validate claims and detect anomalies more accurately. This method improves accuracy by correlating behavioral data with reported incidents, reducing false positives and increasing fraud detection efficiency.

Traditional Fraud Detection Methods

Traditional fraud detection methods in insurance rely heavily on manual claims review, rule-based systems, and pattern recognition through historical data analysis. These techniques use established red flags such as inconsistent claimant information, unusual claim frequency, and deviations from typical claim behaviors to identify suspicious activities. While effective to some extent, they often result in higher false positives and slower detection compared to advanced telematics-based fraud detection systems.

Introduction to Telematics in Insurance

Telematics in insurance utilizes real-time data from devices like GPS and accelerometers to monitor driving behavior, enabling more accurate fraud detection by analyzing patterns such as sudden braking or irregular routes. Traditional fraud detection relies heavily on historical data and claims analysis, which can miss subtle or new types of fraudulent activity that telematics can identify instantly. This technology enhances risk assessment and reduces fraudulent claims by providing precise, behavior-based insights directly from the insured vehicle.

Telematics-Based Fraud Detection Explained

Telematics-based fraud detection leverages real-time data from devices installed in vehicles, such as GPS and accelerometers, to monitor driving behavior and verify claims accuracy. This method enables insurers to identify discrepancies between reported incidents and actual events captured by telematics, improving fraud identification compared to traditional techniques. Enhanced data analytics and machine learning algorithms analyze driving patterns, helping insurers pinpoint suspicious activities like staged accidents or exaggerated claims with higher precision.

Comparative Analysis: Traditional vs Telematics Approaches

Traditional fraud detection in insurance relies heavily on historical claim data, customer profiles, and manual investigations, often leading to delayed and less accurate outcomes. Telematics-based fraud detection leverages real-time driving data, behavior analytics, and AI algorithms to identify anomalies instantly, enhancing precision and reducing false positives. Comparing both, telematics offers a proactive, data-driven solution that significantly improves fraud detection efficiency and customer trust over conventional methods.

Data Sources and Analytical Techniques

Fraud detection in insurance traditionally relies on claims data, policyholder information, and external databases analyzed through statistical models and pattern recognition techniques. Telematics-based fraud detection leverages real-time driving data collected from GPS, accelerometers, and sensors to identify anomalies using machine learning algorithms and behavioral analytics. Integrating telematics data enhances accuracy by providing granular, context-rich information that complements traditional data sources for more effective fraud prevention.

Impact on Claims Management

Fraud detection in insurance uses data analytics and pattern recognition to identify suspicious claims, reducing false payouts and improving overall claims accuracy. Telematics-based fraud detection enhances this by leveraging real-time vehicle data such as speed, location, and driving behavior, enabling more precise validation of claim circumstances and reducing fraudulent exaggerations. Integrating telematics data into claims management accelerates claim verification, lowers investigation costs, and improves customer trust through transparency and evidence-based assessments.

Benefits of Telematics for Fraud Prevention

Telematics-based fraud detection leverages real-time data from vehicle sensors and GPS to accurately verify claim legitimacy, reducing false claims and exaggerated damages. This technology enhances risk assessment by monitoring driver behavior patterns, enabling early identification of suspicious activities that traditional methods often miss. Integration of telematics not only cuts operational costs but also improves customer trust through transparent and precise fraud prevention strategies.

Privacy and Ethical Considerations

Fraud detection in insurance traditionally relies on analyzing claims data and identifying inconsistencies, but telematics-based fraud detection introduces continuous monitoring of driving behavior, raising significant privacy concerns due to the extensive collection of personal data. Ethical considerations emphasize transparency in data usage, ensuring that customers consent to tracking and understand how their information is applied to prevent discriminatory practices. Balancing effective fraud mitigation with respecting individuals' privacy rights and maintaining data security remains a critical challenge in telematics-driven insurance fraud detection.

Future Trends in Insurance Fraud Detection

Future trends in insurance fraud detection emphasize the integration of telematics data with advanced analytics, enabling real-time identification of suspicious patterns in driving behavior and claim submissions. Artificial intelligence and machine learning models increasingly leverage telematics information, such as GPS data and vehicle usage metrics, to enhance predictive accuracy and reduce false positives. The evolution towards personalized, data-driven fraud detection systems is expected to significantly improve insurer efficiency and customer trust.

Related Important Terms

Behavioral Anomaly Scoring

Behavioral anomaly scoring enhances telematics-based fraud detection by analyzing driving patterns and identifying deviations from typical behavior, enabling insurers to detect suspicious activities with higher accuracy. Traditional fraud detection relies on static rules and claim history, whereas telematics integrates real-time data to dynamically assess risk and uncover fraudulent claims through pattern recognition.

Synthetic Identity Fraud

Traditional fraud detection methods rely on historical data analysis and rule-based systems that often struggle to detect synthetic identity fraud, where fabricated identities combine real and fake information to bypass checks. Telematics-based fraud detection enhances accuracy by analyzing real-time driving behavior and vehicle data, enabling insurers to identify inconsistencies associated with synthetic identities and reduce fraud-related losses effectively.

Granular Telematics Triggers

Granular telematics triggers enhance fraud detection by analyzing precise driving behaviors such as sudden braking, acceleration patterns, and route anomalies, enabling insurers to identify suspicious activities with higher accuracy compared to traditional fraud detection methods. This data-driven approach reduces false positives and improves claim verification by leveraging real-time, location-specific insights from telematics devices.

Usage-Based Fraud Profiling

Usage-based fraud profiling enhances traditional fraud detection by leveraging telematics data such as driving behavior, trip patterns, and vehicle usage to identify anomalies and reduce false positives. This method provides insurers with precise, real-time insights that improve risk assessment accuracy and lower fraudulent claim costs compared to conventional detection techniques.

Real-Time FNOL (First Notice of Loss) Telematics

Fraud detection in insurance increasingly leverages telematics-based systems that provide real-time First Notice of Loss (FNOL), enabling instantaneous analysis of accident data such as GPS location, speed, and impact severity to identify suspicious claims. This method enhances accuracy over traditional fraud detection by using precise, time-stamped telematics data to detect inconsistencies and reduce false positives in claim assessments.

Connected Claim Validation

Fraud detection in insurance leverages data analytics to identify suspicious claims patterns, while telematics-based fraud detection enhances accuracy by utilizing real-time vehicle data and driving behavior to validate connected claims. Connected Claim Validation integrates telematics insights with traditional fraud algorithms, reducing false positives and accelerating claim settlements through precise risk assessment.

Black Box Data Tampering

Traditional fraud detection in insurance relies heavily on claim analysis and historical data patterns, which can be limited in identifying sophisticated deception tactics. Telematics-based fraud detection enhances accuracy by monitoring real-time vehicle data but remains vulnerable to black box data tampering, where fraudsters manipulate or erase recorded information to evade detection.

AI-Driven Collision Reconstruction

AI-driven collision reconstruction enhances fraud detection by analyzing telematics data such as vehicle speed, impact angles, and sensor readings to recreate accident scenarios with high precision. This technology reduces false claims by combining traditional fraud indicators with real-time, sensor-based evidence, improving accuracy and efficiency in insurance fraud investigations.

Embedded Device Signal Integrity

Fraud detection in insurance traditionally relies on data analytics and claim pattern recognition, whereas telematics-based fraud detection enhances accuracy by leveraging real-time data from embedded device signal integrity within vehicles. Ensuring the authenticity and tamper-resistance of telematics signals is critical to prevent manipulation and improve the detection of fraudulent claims.

Contextual Driving Pattern Analytics

Fraud detection in insurance traditionally relies on analyzing claims data and customer history, whereas telematics-based fraud detection leverages contextual driving pattern analytics by using real-time vehicle data such as speed, acceleration, braking, and GPS location to identify anomalies indicative of fraudulent behavior. Contextual driving pattern analytics enhances accuracy by comparing individual driving behaviors against normative patterns derived from large datasets, enabling insurers to detect staged accidents, false claims, and usage inconsistencies with higher precision.

Fraud detection vs Telematics-based fraud detection Infographic

industrydif.com

industrydif.com