Policyholders purchase insurance policies from traditional companies, transferring risk in exchange for premiums, while peer-to-peer policyholders participate in a shared risk pool, often reducing costs and increasing transparency. Peer-to-peer models leverage collective contributions to cover claims, creating a community-driven approach compared to conventional individual contracts. This shift fosters greater trust and potential savings by aligning the interests of policyholders within a network.

Table of Comparison

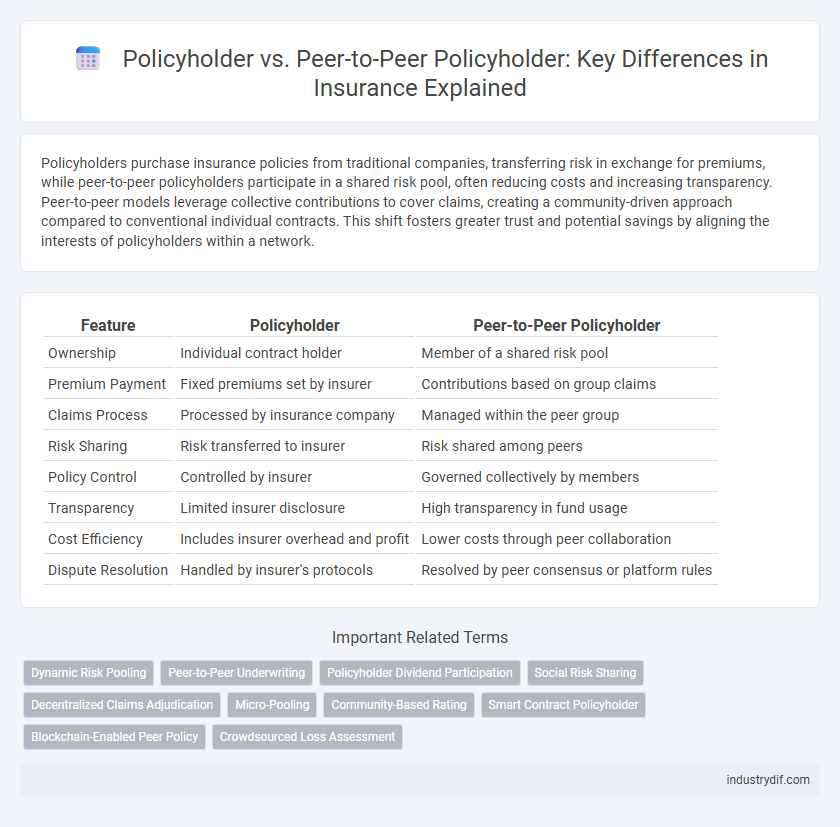

| Feature | Policyholder | Peer-to-Peer Policyholder |

|---|---|---|

| Ownership | Individual contract holder | Member of a shared risk pool |

| Premium Payment | Fixed premiums set by insurer | Contributions based on group claims |

| Claims Process | Processed by insurance company | Managed within the peer group |

| Risk Sharing | Risk transferred to insurer | Risk shared among peers |

| Policy Control | Controlled by insurer | Governed collectively by members |

| Transparency | Limited insurer disclosure | High transparency in fund usage |

| Cost Efficiency | Includes insurer overhead and profit | Lower costs through peer collaboration |

| Dispute Resolution | Handled by insurer's protocols | Resolved by peer consensus or platform rules |

Definition of a Traditional Policyholder

A traditional policyholder is an individual or entity that purchases an insurance contract directly from an insurance company, paying regular premiums in exchange for financial protection against specified risks. This policyholder relies on the insurer's underwriting, claims processing, and risk pooling mechanisms, where the company manages funds collectively from all insured members. In contrast, peer-to-peer policyholders participate in decentralized insurance models that emphasize community-driven risk sharing and reduced reliance on conventional insurance intermediaries.

Understanding Peer-to-Peer Policyholders

Peer-to-peer policyholders participate in insurance models where members pool premiums to cover claims collectively, reducing reliance on traditional insurers. This model promotes transparency and often lowers costs by minimizing administrative fees and aligning incentives among participants. Understanding peer-to-peer policyholders involves recognizing their preference for collaborative risk-sharing and increased control over their coverage terms.

Key Differences Between Policyholder and P2P Policyholder

A policyholder is an individual or entity that purchases a traditional insurance policy from a company, assuming coverage and premiums regulated by the insurer. In contrast, a peer-to-peer (P2P) policyholder participates in a decentralized insurance model where members pool funds to collectively cover claims, reducing reliance on a central insurer. Key differences include the risk-sharing mechanism, claim approval processes, and potential cost savings associated with the community-based structure of P2P insurance compared to conventional policies.

Risk Pooling in Traditional vs Peer-to-Peer Insurance

Policyholders in traditional insurance contribute premiums to a centralized risk pool managed by an insurer, which spreads financial risk across a large group to cover individual claims. Peer-to-peer policyholders share risk more directly by pooling premiums within smaller, often community-based groups, enhancing transparency and potentially reducing costs through collective risk management. This decentralized approach aligns incentives among members, fostering trust and minimizing adverse selection compared to conventional risk pooling models.

Premium Calculation: Standard vs P2P Models

Premium calculation in standard insurance models relies on actuarial data and risk assessment of individual policyholders, leading to fixed rates based on demographics and claims history. Peer-to-peer (P2P) insurance pools premiums from a group of policyholders who share risk collectively, potentially lowering costs through reduced administrative fees and incentivizing claims transparency. P2P models employ dynamic premium adjustments based on group performance and real-time loss data, contrasting with the static pricing typical of traditional policies.

Claims Process Comparison

Traditional policyholders follow a centralized claims process managed by insurance companies, often involving extensive documentation and longer approval times. Peer-to-peer policyholders experience a decentralized claims system where members collectively review and validate claims, promoting faster resolutions and increased transparency. This community-driven approach reduces administrative overhead and aligns incentives for fair claim handling.

Benefits of Being a Peer-to-Peer Policyholder

Peer-to-peer policyholders benefit from lower premiums by pooling resources directly with others, reducing reliance on traditional insurance intermediaries and administrative costs. This model fosters increased transparency and community trust, as members have greater control over claim approvals and fund allocations. Enhanced engagement and shared risk often lead to faster claim processing and improved customer satisfaction compared to conventional policyholders.

Potential Drawbacks of P2P Insurance Structures

Peer-to-peer insurance structures may face challenges such as limited risk diversification and potential financial instability due to smaller, less predictable pools of policyholders. Unlike traditional policyholders who benefit from the extensive underwriting and risk management practices of established insurers, P2P policyholders might encounter slower claim processing and less regulatory protection. The reliance on group consensus in P2P models can also lead to conflicts of interest and decreased transparency compared to conventional insurance policies.

Regulatory Considerations for Policyholder Types

Regulatory considerations for policyholders differ significantly between traditional policyholders and peer-to-peer (P2P) policyholders due to the decentralized nature of P2P insurance models. Traditional policyholders are regulated under established insurance laws ensuring consumer protection, solvency requirements, and claims handling, whereas P2P policyholders often face emerging regulatory challenges related to transparency, risk pooling, and legal classification. Regulators are increasingly developing frameworks to address these distinctions, focusing on compliance, anti-fraud measures, and governance structures specific to P2P insurance platforms.

Future Trends in Policyholder Engagement

Future trends in policyholder engagement emphasize the rise of peer-to-peer insurance models, fostering greater trust and community involvement compared to traditional policyholders. Digital platforms leveraging blockchain and smart contracts enable transparent, direct interactions between peer-to-peer policyholders, enhancing claim processing efficiency and reducing administrative costs. Increased adoption of AI-driven personalized communication and predictive analytics further customizes engagement strategies, improving satisfaction and retention among both traditional and peer-to-peer policyholders.

Related Important Terms

Dynamic Risk Pooling

Dynamic risk pooling in traditional policyholder models centralizes risk among a broad insured population, providing stability through aggregated premiums and claims. Peer-to-peer policyholder structures enhance this approach by grouping individuals with similar risk profiles, enabling more tailored risk sharing, increased transparency, and potential premium cost reductions.

Peer-to-Peer Underwriting

Peer-to-peer underwriting revolutionizes the insurance landscape by enabling policyholders to pool risks directly, reducing reliance on traditional insurers and decreasing overall costs. This approach fosters transparency and trust among peer-to-peer policyholders, leveraging collective risk assessment to enhance policy customization and claims efficiency.

Policyholder Dividend Participation

Policyholders in traditional insurance receive dividends based on the insurer's overall profitability, reflecting collective risk management and financial performance. Peer-to-peer policyholders, however, obtain dividends derived directly from their group's pooled premiums and claims, fostering a more transparent and potentially higher dividend participation linked to their specific risk pool.

Social Risk Sharing

Social risk sharing in insurance distinguishes traditional policyholders, who transfer risk to an insurer, from peer-to-peer policyholders, who collectively pool resources to directly support each other's claims. This decentralized model enhances transparency and community-driven trust, reducing administrative costs and aligning risk incentives among peers.

Decentralized Claims Adjudication

Decentralized claims adjudication in peer-to-peer insurance empowers policyholders by enabling transparent, blockchain-driven claim assessments without intermediaries, reducing fraud and administrative costs. Traditional policyholders rely on centralized authorities for claim decisions, often facing delays and less transparency compared to the efficient, community-vetted processes in peer-to-peer models.

Micro-Pooling

Micro-pooling in insurance enables traditional policyholders to join peer-to-peer (P2P) policyholders in collective risk-sharing arrangements, reducing premiums and increasing transparency. Peer-to-peer policyholders benefit from micro-pooling by directly sharing claims costs within small groups, enhancing trust and incentivizing loss prevention more effectively than conventional insurance models.

Community-Based Rating

Policyholders in traditional insurance pay premiums based on individual risk assessments, while peer-to-peer policyholders participate in community-based rating systems where risk and costs are shared collectively within a group, fostering transparency and potentially lower premiums. Community-based rating leverages social trust and mutual accountability, aligning incentives to reduce fraudulent claims and promoting fairer pricing models across all members.

Smart Contract Policyholder

Smart Contract policyholders benefit from automated claims processing and transparent contract enforcement through blockchain technology, reducing fraud and administrative costs. Unlike traditional Policyholders or Peer-to-Peer Policyholders, Smart Contract policyholders experience increased efficiency and trust via immutable, self-executing agreements without intermediaries.

Blockchain-Enabled Peer Policy

Blockchain-enabled peer-to-peer policyholders leverage decentralized technology to directly manage and share insurance risks within a community, enhancing transparency and reducing administrative costs compared to traditional policyholders bound by insurer intermediaries. This model empowers participants with increased control over policy terms and claims processing, fostering trust through immutable blockchain records and smart contracts.

Crowdsourced Loss Assessment

Crowdsourced loss assessment leverages peer-to-peer policyholders to collaboratively evaluate claims, enhancing transparency and accuracy compared to traditional policyholder-only assessments. This model facilitates quicker claim resolutions through collective validation and reduces fraud by utilizing real-time feedback from a connected insurance community.

Policyholder vs Peer-to-Peer Policyholder Infographic

industrydif.com

industrydif.com