Premium insurance requires fixed payments regardless of how much or little the policyholder uses the coverage, offering predictability in budgeting. Usage-based insurance adjusts costs based on actual behavior, such as miles driven or driving habits, providing savings for low-risk individuals. Choosing between premium and usage-based insurance depends on balancing consistent expenses with the potential benefits of personalized, data-driven pricing.

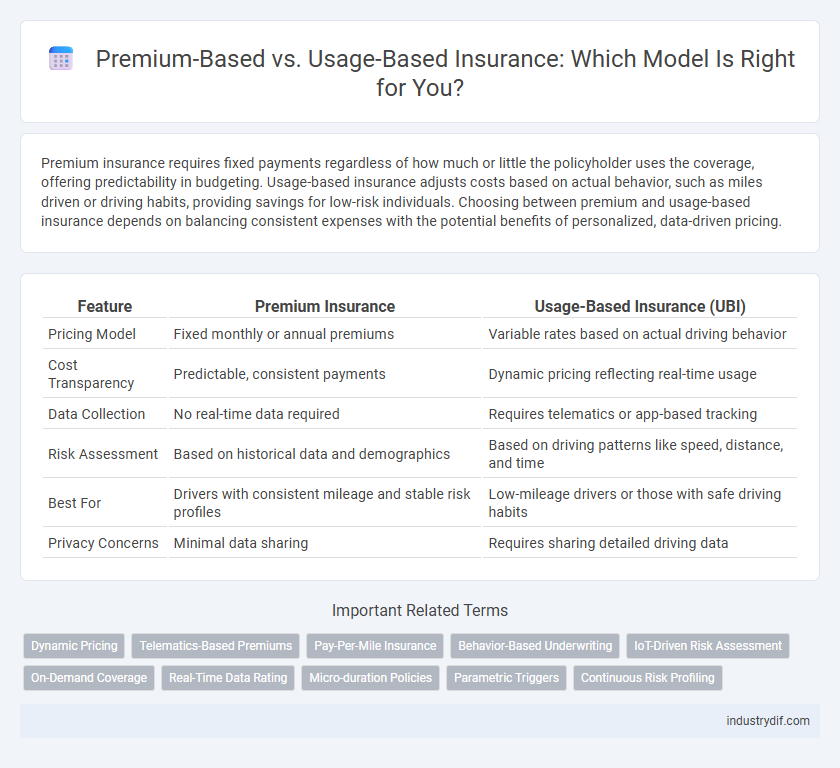

Table of Comparison

| Feature | Premium Insurance | Usage-Based Insurance (UBI) |

|---|---|---|

| Pricing Model | Fixed monthly or annual premiums | Variable rates based on actual driving behavior |

| Cost Transparency | Predictable, consistent payments | Dynamic pricing reflecting real-time usage |

| Data Collection | No real-time data required | Requires telematics or app-based tracking |

| Risk Assessment | Based on historical data and demographics | Based on driving patterns like speed, distance, and time |

| Best For | Drivers with consistent mileage and stable risk profiles | Low-mileage drivers or those with safe driving habits |

| Privacy Concerns | Minimal data sharing | Requires sharing detailed driving data |

Understanding Insurance Premiums

Insurance premiums are fixed monthly or annual payments determined by factors such as age, location, driving history, and coverage level. Usage-Based Insurance calculates premiums dynamically based on real-time driving behavior, including mileage, speed, and braking patterns, recorded through telematics devices. Understanding these variables helps policyholders select the most cost-effective option and optimize their insurance costs.

What is Usage-Based Insurance (UBI)?

Usage-Based Insurance (UBI) is a car insurance model that calculates premiums based on actual driving behavior and mileage tracked through telematics devices or smartphone apps. UBI offers personalized rates by monitoring factors such as speed, braking patterns, and distance driven, promoting safer driving habits. This approach contrasts with traditional premium-based insurance, which relies on fixed factors like age, location, and driving history for rate determination.

Key Differences: Premium vs Usage-Based Insurance

Premium insurance requires fixed payments regardless of driving behavior, providing predictable costs and stable coverage levels. Usage-Based Insurance (UBI) calculates premiums based on actual driving data such as mileage, speed, and braking patterns, rewarding safe drivers with lower rates. Key differences include cost variability, risk assessment methods, and the degree of personalization in pricing models.

How Traditional Premium Models Work

Traditional premium models in insurance calculate rates primarily based on demographic factors such as age, gender, location, and driving history. Insurers assess risk by analyzing historical claims data and adjusting premiums to cover anticipated losses while ensuring profitability. This fixed premium approach does not account for individual usage patterns or real-time behavior, often leading to generalized pricing rather than personalized rates.

The Technology Behind Usage-Based Insurance

Usage-based insurance (UBI) relies on telematics technology, incorporating GPS, accelerometers, and onboard diagnostics to monitor driver behavior and vehicle usage in real-time. Data collected from smartphones or dedicated devices enables insurers to analyze factors like speed, braking patterns, and mileage, allowing for personalized premium calculations. Machine learning algorithms process this data to predict risk more accurately, promoting safer driving habits and potentially reducing insurance costs.

Pros and Cons of Premium Insurance

Premium insurance offers predictable monthly costs, making budgeting straightforward for policyholders. However, fixed premiums may lead to overpayment for low-mileage drivers who do not fully utilize their coverage. This traditional model lacks the flexibility of usage-based insurance, potentially resulting in higher expenses for safe or infrequent drivers.

Benefits and Drawbacks of Usage-Based Insurance

Usage-based insurance (UBI) offers personalized premiums based on real-time driving behavior, promoting fair pricing and incentivizing safer driving. This model enhances cost savings for low-mileage or cautious drivers but raises concerns about data privacy and constant monitoring. Despite these drawbacks, UBI provides insurers with accurate risk assessment and policyholders with potential discounts tied directly to their driving habits.

Cost Comparison: Which Model Saves More?

Premium-based insurance requires fixed monthly or annual payments regardless of driving behavior, often leading to higher costs for low-mileage or cautious drivers. Usage-based insurance charges customers based on actual driving data such as miles driven, speed, and braking patterns, which can result in significant savings for safe and infrequent drivers. Studies show usage-based models reduce average insurance expenses by up to 20% compared to traditional premium structures.

Who Should Consider Usage-Based Insurance?

Usage-based insurance (UBI) suits drivers seeking personalized premiums that reflect actual driving behavior, making it ideal for low-mileage or careful drivers. Customers who prefer pay-as-you-go models benefit from UBI's real-time data collection through telematics devices. Insurance providers targeting risk-averse drivers and tech-savvy customers also find UBI an effective tool for accurate, fair pricing.

The Future of Insurance: Premiums vs Usage-Based Models

The future of insurance is rapidly shifting from traditional fixed premiums to usage-based insurance (UBI) models that leverage telematics and real-time data to tailor costs according to individual behavior. Insurers adopting UBI can offer more personalized pricing, reduce risks, and incentivize safer driving habits, leading to lower claims and enhanced customer satisfaction. Market forecasts predict UBI will represent a significant share of auto insurance within the next decade, driven by advances in IoT, machine learning, and consumer demand for fairness and transparency.

Related Important Terms

Dynamic Pricing

Premium insurance typically involves fixed rates based on estimated risk factors, whereas usage-based insurance employs dynamic pricing models that adjust premiums in real-time according to actual driving behavior, mileage, and risk exposure. Dynamic pricing leverages telematics data and machine learning algorithms to enhance accuracy in risk assessment, resulting in more personalized and potentially cost-effective insurance policies.

Telematics-Based Premiums

Telematics-based premiums leverage real-time driving data such as speed, braking patterns, and mileage to personalize insurance costs, offering potential savings for safe drivers. This data-driven approach contrasts traditional fixed-rate premiums by dynamically adjusting rates based on actual usage and driving behavior, enhancing fairness and cost efficiency in auto insurance.

Pay-Per-Mile Insurance

Pay-per-mile insurance offers a cost-effective alternative to traditional premium models by charging drivers based on the actual miles driven, reducing expenses for low-mileage users. This usage-based insurance approach leverages telematics technology to provide personalized rates that reflect individual driving habits and mileage, promoting fairness and savings.

Behavior-Based Underwriting

Behavior-based underwriting in usage-based insurance utilizes telematics data to assess driving habits, enabling personalized premium calculations that reflect individual risk profiles more accurately than traditional flat-rate premiums. This method enhances risk assessment precision by analyzing metrics such as speed, braking patterns, and mileage, leading to fairer pricing and incentivizing safer driving behavior.

IoT-Driven Risk Assessment

Usage-Based Insurance (UBI) leverages IoT devices to collect real-time driving data, enabling precise risk assessment and dynamic premium adjustments based on individual behavior. Premium insurance relies on static factors such as age, location, and vehicle type, while IoT-driven UBI improves accuracy by integrating telematics, GPS, and sensor data for personalized pricing and enhanced risk management.

On-Demand Coverage

On-demand coverage in usage-based insurance offers policyholders flexibility by allowing them to activate insurance only when needed, significantly reducing premium costs compared to traditional fixed-rate premiums. This model uses telematics data to tailor rates based on actual driving behavior, enhancing affordability and personalized protection.

Real-Time Data Rating

Real-time data rating in usage-based insurance leverages telematics and IoT devices to assess driving behavior dynamically, enabling insurers to offer personalized premiums that reflect actual risk profiles. This contrasts with traditional premium models, which rely on static data and broader risk categories, often resulting in less accurate pricing and limited customer incentives for safer driving habits.

Micro-duration Policies

Micro-duration insurance policies offer flexibility by allowing customers to pay premiums based on short, specific time frames or usage periods, contrasting with traditional fixed premium plans. This usage-based insurance model leverages telematics data to optimize risk assessment and cost efficiency for both insurers and policyholders.

Parametric Triggers

Parametric triggers in usage-based insurance allow automatic claims payouts when predefined parameters such as weather events or mileage thresholds are met, enhancing transparency and efficiency. Unlike traditional premiums based on historical risk assessments, parametric insurance offers real-time risk mitigation by linking payouts directly to measurable triggers.

Continuous Risk Profiling

Continuous risk profiling in usage-based insurance leverages real-time telematics data to adjust premiums dynamically based on actual driving behavior, providing personalized and accurate pricing. This contrasts with traditional premium models that rely on static factors and periodic assessments, often leading to less precise risk evaluation and pricing.

Premium vs Usage-Based Insurance Infographic

industrydif.com

industrydif.com